Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 03, 2023

Look through the volatile and backward-looking official data and there are signs that the US economy has cooled sharply in recent months, with mounting evidence that an economic contraction looms in the early months of 2023. However, there are some rays of light to suggest that the downturn could prove short-lived.

If you look at the latest official GDP data, which showed a 2.9% annualized rate of growth in the fourth quarter of last year (equivalent to a 0.7% quarter on quarter increase) you would think the US economy was in fine shape. After all, that rise came after a solid 3.2% gain in the third quarter.

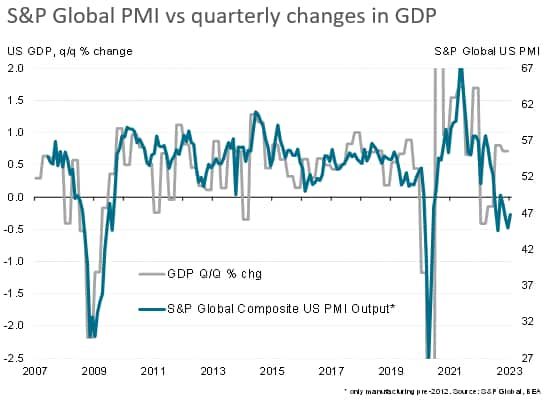

However, business surveys paint a very different picture. The composite US PMI from S&P Global, which monitors the output of the combined manufacturing and services sectors of the economy, has now been deep in contraction territory for some time. At 46.8 in January, the latest reading in fact signalled the seventh successive monthly drop in business output, running well below the survey's 50.0 'no change' level.

The weakness in the PMI encourages some further investigation into the buoyant picture portrayed by the GDP numbers over the second half of last year. An important aspect to note is that the expansion in the third and fourth quarters came on the heels of back-to-back contractions of -1.6% and -0.6% annualized rates in the first and second quarters of 2022 respectively. In other words, some of this strength in the second half of the year merely reflected a corrective rebound from a poor first half of the year.

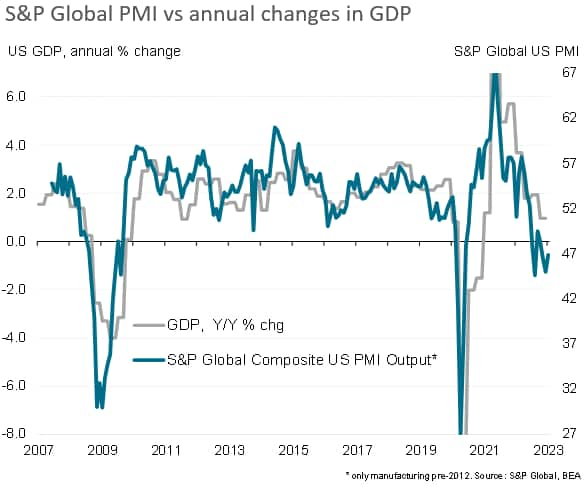

So where do these fluctuations in GDP over the course of 2022 leave the economy? Looking at year-on-year comparisons, GDP was up just 1.0% in the fourth quarter of last year. That was the weakest rate of expansion since the pandemic disruptions in late 2020, and points to a marked cooling in the pace of expansion from the 5.7% annual rate seen at the end of 2021.

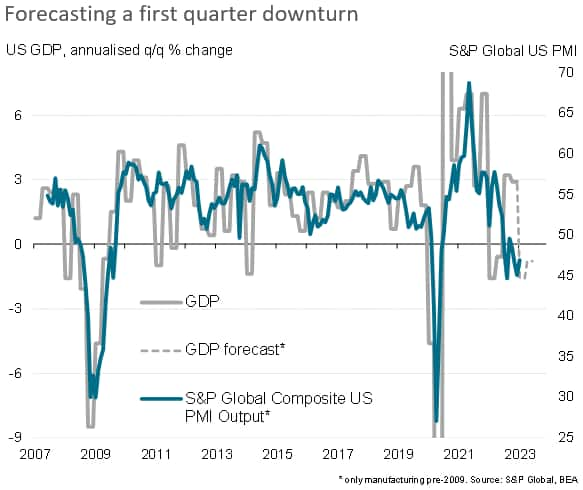

This sharp slowing in the annual rate of economic growth corresponds well with the PMI data. Instead of tracking all of the noise in the GDP numbers, the PMI accurately foretold the slowing in the economy over the course of the past year. And the survey provides a heavy hint that the rate of growth could go negative in the early months of 2023. This in fact corresponds nicely with the forecasts from the US macro team here at S&P Global Market Intelligence. Our forecasters expected US GDP to contract at a 1.6% annualized rate in the first quarter of 2023, followed by a more modest decline in the second quarter.

Encouragingly, having anticipated the slowing in the underlying rate of GDP growth during 2022 and hinting at a contraction in the first quarter, the PMI data for January did bring some rays of light. Rates of decline of both manufacturing and service moderated at the start of the year, and forward-look indicators such as new orders and business optimism for the year ahead jumped higher.

The PMI data therefore support the view from our forecasting team that a nadir for the economy will be seen in the first quarter. After which the economy should start to show signs of turning around again, adding to hopes of a "soft landing". However, growth for the whole of 2023 is only expected to reach 0.5%, reflecting the soggy start to the year and prospect of further interest rate hikes.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location