Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 9 Apr, 2021

The Bankruptcy of J. C. Penney Company, Inc. (JCP)

JCP is an American department store chain with 840 locations in 49 U.S. states, plus Puerto Rico. Like many U.S retailers, JCP was seriously impacted as soon as the COVID-19 pandemic spread in the U.S. in early 2020. With a significant decline in sales and increasing operating expenses, JCP had already struggled in prior years, trying to adapt its business model to the competitive U.S. retail space. However, the situation only got worse with the COVID-19 shock and severe economic recession.

In this blog, we discuss how the S&P Global RiskGauge model could have been applied to help track JCP’s credit risk before and during the COVID-19 pandemic, and act as an early-warning signal of a bankruptcy event.

RiskGauge Model – An Integrated Credit Risk View

S&P Global Market Intelligence’s Credit Analytics suite offers a variety of credit risk models that facilitate an easy, scalable, and time-efficient evaluation of credit quality for rated, unrated, public, and private companies globally across a full range of company sizes and industries:

Each model is tailored and optimized for its specific objective and use case. Given this, it is useful to combine them to achieve a well-rounded view of a counterparty’s credit risk, whilst mitigating any possible limitations with the individual models. The RiskGauge model does just that by integrating quantitative assessments from each of the three statistical models to generate a single credit score,[2] providing a unified view of a counterparty's creditworthiness. The S&P Global RiskGauge Scores have been optimized on default predictive power separately for public and private companies. RiskGauge generates an overall daily PD value for public and private companies globally, which can also be mapped to a credit score on a 1-100 scale, where a score of 100 (1) corresponds to companies with the lowest (highest) credit risk.

The Evolution of Credit Risk at JCP

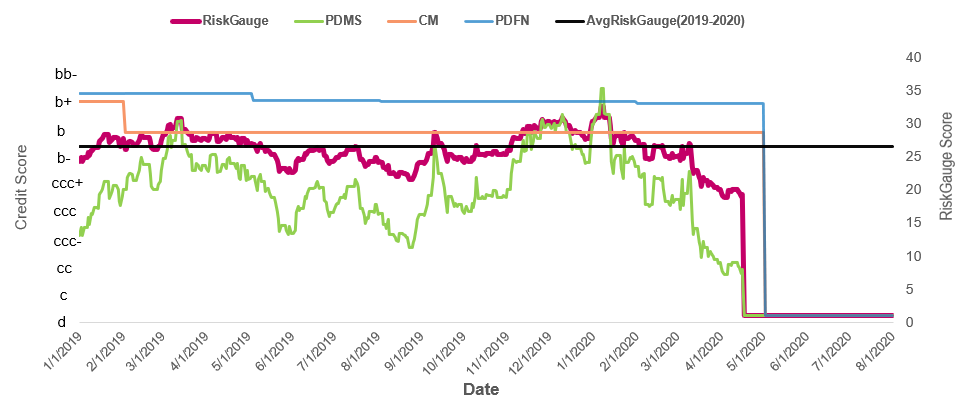

Figure 1 below shows JCP’s credit score generated by RiskGauge (purple line) between January 2019 and August 2020. Throughout 2019, JCP had negative outlook and experienced growing risks. On the Macro side, the fundamentals in the department store sector was tough, with a decelerated GDP growth rate and an elevated risk of a recession. JCP was on the weaker side of the competitive landscape. With years of inconsistent branding, inventory management issues and heavy debt burden squeezing its cash flows, JCP became financially and operationally fragile on its recovery trajectory. As a result, the S&P Global RiskGauge score had deteriorated from ‘b-’ to ‘ccc+’ from the beginning of 2019 to third quarter of the year.

Figure 1: Evolution of credit risk for JCP from January 2019 to August 2020

Source: S&P Global Market Intelligence. Data as of Aug 30, 2020. For illustrative purposes only.

