Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Dec 05, 2023

By Matt Chessum

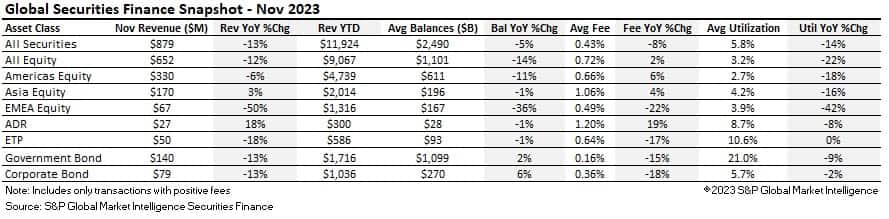

Securities lending activity generated $879M in revenues during the month of November, marking the lowest revenue producing month of the year so far. Revenues declined 13% YoY and 2% MoM. Revenues declined YoY across most asset classes, with only APAC equities (+3%) and ADRs (+18%) bucking the trend. EMEA equities continued to see a sharp decline in activity with revenues declining 50% YoY despite an increase led by seasonal activity of 15% MoM.

When looking across the other metrics, average balances, and utilization declined when compared YoY. Again, the noticeable region was EMEA equities where average balances declined 36% and utilization declined 42% YoY. Despite the recent decline in specials activity across the Americas, average fees trended higher YoY by 6%, and a small move higher of 4% was also seen across the APAC region (despite the short selling ban across South Korea). ADRs were the highest outperforming asset class over the month with an 18% YoY increase in revenues and a 19% increase YoY in average fees.

Across the fixed income markets, after government bond balances marked a 2% YoY decrease during October, average YoY balances increased by 2% during November. It appears that year end positioning has been slower this year given the eradication of the risk of negative interest rates and the normalization of the level of return on offer over the annual reporting period. Revenues and average fees across corporate bonds continued their YoY and MoM declines as markets started to call peak rates and momentum moved from higher for longer to aggressive cuts during 2024.

For US equity markets it was a November to remember with the NASDQ climbing +11% and the S&P 500 up by 9% over the month. November proved to be the best month for the equity markets in close to a year and a half, and the second best since the 1980's. Following a lower-than-expected US inflation print mid-way through November, treasury yields declined by some of the largest monthly moves ever recorded pushing equity markets strongly higher. In the US, the largest gains were once again seen across the tech sector, as growth stocks retained their dominance. With the fall in inflation pushing the headline figure close to its pre-pandemic norm without a recession or a high degree of economic weakness, a soft landing is now in sight and is considered the most likely scenario heading into the new year.

This soft-landing sentiment dominated throughout the month as Wall Street feverishly revaluated its interest rate projections, with some US banks expecting the first rate cut to come towards the end of spring 2024. A new high of 5000 for the S&P 500 was also being touted by some analysts as they claimed that the Fed has now accomplished its objective of lowering inflation, avoiding a recession, and keeping the US equity market intact. Optimism was buoyed further given that financial markets have already absorbed multiple geopolitical shocks so far this year and continue to grow.

Official figures showed that inflation also cooled across Canada during October, adding to expectations for the central bank to hold interest rates steady in the near term. The TSX60 reacted positively as a result, increasing by 6.5% over the month.

In the Canadian securities lending markets, despite revenues declining by 6% YoY, November revenues were the highest seen across the region since August. The increase in revenues was a direct result of an increase in average fees. Average fees increased by 6% YoY and by an impressive 18% MoM. Loan balances increased by only 0.2% MoM despite a near 7-10% increase in the two main indices across the region. Balances declined 11% when compared YoY and marked their lowest November average since 2020. Utilization across Canada declined MoM and YoY, dipping back below 7% for the first time since August. Average utilization in the country YTD remains higher than during 2022 however at 7.15% vs 6.34% during 2022.

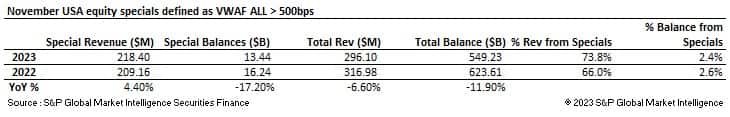

Specials activity continued to grow across USA equities during the month. Specials revenues increased to $218.4M marking a 4.4% increase on November 2022. 74% of all USA equity revenues were derived from specials over the month, representing just 2.4% of balances. YTD specials revenues of $3.356B have been generated from USA equities.

