Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 21 Feb, 2023

By Jessica Fuk

Following the intensive price wars between Walt Disney Co.-owned Disney+ Hotstar, Amazon.com Inc.'s Prime Video and Netflix Inc. in the second half of 2021, streamers in the Indian subscription-video-on-demand market continued to adjust pricing strategies in 2022. While there is still room for most platforms to raise prices, companies are also revising their pricing structures to generate more growth.

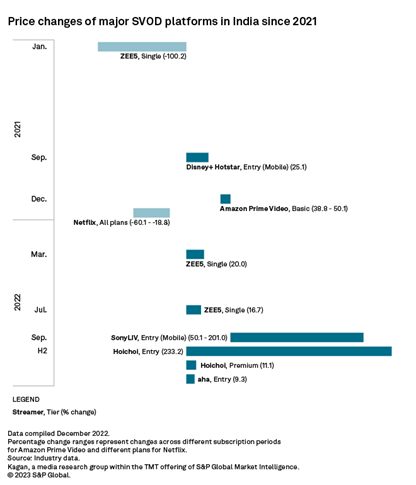

ZEE5 of Zee Entertainment Enterprises Ltd., SonyLIV of Sony Pictures Networks India Pvt. Ltd., Hoichoi Technologies Private Ltd. and Arha Media & Broadcasting Private Ltd. all raised the price of their entry pack in 2022. The range of percentage increases remains moderate for ZEE5 and Arha's aha as they tend to be cautious about price hike-related churn. ZEE5 adopted a single pricing tier and increased its subscription fee twice in March and July, respectively. The two price hikes add up to an increment of 40.1% on top of its original price. Having lowered its subscription fee by 100.2% in January 2021, the increment in 2022 should be fairly reasonable to long-time subscribers of ZEE5.

SonyLIV replaced its previous entry tiers Special and Special+ with the launch of its mobile tier in September 2022. Setting its mobile tier at an annual subscription rate of 599 rupees, SonyLIV raised the subscription fee of its entry pack by up to 201%. Hoichoi made a bold attempt to upsell subscribers to its premium tier by raising the prices of its entry and premium tiers by 233.2% and 11.1%, respectively. Following the price hike that makes its entry pack only available for a three-month subscription, the average monthly rate of Hoichoi's premium plan, which allows two streams and eight devices, became lower than that of its entry pack. Although the percentage increases sound high, subscription plans in India remain fairly affordable as most streamers had initially set their prices at minimal levels.

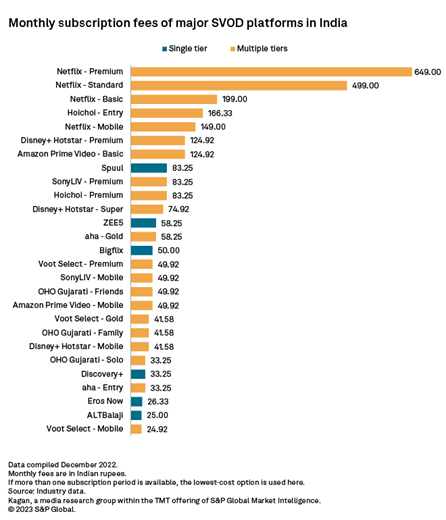

Subscription plans of major over-the-top platforms start with Viacom18 Digital Ventures-operated Voot Select's mobile tier at 24.92 rupees per month and go all the way up to Netflix's premium pack at 649 rupees per month. Consumers have a lot of options: Over 70% of subscription plans offered by major streamers lie below 100 rupees per month, although there are also plans for 50 rupees or less a month. Packs that are over 100 rupees per month include all of Netflix's subscription plans, Prime Video's basic subscription bundled with Prime membership, Disney+ Hotstar's premium pack and the inflated three-month entry subscription of Hoichoi.

Netflix has yet to announce the launch of its ad-supported tier in India. The global streaming company is estimated to have added roughly 1 million subscriptions in the market in 2022 following significant price cuts in late December of 2021. Netflix's entry mobile plan remains 19.3% higher than a subscription to either Disney+ Hotstar's premium tier or Prime membership.

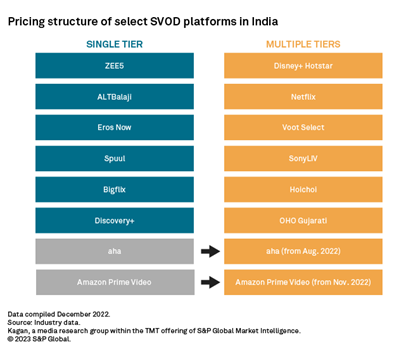

Stratified pricing is the most widely adopted strategy among major streaming services in India. Top OTT platforms in terms of subscriber share including Disney+ Hotstar, Amazon Prime Video, SonyLIV and Netflix all provide more than one subscription tier. Prime Video is the latest to join stratified pricing with the launch of its mobile tier in November 2022 while regional service aha rolled out a premium tier in August 2022. Apart from offering consumers flexibility, multiple tiers maximize annual revenue per subscription and revenue growth opportunities and retain price-sensitive consumers at the same time.

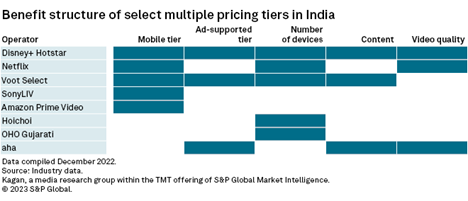

Major streaming services offer the mobile-only tier as its entry pack in India, characterized by high mobile penetration and low mobile data costs. Netflix introduced the country's first mobile streaming plan in July 2019. Others followed including the latest launches of SonyLIV and Prime Video in the second half of 2022. SonyLIV simplified its pricing tiers into two, mobile-only and the premium tier that enables streaming on nonmobile devices in full HD video quality. Prime Video also adopted this model.

Disney+ Hotstar, Voot Select and aha charge subscribers for viewing experiences without advertisements. Only subscribers of the most expensive premium tier can enjoy ad-free streaming on the three services. Other benefit classifications include premium content, video quality and the number of connected devices. Netflix provides the highest number of four tiers in the market, while Disney+ Hotstar and Voot Select offer three.

ZEE5 and a few local services maintain a single-tier pricing structure. Spuul Pte. Ltd. and ZEE5 are the most expensive single-tier services that charge subscribers a monthly cost of 83.25 rupees and 58.25 rupees, respectively. Both platforms operate on a global level and have an extensive collection of local content. ALTBalaji of Balaji Telefilms Ltd., Eros Media World PLC's Eros Now and Discovery Communications India-operated Discovery+, on the contrary, still focus on subscription growth and keep their monthly fee at close to 30 rupees.

Low-cost and effective packaging strategies contribute to the growth of premium subscriptions in India. Our model indicates over 50% of the total subscriptions of Disney+ Hotstar, Prime Video and SonyLIV opt for a premium tier as of year-end 2022. As most Prime Video subscribers are expected to continue to pay for the Prime membership in order to enjoy e-commerce benefits, we project 85% of the service's subscribers fall under the premium category.

Premium subscriptions of Voot Select could surge progressively in 2023 if the service retains streaming of matches of the Indian Premier League, or IPL, for their premium subscribers. The platform's packaging of IPL is highly anticipated. Disney+ Hotstar had only offered ad-free streaming of IPL matches to subscribers of their most expensive premium tier.

Research

Blog