Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jan, 2022

By Keith Nissen

Online subscription video service providers are looking to add or expand coverage of live sports to supplement their on-demand video content.

* Online subscription video service providers are seeking to add or expand their coverage of live sports as the percentage of U.S. households not subscribing to a multichannel TV service continues to grow.

* Less than one-third of total survey respondents, but 93% of live sports viewers, indicated they would be interested in subscribing to an SVOD service because of sports.

* Those interested in SVOD sports are primarily avid sports fans who tend to be very loyal subscribers.

Live sports are becoming increasingly available online through virtual multichannel services, such as Walt Disney Co.'s Hulu + Live TV, Alphabet Inc.'s YouTube TV and fuboTV Inc., that mimic pay TV packages. In addition, sports programming is making its way to subscription video, or SVOD, offerings such as Amazon.com Inc.'s Prime Video, ESPN+, Paramount+ and Peacock.

Historically, about 40% (+/- 3 ppts seasonally) of internet adults have cited watching live sports at least once a week (a.k.a. avid sports viewers). As of the first quarter of 2021, over three-quarters (76%) of avid sports viewers reported subscribing to a multichannel TV service, with the majority (55%) indicating they subscribe to pay TV specifically to watch live sports. This suggests that SVOD service providers are not trying to pry avid sports viewers away from their pay TV service subscriptions, as much as they are seeking to capture some of the extreme viewer loyalty that comes with offering live sports.

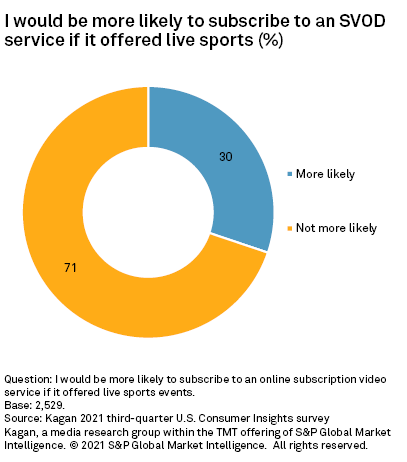

The Kagan third-quarter U.S. Consumer Insights survey asked respondents if they agreed or disagreed with the statement "I would be more likely to subscribe to an online subscription video service if it offered live sports events." Less than one-third of surveyed internet adults said live sports would persuade them to subscribe to an SVOD service.

The main reason SVOD service providers are seeking to add live sports coverage is the growing number of households that do not subscribe to a multichannel TV service. Kagan U.S. Consumer Insights surveys have found that multichannel TV households have declined 5 percentage points over the past two years, totaling 65% in late 2021.

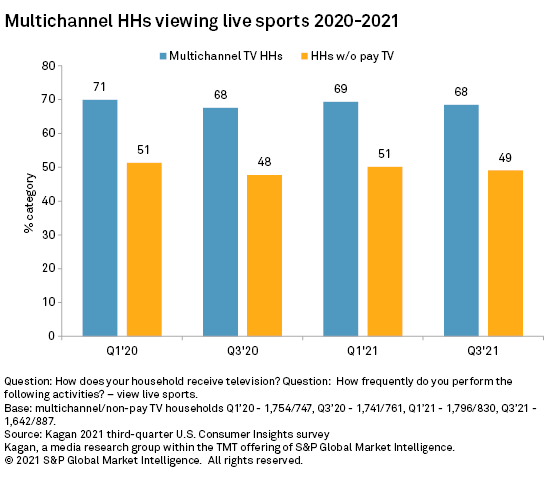

Interestingly, the survey data also illustrates that the percentage of multichannel and non-pay TV households viewing live sports has remained remarkably stable over the past two years. Approximately 70% of multichannel TV households report viewing live sports throughout the year. Approximately half (50%) of non-pay TV households also watch live sports, as well. It is important to note that as households have continued to drop their multichannel subscriptions, live sports viewing has remained at the same levels over the past four survey waves.