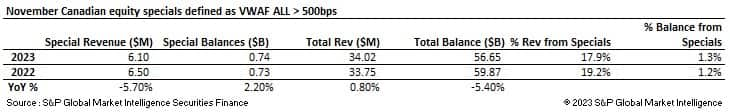

Across Canada, specials activity generated $6.1M marking the lowest monthly specials revenues of the year so far. This represents 18% of all revenues and 1.3% of the on-loan balances. The percentage of revenues generated from specials has fallen throughout the year across the Canadian market, reaching a peak of 36% during February. YoY specials revenues have accounted for $92.7M, approximately 15% higher than at the same point during 2022.

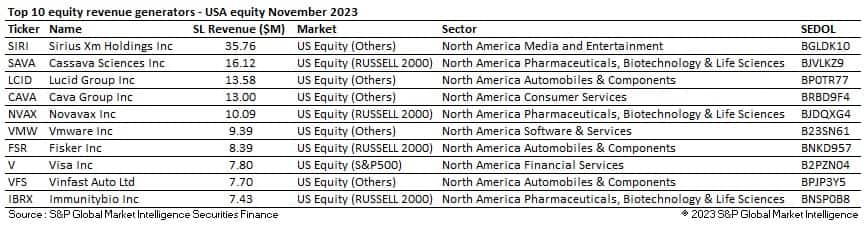

During the month the top ten revenue generating stocks in the Americas earned a combined $129.26M increasing to 39% of the total revenues of the region ($82.8M, 29% of total revenues during October). Sirius XM Holdings Inc (SIRI) continued to top the table, increasing monthly revenues by 60% when compared with October. As reported last month, a potential arbitrage opportunity continues to drive demand in this stock. Utilization remained steady over the month, but average fees increased after the dividend payment on November 7th.

Immunitybio Inc (IBRX) was a new entrant to the list during November. The company reported its third quarter earnings during the month and missed analyst expectations by 80%. This news sent the company's shares 5% lower after the announcement. As discussed previously, the Biotech sector remains under pressure as funding costs become more expensive and demand for anti-viral treatments declines.

Broadcom (AVGO) closed its $69B cash and stock acquisition of cloud computing firm VMware Inc (VWM) during the month after receiving regulatory approval in China. This news increased borrowing in VMware Inc shares as a result of the terms of the acquisition.

Across Canada, seasonal activity remained a large driver of demand across the top ten highest revenue generating stocks. One exception to this was Emera Inc (EMA), the energy and services company which continues to face a number of growing pressures. Its interest payments on debt are reportedly not well covered and its annual dividend remains low when compared with the sector average. Its annual earnings are also expected to grow slower than those across the Canadian market going forward.

The big news across the APAC region during the month was the renewed ban on short selling activity in South Korea. The ban was imposed by the Financial Services Commission (FSC) and will be in place until June 2024 across all listed stocks in South Korea. The FSC stated that it intends on using the time period to improve regulations and investigate naked short selling across a number of large global institutions. The ban reportedly triggered a bear market on single stock futures as a result, with some companies trading at up to a 6% discount to their spot prices. Other markets across the region embraced the practice however as short selling debuted across the Philippines, with the PSE launching a securities financing solution to facilitate trading.

In China, real estate developer stocks and bonds rallied during the month as speculation started to grow that authorities may introduce additional stimulus into the market. Beijing reportedly wants to ensure that developers have enough cash available to finish building the millions of homes undergoing construction.

Strong earnings figures boosted the Japanese stock market to a 33-year high during November. The weak Yen continues to support Japanese exports, comments from the Bank of Japan building expectation for the end of negative interest rates and ongoing corporate governance reforms led to ongoing outperformance.

