Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 11, 2024

US private auto insurers' premium rates have continued to rise in 2024 but at a lower pace than previous years.

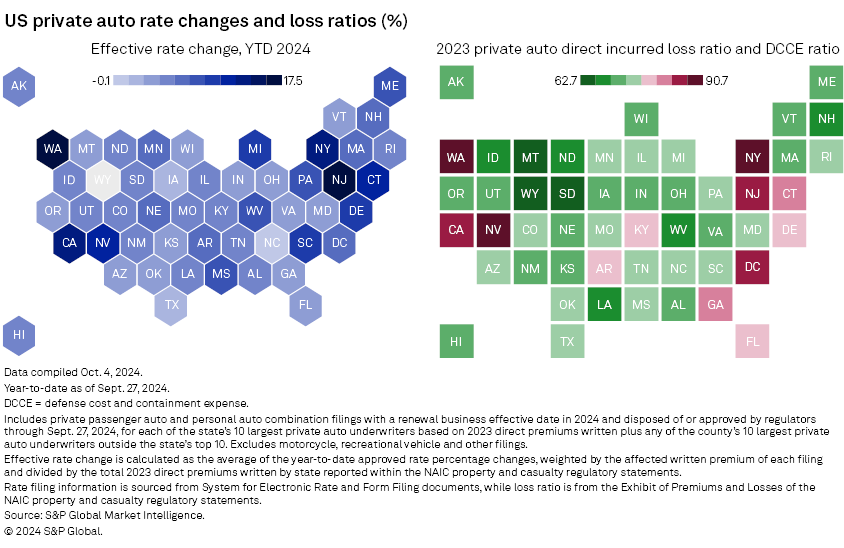

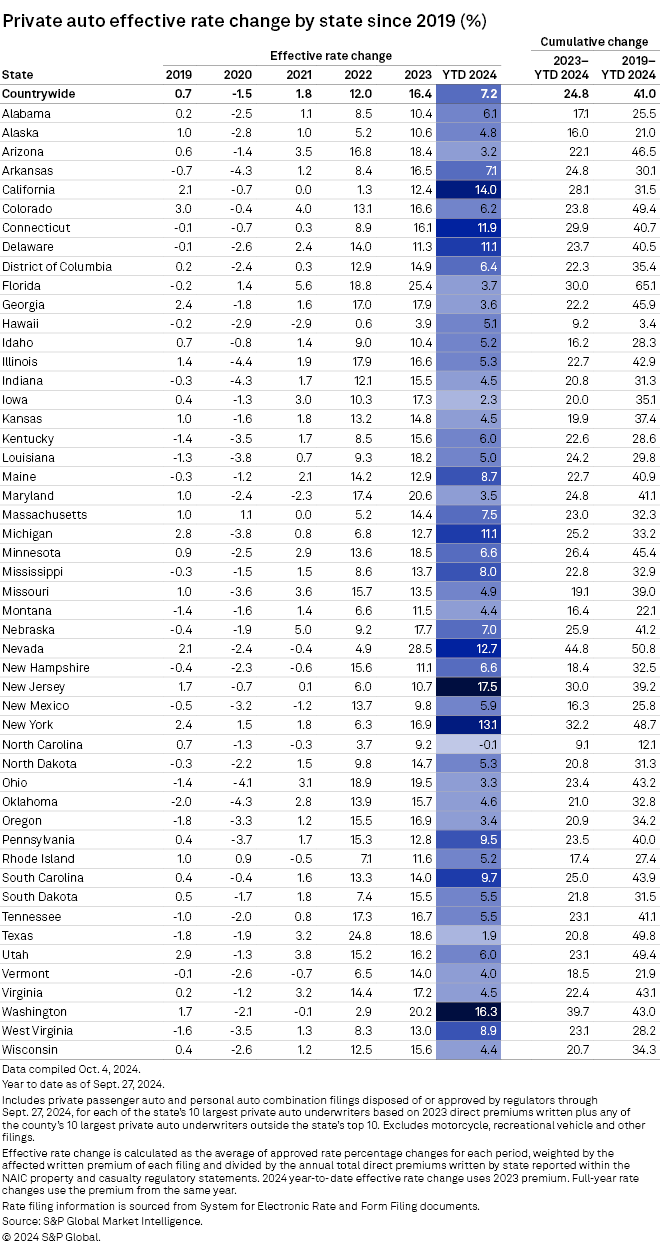

The year-to-date nationwide calculated weighted average effective rate change for private auto insurance is up 7.2% from rate filings approved through Sept. 27, 2024, according to S&P Global Market Intelligence's RateWatch application. US private auto insurers increased rates by double digits in each of the previous two years, a calculated increase of 16.4% in 2023 and 12.0% during 2022.

