Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 30, 2025

By John Abbott

Taking full advantage of the current political publicity frenzy, Sam Altman's OpenAI chose the second day of the Trump administration to announce its investment vehicle for AI infrastructure. With investment partner SoftBank Group Corp., OpenAI has formed a new company, The Stargate Project, with the intention of investing $500 billion over the next four years in AI infrastructure, specifically for OpenAI, and specifically in the United States. The initial equity funders will be SoftBank, OpenAI, Oracle Corp. and the United Arab Emirates' MGX investment fund. President Donald Trump claims that the project will create over 100,000 jobs in the United States. Microsoft Corp., Arm Holdings PLC and NVIDIA Corp. are also involved in the project as tech partners.

A massive investment in AI infrastructure and semiconductor capacity was anticipated almost a year ago by Altman, who in February 2024 said he was in talks with the UAE government, sovereign wealth funds and others to raise between $5 trillion and $7 trillion to increase chip-building capacity. That massive figure was met at that time with a great deal of skepticism, and indeed it makes the actual funds now committed to — a far from insubstantial $500 billion — seem relatively small. With technology and politics now so closely intertwined, the announcement highlighted the potential political and economic benefits — American leadership, hundreds of thousands of jobs, re-industrialization of the US and national security — over more technical issues and concerns. Stargate could be viewed as a private money (and a more datacenter-focused) equivalent of the government-led US CHIPS Act, which pledged "only" $53 billion but, according to the Semiconductor Industry Association (SIA), has also sparked dozens of private investments in the US, totaling nearly $450 billion. The exclusive US focus sits a little uneasily, given the involvement of internationals SoftBank (Japan) and MGX (UAE) and the fact that OpenAI has indicated ambitions beyond the US.

Two massive factors have combined over the past few years to boost semiconductor manufacturing capacity and (especially) AI infrastructure. The COVID-19 disruption beginning in 2020 revealed how fragile semiconductor supply chains were and led to the signing of the CHIPS Act into law in August 2022. And the launch of ChatGPT in November 2022 fueled a massive race to establish giant accelerated computing datacenters to train large language models. Both of these catalysts are still playing out.

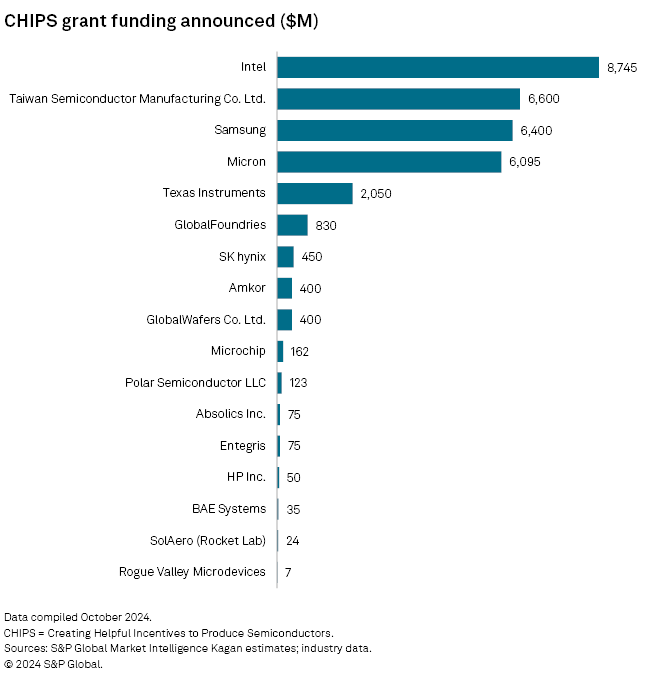

The Chips Act (according to SIA figures) has so far announced $32.50 billion in grant awards and up to $5.50 billion in loans to 32 private companies. Total investments associated with these projects —spread over two decades — are valued at $380 billion, with up to 145,000 new jobs expected to be created, including 43,000 manufacturing jobs and 102,000 construction jobs. Intel Corp. has been the largest beneficiary, awarded $7.86 billion in November 2024. TSMC received a $6.60 billion grant, also in November.

