Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 24 Jan, 2022

With the conclusion of the 2021 legislative year, states that remained in session during the fourth quarter passed a handful of measures ranging from ratemaking to utility commissioner experience prerequisites.

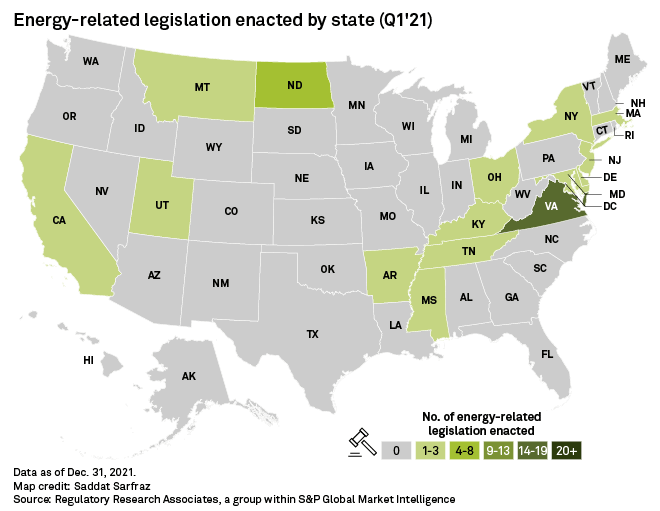

During the last quarter of 2021, 16 energy-related measures were enacted, bringing the total of enacted measures to over 250 bills for the year. With roughly five times the amount of bills passed last year than in the prior years, legislators pushed through measures covering a wide array of issues that affect the utility industry.

The quantity of bills enacted in 2021 was significantly increased from the 65 measures signed by the end of the 2020 calendar year and 120 measures enacted in 2019, as tracked by Regulatory Research Associates.

A decline in enacted legislation toward the later months of the year is expected since a large majority of states wrap up their respective legislative sessions during the second and third quarters of the year. While only a handful of states remain in session during the last three months of the year, it does not diminish the quality or importance of the measures that are enacted.

Major bills that affect the utility industry were still enacted during the fourth quarter of 2021. For example, lawmakers in North Carolina signed a sweeping energy bill that authorized the state's utilities to make use of new ratemaking mechanisms as well as pushed the state to move toward achieving carbon neutrality by 2050 without sacrificing reliability.

Although a good deal of legislatures left an abundance of energy measures on the table, many states have only concluded the first year of a two-year legislative session, and roughly half of the country will allow for measures to be carried over into the 2022 legislative session.

For major enacted and vetoed energy legislation tracked by RRA in 2021, please see the state-by-state summary available here.

Fourth-quarter 2021 highlights

As the legislative year came to a close, only a handful of states remained in session. Whereas states focused on natural gas bans, renewable energy and securitization during the first nine months of the year, the last three months of 2021 saw measures related to reducing carbon emissions, electric vehicles and utility commissioner qualifications.

In North Carolina, Gov. Roy Cooper, a Democrat, signed House Bill 951, which provides utilities operating within the state with new ratemaking tools, including multiyear rate plans and performance-based ratemaking mechanisms.

The new law gives Duke Energy Corp.'s subsidiaries the ability to file multiyear rate plans with the commission and develop performance-based incentives, with the ability to pursue regulatory approval for increases of up to 4% over three years rather than starting rate approval processes again each year. The bill also effectively solidifies the state's regulated energy monopoly system, maintaining the public utility vertical-integration model and commission regulatory authority. The new legislation requires public utilities to use securitization at 50% to retire coal-fired power plants.

The measure also calls for the North Carolina Utilities Commission, or NCUC, to follow the least-cost pathway in reducing carbon emissions by 70% by the year 2030 and achieving carbon neutrality by 2050 without sacrificing reliability. No later than Dec. 31, 2022, the NCUC is required to develop a plan for the utilities to achieve the authorized reduction goals through power generation, transmission and distribution, grid modernization, storage, energy efficiency measures, demand-side management, and emerging technology. The plan will then be reviewed every two years and adjusted as necessary.

