S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Dec, 2022

By Michael Miller, Harold Garrity, Najy Nahkle, Michael Taschner, Preston Gelman, Qian Shin, William Moebius, and Christopher Blake

Global markets have been mired by inflationary pressures, geopolitical disruption, and the threat of a potential recession for much of 2022. What lies ahead for 2023? In our recent Big Picture webinar, Michael Miller – Executive Director of S&P Global Market Intelligence’s Global Client Advisory & Thought Leadership – shared analysis of investment trends in 2022, the record-breaking pace of investor activism, best practices for Investor Relations teams going forward, and other insights from our Big Picture Outlook report for Investor Relations.

Editor’s Note: the commentary and outlooks in this post were shared on November 17, 2022. They do not reflect any potential change in forecast from the intervening month.

Nathan Stovall – Principal Analyst, S&P Global Market Intelligence

Michael, in your Big Picture 2023 Outlook report, you pointed out that institutional and retail investors have reacted differently to the market uncertainty this year. I mentioned [that] we've seen things flashing yellow, but you've highlighted that there's been a divide on how we've seen institutional and retail money react. Could you talk about what we've seen and perhaps, most importantly, what your expectations are going forward?

Michael Miller – Executive Director, Global Client Advisory & Thought Leadership, S&P Global Market Intelligence

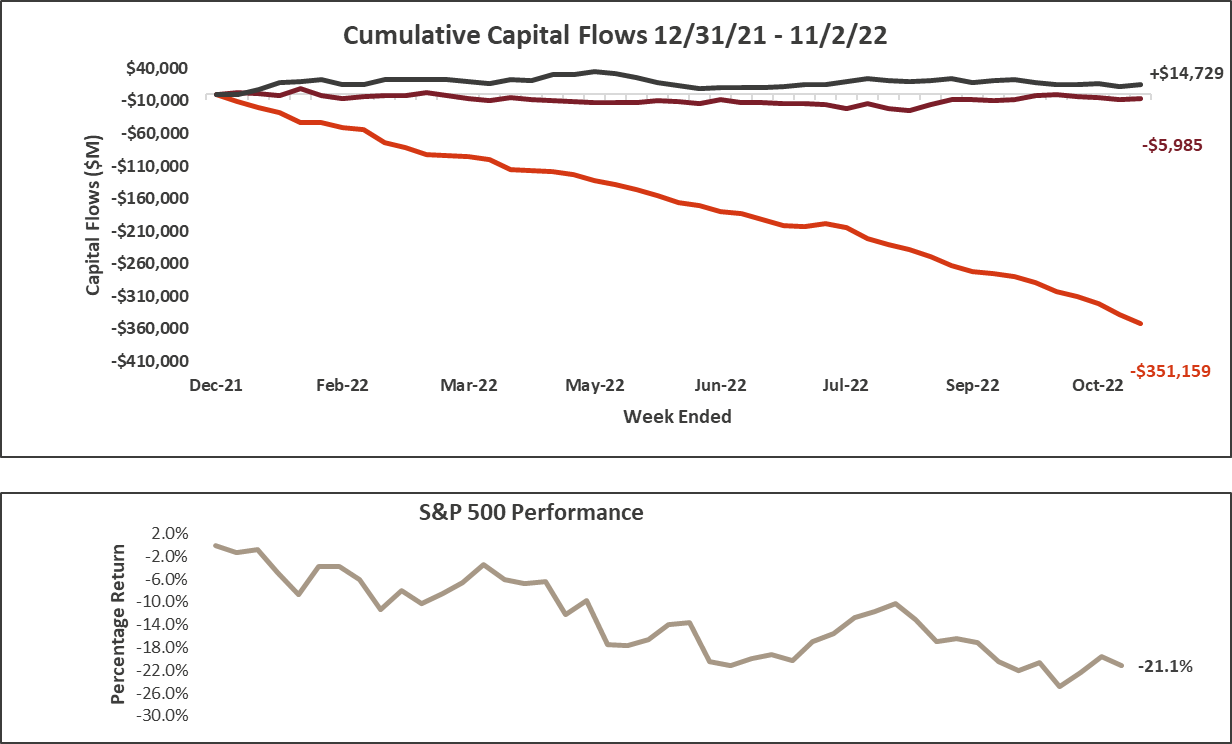

Absolutely. We certainly have seen a divergence of the behavior. If we look at [the chart below], we'll see that [it] shows the S&P 500 year-to-date performance through early November. The capital flows on the top are broken out by institutions, hedge funds and retail.

Graph 1: Investor Capital Flows & ROI (%)

Source: S&P Global Market Intelligence

Looking at the bottom first, you can see that institutional investors have been the large driver of selling activity throughout 2022. This has been relatively widespread [by sector]. In many reports, we've seen eight, nine, or even all 10 sectors sold off by institutions. There are a number of things that are driving institutional sell-off: all of the uncertainty that Lindsay and Nathan have talked about already, an overall weakness in equities, the ongoing shift from active to passive investing, and an increase overall in retail investing.

Moving up, if you look at the next line, we've got hedge funds. That hedge fund line is a little misleading. It looks very flat, but under the surface, there's been a lot of volatility. Hedge funds are high-risk, high-reward strategies. The hedge funds have been relatively flat, but there's been a lot of buying and selling in and out of different sectors. For example, the last report that we put out, there were five net buying sectors and five net selling sectors. So, there's a lot of support, liquidity, and a lot of volatility in the hedge fund space.

At the top, retail is actually the only net buyer for the year. There's been consistent support from retail investors over the last several weeks. We've seen a little more bearish sentiment seep into the retail space as well. But throughout the year, there's been a likeliness of retail investors to buy the dip, which has been supportive particularly in the technology sector from time to time.

