Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Sep, 2022

By Nathan Sovall and Ronamil Portes

Some members of the investment community fear banks might have to ultimately recognize large unrealized losses in their bond portfolios to meet their liquidity needs, but institutions have a number of other funding sources they likely would utilize first.

While higher interest rates have pushed U.S. banks' net interest margins upward, the drastic increase in rates has negatively impacted the values of most bonds that institutions own, serving as a headwind to tangible book value growth. The Federal Reserve has committed to reduce inflation with further rate hikes and some members of the investment community have expressed concern that additional tightening of monetary policy could lead to deposit runoff and push banks to sell bonds at a loss for liquidity. However, it seems more likely that banks would defend their deposits with higher rates or access wholesale funding before purging their positions.

Investors questioning if banks will harvest bond portfolios for liquidity

Bank bond portfolios have grown considerably since the pandemic began as liquidity flowed into the financial system. Through the first quarter of 2022, deposit growth has outpaced loan growth by close to $4.6 trillion since year-end 2019. Deposits actually declined in the second quarter from the prior quarter though as the Federal Reserve aggressively tightened monetary policy and consumers utilized some of the excess savings accumulated during the pandemic. Even with that change, deposits had still outgrown loans by nearly $3.8 trillion since the pandemic.

Hovde Group's bank analyst team noted in an Aug. 29 report that some investors have expressed concern that banks could be forced to sell some bonds due to declines in deposits and take embedded losses in underwater securities. As interest rates have risen, the values of many of the bonds that banks own have come under pressure and moved deep into negative territory. All banks have to mark bonds sitting in available-for-sale, or AFS, portfolios on a quarterly basis, and those portfolios continue to hold the bonds owned by the majority of banks.

The Fed remains committed to raising rates until elevated inflation wanes, suggesting that interest rates are unlikely to decline and push values in bond portfolios substantially higher soon. Liquidity needs could increase as the central bank tightens further, marking a reversal of a trend over the last few years where unprecedented government stimulus and accommodative monetary policy left banks awash with excess liquidity.

Some signs of that shift already occurred in the second quarter, when deposits dipped modestly, while loans grew at a quicker pace, allowing loan-to-deposit ratios to recovery notably in the period. Banks have done little to defend deposits thus far, at least by offering higher rates, but deposit bases should be far more sensitive to changes in rates during the second half of the year.

Hovde analysts acknowledged in the Aug. 29 report that banks' liquidity needs could grow but also noted that institutions have ample alternative sources of funding, including brokered CDs, fintech deposits or advances from Federal Home Loan Banks.

Janney Montgomery Scott analysts Feddie Strickland and Christopher Marinac made a similar argument in an early August report, noting that banks have substantial capacity to borrow from the FHLBs, subject to a 25% maximum borrowing limit against their assets. The analysts examined all the eligible, individual securities and loans banks can pledge as collateral to FHLB and found the median net borrowing capacity stood at 23% at the end of the second quarter, or two percentage points below the maximum.

Bond portfolios putting pressure on tangible book value

Even if banks are not forced to take action and sell underwater positions in their bond portfolios, the large amount of unrealized losses sitting on those books have already negatively impacted tangible book values. The vast majority of bonds banks' own remain in AFS portfolios and changes in the value of those portfolios flow through accumulated other comprehensive income, or AOCI, and impact tangible common equity.

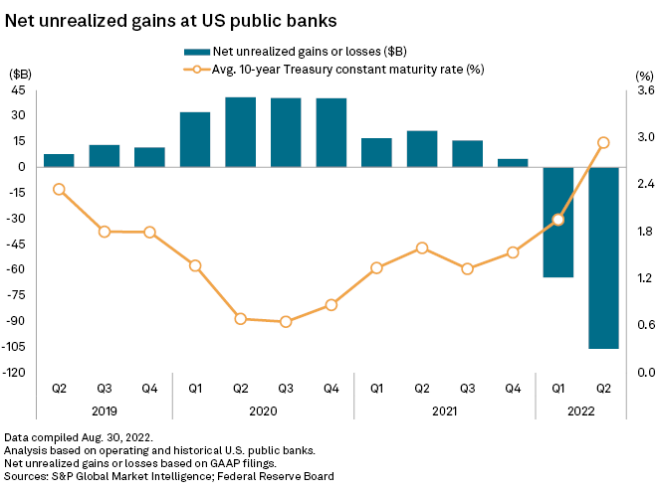

Rates rose notably in the second quarter, with the average yields on the 5-year and 10-year Treasurys ending the period 112 basis points and 98 basis points higher, respectively, than the averages in the first quarter. Those increases in rates put even greater pressures on the values of AFS portfolios.