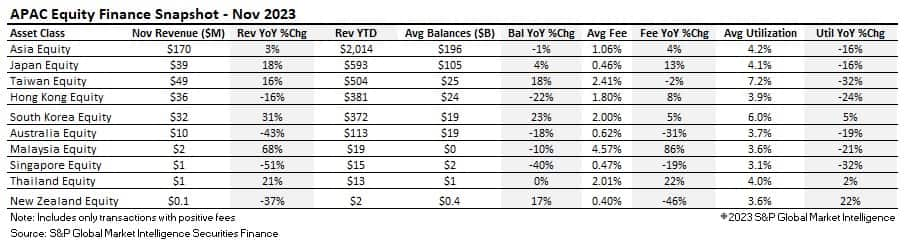

Across the securities lending markets, balances remained unchanged across APAC equities, to those seen during November 2022 but, when compared MoM, balances declined by a total of $18.5B. This decline was driven by the fall in Japanese equities balances which declined by $22B over the month. Despite a 3% YoY increase in revenues, MoM revenues declined by 15%. When compared with October, revenues declined significantly across both Japan (-35%) and South Korea (-26%), this is despite the impressive YoY increases that can be seen. Balances declined by 7% MoM across South Korea as short covering took place as a result of the short selling ban. Average fees also declined in the market as demand reduced. Utilization declined to 6.05% which is the lowest level seen since March.

Across Japan, securities lending activity declined throughout the month. Revenues during November were the lowest seen during the year so far. Average fees dipped by 8bps to 46bps, and utilization hit a 2023 low. Activity dipped during the middle of the month, balances (value on loan ex-financing) fell below $100B for the first time this year and utilization dipped below 4%. Balances, utilization, and average fees did start to climb back higher towards the end of November, however.

Across Taiwan and Hong Kong, market activity remained steady. Average fees, revenues and balances remained unchanged when compared to October.

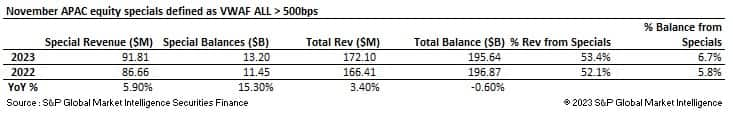

Specials activity generated $91.8M during the month, approximately 53% of all revenues. Despite declining MoM ($103.7M during October) this figure represents an increase of 6% YoY. YTD APAC equities specials have generated $976.2M, the highest YTD amount since 2018.

Real estate companies Sunac China Holdings ltd (1981) and Country Garden Holdings Co Ltd (2007) continued to dominate the top ten revenue generator table over the month. Korean Ecopro Co Ltd (086520) also remained a top borrow despite the recent short selling ban across the country. Both the quantity of shares on loan and the average fee have declined by circa 50% since the announcement of the ban.

Benchmark fees increased rapidly in Alchip Technologies Ltd (3661) during the month and active utilization surpassed 60%. Software and services along with Asia Semiconductors remained popular sectors for borrowers over the month. Geopolitical risk remains a concern in the region not only between China and the US but also between China and its Provinces. Chip restrictions and trade barriers remain an active concern amongst investors and the news flow continues to impact share prices.

European equities benefited from the overall improvement in market sentiment during the month with the Euro Stoxx 600 climbing by 7.9%. Comments from the International Monetary Fund (IMF) were a boost to equity market performance across the region. The IMF not only increased its likelihood of a soft landing across the continent but also confirmed its expectation for a steady decline in inflation and higher GDP growth during 2024. The fund did warn however that bringing inflation back to normal levels (close to 2%) may take several years to achieve.

The Euro experienced its best monthly gain of the year so far against the US Dollar during November as the markets started pricing in rate cuts by the ECB as soon as April 2024, going against the advice of both the IMF and the ECB. Government bond yields declined as a result of the fall in inflation which helped to push equity markets higher. Weaker than expected inflation figures across the UK also contributed to positive sentiment.

The outlook for European equities heading into the new year also improved as lower inflation, increased consumer spending and a decline in recessionary pressures are all expected to help boost the Euro Stoxx 600 by an expected 7% during 2024 according to an analyst note. An increase in M&A activity was also predicted across EMEA as higher interest rates have been leading to increased costs for private equity companies. A pickup in buy back activity was also mentioned, which is also expected to contribute to stronger equity returns throughout the new year.

