S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 19, 2024

By Sian Jones

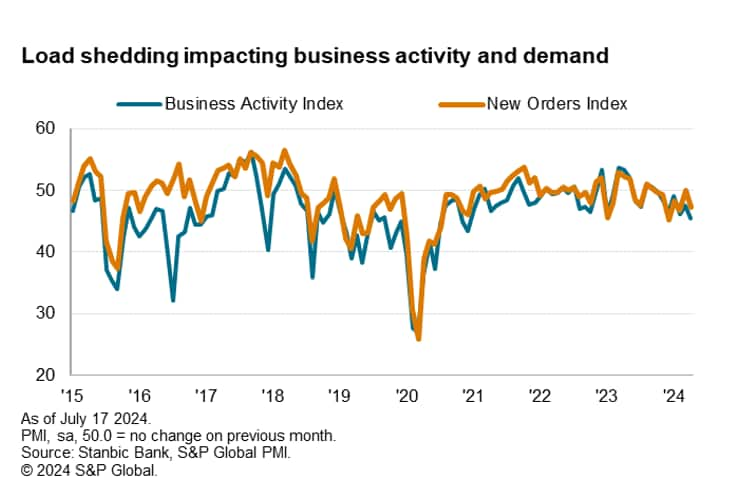

The Stanbic Bank Zambia PMI signalled further challenging business conditions for companies as electricity supply disruptions affected firms' production schedules and ability to operate. Moreover, electricity shortages resulted in higher costs for businesses, whilst also weighing on the purchasing power of customers.

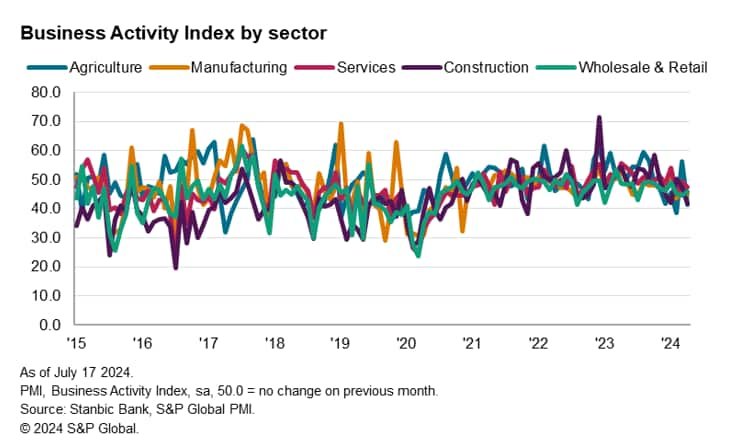

June data indicated a sharp contraction in output as demand conditions deteriorated again. The availability of sector data for Zambia allows us to analyse the impact on individual industries across the private sector. Drought conditions caused by El Niño climate conditions and the effects of load shedding were particularly felt in agriculture and construction, although the decline in output was broad-based by sector.

PMI hit by electricity supply disruptions

The Stanbic Bank Zambia PMI signalled challenging business conditions across the private sector during June, as output and new orders contracted at sharper rates. Moreover, the fall in business activity was the quickest since February 2021, as survey respondents noted difficulties planning production schedules and opening hours due to an unstable electricity supply. At the same time, weak client demand following hikes in selling prices coincided with some firms needing to restrict the amount of new order intakes due to power outages and strain on capacity. In fact, backlogs of work rose for the third month running, albeit only slightly.

Firms also noted that higher energy costs and a greater overall cost-of-living put pressure on client purchasing power, which drove the latest downturn in new business. In fact, of the five monitored sectors, only manufacturing recorded a rise in new sales, with the strongest decline seen in the construction sector.

Drought conditions seen earlier this year have taken their toll on agricultural production in Zambia, but have also adversely affected the supply of electricity, the vast majority of which is provided by hydroelectric stations (83% - Zambia Ministry of Energy). In late May 2024, the Zambian government announced extensions to the hours of load shedding (the deliberate reduction of electricity supply to protect the energy system) per day - bringing this up from eight to 12 hours, split into two six-hour blocks. However, power outages have become unpredictable and more commonplace, according to PMI panellists, who also often note that it is becoming increasingly difficult to plan schedules or accept new business.

Moreover, our current forecast for GDP in Zambia anticipates slower growth in 2024 of 3%. This has been revised down from a previous expectation of 3.7%. Nevertheless, Zambian firms have remained strongly upbeat in their outlook for output over the coming year. Although dipping from May, June data signalled the second-highest level of optimism in growth in business activity since December 2021. Among the anecdotal evidence supplied by survey respondents were reports of firms beginning to look into alternative energy sources to aid the stability of production and businesses' operational hours. The purchase of new machinery is also expected to help boost output over the coming year.

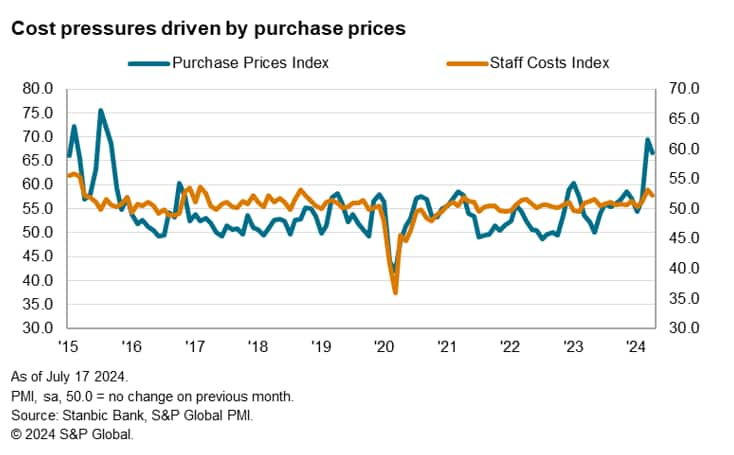

Price pressures remain steep in June, amid kwacha depreciation and higher energy costs

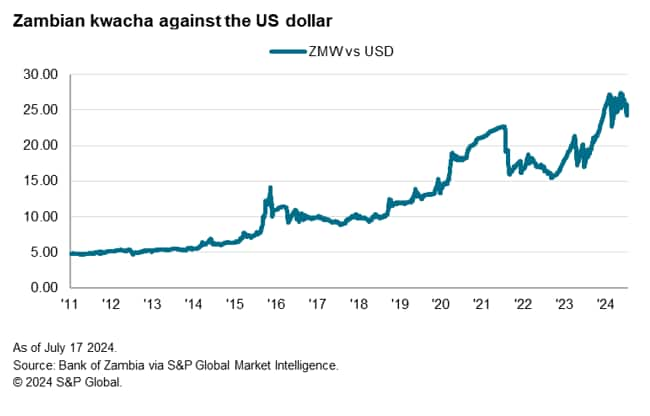

Zambian firms were once again faced with a sharp rise in total input costs during June, despite the pace of increase easing slightly from May's recent high. The depreciation of the kwacha against the US dollar has had a marked upward impact on firms' cost burdens due to higher imported goods prices, including fuel.

As has been the case since August 2023, producer input prices rose at a much sharper rate than staff costs in June. Although firms have noted efforts to help employees out with cost-of-living payments added on to wages, utility and raw material cost inflation has been even higher. The pace of purchase cost inflation in June was the second-fastest since November 2015. Further unfavourable movements in the kwacha against the US dollar are possible as the currency remains vulnerable, with companies braced for more and marked rises in input costs through 2024.

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.