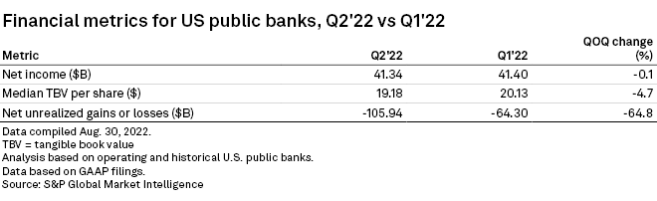

In the second quarter, institutions including U.S. commercial banks, savings banks, and savings and loan associations that file GAAP financials reported $105.94 billion in unrealized losses in their AFS portfolios, compared to $64.30 billion in unrealized losses in the prior quarter. Those institutions saw their median tangible book values dip 4.7% from the linked quarter despite more than $40 billion in earnings in the period.

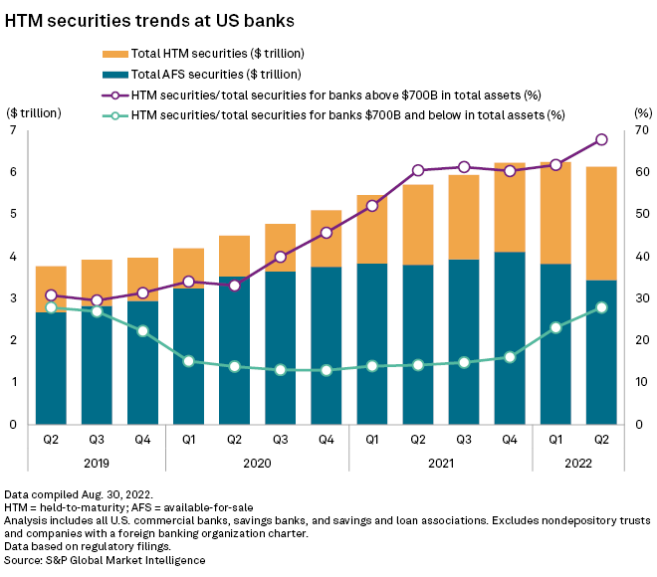

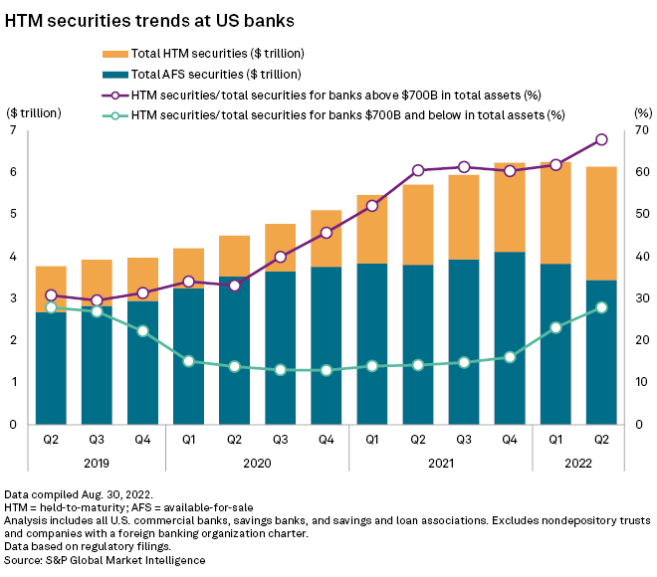

Some banks, particularly the nation's largest institutions, have sought to protect large portions of their securities portfolios from swings in the market by placing bonds in their held-to-maturity, or HTM portfolios, which are not marked on a quarterly basis. For banks with over $700 billion in assets, changes in AOCI would impact regulatory capital in addition to tangible book value.

Large banks classified as U.S. global systemically important banks, or GSIB, holding companies — those with more than $700 billion in assets — have placed nearly 68% of their bond portfolios in held-to-maturity, or HTM, portfolios. That is up from 62% in the first quarter and just shy of 31% three years ago.

The growth in HTM portfolios at large banks has occurred while those institutions' securities portfolios ballooned during the pandemic, growing more than 55% since the end of the fourth quarter of 2019.

Large banks have been mindful of a potential capital hit that could come with higher interest rates, particularly since the institutions deployed funds in the bond market when rates were near historic lows during the height of the pandemic. Banks with over $700 billion in assets have grown their HTM securities 237% since the fourth quarter of 2019.

Meanwhile, HTM securities at banks with less than $700 billion in assets have risen in the last few quarters, increasing to 27.9% of total securities in the second quarter from 23.1% in the prior quarter and 16.1% in the fourth quarter of 2021.

Podcast