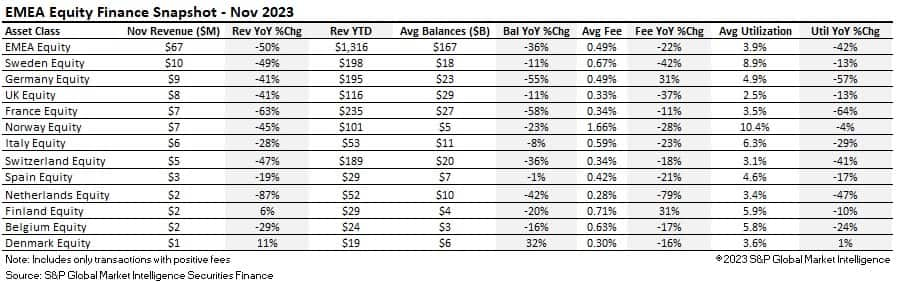

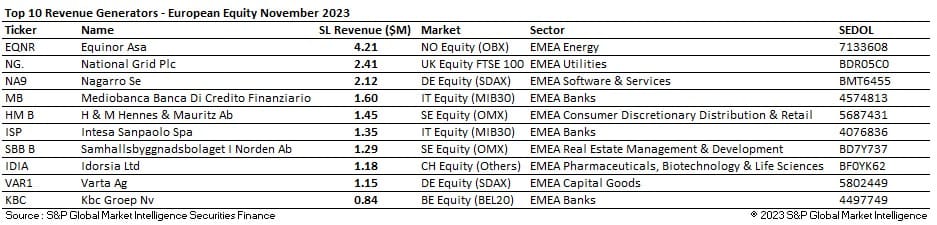

In the securities lending markets revenues across the EMEA region experienced a 50% decline when compared YoY. When looking MoM, revenues actually experienced a 15% increase, following a disappointing October revenue number. The increase in revenues was a direct result of an increase in average fees (October 45bps, November 49bps) and a $11.8B increase in monthly balances. Utilization across the region increased slightly MoM but remains 42% lower when compared with November 2022.

Across most countries within the region, securities lending activity showed large YoY declines in both revenues, average fees, and balances. Revenues remained unimpressive and utilization continued to decline. Germany experienced its lowest revenue generating month of the year so far. YoY revenues declined by 41% whilst MoM revenues experienced a 2% fall. Balances increased slightly when compared with October but remain $12B (35%) lower than the year average ($35.3B). Norway and Italy both experienced relatively strong increases in revenues throughout the month, increasing by 24% and 57% respectively. Average fees increased significantly across the two countries and accounted for the majority of the increase seen in monthly revenues.

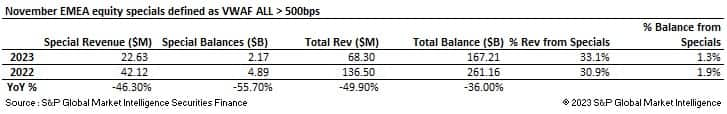

Specials activity across EMEA equities generated $22.6M during the month. This accounted for approximately 33% of all revenues and 1.3% of on loan balances. Both the percentage of revenues derived by specials activity and the percentage of the overall balance required to generate this revenue continues to fall. Whilst increasing by 2% MoM, YoY specials revenues declined by 46%. YTD EMEA equity specials revenues totaled $418.1M, slightly under the $419.7M generated during the first eleven months of 2022.

Across the EMEA region, the revenues from the top ten highest revenue generating stocks increased by 31% over the month. Seasonal activity was a large contributor to this increase. A Scrip dividend in National Grid PLC (NG.) generated $2.4M over the month as the embedded optionality in this corporate action led to a higher lending rate for cash guaranteed stock. Nagarro SE (NA9) remained one of the most popular borrows across the region. Active utilization declined slightly over the month but remained above 90%. Average fees also declined in line with utilization but remained in strong special territory.

