Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2018 | 08:00

Metals & Mining

Highlights

As it stands, much of the effect of the steel tariffs has been deferred for the time being.

S&P Global Market Intelligence reported on March 8 that President Donald Trump's plans to impose 25% tariffs on U.S. imports of selected foreign-made steel were, on "first impression, alarming" but the world's economy would be less impacted than its political sphere.

On a net-imports basis, the U.S. imported approximately 38.4 million tonnes of finished steel in 2017, which comprises 29% of the steel it consumed, according to the World Steel Association and S&P Global Market Intelligence. Since the initial announcement of steel tariffs, the trade relationship between China and the U.S. has soured, exemptions have been widely granted, and the magnitude of expected effects has subsided. Furthermore, a key Australian-American steelmaker continues to see little effect on its target market.

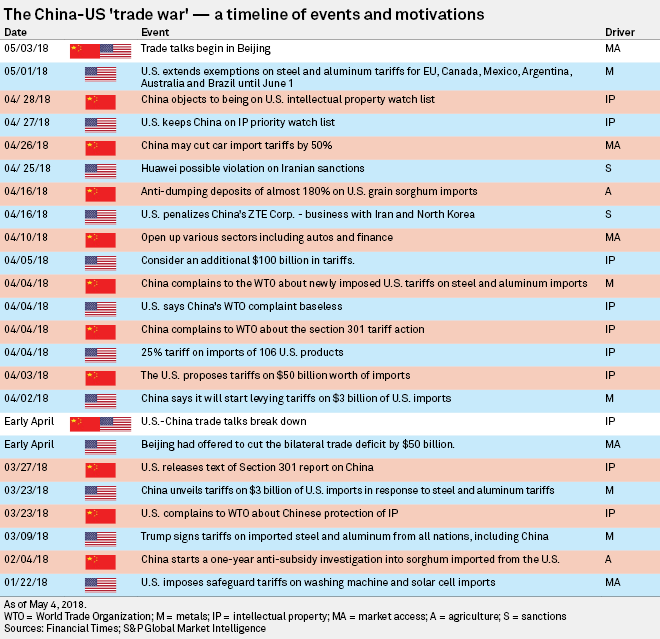

Most recently, Trump provided key members of the North American Free Trade Agreement with a reprieve from the measures, in good time for ongoing trade policy discussions being held in Beijing. This timing is significant because it reveals the underlying strategy of the imposed tariffs; the intention is more concerned with the renegotiation of existing trade deals than with the levying of new tariffs. The intent is to renegotiate with the U.S. trade partners on some key agreements related to metals, agriculture, market access, and intellectual property and on trade partners subject to international sanctions.

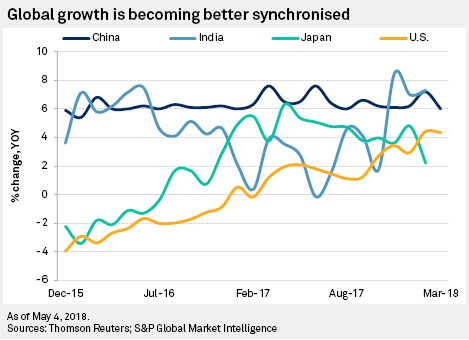

Strength in global steel production is fueling economic activity elsewhere in the world, and synchronous global growth is paying dividends. Industrial production growth has been increasing in the U.S. and China in particular. Bluescope is a producer of hot-rolled coil; therefore, the demand from automakers, industry, and consumer markets remain key and buoyant.

As it stands, much of the effect of the steel tariffs has been deferred for the time being. We have yet to see whether this policy will be brought into effect and continue to view the issue skeptically in terms of a real impact to the global steelmaking industry. We continue to expect steel prices in the U.S. to increase in response to these inflationary pressures, particularly if some of these exemptions are later removed in wide-ranging trade negotiations. Currently, however, U.S trade partners, China in particular, are likely to be testing whether the U.S. is a paper dragon by measuring its bite relative to its roar.

As it stands, much of the effect of the steel tariffs has been deferred for the time being. We have yet to see whether this policy will be brought into effect and continue to view the issue skeptically in terms of a real impact to the global steelmaking industry. We continue to expect steel prices in the U.S. to increase in response to these inflationary pressures, particularly if some of these exemptions are later removed in wide-ranging trade negotiations. Currently, however, U.S trade partners, China in particular, are likely to be testing whether the U.S. is a paper dragon by measuring its bite relative to its roar.

This article is based on collaboration between S&P Global Market Intelligence's Maximilian Court and S&P Global Platts' Alina Arnold. Both companies are owned by S&P Global Inc.

Like what you read? Start receiving essential metals and mining industry insights via email. Subscribe now.