Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 17 Feb, 2021

Highlights

The pandemic has highlighted the value of ESG considerations in financial markets, as global sustainability benchmarks outperformed traditional market benchmarks and ESG funds achieved record inflows.

Many investors and other stakeholders have been actively expressing the need for greater transparency on the ESG strategies of companies. Adding to this, the COVID-19 pandemic has further brought sustainability into the spotlight, raising awareness about the negative impact climate change and social justice issues are having on the world. At the same time, the pandemic has highlighted the value of ESG considerations in financial markets, as global sustainability benchmarks outperformed traditional market benchmarks and ESG funds achieved record inflows.[1] The pandemic seemed to confirm what ESG pioneers have long propagated: that companies with superior ESG performance can be expected to be better prepared to weather such crises and to operate in the post-crisis world. This is because they are well-managed companies, with stronger competitive advantages, healthier balance sheets and a better social license to operate than their non-ESG peers.[2]

This growing attention is underscored in this year’s look at the progress that is being made on environmental sustainability, as many publicly-traded companies take additional steps to improve their situations. For example, in 2011 approximately 20% of the largest 500 companies in the U.S. published a sustainability report.The volume has been increasing steadily ever since, reaching 75% of these companies in 2014 and a record 90% in 2019.

This section highlights a number of important trends we are seeing as corporations focus more effort on their environmental performance. It should be noted that company reported data does not yet provide coverage of the abrupt COVID-19-related decreases in global carbon emissions observed since March 2020.

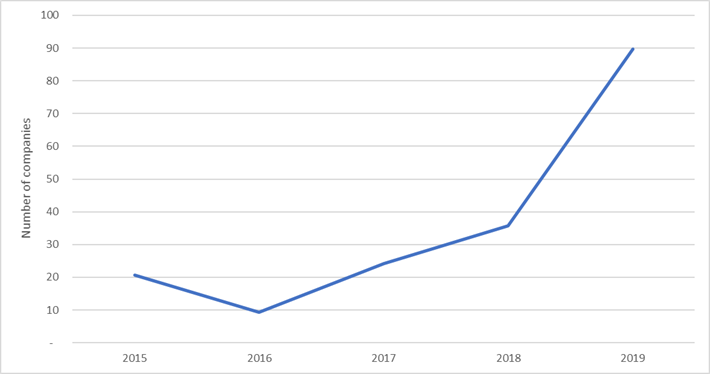

Companies Mentioning ESG for the First Time in SEC Filings Are on the Rise

Source: Social Market Analytics, 2020

ESG reporting has remained largely voluntary in the U.S. The Securities and Exchange Commission’s (SEC’s) general disclosure guidance, which includes ESG issues, emphasizes materiality − the extent to which a reasonable investor would consider information important in relation to an investment decision. There have been a total of 597 different publicly-traded U.S. companies mentioning ESG in SEC filings since 2006.[3] While this only represents approximately 16% of all public companies in the country, the number mentioning ESG in their SEC filings for the first time has been steadily increasing − from 9 companies in 2016 to 36 in 2018 and 90 in 2019. We look forward to the opportunity to provide continued updates on this significant trend.

Source: G&A Institute, 2020

Over the past five years, there has been a growing trend in the number of companies publishing sustainability reports, with 90% of the largest 500 companies in the U.S. reporting in 2019 – an 11% increase since 2015. A range of frameworks and standards are being used, including those provided by the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Taskforce on Climate-related Financial Disclosures (TCFD). While 51% of the S&P 500 reporting companies use GRI, support continues to grow worldwide for the framework recommended by the TCFDand increasingly mandated by regional governments.

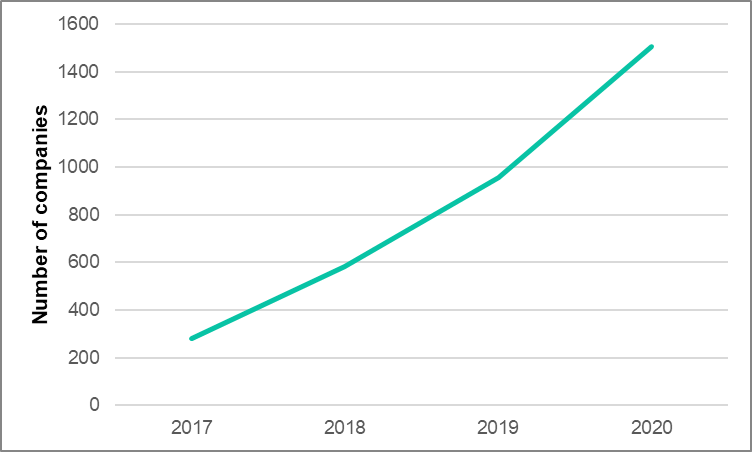

There’s Been a Steady Growth in the Number of Companies Supporting TCFD

Source: TCFD, 2020

According to the TCFD, which was established in 2015, better disclosure will lead to more informed and more efficient allocation of capital, and help facilitate the transition to a lower-carbon economy. Backing for the framework has surpassed initial expectations, with the number of supporting companies exceeding 1,500 in 2020 − over five times that in 2017. This includes every major type of financial market participant, plus nearly 60% of the world’s 100 largest public companies that either support the TCFD, report in line with its recommendations, or do both.[4]

