Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 28, 2023

March saw a welcome acceleration of output growth to the fastest since May of last year, according to the flash PMI surveys. The upturn is uneven, however, being driven largely by the service sector. Although manufacturing eked out a small production gain, this was mainly a reflection of improved supply chains allowing firms to fulfil backlogs of orders that had accumulated during the post-pandemic demand surge.

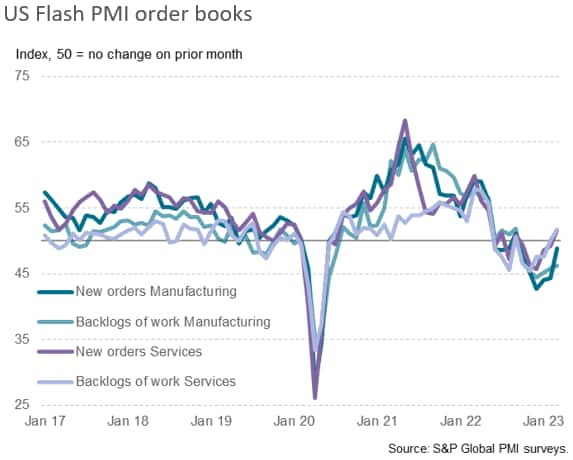

Tellingly, new orders have now fallen for six straight months in manufacturing. Unless demand improves, there seems little scope for production growth to be sustained at current levels.

In services, there are more encouraging signs, with demand blossoming as we enter spring. It will be important to assess the resilience of this demand in the face of the recent tightening of interest rates and the uncertainty caused by the banking sector stress, which so far only seems to have had a modest impact on business growth expectations.

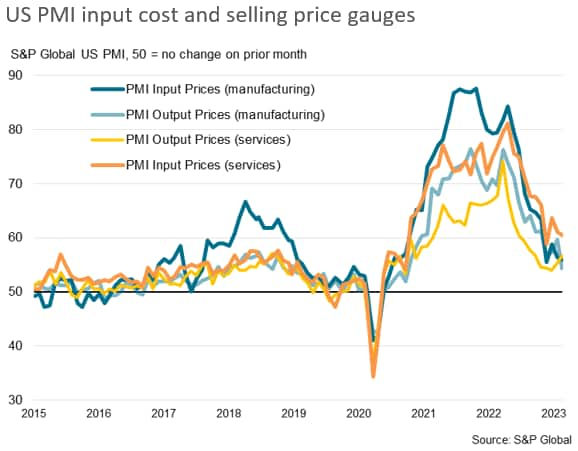

There is also some concern regarding inflation, with the survey's gauge of selling prices increasing at a faster rate in March despite lower costs feeding through the manufacturing sector. The inflationary upturn is now being led by stronger service sector price increases, linked largely to faster wage growth.

Below we list five key charts from the latest survey data.

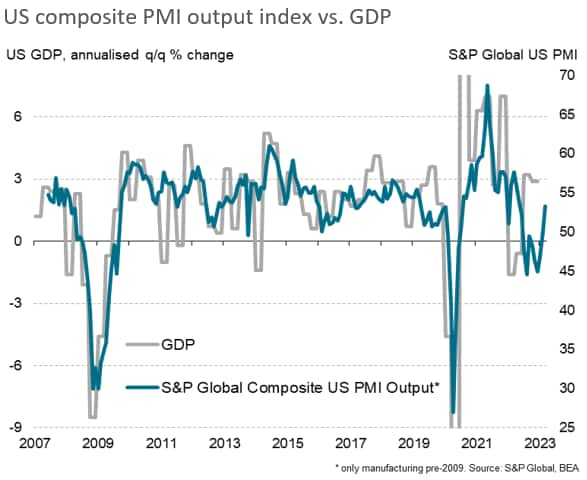

The headline S&P Global Flash US PMI Composite Output Index registered 53.3 in March, up notably from 50.1 in February. The latest index reading was the highest for almost a year, and signalled a solid expansion in private sector activity.