Read: 2 years into the US CHIPS Act, Intel and TSMC are top recipients

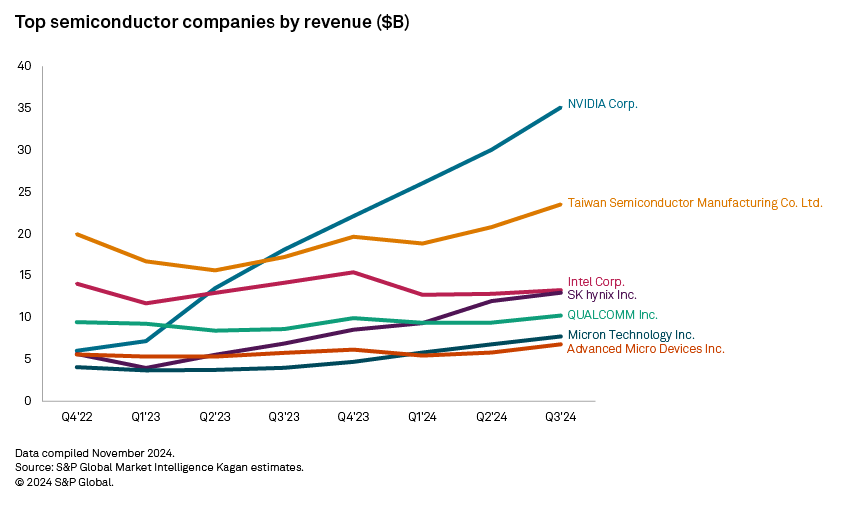

Despite the massive funding, Intel has struggled to maintain its technology road map and negotiate shifting customer demand from CPUs to graphics processing units (GPUs), and its future is uncertain. As for the boom in spending on massive GPU clusters for AI training, there has been widespread concern that current growth rates are unsustainable over the long term, for two main reasons: the inevitable shift in AI workloads from LLM training to distributed inference, and the huge energy consumption demands of large-scale AI accelerated datacenters.

Stargate has been set up as a new company, and says it will begin deploying its $100 billion in initial funding in the US immediately — the $100 billion figure is said to include projects already announced and underway, including a datacenter in Abilene, Texas, that is under construction and will be operated by Oracle. Other sites are being evaluated. The initial equity funders in Stargate are SoftBank, OpenAI, Oracle and MGX, with SoftBank having financial responsibility and OpenAI having operational responsibility. SoftBank's Masayoshi Son will be chairman, but a new board of directors and CEO are being sought. As for Oracle — in conjunction with its technology partner NVIDIA — it will "closely collaborate" to build and operate the computing systems. OpenAI has been working with NVIDIA since 2016, and in June 2024 announced a partnership with Oracle intended to extend its existing Microsoft Azure AI-based platform to the Oracle Cloud Infrastructure. NVIDIA and OpenAI announced a renewed alliance in December 2024, focused on the optimization of performance and scalability of NVIDIA GPUs for ChatGPT.

Although Microsoft is not being presented as a frontline participant in Stargate, OpenAI insists that Stargate "builds on the existing OpenAI partnership with Microsoft," and that OpenAI "will continue to increase its consumption of Azure." In its own separate blog post, Microsoft said that it "was thrilled to continue our strategic partnership with OpenAI" but admitted that it is now moving from an exclusive provider of computing capacity for OpenAI to a "right of first refusal" model. Microsoft remains a major investor in OpenAI, still has access to OpenAI's IP, has an exclusive on the OpenAI API for Azure and has revenue-sharing agreements in place until the current contract ends in 2030. Microsoft and Arm are both mentioned as "key initial technology partners," but Advanced Micro Devices Inc. and Intel are not.

The job growth Trump alluded to is aligned with the infrastructure buildout phase, including both datacenters and energy generation. On the latter, Trump has signaled that "energy will be generated at their own plant if they want."

The job growth Trump alluded to is aligned with the infrastructure buildout phase including both datacenters and energy generation. On the latter, Trump has signaled that "energy will be generated at their own plant if they want."

Competitive landscape

Microsoft has separately announced that it will spend $80 billion in 2025 to further build out its AI infrastructure. Amazon Web Services says it spent $75 billion on capital expenditure in 2024, and expects to invest more than that this year. Stargate looks as if it is intended to provide an alternative to the hyperscaler clouds — including its partner and investor Microsoft — which continue to build out their own accelerated infrastructures and introduce custom silicon, hoping to make them more cost-efficient to run and less energy intensive. OpenAI itself is said to be negotiating with Broadcom Inc. to design custom silicon for OpenAI inferencing.

Meanwhile, we have seen the emergence of a new class of specialized cloud infrastructure providers focused on AI workloads and GPU as a service, heavily funded by NVIDIA, as well as from outside investors. Hosted private cloud and edge infrastructure initiatives have also been boosted by the demand for AI. NVIDIA continues to dominate the market for the GPUs that power AI infrastructure, although AMD is emerging as a competitive alternative.

SWOT

| Strengths: Stargate is OpenAI’s push to build out its own AI-accelerated datacenters, backed by the deep pockets of SoftBank and the infrastructure expertise of Oracle (and its partner NVIDIA). | Weaknesses: Two things jump out. One is the somewhat ambiguous position of Microsoft, no longer OpenAI’s exclusive provider of infrastructure. The second is the exclusive focus on the US — was this emphasized for political purposes? |

| Opportunities: Altman may still be going ahead with a somewhat separate investment initiative to expand chip making. The two are closely linked, as GPUs for AI acceleration must be tightly coupled to datacenter infrastructure. | Threats: The shift from heavy-duty training to inference workloads could change the demand for massive GPU clusters concentrated into giant datacenters. Although potentially a larger opportunity than training, inference can run on less powerful silicon and distributed across datacenters. |

Read our report on European free ad-supported TV revenue, which could near $1B in 2028.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Wireless Investor is a regular feature from S&P Global Market Intelligence Kagan.