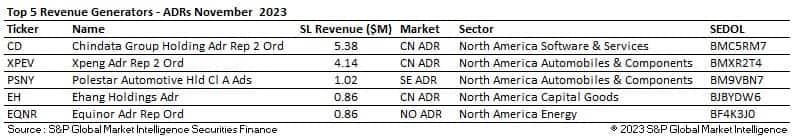

In November ADRs experienced their strongest revenues since May as average fees surged to their highest level seen for five months. Balances remained 1% lower YoY but increased by 4% MoM. The strong monthly increase in average fees helped to push the revenues higher. The appearance of new specials was directly responsible for the improvement in performance as Chindata Group holding (CD) and Equinor (EQNR) found their way into the top 5 revenue generator table.

Revenues generated by Chindata Holding (CD) more than doubled over the month, rising from $2.56M during October to $5.38M during November. The data center company is currently part of a takeover deal by Bain Capital with an objective to perform a full buyout of the company to take full control of its data centers. The company has committed to pay $4.30 per ordinary share and $8.6 for each ADR. Benchmark fees declined slightly over the month, but utilization remained high. Xpeng (XPEV) remained the highest revenue generating ADR over the month having contributed $58.9M year to date.

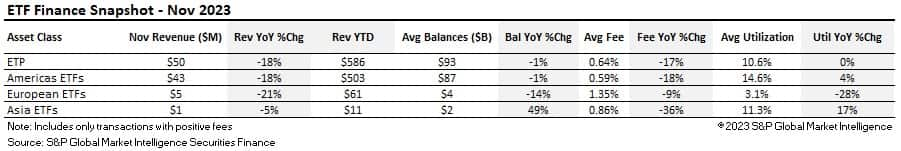

Investment flow data released during the month reported that ETFs experienced $30B of inflows during October. It was also reported that traditional Mutual funds experienced $80B of outflows, highlighting the growing importance of the asset class amongst global investors. The biggest move in ETF flows was seen across the corporate bond sector. A record $9.4B was reportedly withdrawn from these products during October as government bond yields increased, hitting 16-year highs. Investors have been repositioning portfolios given the increase in yields and lower risk on offer. One clear sign of this was seen in the Vanguard Total Bond Market ETF which crossed the $100B AUM mark for the first time amongst any fixed income ETF. The highest yields in years and the tax effective ETF wrapper continues to attract investors. ETFs holding physical gold also suffered outflows during the month as an increase in low-risk investment returns reduced the allure of the asset class.

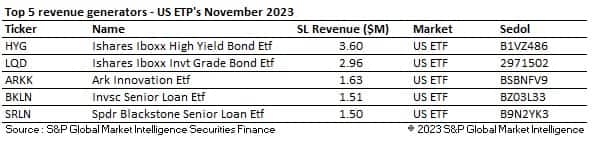

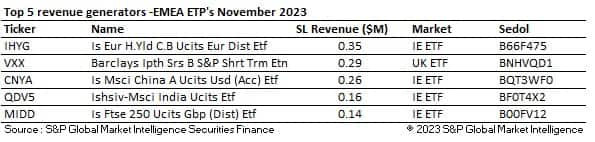

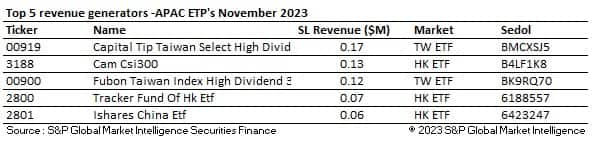

Across the securities lending markets, as has been the case for the majority of 2023, revenues declined by 18% YoY. This decrease was led by Americas ETFs as average fees declined. When compared MoM, Americas ETFs were also responsible for a 30% decline in revenues. Those assets driving the revenues - HYG, IWM, LQD - all experienced lower revenues and lower average fees during the month. Balances across the asset class declined by 1% YoY but 8% MoM. Declines were seen across both Americas ETFs and Asia ETFs but there was a small increase seen across EMEA ETFs.

Across the highest revenue generator tables, fixed income ETFs continued to dominate across the US and EMEA. ARKK - Ark Innovation ETF generated $1.63M over the month after recording one of its best performing months ever (+31%). Investor hopes that the US will be able to start cutting interest rates in 2024 helped to propel the fund higher as gains in risk assets took off during the month. Across the APAC region, as in EMEA, ETFs providing exposure to China and the CSI300 remained popular borrows. Despite a trend of disinvestment from China being well documented over the year, the financial press is reporting record inflows by Chinese investors into exchange traded funds throughout this year.

