Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Mar, 2021

By Sidiq Dawuda

U.S. consumers further tightened their purse strings in late 2020 amid rising COVID-19 cases and new restrictions on dining and shopping outside of the home. In November, clothing and clothing accessories stores saw a 6.8% decline in sales to $18.48 billion, and by late November to early December two major U.S. retail companies covered by S&P Global Market Intelligence (“Market Intelligence”) went bankrupt. This pushed the 2020 year-to-date count to 51,[1] a figure that exceeded the number of filings in any year since 2009. Adding to this, the retail sector lost 34,700 jobs in November, a 0.23% month-on-month decrease to 15.12 million jobs, according to data from the U.S. Bureau of Labor Statistics.

Tailored Brands, Inc., a Houston-based apparel retailer founded in 1973, faced similar difficulties. In August 2020, the company was operating 1,450 stores throughout the U.S. selling suits, sport coats, slacks, accessories, and more for men, plus a range of apparel for women and children. Then, on August 2, 2020, the company became one of the ten largest U.S. retail bankruptcies of the year with more than $1 billion in liabilities and assets.[2] The company’s impending challenges were highlighted in the March 20, 2020 research report from S&P Global Ratings describing its capital structure as “unsustainable in light of substantially weakened earnings prospects”.[3]

Two models in Market Intelligence’s suite of credit risk solutions that generate quantitatively-derived credit scores that statistically match a credit rating by S&P Global Ratings pointed to problems:[4] These include:

Troubles on the Horizon

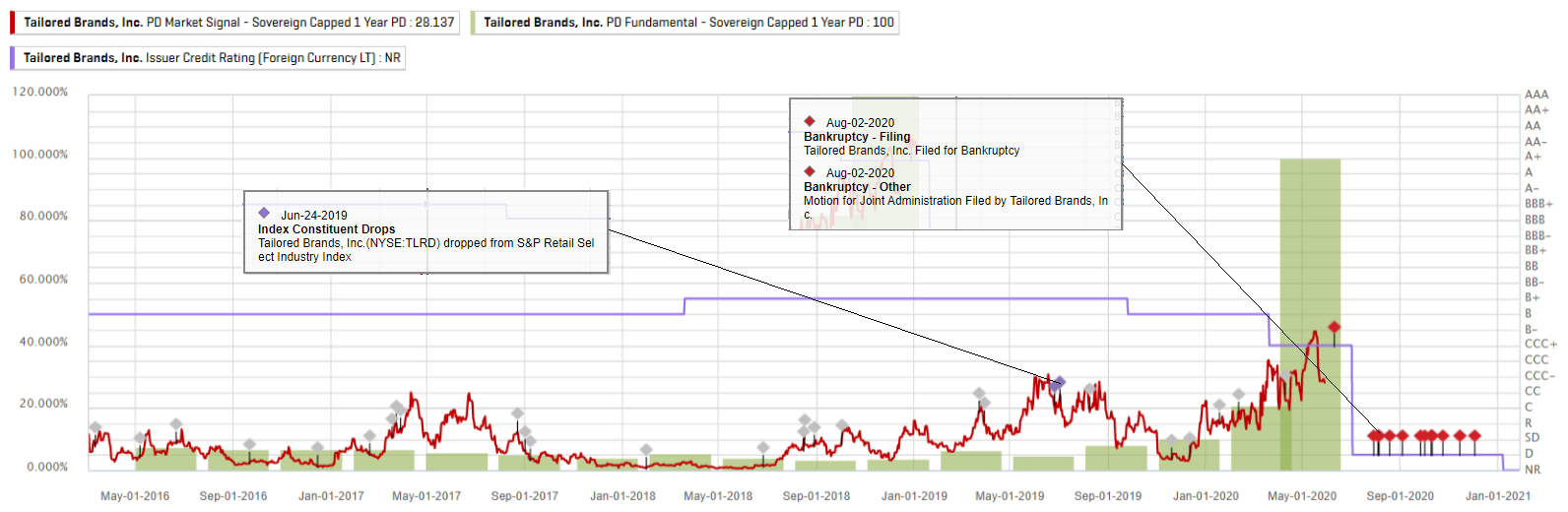

As shown in Exhibit 1, the one-year PDMS experienced a near four-fold increase between January 3, 2020 and May, 15, 2020, jumping from 12.91% (an implied credit score of ‘ccc’) to 44.47% (an implied credit score of ‘cc’). This was three months before the company filed for bankruptcy and seven weeks before its rating downgrade by S&P Global Ratings from ‘CCC+’ to ‘D’. By May 28, 2000, the implied score for the company was ‘ccc-’. Similarly, the one-year PDFN exceeded 10% since Fiscal Quarter (FQ) 4 2019, and had reached 20.92% by May 2, 2020 (an implied credit score of ‘ccc’). The COVID-19 outbreak had significantly impacted the financial condition of the business through the first quarter of 2020, resulting in the temporary closure of its stores and the need to furlough all U.S store employees and temporarily layoff all Canadian store employees.

Exhibit 1: PDMS and PDFN Escalation

Source: S&P Global Market Intelligence as of February 23, 2021. For illustrative purposes only.

