S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Feb, 2024

By David Hayes

Bankers expect to charge off a higher proportion of loans in 2024, even as economic expectations remain little changed, according to S&P Global Market Intelligence's fourth-quarter 2023 "US Bank Outlook Survey."

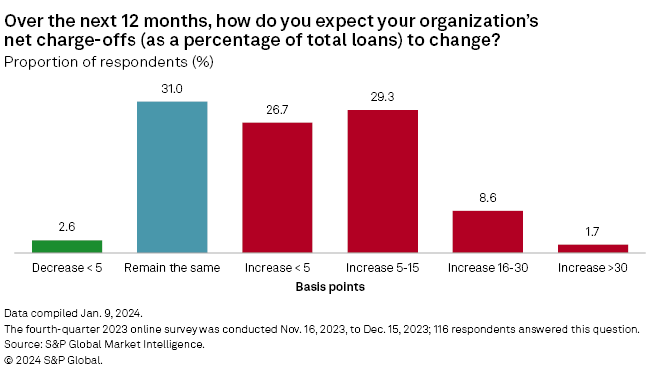

➤ A majority of bankers expect net charge-off ratios to increase at their institution over the next 12 months, but most believe the increase will be small.

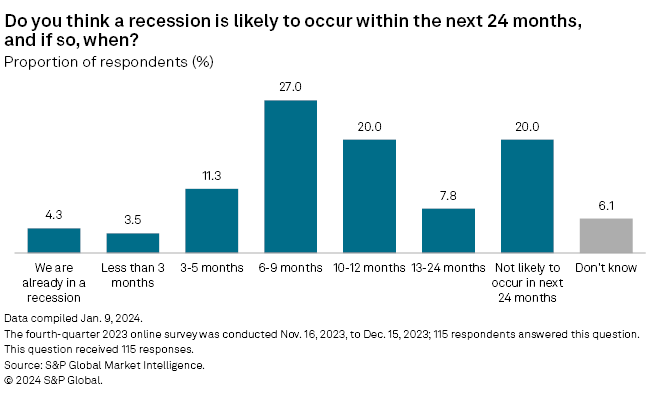

➤ The proportion of respondents indicating that the US is already in recession dropped to the lowest point in four surveys, but almost two-thirds of survey participants still expect a recession within the year.

➤ M&A appetite among would-be sellers remains muted, but January gives room for hope.

Net charge-offs expected to climb

S&P Global Market Intelligence surveyed US banking industry professionals between Nov. 16 and Dec. 15, 2023, and found that 66.4% of bankers expect net charge-offs (NCOs) as a percentage of loans to increase at their institution over the next 12 months.

Over half of respondents expect their institution's NCO ratio to increase by less than 15 basis points over the next 12 months. In the third quarter of 2023, US banks and thrifts reported an aggregate 0.51% net charge-off ratio, a 25-basis-point increase year over year.

Multiple banks have already noted potential storm clouds on the horizon for credit quality in 2024, especially for commercial real estate.

Most notably, New York Community Bancorp Inc. saw its share price battered by over 30% after announcing a surprise loss due partially to significant increases in provisioning against its office and multifamily loans.

Majority of bankers still expect recession within a year

Interestingly, while a majority of bankers expect credit quality to decline this year, only 4.3% of respondents felt the US was currently in a recession, the lowest mark in the four surveys where the question was asked and down from 21.8% in the fourth-quarter 2022 survey.

However, 66.1% of correspondents indicated that the US was currently in recession or would enter recession within the next year, essentially unchanged from the third-quarter survey's 67.6% mark.

US GDP increased by an annualized 3.3% in the fourth quarter according to advanced estimates, down from 4.9% in the third quarter, but still the second-highest quarterly rate since the end of 2021.