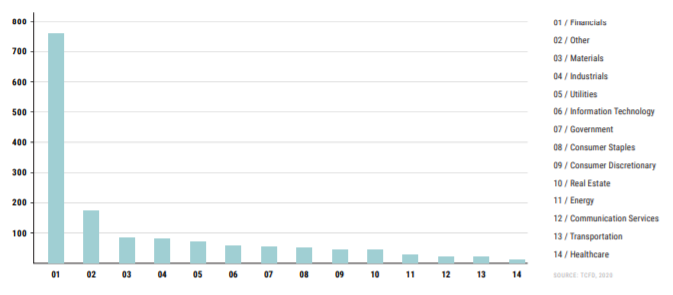

Financial Sector Accounts for Half of TCFD Supporters

Source: TCFD, 2020

Half of all companies that support the TCFD are in the financial sector. Asset management/investment management, banks, and pension funds together represent 75% of the supporting organizations in the sector. According to the TCFD, larger companies are more likely to disclose information aligned with the recommendations. On average, 42% of companies with a market capitalization greater than $10 billion U.S. disclosed in 2019, while the average was 15% for companies with a market cap less than $2.8 billion.

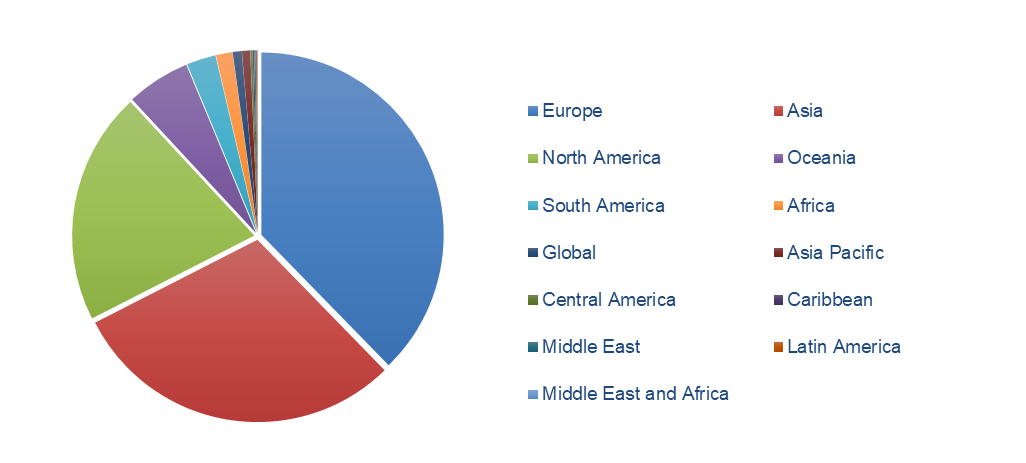

Europe, Asia and North America Are Home to Most TCFD Supporters

Source: TCFD, 2020

The European Union is among the leading major economies when it comes to tackling greenhouse gas (GHG) emissions.[5] By 2018, it had cut GHG emissions by 23% compared to 1990 levels, and is committed to achieving a 40% reduction by 2030. Not surprisingly, therefore, it represented 38% of organizations supporting the TCFD in 2020. With typhoons and floods becoming more intense and frequent in Asia,[6] companies here are showing their concern with climate change, with the region representing 30% of organizations supporting the TCFD in 2020. North America was third at 21%, leaving these three regions accounting for 88% of overall support in this year.

[1] “Major ESG investment funds outperforming S&P 500 during COVID-19”, S&P Global Market Intelligence, April 2020.

[2] “The Evolution of Sustainable Investing Rewards”, S&P Global Market Intelligence, June 26, 2020.

[3] “Machine Readable Filings Extracts the Significance of ESG in Future Earnings”, Social Market Analytics (SMA), August 4, 2020.

[4] “Task Force on Climate-related Financial Disclosures 2020 Status Report”, TCFD, 2020, https://assets.bbhub.io/company/sites/60/2020/10/TCFD_Booklet_FNL_Digital_March-2020.pdf.

[5] “Fact Sheets on the European Union, Combating climate change”, European Parliament, www.europarl.europa.eu/factsheets/en/sheet/72/combating-climate-change.

[6] “Boiling Point”, International Monetary Funds, September 2018, www.imf.org/external/pubs/ft/fandd/2018/09/southeast-asia-climate-change-and-greenhouse-gas-emissions-prakash.htm

Research

Podcast