Both the District of Columbia and New York enacted measures that specified certain commissioner qualifications for newly appointed regulators.

In Washington, D.C., several variations of the same measure, all with varying effective dates, were introduced and enacted during the fourth quarter of 2021. An emergency amendment act, B24-0414, was enacted in November 2021 and requires future District of Columbia Public Service Commission nominees to have certain qualifications. One commissioner must have experience in electric grid modernization and renewable energy integration or technology and issues affecting the environment, while the second member must have experience in consumer protection. The new qualification requirements would apply to nominations made after Oct. 1, 2021, and would require that the mayor's first nomination have experience in electric grid modernization and renewable energy integration or technology. The measure is only in effect for 90 days, or until Jan. 30, 2022.

A similar measure, temporary amendment act B24-0415, was enacted in December 2021 and has identical language to the aforementioned bill; however, the measure may only remain in effect for no longer than 225 days or until July 27, 2022.

These measures come after years of District of Columbia councilmembers and advocacy groups voicing their concerns over district utility commission nominees not having sufficient utility or energy experience. Citing the ever evolving energy industry and the shift in the utility commission's role, the council has introduced a series of amendments and resolutions to codify the necessary qualifications for future nominees.

New York Gov. Kathy Hochul, a Democrat, signed Senate Bill 1199, requiring that the New York Public Service Commission have at least one commissioner with consumer advocacy experience. Hochul also signed Assembly 476, which requires any PSC regulator appointed after July 1, 2022, to have education and training and at least three years of experience in one or more of the following fields: economics, engineering, law, accounting, business management, utility regulation, public policy, consumer advocacy or environmental management.

The PSC is bipartisan, and no more than three of a five-member commission and four of a seven-member commission may be from the same political party. Other than the provision for political party balance, historically, there were no statutory background standards for appointments to the PSC.

2021 wrap up

After a sluggish 2020 in terms of enacted energy measures, it seemed that 2021 was going to see states focus on economic recovery from the various challenges of the coronavirus pandemic and address social justice reform, making energy policy, particularly renewable energy policy, less of a legislative priority.

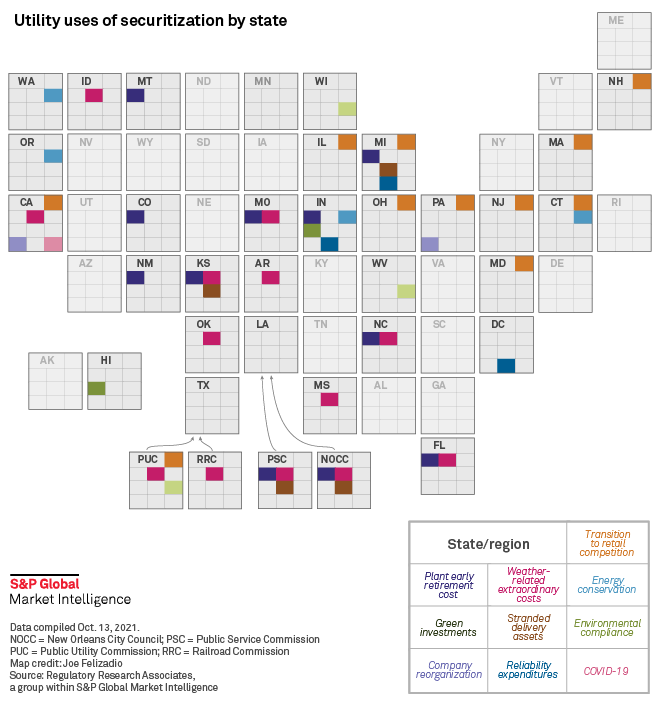

However, following the winter storm and other extreme weather events, which caused major disruptions in energy markets and crippled portions of the Midwest in February, several states enacted legislation focused on securitization and storm cost as well as overall energy market reform.

