Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 May, 2022

By Scott Robson, Deana Myers, and Seth Shafer

Highlights

The top 20 sports-related basic cable networks by 2021 net advertising revenue increased combined revenues 13.2% in 2021, following a 23.2% decline in 2020.

Sports rights fees have risen far faster than inflation, with the major leagues bringing in about $15.5 billion per year under current contracts.

Sports networks charge operators some of the highest license fees in the industry, led by ESPN at $8.15 per subscriber per month. This rate has consistently grown over the last 10 years at an average annual rate of 5.6%.

In a world where on-demand, commercial-free content has become increasingly prevalent, many people are hanging on to traditional pay TV subscriptions to watch live sports.

Walt Disney Co. CEO Robert Chapek highlighted the importance of sports on the company's Feb. 9 earnings call, noting that sporting events accounted for 95 of the top 100 live broadcasts of 2021. Despite the genre's popularity, sports networks experienced declining margins in 2021 as rising programming expenses and a dip in subscribers offset license fee rate hikes and a rebound in advertising.

In this report, we take a closer look at the broadcast, basic cable and regional sports networks that hold valuable sports rights by analyzing their reach, revenue, and expenses. We also examine how emerging streaming services are purchasing live sports rights to attract subscribers.

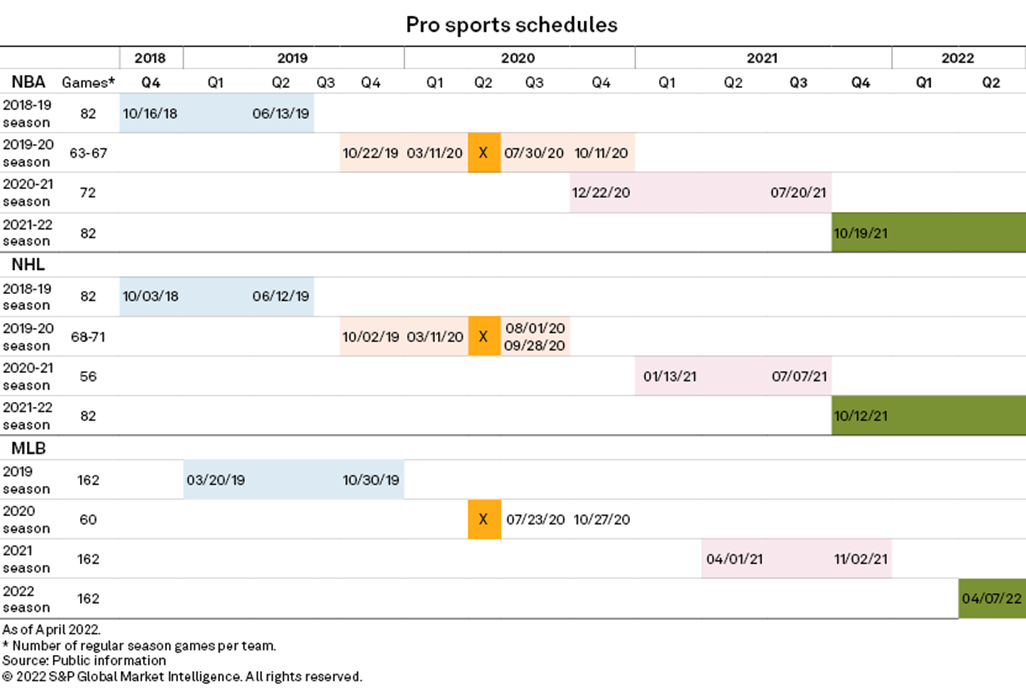

Sports broadcasting had a pivotal year in 2021 as live events returned to their regular schedules, following a year when many seasons and events were canceled or postponed due to COVID-19-related lockdowns, including:

Kagan's U.S. Consumer Insights survey of 2,529 internet adults conducted in September 2021 highlights the important role that live sports plays for the American consumer. Over half of U.S. internet households surveyed said they typically watch football while about one-third of households tune into basketball and baseball games. While not as popular as the "Big Four," a host of other sports — hockey, motor sports, golf, soccer and tennis — each reach a healthy slice of U.S. households.

For more information on regional sports networks, sports rights deals, the cost to consumers and other key sports related data, please see our 2022 Sports Report.

News

News