Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 03, 2023

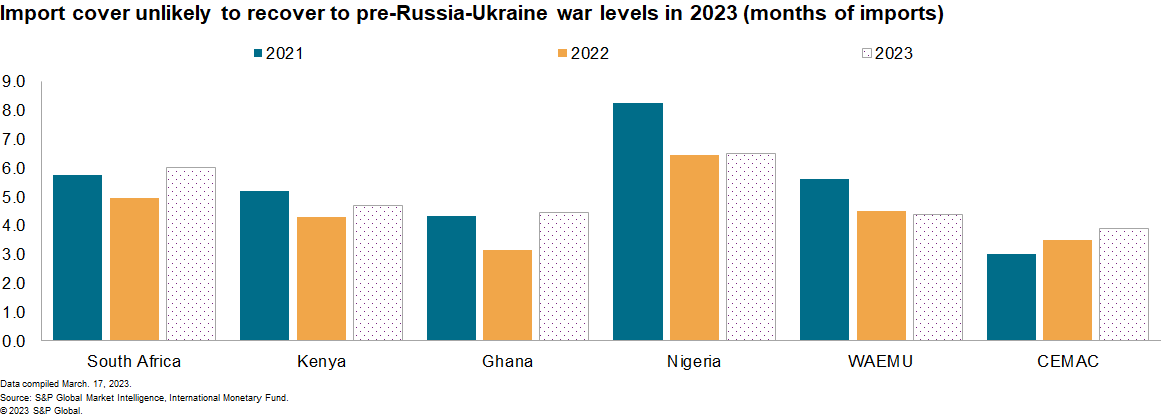

Exchange rate pressures will remain prevalent during 2023. With lower external buffers, sub-Saharan African currencies will be more vulnerable to a stronger US dollar, changing global commodity prices, widening interest differentials, and changing global market sentiment.

The weaker import cover ratio also increases the devaluation risk of managed float exchange rates such as the Nigerian naira, Ethiopian birr, and Mozambican metical. However, the risk of devaluation or de-pegging the CFA franc from the euro in the WAEMU and CEMAC regions is low. We anticipate France will continue to guarantee unlimited convertibility of CFA francs into euros for the foreseeable future.

In several sub-Saharan African countries, financial flows remained lackluster during the first two months of 2023, reflecting weaker macroeconomic fundamentals with no significant changes assumed for the remainder of the year.

Multilateral financing will remain essential to meet fiscal and current account needs in the near term. Moving to an International Monetary Fund (IMF) support program sets solid monetary and fiscal anchors, which could strengthen a country's import cover ratio.

Indeed, the successful completion of IMF-supported program reviews due to sufficient program implementation allowed for the accumulation of foreign reserves in the CEMAC region in 2022. The CEMAC region's foreign-exchange reserves are projected to improve further during 2023 to around 4.0 months of import cover with additional support from high oil revenues, increased oil production, more stringent application of foreign-exchange regulations, and resumption of fiscal consolidation.

Bottom line, the level of foreign-exchange reserves in several sub-Saharan African countries has fallen in 2022 and it is unlikely to recover significantly in 2023. Although the weaker foreign-reserves position increases the risk of currency depreciation or devaluation and the introduction of capital controls, these risks are countered by continued multilateral support and a suspension of global monetary tightening as inflation eases.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.