The hiking cycle of central banks came to an end during the month of November with major developed central banks delivering just one increase during the month and the number of cuts outstripping hikes for the first time in 33 months across emerging markets.

The Federal Reserve held interest rates steady at a 22-year high during November. At the post-meeting press conference, Federal Reserve Chairman Jerome Powell said that central bank officials are focused on whether or not it needs to raise rates further, not about when rates will fall, as officials appeared less convinced than the market that they have done enough to cool inflation. Despite Powell's comment that policymakers are "not thinking about rate cuts at all," futures market data following the meeting suggested that investors expected several rate cuts over the course of 2024. The 10yr treasury yield declined 64bps during the month and the 2yr yield fell by 45bps, one of the largest declines ever. This was despite a change in Moody's rating outlook to negative for US government debt during the month.

Treasury issuance for the first nine months of the year was also confirmed at $1.56T. Questions regarding the absorption of future issuance started to appear across the financial press as any growth in demand remains an unknown quantity. The issue of increased issuance remains a potential issue across all major economies as the International Monetary Fund (IMF) released analysis stating that Government debt in rich countries is set to hit 116% of gross domestic product in 2028 from 112% in 2022. The US Securities and Exchange Commission also decided to postpone the final vote on proposed reforms for the US Treasury market until the first quarter of 2024. The SEC plans for mandating the clearing of US Treasuries have been delayed amid lobbying efforts by industry bodies.

The Bank of England voted to maintain rates at 5.25% over the month, their highest level since 2008. The vote was split 6-3 with some members voting for an additional 0.25% increase to try to bring inflation closer to the 2% target. The BOE continues with its "Table Mountain" approach, following a hold during October. Huw Pill, the Bank of England's chief economist, suggested that interest rates in the UK could be reduced during 2024. Swap markets were pricing in a cut of 75bps for 2024, an increase from 50bps that was previously being priced in. Andrew Baily the governor of the Bank of England did state later on in the month however that there was little likelihood of rate cuts in the "foreseeable future" and that the rest of the battle on inflation would be hard work. A sale of £7B of Gilt issuance experienced record demand however, during the month, generating £93B in potential orders, as investors continued to clamour for yield.

The ECB, following its most recent pause during the final days of October, followed the Fed and the Bank of England, stating that further rate hikes could not yet be ruled out. Price stability and further inflationary pressures remain the main causes of concern for central bankers despite recent declines.

During the month, the Bank of Japan continued to issue a number of hawkish statements leading investors to believe that the bank was priming markets for an end to negative interest rates. Many investors believe that the BOJ is starting to lay the groundwork for a normalization in policy. Japanese regional banks were also being warned to prepare for the country's first interest rate hike in over ten years, with the central bank cautioning regional banks that bought into long-term loans and securities as they may be exposed to heightened interest rate risks.

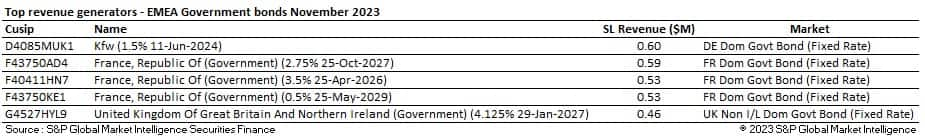

Across the securities lending markets government bond revenues hit a 2023 low. Monthly revenues have been falling throughout the year, even though we are quickly approaching the year end reporting period. Average fees remained steady at 16bps, and balances increased YoY by 2% and by 4% MoM. Utilization pushed above 21% for the first time since March as a result.

US treasuries marked their lowest monthly revenues of the year so far, $75M. This is despite balances increasing by an average of $22B over the course of November and average fees remaining aligned with those seen during October (16bps). Utilization also increased from 19.47% in October to 20.67% in November, the first time that it has breached the 20% mark since March. This would suggest a decline in specials activity within this market.

Across Europe, a similar story played out over the month. Monthly revenues of $47M were also the lowest generated since not only the start of the year but since November 2021. Average fees declined by 1bps to 16bps, but utilization increased from 21.4% during October to 21.73% during November.

