Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 06, 2023

By Alyssa Grzelak and Natasha McSwiggan

As expected, despite an overhang of risk from the pandemic, global banking sectors again avoided major crises in 2022. Only two markets met our definition of a systemic banking crisis in 2022: Lebanon, where political paralysis extended a severe systemic banking crisis into its third full year, and Ukraine, where Russia's invasion and physical asset destruction exacerbated pre-existing vulnerabilities. COVID-19-related support measures were phased out at the end of 2021, but loans benefiting from forbearance at the height of the pandemic proved more resilient than many had expected, and non-performing loans (NPLs) did not rise markedly in 2022. Starting 2023, however, uncertainty and risk remain elevated. The world is heading into a cooling off period, with sharp reversals in monetary and fiscal stimulus expected to slow global growth and gradually bring down inflation.

1. Credit growth is likely to decelerate in most regions, but not contract.

The combination of higher interest rates, tighter liquidity conditions, and risk aversion against a background of weaker global economic growth will slow credit growth in most regions. However, a sharp pullback in credit provision remains unlikely, in part due to the lack of major credit booms over the last decade. Despite low interest rates, banks had remained more cautious with credit extension, reducing the likelihood of a sudden pullback in lending and sharp tightening of lending standards - as experienced during the global financial crisis - this year. Countries with high domestic inflation, such as Argentina, Turkey, and Venezuela, will remain exceptions to slowing credit provision, maintaining robust nominal credit growth even if credit contracts in real terms. In Asia, mainland China is likely to continue policies designed to boost credit provision targeting small and medium-sized enterprises in order to counteract its sluggish economic growth, in contrast to global trends. Globally, Sub-Saharan Africa is likely to post above-average credit growth rates given its higher inflation rates and low financial inclusion.

2. Growing pressure on debt service in early 2023 will gradually lift NPLs.

The normalization of interest rates and the removal of extraordinary borrower support and forbearance that masked asset-quality problems at the height of the pandemic will put upward pressure on NPLs this year1. The combination of tighter monetary policy and slowing global economic growth will affect the ability of borrowers to service debt, leading to a gradual increase in NPLs in early 2023, in turn hurting bank profitability and capital buffers. On a more positive note, growing impairment starts from historically low levels in many emerging economies, providing banks with more room to absorb asset-quality deterioration before problems become severe. Several Emerging European states have deployed multiple targeted support measures that will remain in effect in 2023. These will mitigate the impact of rising interest rates and higher prices on borrowers, helping to dampen the peak in cyclical NPLs.

3. With COVID-19 support measures fully phased out in most regions, we expect most countries to allow market forces to reassert themselves in 2023.

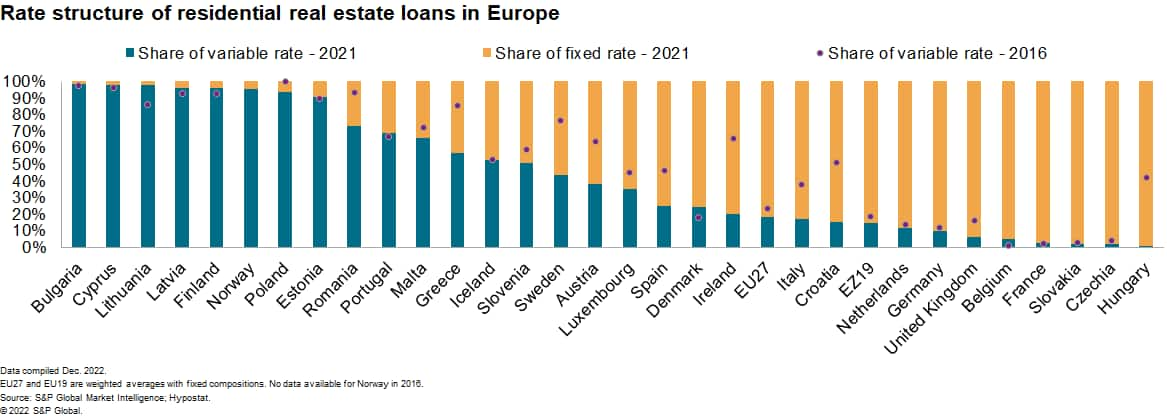

The exception to this will be Europe, which is hit most directly by knock-on effects from the Russia-Ukraine war. Forbearance and other targeted borrower support will remain important in stemming asset-quality deterioration for countries such as Hungary, Poland, and Romania that implemented such measures in 2022 in response to cost pressures and higher interest rates. Europe is most directly affected by the Russian invasion of Ukraine, making the region likely to extend existing measures if energy insecurity continues and the expected economic recession deepens beyond early 2023. Measures such as interest rate caps are most likely in countries with larger proportions of variable rate borrowers and which are undergoing more aggressive policy rate increases. Loan moratoria and credit holidays are likely to be directed to segments experiencing acute shocks or greater erosion of income streams, such as exporters and small- to medium-sized enterprises.

4. Bank-sovereign linkages will expand in Africa and Southeast Asia given worsening fiscal positions.

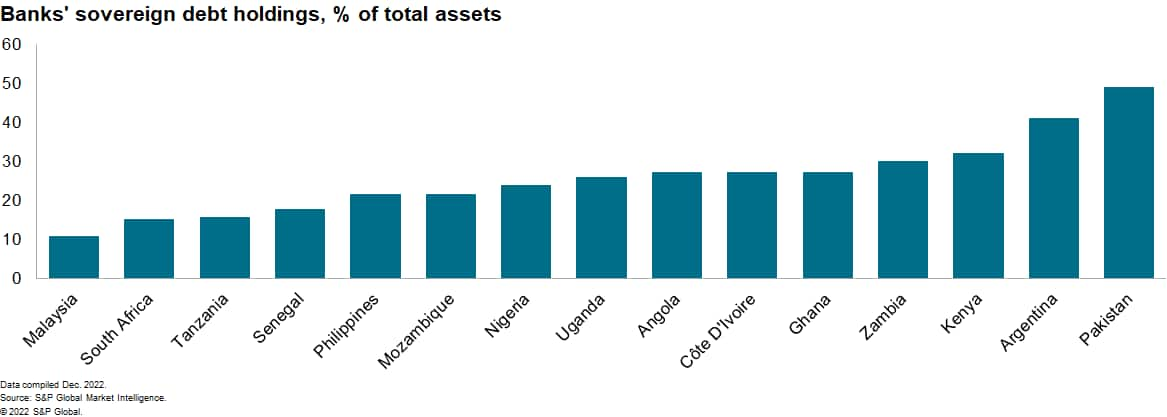

Government fiscal deficits have increased in recent years, prompting developing market governments in Africa and Southeast Asia to borrow more heavily from domestic banks. Banks' holdings of sovereign debt are high in countries facing debt stress such as Algeria, Angola, Egypt, Ghana, Kenya, Mozambique, Nigeria, Pakistan, Sri Lanka, and Zambia, among several others, leaving banks vulnerable to sovereign debt rescheduling and arrears accumulation. Although IMF funding will help to meet 2023 needs in some locations - notably in Angola, Egypt, Ghana, Mozambique, and Sri Lanka, and potentially Ghana and Zambia - the combination of higher budget deficits and limited portfolio inflows to emerging markets will push bank holdings of sovereign debt to more elevated levels, further increasing bank-sovereign linkage in Southeast Asia and Africa in particular. Higher borrowing costs and expanded debt stocks have caused significant challenges for African countries to service public debt, thus increasing the likelihood of sovereign debt restructuring (on both external and domestic liabilities) and default, exposing banks to substantial losses. Falling prices for government bonds would lower their market value as collateral for funding, increasing liquidity risks, while generating mark-to-market impacts on profitability.

5. Falling house prices and rising real estate risks will increase financial stability concerns, reinforcing an expected lending slowdown.

Facilitated by low interest rates, mortgage loan disbursement remained strong throughout the pandemic but high inflation, falling living standards, and higher interest rates will reduce the affordability of housing loans in 2023. Europe in particular faces growing risks of a sharp correction in housing markets. Housing loans represent a sizeable share of European bank assets, and a housing market correction will have adverse implications for lending, funding, profitability, and potentially even for financial stability given the large share of variable rate loans. Real estate issues also apply elsewhere - namely in mainland China, where banks are heavily exposed to ongoing real estate risks. Although mainland China's monetary policy has been on an opposing trend with a more accommodative stance and there are some signs of easing lending conditions for Chinese real estate companies, house prices remain soft, which is hurting developers' liquidity and their ability to service loans.

6. Financial conditions will remain tight, favoring banks with good liquidity management.

New wholesale bank borrowing conditions will continue deteriorating as advanced economy policy rates rise further, at least in early 2023 - and domestic deposit growth is likely to slow as household and corporate deposits are hurt by pressure on living standards and slower economic activity. Continued dollar strength, in part reflecting further US rate tightening, would increase the local currency cost of unhedged foreign exchange funding. Impacts are likely to vary, benefiting banks that previously have locked in large volumes of long-term funding at historically low rates, while penalizing those that are more exposed to short-term refinancing "extension risk", in which banks fail to call subordinated and AT1 debt when first permitted. This threatens to increase cost levels for new capital instruments and may curtail available investor demand.

7. Banks' profitability faces downward pressure due to asset-quality deterioration and higher cost pressures, with this being counterbalanced by higher policy rates potentially facilitating wider margins.

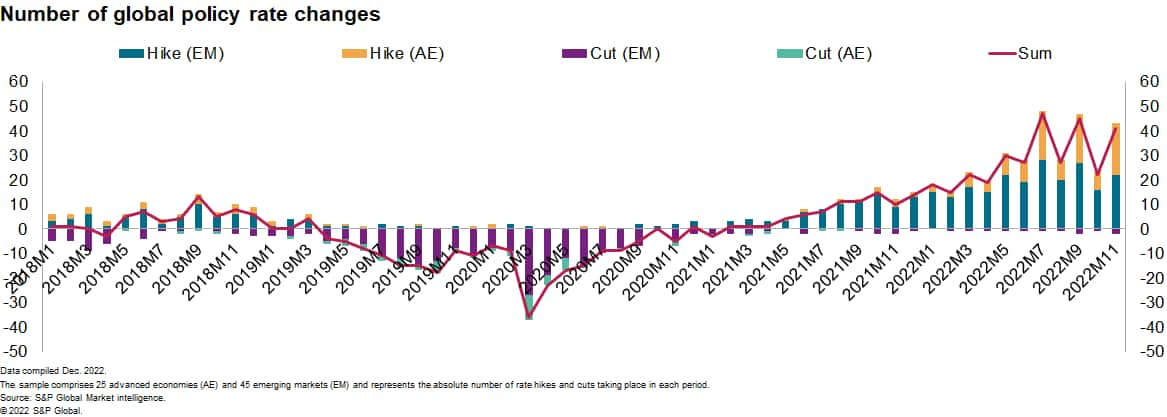

We foresee two-way bank profitability in 2023. Declining asset quality is likely to push profits lower as inflationary pressures (specifically, higher energy and food prices) damage the financial position of households and corporates, and banks adapt with higher loan-loss provisions and write-offs. Rising inflation has prompted central banks globally to tighten monetary policy in 2022 and we expect further monetary tightening in 2023, increasing funding costs for banks and curtailing the debt-service capacity of borrowers. In addition, higher operational and refinancing costs are likely to squeeze earnings. Global (and resulting domestic) economic slowdown will encourage tighter lending standards and reduced loan demand, putting further pressure on bank earnings. Counterbalancing this, rising interest rates should support margins, cushioning the decline in earnings and permitting improvements in profitability in stronger-performing geographies and over the longer term. At the opposing end of this spectrum, property sector difficulties, easing monetary policy, and ongoing economic impacts from COVID-19 threaten to lower profit margins in mainland China, while wider spreads and a strong regional performance offer scope for further improvement in the MENA region.

8. Escalating cost pressures increase the risk that additional taxes will be imposed on banks.

Strong and sustained lending throughout the pandemic accompanied by better-than-expected loan performance lifted bank profitability to multi-year highs in 2022, particularly in Europe. Persisting energy cost pressures and the associated deterioration in fiscal positions increase the likelihood of countries imposing temporary additional sector-specific taxes, including on bank profits, particularly where government deficits and debt burdens are higher and in Western Europe, where spillovers from Russia's invasion of Ukraine will remain key issues. Taxes risk discouraging large banks from lending while asset-quality pressures persist because of reduced post-tax margins while hindering bank capacity to bolster capital buffers. However, given that loan-loss provisioning is a pre-tax expense, a silver lining of higher bank taxes is likely to be that European lenders will shift to building reserves to lower their tax bills and prepare for asset-quality deterioration in 2023.

9. Technological innovation will continue changing the banking landscape.

In 2023, at least some of the more than 90 countries researching or developing central bank digital currencies (CBDCs) are likely to reach the implementation phase, with India and mainland China seeking to boost CBDC usage with an expanded rollout in 2023. Depending on how CBDCs are configured, they may reduce bank deposits and increase the state's financial sector footprint, but in most cases, including mainland China, CBDCs are likely to work through existing banks to limit financial instability risks. More broadly, this should accelerate and make international payment flows less costly - a priority objective for CBDC rollout. Traditional banks are also likely to continue establishing partnerships and making fintech acquisitions to capture access to financial innovation, alongside internal technological initiatives, to avoid losing their established positions. Migration from traditional "bricks and mortar" branches to electronic banking will continue, with physical networks being scaled back, along with wider use of non-digital ledger (blockchain) technologies such as artificial intelligence and multi-national initiatives for faster and cheaper payments.

10. Environmental social governance (ESG) issues will remain a key focus area for global regulators.

Globally, regulators will need to balance the desire to prioritize funding for green initiatives without inadvertently cutting off access to funding for vulnerable developing economies that rely most heavily on energy intensive industries. Tactics are likely to vary by region, with advanced economies likely to introduce tighter regulations to identify and monitor ESG-related exposures and impose penalties on financial institutions that fail to meet new targets. Europe was already leading these initiatives ahead of Russia's invasion of Ukraine, and is likely to push forward with European Green Deal initiatives and developing economies are more likely to employ lending targets for renewable energy and other green initiatives.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.