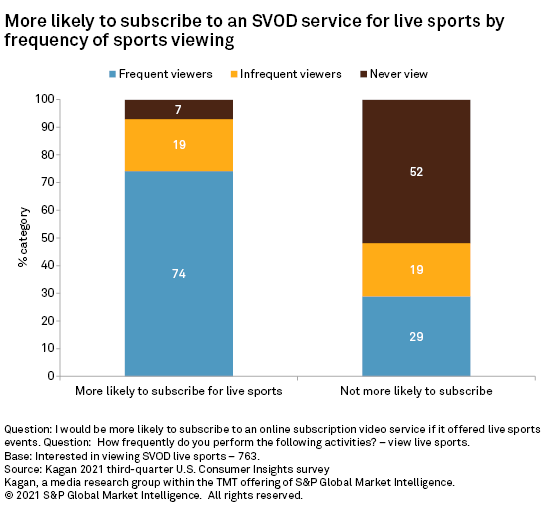

As might be expected, three-quarters (74%) of respondents who expressed interest in watching SVOD live sports are frequent (at least once a week) sports viewers, whereas the majority (52%) of those indicating live sports would have no impact the SVOD subscription decisions said that they never view live sports.

To capture the viewer loyalty behavior that pay TV operators have long enjoyed, SVOD services may need to offer viewing of various major sports, including football, baseball and/or basketball. The survey data reveals that three-quarters (76%) of those interested in SVOD live sports watch football, 56% watch basketball and 53% watch baseball. However, only one-third (33%) watches all three major sports.

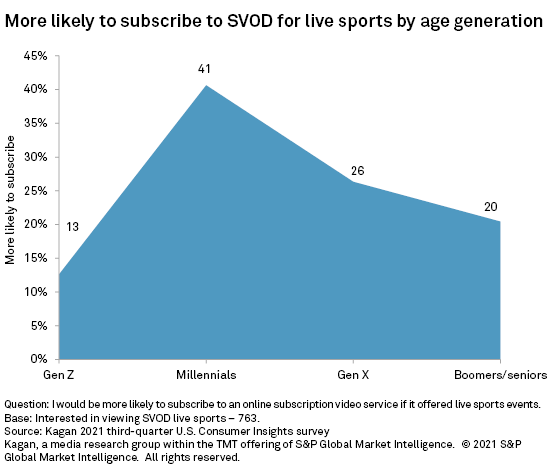

Examining the age distribution of those interested in SVOD live sports shows that millennials (41%) are the primary target audience. However, the over-40 adult population (Gen X, baby boomers and seniors) represents nearly half (46%) of potential SVOD live sports viewers.

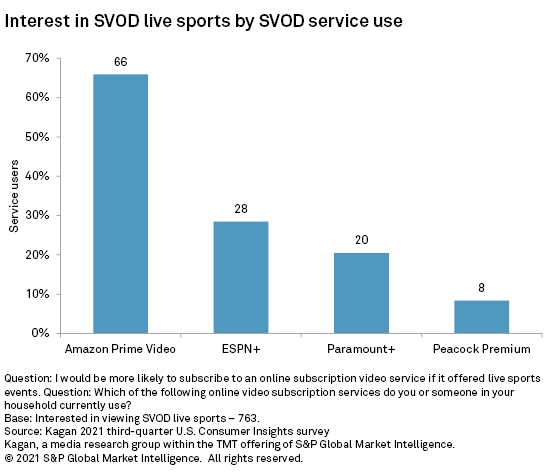

The survey found that two-thirds (66%) of those interested in SVOD live sports already subscribe to Amazon Prime Video. As a result, the benefit of live sports coverage to Amazon is more about expanding service usage and viewer loyalty than about attracting new subscribers. For other SVOD services, such as ESPN+, Paramount+ and especially Peacock Premium, offering live sports streaming can be a way to attract new loyal subscribers with the goal of increased viewing hours across their entire content library.

Data presented in this article was collected from Kagan’s Q3’21 U.S. Consumer Insights survey conducted in September 2021. The survey totaled 2,529 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number. Gen Z adults are ages 18-23, millennials are 24-40, Gen X are 41-55, and boomers/seniors are 56+.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.