The latest PMI is broadly consistent with annualized GDP growth approaching 2%, painting a far more positive picture of economic resilience than the declines seen throughout the second half of last year and at the start of 2023.

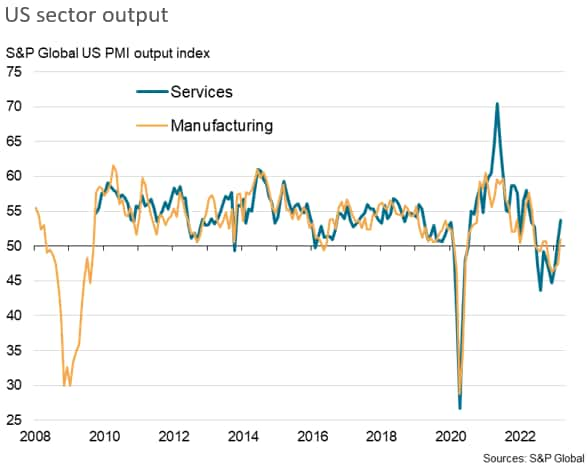

Goods producers recorded the first rise in production since October 2022, partially stemming from improving supply chains, but it was service providers that reported the main thrust to growth, seeing a notable acceleration of business activity to register the quickest expansion since April 2022.

In manufacturing, any increase in output was often associated with improving supply of raw materials rather than any fundamental improvement in the demand picture. In fact, new orders continued to fall in the manufacturing sector during March while supplier lead times quickened to the greatest extent on record (since May 2007), allowing firms to process backlogs of work which had in many cases built up as a consequence of the supply squeeze during the pandemic. Backlogs fell solidly as a result, though this of course bodes ill for production in coming months in the absence of new order inflows.

In the service sector, in contrast, backlogs of work rose as firms struggled to meet the rise in demand, as new business inflows hit the highest for ten months.

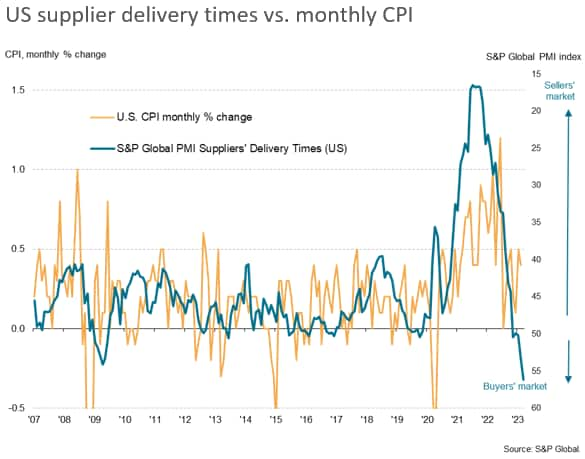

The sustained downturn in demand for manufactured goods, signalled by the survey in March facilitated a further easing of supply chain constraints. Combined with improved logistics compared to the problems seen during the pandemic, notably container shortages and port congestion, the drop in demand contributed to the greatest improvement in supplier delivery times recorded since survey data were available in 2007.

The reversal of widespread supply delays to a situation of improving availability of inputs over the past year has in turn alleviated supply chain price pressures, and in the past is consistent with a shift from a sellers' to a buyers' market which will help cool consumer price inflation.

Producer input costs rose at the second-slowest rate for 32 months in March according to the flash manufacturing PMI, reflecting the moderation of supply chain price pressures. Selling prices for goods leaving the factory gate also rose at a slower rate, the rate of increase down to a 29-month low, as producers sought to boost sales by pricing more aggressively and passing lower cost growth on to customers.

However, whereas manufacturing inflation rates cooled, average prices charged for services rose at an increased rate for a second successive month in March, rising at the sharpest rate since last October, suggesting some worrying stickiness to inflation, linked in many cases to upward wage pressures.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.