Across the highest revenue generator table sub-10-year government bonds continued to attract the highest revenues. As interest rate cuts start to be priced in for 2024, holding shorter dated bonds helps investors to mitigate interest rate volatility. Maturities of less than five years can often help to hedge against interest rate risk versus all maturity bonds. Given the remaining unknowns regarding both inflation and interest rates, it seems logical to assume that shorter dated borrows will remain in focus for the foreseeable future. Given the rapid increase in interest rates and the discount that many of these bonds have had to be sold at to ensure that they keep pace with the returns on offer, many of these bonds will also be trading well below par. As a result, short-dated bonds currently provide an opportunity for investors to hold these bonds until to maturity and receive the par price. Liquidity in some issues is therefore likely to remain stretched as those bonds with the largest discounts continue to be located in the market.

Across the corporate bond market, it was announced that the Mortgage-Backed Securities (MBS) would be facing a third consecutive year of losses. The market is reportedly suffering from cuts in both supply and demand and from ongoing issues within the housing market.

The CDX HY Index continued to rally over the month, tightening by levels only previously seen during 2011. Spreads continued to rally following dovish Fed comments, leading investors to believe that the interest rate hiking cycle may be over. If true, this would lead to a decline in the potential levels of corporate defaults heading into next year as refinancing costs fall as a result.

Bond spreads across investment grade bonds also fell during the month to levels not seen since April 2022. Spreads across blue chip stocks have remained tight but analysts expect these to fall further as recession fears continue to decline. The fall in spreads led to $17B of issuance during the last week of the month.

It was also reported during November that banks are expanding their convertible bond teams heading into the new year as companies look to refinance an estimated $1.9T in maturing debt between 2024 and 2028.

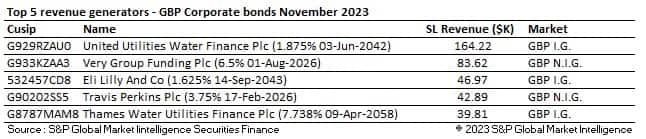

In the securities lending markets corporate bonds generated $79.4M, their lowest monthly revenue figure since March 2022. Average fees fell throughout the month ending November at 35bps but averaging 36bps over the period. This is 7bps lower than the YTD average of 43bps. Balances increased by 3% MoM and by 6% YoY as utilization hit 5.68%, its highest level since June.

USD denominated non-investment grade bonds experienced the largest declines seen across the asset class. Monthly revenues ($10.4M) were the lowest since September 2021. Average fees declined to 65bps, down from 69bps during October which is a 16% decline YoY and well below the YTD average of 81bps.

Over the month many of the top revenue generating bonds remained unchanged. Non-investment grade bonds remained popular across EMEA whilst investment grade bonds dominated across both USD and GBP denominated bonds. The General Motors 6.4% 09-Jan-33 (37045XED4) topped the USD table as monthly revenues increased by 83% MoM and on loan balances increased by 29% MoM. Benchmark fees have grown significantly in this bond over the last 60 days and utilization remains close to 100%. A lack of general liquidity in this popular bond appears to be driving average fees higher.

Over the past month, data from S&P Global Market Intelligence Repo Data Analytics showed that global volumes and average terms in both repo and reverse repo markets increased whilst haircuts remained unchanged.

Repo activity: Volume +5.97%, Weighted Average Haircut unchanged, Average term increased by 0.69 days (87.39 days current average).

Reverse repo activity: Volume +2.8%, Weighted Average Haircut unchanged, Average term increased by 3.79 days (137.32 days current average).

EMEA

Across the EMEA region, government bond repo volumes increased by 7% and reverse repo volumes increased by 3.2% over the month. The largest increases were seen in Spanish and Austrian repo activity with a growth in volumes of 19.2% and 16.9% respectively. Italian government bond repo volumes also increased by 17% and reverse repo volumes increased by 10% over the period. Trading across Gilts also grew during the month with repo volumes increasing by 8.8% and reverse repo volumes increasing by 4.3%. Rates cheapened across both Polish and Greek government bonds, whilst short dated (sub 5yr) Italian government bonds became more expensive in both repo and reverse repo markets. The Italian 1.4% 05/06/25 became more expensive by 29% whilst the Italian 03/28/24 became more expensive by 15.7%.

