Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Mar, 2023

By Adam Wilson

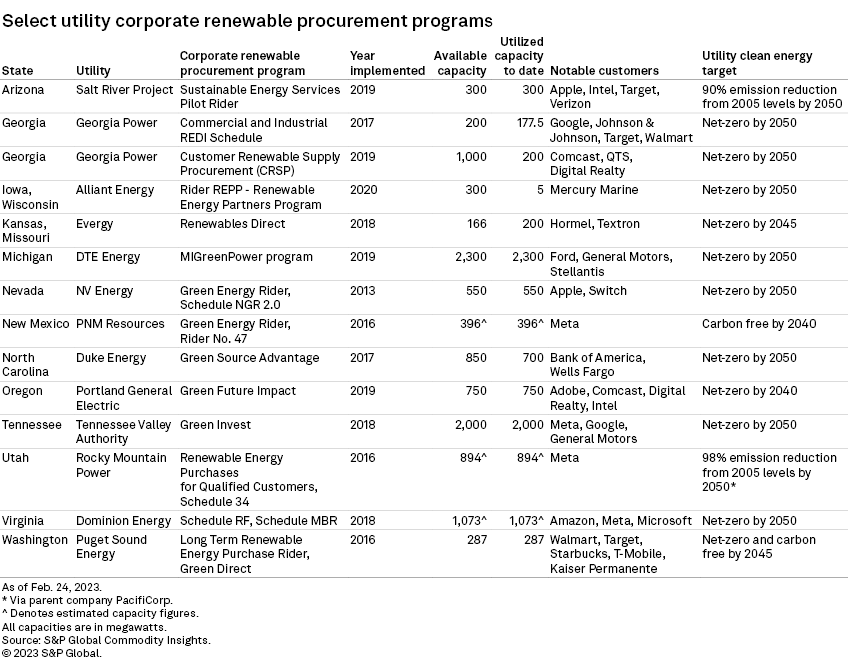

Utility programs for corporate renewable procurement, also known as green tariffs, continue to drive the rapidly expanding corporate renewables market. These programs are increasingly crucial for utilities as the appetite for clean energy grows across multiple industries. Of the 66 GW of corporate renewable capacity contracted in the U.S. as of Feb. 1, over 13 GW are through a utility green tariff system.

The expansion of utility renewable energy procurement programs has helped fuel the growth of the corporate renewables market in the U.S. These programs help companies, particularly in regulated energy markets, meet their clean energy goals by streamlining access to renewable energy without the potential complication of power purchase contracts. The convenience that these programs can offer also helps to expand the corporate renewables market beyond the veteran players in the tech industry and makes clean energy goals more obtainable for small and mid-sized businesses.

Over 13 GW of capacity is tied to corporations through green tariff deals, and this market is expected to continue to grow as demand increases. Boosted by the passage of the Inflation Reduction Act in 2022, wind and solar are growing at a blistering pace, giving utilities more capacity to offer as part of dedicated corporate procurement programs in addition to meeting their own renewable and clean energy targets.

At least 40 different green tariffs or broad utility-led renewable programs for large businesses have been created across 21 states. These programs are exclusive to fully or primarily regulated energy markets where utilities are vertically integrated, owning generation including wind and solar resources. As a result, if a corporation wants to buy renewable energy to power its facilities in these markets, generally, a utility must be involved in some form.

The area of Texas served by the Electric Reliability Council of Texas Inc. is deregulated and home to the largest fleet of wind and solar generation in the country at over 78 GW. The renewable pipeline in Texas has swelled to a staggering 105 GW. The relative ease with which corporations can directly contract with renewable generators in deregulated markets, combined with this massive pool of renewable energy, has made Texas the de facto hub for corporate renewable capacity in the country.

Over 20 GW of wind and solar capacity is contracted to nonutility off-takers in Texas. Adding Illinois and Ohio, which are also deregulated, these three states account for 42% of the corporate renewable capacity in the U.S. Virtual power purchase agreements have become the popular option in these markets, allowing companies the flexibility of purchasing cost-effective renewable energy to offset their power consumption regardless of the power plant's location.

Virtual power purchase agreements are still utilized in regulated markets; however, companies not eager to get bogged down in potentially convoluted power contract negotiations may prefer to have their local utility handle the details. Additionally, green tariff deals bolster to a company's claim of being powered by clean energy as the projects serving the program are typically located relatively close to the company's facilities. These benefits, combined with the growing movement toward green energy commitments, have resulted in most green tariff programs being fully subscribed soon after they are offered.

Virginia is partially deregulated, but Virginia Electric and Power Co. parent Dominion Energy Inc. has implemented multiple green tariff programs, including the Schedule RF and Schedule MBR (market-based rate) programs, to provide green energy to the massive fleet of data centers in the state. Hyperscalers Amazon, Meta and Microsoft, among others, participate in these programs, which provide over 1 GW of primarily solar power to its customers.

In Michigan, which is also partially deregulated, DTE Energy Co.'s MIGreenPower program has roughly 2,300 MW of allocated capacity, with automobile manufacturers Ford Motor Co., General Motors Co. and Stellantis NV as the largest of nearly 1,000 businesses enrolled in the program. According to a company spokesperson, 9% of DTE's load is served by MIGreenPower.