Kansas Senate Substitute for House Bill 2072, which was enacted in April 2021, authorizes the Kansas Corporation Commission to approve the issuance of securitization bonds in order to lower rates paid by electric utility customers by reducing financing costs of certain property of the utilities. In addition, the new law allows the state's electric and natural gas utilities to securitize certain "qualified extraordinary costs," including those related to February's extreme weather, upon receiving commission approval of a financing order.

In Oklahoma, Senate Bill 1050, enacted in April 2021, allows the state's utilities to securitize, through the Oklahoma Development Finance Authority, the costs they incurred in connection with the February 2021 weather event, following the issuance of a financing order by the Oklahoma Corporation Commission.

In Texas, two measures signed by Gov. Greg Abbott stem from the aftermath of the February winter storm. House Bill 4492, enacted in June 2021, authorizes the Public Utility Commission of Texas to allow competitive wholesale market participants and load-serving entities in Electric Reliability Council of Texas Inc. to securitize up to $2.9 billion of costs/expenses incurred during the energy scarcity conditions in the electric power markets in February 2021 during the storm.

A separate measure, House Bill 1520, enacted the same day, authorizes the Railroad Commission of Texas to allow gas local distribution companies to securitize extraordinary gas commodity costs associated with natural or human-caused disasters, system failures and other catastrophic events for which the Railroad Commission has approved the creation of a regulatory asset.

Extreme winter weather conditions were not the only reason a handful of states passed securitization laws during 2021.

In July 2021, Missouri passed House Bill 734, which would allow electric utilities, following approval by the Missouri Public Service Commission, to securitize energy transition costs, which include undepreciated investment in generation facilities that are to be retired or abandoned prior to the end of their useful lives, related ancillary facilities, decommissioning and site restoration costs, carrying charges, deferred expenses, previously incurred retirement/abandonment costs for facilities closed prior to Aug. 31, 2021, and issuance costs.

As previously mentioned, North Carolina passed HB 951, which also calls for the NCUC to establish rules for securitization of costs associated with early retirement of subcritical coal-fired electric generating facilities within 180 days of the enactment of the measure. The NCUC is required to develop rules to determine costs to be securitized at 50% of the remaining net book value of all subcritical coal-fired electric generating facilities to be retired to achieve the authorized carbon reduction goals with any remaining nonsecuritized costs to be recovered through rates.

In Indiana, Senate Bill 386, signed in April 2021, was enacted and allows a utility with certain qualified costs associated with an electric generation facility that will be retired from service within 24 months and are equal to at least 5% of the electric utility's total rate base to seek Indiana Utility Regulatory Commission approval to issue securitization bonds to recover the related costs.

Also in Indiana, House Bill 1220 was signed in April 2021, which effectively reestablished the 21st Century Energy Policy Development Task Force, which is required to develop recommendations concerning the management of stranded assets and the use of securitization to recover stranded costs, among other issues.