The fundamentals-driven models (CM and PDFN), remained relatively stable throughout 2019, with a slight deterioration in the first half of the year. This was the result of a decline in JCP’s financial performance, due to consistently declining revenues, increased debt, and an unstable capital structure. In addition, the macroeconomic factors facing JCP were expected to be more challenging, further weakening its competitive position. In contrast, the market-driven PDMS scores were rather volatile, due to the company’s daily volatile stock price and negative market expectations in the first half of 2019. By combining these metrics, the RiskGauge score reliably reflected the company’s fundamental and market-driven credit risk profile.

Since the beginning of 2020, with the disruption caused by COVID-19 and the ensuing global recession, the U.S. retail sector has been faltering. JCP was hit even harder by the long-term lockdown, given its already weakened market position. On April 16, 2020, JCP’s ICR was downgraded to ‘D’, due to a missed interest payment on its senior unsecured notes.[3] On May 15, 2020, JCP commenced formal process for a voluntary Chapter 11 bankruptcy filing and entered into a restructuring support agreement with lenders, aiming to reduce balance sheet debt to achieve long-term sustainability in the post COVID-19 era.[4] Since January 2020, whilst declining sales were not yet reflected in JCP’s FQ1 2020 financial statements, the market-driven PDMS started deteriorating substantially, reflecting negative equity market prospects with the pandemic and providing an initial early-warning signal of JCP’s distressed conditions. As a result, the RiskGauge score deteriorated continuously throughout the first half of 2020, from ‘b’ to ‘b-’ to ‘ccc+’, eventually hitting ‘d’. Here we note that the RiskGauge score started declining since the beginning of 2020, exhibiting an overall downward trend from January to May, four months prior to the official bankruptcy date. When compared with the average RiskGauge score of JCP from 2019-2020 (horizontal black line), we also observe that the score dropped below its average level as early as February 2020, showing a rapid deterioration afterwards, three months prior to the bankruptcy date. We further notice that the rate of decline for the RiskGauge score was not as rapid or as large as that of PDMS, as the spurious market noise causing the PDMS volatility was partially reduced by the inclusion of the relatively stable CM and PDFN score contributions. Thus, the elevated RiskGauge score was a reliable and timely representation of JCP’s evolving credit profile, reinforcing PDMS’s early-warning detection function, while incorporating the stability of fundamental assessments from CM and PDFN.

In summary, the RiskGauge model intelligently integrates three standalone credit risk models – CM, PDFN, and PDMS – into a combined credit score and PD value, providing unique insight into a company’s creditworthiness. It offers users a streamlined view of counterparty credit risk by generating daily PD and credit score estimates for a broad range of private and public companies globally. By analyzing the time series pattern of JCP’s creditworthiness utilizing RiskGauge scores, along with the underlying drivers, we conclude that the RiskGauge model is effective and timely in predicting credit risk elevation. It captures both the most recent market sentiment and the long-term fundamental changes, acting as a reliable early-warning detection tool for a possible bankruptcy event.

Figure 2: Research Update from S&P Global Ratings

|

Date |

Headline |

Types |

|

July 2, 2020 |

Research Update: J.C. Penney Co. Inc. Ratings Discontinued Following Chapter 11 Filing |

Research Update |

|

April 16, 2020 |

Research Update: J.C. Penney Co. Inc. Downgraded To 'D' On Missed Interest Payment |

Research Update |

|

August 28,2019 |

Research Update: J.C. Penney Corp. Inc. Lowered To 'CCC' On Greater Risk for Debt Restructuring On Industry Headwinds, Outlook Negative |

Research Update |

Source: S&P Global Ratings as of Feb 05, 2021. For illustrative purposes only.

To learn more about S&P Global RiskGauge click here.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[2] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[3] S&P Global Ratings: “J.C. Penney Co. Inc. Downgraded To 'D' On Missed Interest Payment”, Research Update, Apr 16, 2020.

[4] S&P Global Ratings: “J.C. Penney Co. Inc.'s Debt Downgraded To 'D' On Chapter 11 Filing; Secured Recovery Rating Revised To '3'”, Rating Action News, May 19, 2020.

BLOG

BLOG

Theme

Products & Offerings

Segment