There is a wide variance in the effective rate change between individual states. New Jersey’s calculated effective rate increase so far in 2024 is 17.5%, compared to a slight decrease of 0.1% in North Carolina.

The rate information is sourced from disposed private passenger auto rate filings collected by S&P Global Market Intelligence that are submitted to the Department of Insurance in various states. The analysis is limited to rate filings of each state's 10 largest private auto underwriters based on 2023 direct premiums written plus any of the country's 10 largest private auto underwriters outside the state's top 10.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the National Association of Insurance Commissioners property and casualty regulatory statements. For year-to-date 2024 figures, 2023 direct premiums written were used. The calculations are based on rate filings entered into the database through Sept. 27, 2024, for 49 states plus the District of Columbia. Wyoming has been excluded as a limited number of rate filings are available within the database.

Read more about S&P Global Market Intelligence's RateWatch.

In total, only seven other states reflect a double-digit calculated increase based on roughly nine months of approved rate filings in 2024. Those states are Washington (16.3%), California (14.0%), New York (13.1%), Nevada (12.7%), Connecticut (11.9%), Delaware (11.1%) and Michigan (11.1%).

North Carolina is the lone state with a calculated effective rate decrease as several of the country's largest private auto underwriters have either decreased or will be lowering their renewal rates in North Carolina in 2024.

|

– Download a document with the top private auto insurers year-to-date 2024 effective rate changes by state. |

State Farm Mutual Automobile Insurance Co. initially boosted their rates in The Tar Heel State by 4.7% at the start of 2024 but will be lowering its renewal rates by 7.5% on Dec. 1. The nation's largest private auto underwriter had a calculated effective rate decrease in North Carolina is 3.9% in 2024.

Among the nation's other largest private auto underwriters, Farmers Insurance Group of Cos. and United Services Automobile Association are the other insurers lowering their rates in North Carolina with a calculated effective rate change of 18.0% and 1.7%, respectively.

GEICO, Progressive begin to lower rates in some states

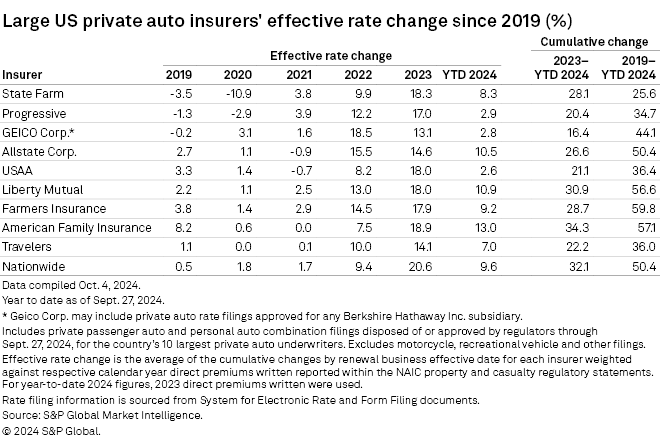

Berkshire Hathaway Inc.'s Geico Corp. has begun decreasing rates in some states after dramatically improved underwriting results through the first six months of 2024. The rollout of a "welcome factor" for new customers has contributed to the lower calculated effective rate across numerous states for the country's third-largest private auto insurer.

GEICO shows a calculated decrease in 20 states so far in 2024 from rate filings approved through Sept. 27, 2024. The insurer's weighted average change in Kansas reflects the largest decrease of 4.6%, followed by a decrease of 2.4% in Tennessee and Utah's 2.2%.

On the other hand, GEICO has boosted rates in 16 states so far in 2024, with the three highest calculated changes occurring in New Jersey (18.7%), Minnesota (10.9%) and Massachusetts (10.8%). Overall, GEICO has raised rates in 2024 and its national calculated weighted average rate change is up 2.8% during the year.

The Progressive Corp. also lowered rates in several states with its calculated effective rate decrease of 6.2% in Iowa being its largest decrease. The insurer's first decrease of 2.4% went into effect for renewal business on Feb. 29 in Iowa, with a follow-up overall decrease of 3.9% that went into effect in September.

The Ohio-based insurer reflects a lower calculated rate in six other states — Wisconsin (3.6%), Nebraska (2.0%), Illinois (1.1%), South Dakota (1.1%), Mississippi (0.6%) and New York (0.1%).

In total, Progressive boosted rates in 29 states so far in 2024, which makes its calculated national effective rate increase of 2.9%.

Three of the nation's largest private auto insurers have a calculated effective rate increase in the double digits so far in 2024. The American Family Insurance Group has the highest calculated rate increase of 13.0%, followed by Liberty Mutual Holding Co. Inc. at 10.9% and The Allstate Corp.'s 10.5% increase.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.