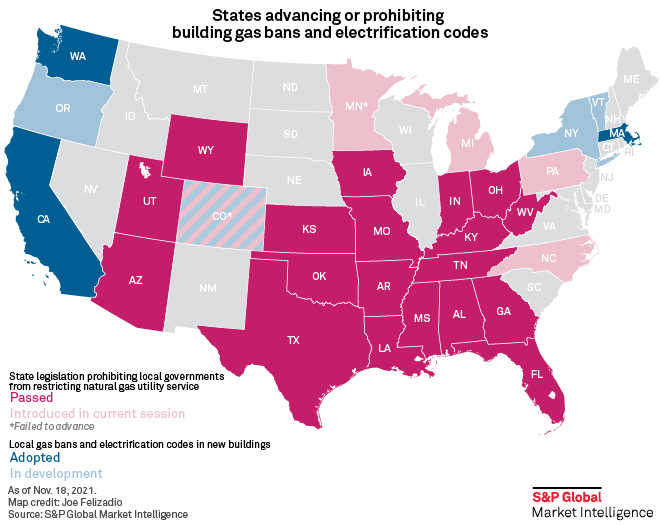

In several states, the idea of electrification has gained vast momentum among industry stakeholders and lawmakers, with cities, municipalities and counties leading the charge on restricting natural gas use. Meanwhile, many state legislatures have begun to take preemptive steps to assure that local government entities are prohibited from passing such policies or ordinances.

In 2021, lawmakers in 15 states passed measures that prohibit local governments from restricting the connection of certain energy utility services. While no states enacted such bills during the final three months of 2021, Missouri and Ohio were the lone states to prohibit natural gas bans in the third quarter. During the second quarter of 2021, nine Republican majority states — Alabama, Florida, Georgia, Indiana, Iowa, Kansas, Texas, West Virginia and Wyoming — adopted such policies. These states joined Arkansas, Kentucky, Mississippi and Utah, which passed similar measures during the first quarter of 2021, and Arizona, Louisiana, Oklahoma and Tennessee, which passed similar measures in 2020.

California, on the other hand, passed Senate Bill 68 on Oct. 8, 2021, which requires the State Energy Resources Conservation and Development Commission to develop and publish guidance on best practices to help building owners, the construction industry and local governments overcome barriers to electrification of buildings and installation of electric vehicle charging equipment.

In California, local governments have taken the lead on electrification, with roughly 50 mandates in place that would restrict natural gas use in buildings. According to the California Air Resources Board, residential and commercial buildings are responsible for roughly 25% of the state's greenhouse gas emissions when accounting for electricity demand, fossil fuels consumed on-site, and refrigerants. Of the 25%, roughly 10% of emissions are attributable to fossil fuel combustion, including natural gas, with residential buildings accounting for slightly more of those emissions than commercial buildings.

On Dec. 9, 2021, North Carolina's governor vetoed House Bill 220, which would have prohibited a city from adopting an ordinance that restricts the connection, reconnection, modification or expansion of an energy service based upon the type or source of energy to be delivered to an individual or any other person as the end-user of the energy service. "This legislation undermines North Carolina's transition to a clean energy economy. ... It also wrongly strips local authority and hampers public access to information about critical infrastructure that impacts the health and well-being of North Carolinians," the governor said in his veto message.

Another prevailing theme among enacted energy measures was statutory modifications to the composition of state utility commissions. Along with the bills passed in the District of Columbia and New York, which specified commissioner qualifications, Tennessee and Texas enacted measures that expanded the total number of commissioners at the agencies.

Senate Bill 252 was enacted during the Tennessee legislative session, which expanded the commission membership to seven part-time regulators. The governor, the speaker of the House and the speaker of the Senate, who is the lieutenant governor, each appoint two Tennessee Public Utility Commission members. All three offices jointly appoint an additional commissioner.

One commissioner appointed by each office must have at minimum a bachelor's degree and at least three years of experience in a regulated utility industry, in executive management, or in at least one of the following fields: economics, law, finance, accounting or engineering. In addition, one commissioner appointed by the speaker of the House and the speaker of the Senate must be a public member with no experience in a regulated utility industry.

Texas' governor signed Senate Bill 2154 into law June 18. The legislation increases the number of commissioners on the Texas PUC to five from three and changes some of the prerequisites for commission membership. The new law requires all commissioners to be residents of the state, citizens of the U.S. and registered voters. The measure also modifies the number of commissioners who must be well informed and qualified in the field of public utilities and utility regulation from all commissioners to at least two. Additionally, commissioners must have at least five years of experience in business or government administration or as a practicing attorney, certified public accountant or professional engineer.

Regulatory Research Associates is a group within S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.