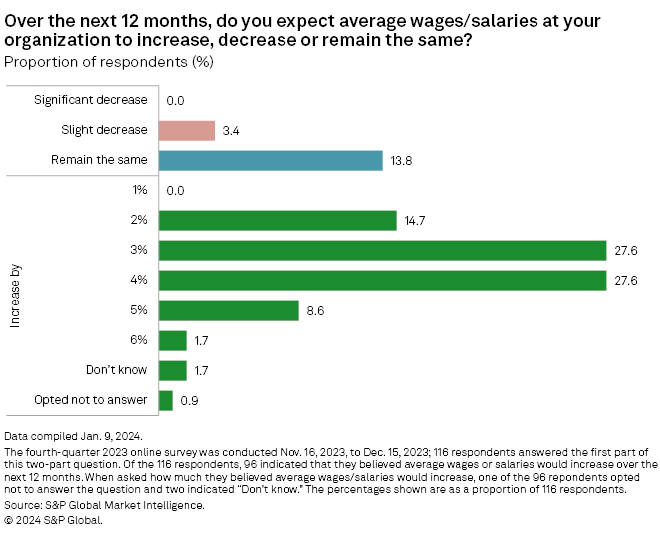

Wage growth expectations of 3% to 4%

Continued robust economic growth has also made predicting when the Fed will cut rates more difficult as fears of reigniting inflation persist.

Last month, average hourly pay for American workers increased 0.6% month over month, the largest monthly increase in almost two years, according to data from the US Bureau of Labor Statistics. In addition, 353,000 jobs were created in January, significantly more than analysts predicted.

A majority of respondents to S&P's survey expect average wages at their institution to increase by 4% or less over the next 12 months.

M&A hopes rise after slow 2023

Rapidly rising interest rates and a liquidity scare helped to slow US bank M&A to multiyear lows in 2023 as less than 100 whole-company deals were announced last year, lower even than 2020.

Early indications in 2024 suggest that the M&A chill may be thawing, at least in the niche corner of credit union-bank deals. January saw four deal announcements alone, including the largest credit union-bank deal ever, compared to 11 total deals over all of 2023.

Among survey participants, 8.6% of bankers believed their company was "somewhat likely" to sell over the next 12 months, up from 7.9% of bankers that felt their company was "somewhat" or "very likely" to sell in the third-quarter survey, but down from 10.8% in the fourth-quarter 2022 survey.

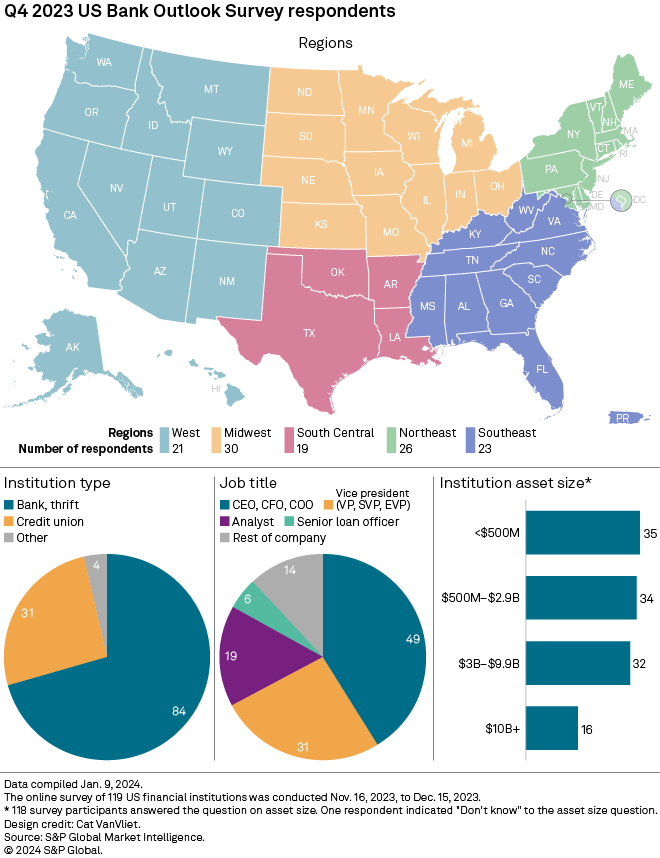

S&P Global Market Intelligence surveyed 119 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and credit quality trends. Of the 119 participants, 84 worked for commercial banks or thrifts, 31 for credit unions and four for other US institutions.

The online survey was conducted between Nov. 16, 2023, and Dec. 15, 2023.

The margin of error for topline statistics is +/- 9 points at the 95% confidence level.

Download a spreadsheet containing the results of the latest survey.

If you would like to participate in future US banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.