Across corporate bonds, there was very little change to average haircuts and rates. Volumes did increase by 6% in reverse repo and 11% in repo, however. Italian EUR denominated investment grade and high yield bonds became slightly more expensive over the month and Spanish high yield EUR denominated bonds became 7.5% more expensive across reverse repo markets.

USA and Canada

Growth in volumes was also seen across the Americas during the month. Reverse repo volumes increased by 8% and repo volumes grew by 5.3%. This can be broken down further: UST repo volumes +5.3%, reverse repo volumes +7.9%, Canadian government bond repo volumes +9.8%, reverse repo volumes +31%. Despite the growth in flows across the two jurisdictions, average rates remained steady when compared with October, with less than 1% change in both repo and reverse repo rates across both markets. Movement was seen in the rates traded across 2025 US treasury maturities with the 2% 08/15/25 trading deeply negative (change in average rate of 98% over the month). The UST 0.25% 08/31/25 (repo) and the UST 0.25% 09/30/25 (repo and reverse repo) also experienced a change in average rates of over 30%. The UST Bill 07/11/24 also became more expensive over the month with rates in reverse repo moving by 28% and in repo by 12%. The UST Bill 2% 05/31/24 cheapened however moving back to GC.

In the corporate bond markets a small increase of 2% was seen across reverse repo volumes but repo volumes remained unchanged when compared with October. US USD denominated high yield corporate bonds along with US GBP denominated investment grade bonds traded more special by 4.69% and 4.4% respectively. In Canada, Canadian USD denominated investment grade repo cheapened by 13.8% along with Canadian USD denominated high yield reverse repo which cheapened by 6.94%.

APAC

The APAC region bucked the trend over the month, posting a decline in government bond repo (-12%) and reverse repo (-21%) volumes. The largest declines in volumes could be seen across Japanese Government Bonds (JGBs) where repo volumes declined by 12.84% and reverse repo volumes declined by 26%. JGBs traded more special over the month however as volumes declined. Average rates in the repo market moved by 19.6% and reverse repo rates changed by 21.4%. Sub 10-year JGBs started to trade more special over the period with a focus on the 0.1% 03/20/21 where repo rates became more expensive by 15.71% and the 0.2% 06/20/32 where average rates changed by 13.96%. The 0.8% 09/20/33 cheapened significantly however in both repo and reverse repo markets.

Australian government bond volumes were the second largest movers, lower over the month with repo volumes declining by 13.6% and reverse repo volumes falling by 9.1%. Australian government bonds generally cheapened over the month with maturities in the shorter end (sub 10yr) becoming less expensive by 6-7%.

Across APAC corporate bonds, declines in volumes were also seen. Repo volumes declined by 6% and reverse repos volumes declined by 20%. The largest moves were seen across Hong Kong bonds. In this market, USD denominated investment grade repo cheapened by 10% and volumes declined by 16% whilst USD denominated high yield repo (+27%) and reverse repo (+13%) became more expensive. Two bonds to trade special in both repo and reverse repo markets included CGHCL 7.25% 04/08/26 and FOSUI 6.85% 07/02/24 which traded negative over the month.

As the end of 2024 approaches, a slow-down in securities lending revenues is evident. As the economic environment starts to change, some of the revenue streams that have been relied upon over the last twelve to eighteen months to provide strong returns for lenders have started to fade. As it stands, YTD market revenues are the equivalent of 95% of those achieved during 2022 and have already surpassed those generated during 2021 and 2020. Over the last few years, revenues during December have typically increased slightly on those seen during November. If this remains the case during 2023, market revenues are set to surpass those seen during last year. Whilst not all market participants have been able to participate in this revenue growth to the same degree, 2023 has provided a great market backdrop for those investors looking to sweat their assets and generate additional incremental returns for their investors.

As this is the last snapshot of 2023, the securities finance team at S&P Global Market Intelligence would like to take this opportunity to thank you all for your custom, support, and continued partnership throughout 2023. As we look towards 2024, we wish you all a happy, healthy, and prosperous new year and look forward to working with both yourselves, and the broader industry throughout next year to further enhance the transparency, efficiency, and profitability of the securities lending markets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.