Southern Co. subsidiary Georgia Power Co., which is fully vertically integrated, has two different corporate renewable procurement programs with 1,200 MW of available capacity, with Comcast Corp., Alphabet Inc. subsidiary Google LLC and Target Corp. among the main off-takers of these programs. Neighboring Southeast U.S. energy provider Tennessee Valley Authority initiated the Green Invest program with 2,000 MW available to serve the growing data center footprint in the region. Meta Platforms Inc. and Google are the main customers of the program alongside General Motors.

The Western U.S. has seen growth in green tariff programs in Arizona, Nevada, New Mexico, Oregon and Washington; New Mexico is vertically integrated, but the other states in this group are partially deregulated. The tech industry, not surprisingly, dominates the user list for these programs, again driven primarily by data center development. Meta is the main customer for PNM Resources Inc.'s Green Energy Rider as well as PacifiCorp subsidiary Rocky Mountain Power's Schedule 34 tariff.

Salt River Project Agricultural Improvement and Power District Arizona in Arizona set up a 300 MW corporate renewable program and counts Apple Inc., Intel Corp. and Verizon Communications Inc. among its off-takers. Salt River Project also announced 450 MW of new capacity to service Meta's data centers in the state, but this capacity was contracted via separate power purchase agreements negotiated between the two companies.

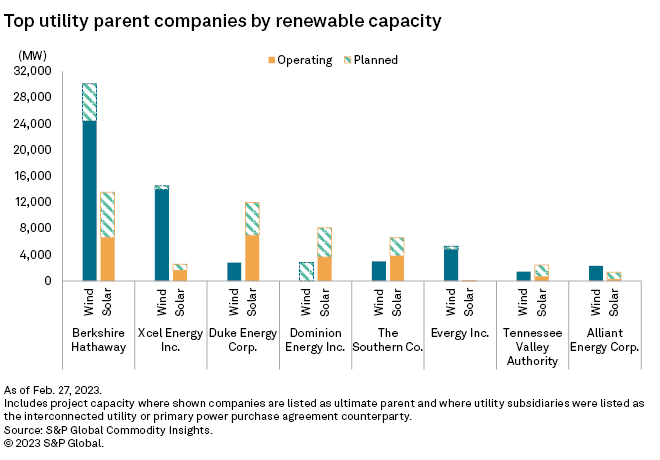

The top 10 parent companies of utilities with dedicated corporate renewable procurement programs have over 79 GW of operating wind and solar currently. Berkshire Hathaway Inc. accounts for 31 GW of this capacity, with subsidiaries PacifiCorp and MidAmerican Energy Co. launching the Accelerated Commitment Tariff and GreenAdvantage programs, respectively.

Xcel Energy Inc. and Duke Energy Corp., along with their utility subsidiaries, rank second and third, respectively, in operating renewable capacity. Xcel launched the Renewable*Connect program, which is offered in the company's territories in Colorado, Minnesota and Wisconsin, all of which have traditional, regulated generation markets. Duke Energy implemented the Green Source Advantage program, which has up to 850 MW of capacity for businesses, of which 700 MW have been claimed. Wells Fargo & Co. and Bank of America Corp. are among the customers of the program.

Another 35 GW of wind and solar capacity are in development among the top 10 parent companies and their subsidiaries with solar making up over 70% of this planned capacity. There are numerous drivers of this clean energy expansion, but the increasing demand from commercial and industrial customers, large and small, is certainly one of them. Utilities increasing their percentage of generation from carbon-free resources is attractive to customers with clean energy commitments, and many utilities have implemented aggressive net-zero and emission reduction targets.

Expanding the market

MIGreenPower in Michigan, a state big on manufacturing and light on tech industry presence, is a prime example of the expansion of the corporate renewables markets. While the tech industry maintains its dominance, accounting for 59% of contracted corporate renewable capacity, the manufacturing sector experienced the largest percentage increase among all business segments in this update, boosting its clean energy purchases 79% from 2021, thanks in large part to utility green tariffs. The services industry, which includes banking, insurance and financial businesses, saw contracted renewable energy capacity increase by 49%, while contracted wind and solar by food and beverage companies — led by PepsiCo Inc. and Anheuser-Busch InBev SA/NV — jumped 38%.

Due to their prodigious electricity demand and aggressive clean energy goals, corporate renewable leaders such as Amazon, Google and Microsoft have dedicated departments for handling renewable energy contracts and project development. Most companies, particularly small and midsize ones, however, may not be able to dedicate resources to such a disparate group within their organization. Utility corporate procurement programs offer a welcome convenience for those looking to decrease their carbon footprint without engaging directly in renewable power purchase agreements.

The passing of the Inflation Reduction Act should bolster the already-active green tariff market as project development increases and rates continue to decrease thanks to lucrative long-term tax credits. Utilities renewable programs will be an increasingly crucial piece of the puzzle as the corporate renewable market expands to every corner of industry.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Tony Lenoir and Qaiser Ali contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign