Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 30, 2024

This blog is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

The US Federal Reserve has just made its first interest rate cut in four years, raising hopes of reduced pressure on borrowers. However, some companies did not survive long enough to hear the good news. Tupperware Brands Corporation (Tupperware), along with its nine affiliates - is one of them. The storied company filed for bankruptcy on 17th September 2024 after years of decreasing popularity and financial struggles.[1]

While most central banks have begun the cycle of interest rate normalization, a relatively high interest rate environment is still expected to persist, and risks remain due to the long and uncertain journey ahead. It is imperative for credit practitioners to distinguish between companies facing a genuine risk of default, such as Tupperware, and those that will successfully navigate through.

S&P Global Market Intelligence utilizes a proprietary Early Warning Signals (EWS) framework that is purpose-built to help credit practitioners by providing timely warning signals for early detection of entities with genuine risk of default.[2] The framework is powered by S&P Market Intelligence’s flagship RiskGaugeTM model, and combines a firm’s probability of default (PD) level and its change from a previous period with a set of dynamic thresholds that account for the economic cycle to create a powerful, early indicator of default.

To demonstrate this capability, we analyzed Tupperware and its performance over the last several years. Tupperware, founded in 1946 and headquartered in the United States, was known for its iconic plastic food storage containers. The company manufactured and distributed preparation, storage, and serving containers for kitchens and homes worldwide.[3] In the 1950s, Tupperware gained popularity through the initial marketing genius of Tupperware Parties but adherence to this strategy and the rise of lower cost competitors gradually eroded its market share. [4]

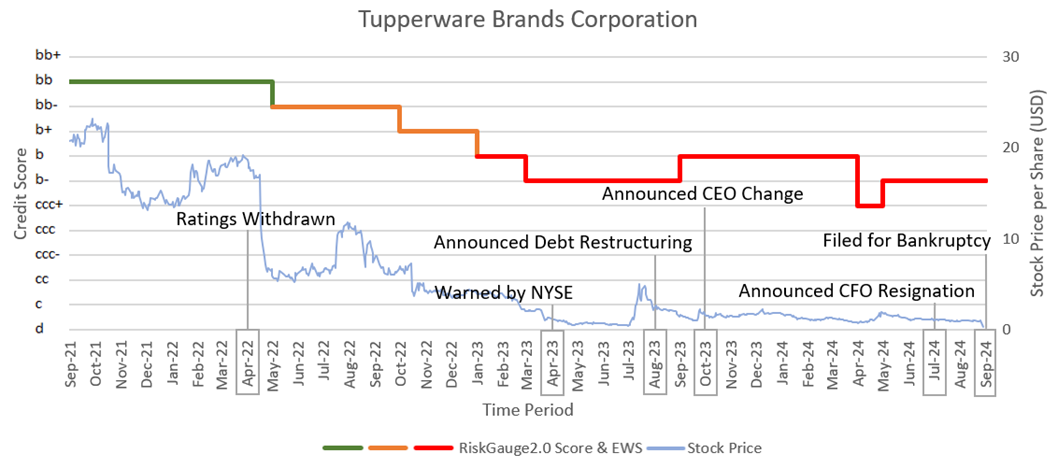

In the three years leading up to its bankruptcy, the company’s performance showed signs of business distress. In September 2021, Tupperware was rated B+ by S&P Global Ratings, although the rating was later withdrawn in April 2022 at company’s request.[5],[6] In April 2023, the New York Stock Exchange (NYSE) warned the company’s stock risked being de-listed due to its failure to file its annual report within an acceptable time frame. In August 2023, Tupperware reached a deal with its creditors to reduce interest payments and to extend the maturity of certain debt facilities. In October 2023, company appointed a new CEO and announced other management changes.[7] In July 2024, the company announced the resignation of CFO. On 17th September 2024, Tupperware filed for bankruptcy protection.

Figure 1: EWS Assessments Trend for Tupperware

Source: S&P Global Market Intelligence as of September 25, 2024. For illustrative purposes only.

Figure 1 above shows how monthly EWS assessments warned of challenges with the company. Tupperware began with a bb RiskGauge credit score [8] and a green EWS signal in September 2021 (indicating – via traffic light color scale - minimal warning signals). A few months later, in May 2022, Tupperware’s stock price crashed and the EWS signal turned amber, indicating an elevated credit risk. Since January 2023, a persistent red EWS signal emerged and its RiskGauge credit scores fluctuated around b-, indicating ongoing high chances of a default crystallization. The red EWS signal appeared 21 months before the company filed for bankruptcy, which allowed asset managers and risk analysts to take necessary actions well in advance of actual default.

As shown in this case study, Tupperware’s impending default was identified early via the EWS framework. Since ratings withdrawn does not necessarily lead to subsequent credit deteriorations or defaults, the only way to follow the credit risk evolution would be via RiskGauge model and the EWS framework in this case, especially after Tupperware became unrated since April 2022. Credit practitioners utilizing the RiskGauge platform have advanced warning of potential defaults. Additionally, the platform allows further analysis including detailed company financials, news and key developments, and peer comparison analysis. This single platform gives early warning of risks with an entity, and allows credit practitioners to confirm the signal, understand its drivers, and potentially reduce exposure towards the vulnerable counterparty.

If you want to learn more about RiskGauge and Risk Solutions’ Early Warning Signals capability, please click here.

[1] Source: The S&P Capital IQ® Platform.

[2] Please refer to the Early Warning Signals Framework 1.0 White Paper.

[3] Source: The S&P Capital IQ® Platform.

[4] Tupperware - Wikipedia. A Tupperware party is run by a Tupperware consultant as a host or hostess who invites friends and neighbors into their home to see the product line. Parties also take place in workplaces, schools, and other community groups.

[5] Tupperware Brands Corp. Rating Raised To B+ From B On Continued Deleveraging; Outlook Stable, S&P Global Ratings, August 2021.

[6] Tupperware Brands Corp. Ratings Withdrawn At Company’s Request, S&P Global Ratings, April 2022.

[7] Source: The S&P Capital IQ® Platform.

[8] Analytical models that deliver credit scores for companies of all types including rated and unrated, public and private companies, globally.