Contributing Factors to the Companies Bankruptcy

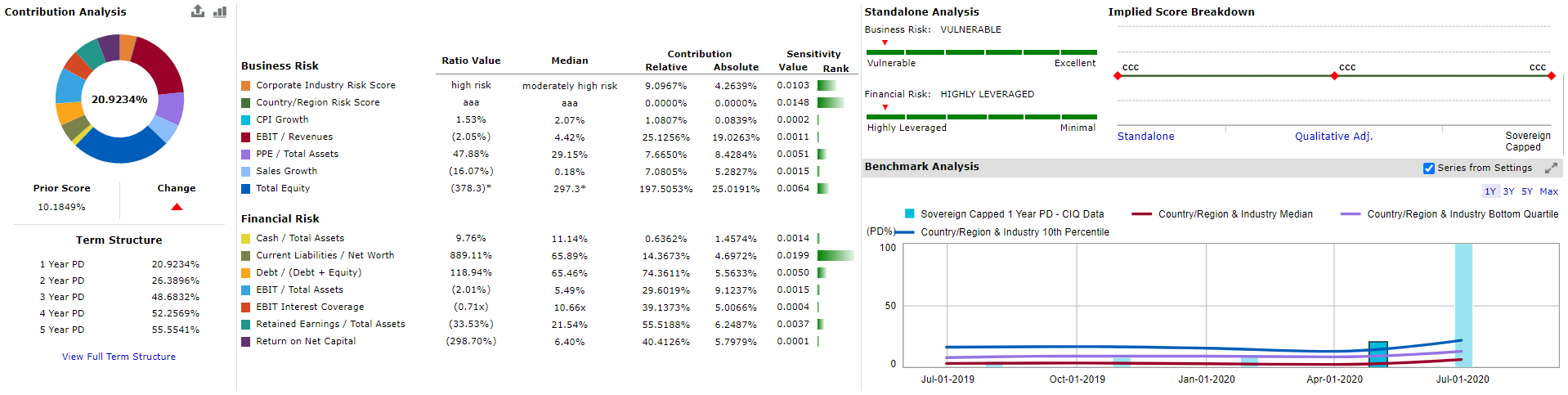

The company had been experiencing issues for a significant length of time with a PDFN in, or close to, the worst 25% of companies in the region and industry in the last three reporting periods starting fiscal quarter (FQ)4 2019, and in the worst 10% for the final reporting period. As shown in Exhibit 2, the largest factor contributing to the increase in PD was total equity, which was increasingly negative every quarter since FQ4 2019. Total equity decreased by more than 2,000% between FQ4 2019 and FQ1 2020, falling from $4 million to -$98 million. This trend continued between FQ1 2020 and FQ2 2020, ending with total equity of -$378 million.

The decrease in total equity was a result of persistent negative retained earnings after the FQ1 2016 reporting period. At this time, the firm had recorded large net income losses of more than $1 billion, largely due to impairment charges from the 2014 acquisition of former rival company Jos. A. Bank. The loss of sales revenue due to COVID-19 added to this, resulting in negative net operating income in the last two reporting periods, and the company’s eventual filing for bankruptcy. Although Tailored Brands has since emerged from Chapter 11, this was yet again another indication of the struggles that brick and mortar retailers face against online retailers given the additional costs associated with their stores. Against a backdrop of COVID-19 and the associated supply chain disruptions, social distancing, forced store closures, and subsequent reduced consumer demand, the company was unable to maintain solvency.

Exhibit 2: PDFN Contribution Analysis

Source: S&P Global Market Intelligence as of February 23, 2021. For illustrative purposes only.

Exhibit 3: Key Developments

|

Date |

Type |

Headline |

|

Aug-02-2020 |

Bankruptcy - Filing |

Tailored Brands, Inc. files for Bankruptcy |

|

Jul-28-2020 |

LCD* Distressed News |

Tailored Brands issues going concern warning |

|

Jul-28-2020 |

Bankruptcy - Other |

Tailored Brands contemplates bankruptcy |

|

Jul-24-2020 |

Delisting |

Tailored Brands receives non-compliance notice from NYSE |

|

Jul-21-2020 |

Discontinued Operations/Downsizing |

Tailored Brands plans to reduce headcount by 20% and close 500 stores |

|

Jul-21-2020 |

Executive/Board Change - Other |

Tailored Brands announces executive changes |

|

Jul-02-2020 |

Credit Rating - S&P - Downgrade |

Issuer Credit Rating: ‘D’; NM** from ‘CCC+’; Negative: Foreign Currency LT |

|

Jul-02-2020 |

LCD Default News |

Tailored Brands misses interest payment on bonds |

|

Jun-22-2020 |

Index Constituent Drop |

Tailored Brands (OTCPK:TLRD) dropped from S&P 600 |

|

Aug-21-2019 |

M&A Rumors and Discussion |

Sycamore Partners reportedly seeks to acquire Tailored Brands |

*LCD=Leveraged Commentary and Data

**NM= Not Meaningful

Source: S&P Global Market Intelligence as of February 23, 2021. For illustrative purposes only.

To learn more about our Credit Analytics models and data, contact us here.

[1] Source: December retail market: US sales drop, 2 retailers file for bankruptcy, S&P Global Market Intelligence, as published December 16, 2020.

[2] Source: Billion-dollar bankruptcies hit record in 2020 as COVID-19 takes toll, S&P Global Market Intelligence, as published January 25, 2021.

[3] Source: Tailored Brands Inc. Cut To 'CCC+' On Operational Headwinds, Potentially Unsustainable Capital Structure; Outlook Neg, S&P Global Ratings, as published on March 20,2020.

[4] : S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD scores from the credit ratings used by S&P Global Ratings. S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence.

Products & Offerings

Segment