When we talk about what we actually expect for next year, it's difficult to predict. This is not an actual projection, but we said in the [Big Picture Outlook that] we wouldn't be surprised if these trends continue into 2023. We [conduct] an IMI (Investment Manager Index) survey of investment professionals and the latest [version shows] a lower risk appetite in the near term and lower expectations for market performance. Breaking down [expected performance for] sectors, there is a bullish sentiment on energy. Lindsay's comments would support the reasons why.

There's more bearish sentiment overall in consumer discretionary and real estate. It's very difficult to see the market recovering without institutions moving from net sellers to net buyers. Once we start to see institutions consistently buying [into] seven, eight, nine or 10 industries instead of selling them, that would be a good sign that we're in the midst of a market turnaround.

Richard Neale – Managing Director, Financial Institutions Group, S&P Global Market Intelligence

Thanks for that insight. It's really interesting to hear about that sentiment. One thing consistently coming through [in conversations with clients] is shareholder activism. We've seen that surge [in] 2022. Can you give us a little bit of insight and comment around what's driving that uptick?

Michael Miller

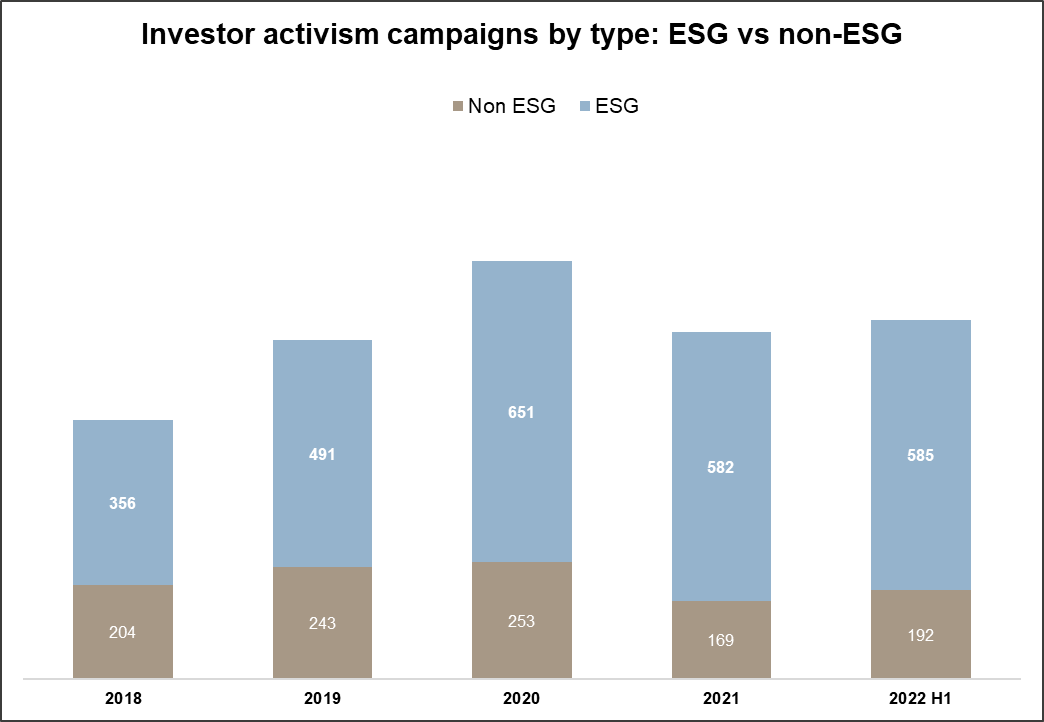

Thanks so much, Richard. It's a great question. Activism certainly has picked up. But now we do look at that next slide that was up earlier, we see investor activism campaigns from 2018 through the first half of 2022. The first half has been record-breaking. We're on track for the highest year ever in shareholder activism, and it's due to market volatility [and] the challenging macro environment that we're discussing today. Stock prices are down, and when stock prices are down, activists see opportunities.

Graph 2: Investor Activism Activity

Source: S&P Global Market Intelligence. Data as of July 1, 2022

What are activists looking for? What are the demands that they're making? They're looking for all sorts of things, [such as] change in strategy. They have questions about capital allocation policies. We've seen a real uptick in demand for companies to look at selling. [Another] trend is how ESG has affected institutions, either good or bad. As you can see on this chart, [ESG] is a big component of the investor activism campaign.

Corporate governance is the biggest part of that: proxy battles, board and management changes, those sorts of things. We're also seeing a real uptick in environmental and social issues. Do companies have a carbon transition plan in place? How are they dealing with social justice and DEI initiatives?

What should executives and investor relations teams [do]? There [are] a couple of things that we talk about in the report. Engaging with the activist is certainly a good idea, if appropriate. You want to understand the timeline of the activists, what their requests are, [and] any of the issues and expectations that they have. You want to make sure that you treat them as an investor [and] not give them preferential treatment.

There are a lot of resources that you can utilize. Retail shareholder activist surveillance is one thing that we help clients to track buying and selling in real time and understand if there is an activist build-up in the stock. Activist defense firms [and networks of contacts] can be helpful. If you have a network of contacts on the trading desks, buy side and sell side analysts, and portfolio managers, that's a great way to know exactly what people are hearing on the street.

In terms of things to avoid, you don't want to brush off an activist. You don't want to be flippant – publicly or in writing – and don't be reactionary. We always tell clients [to], from a fundamental perspective, be your own activist. Any company should look at how are [they’re] doing versus peers [and determine if they are] running the company effectively. The best [strategy] is to run your company effectively in a way that builds long-term shareholder value.

Campaign

Theme