Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Apr 11, 2023

By Matt Chessum

Despite March being one of the most financially tumultuous months since the global financial crisis, it was one of the best in recent history for securities finance revenues. Along with Bitcoin (+71.2%) and tech stocks (Nasdaq 100 +20.5%), securities finance was one of the big quarterly winners during Q1 2023.

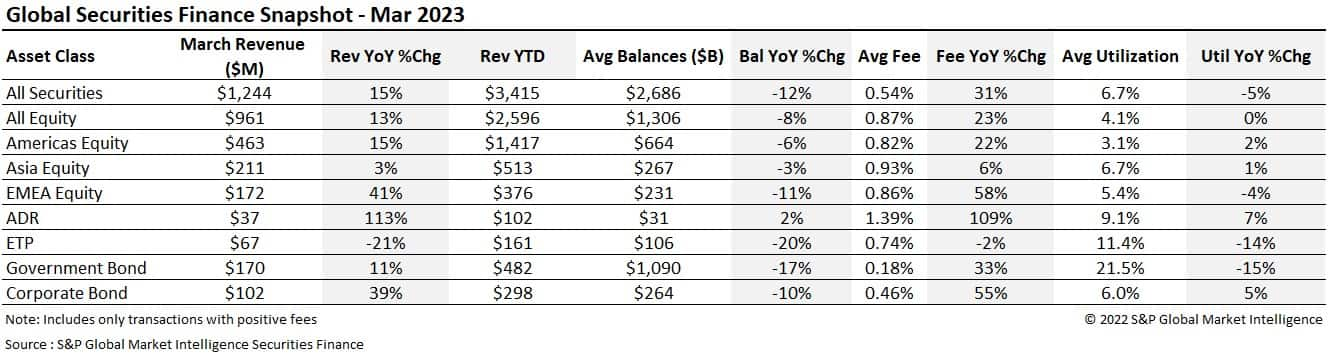

During March securities finance revenues reached $1.244B (+15% YoY) resulting in one of the strongest months for securities finance revenues to date. The first quarter of 2023 was also one of the best in recent history with $3.414B in revenues being generated, reflecting a 24.5% increase on Q1 2022. During 2023, every month of Q1 has exceeded the $1B mark with the lowest revenue generating month being February ($1.054B, January revenues $1.116B). Average fees over the month across all securities increased 31% to 54bps, maintaining the same level as during February. The Q1 2023 average fee of 53bps was a 39% increase on Q1 2022 (38bps).

The largest gains in revenues during March, when compared YoY, were seen across EMEA equities (+41%), ADRs (+113%) and corporate bonds (+39%).

Securities finance activity within Americas equities generated $463M (+15% YOY, -5% MoM) over the month. Despite the market turmoil in the US, the S&P 500 finished the month 3.67% higher (this would have been 4.81% if it excluded financial stocks), notwithstanding financials experiencing a 9.55% decline in value. Market news was heavily focused on the liquidation of Silvergate Capital Bank, Signature Bank and Silicon Valley Bank over the month as the biggest bank failure since to global financial crisis shook financial markets.

Securities finance revenues declined across the region by 5% MoM despite increasing 15% YoY. Average fees were significantly higher YoY (+22%) but also declined when compared MoM (-14%). Despite this, average fees were higher than during any other month (except February) since August 2022. Q1 average fees of 86bps were also significantly higher when compared with Q1 2022 (+47%). This is the highest quarterly average fee since Q2 2020. Fees have remained elevated throughout the quarter due to the ongoing strong specials activity seen within this market. A handful of names continue to generate significant revenues within this market.

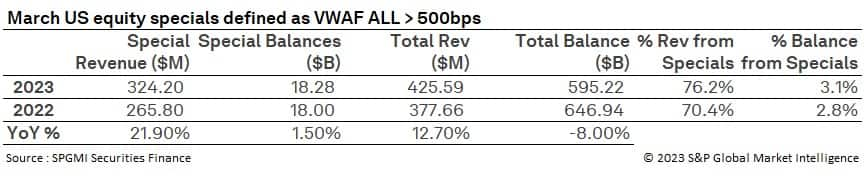

US specials activity remained robust throughout the month but declined when compared with February. $324.2M in revenues were generated from US specials over the month (circa 76% of all US equity revenues which were generated) by approximately 3.1% of all on loan balances. Over Q1, over $1B of revenues have been produces by US equity specials ($1.015B) which represents an increase of 67% on Q1 2022. It also represents the highest Q1 specials balance by a significant amount (previous high of $642M in 2021) since 2008.

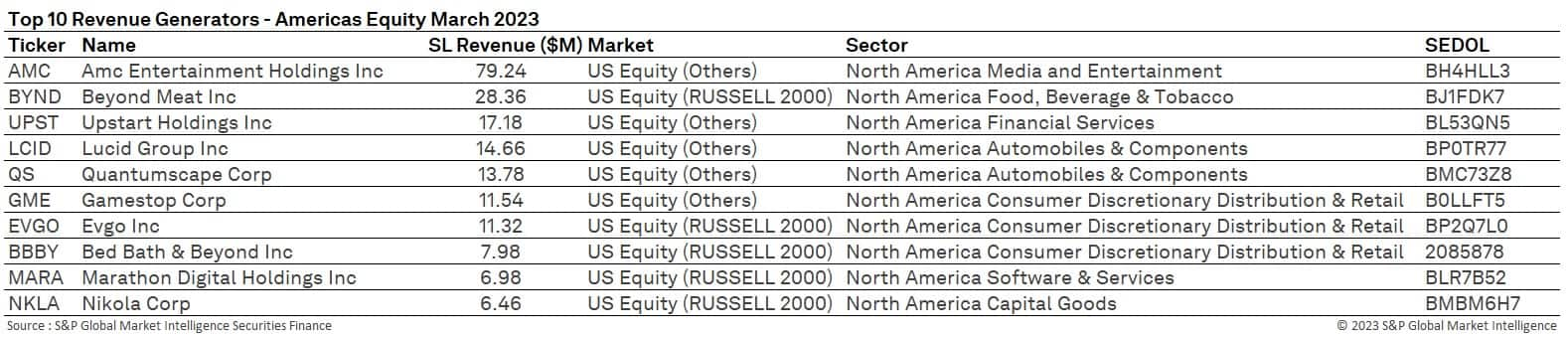

The highest revenue generating stocks over the month all remained very familiar names. AMC produced significant revenues during March as market participants looked to take advantage of the potential arbitrage opportunity between AMC and APE shares. The share price of AMC has recently increased circa 22% following the news that a Delaware Chancery Court judge has issued a status quo order preventing AMC from following through on proposed share conversion. This is likely to have a downward impact on average fees in this stock which had been increasing significantly as utilization has edged close to 100%.

After posting its first quarterly profit for two years, securities finance revenues declined (-30%) MoM in GameStop (GME). Following the announcement, an increase in the company's share price resulted in a reduction in the amount of stock on loan and in its average fee.

Bed Bath and Beyond (BBBY) remained a common borrow within the increasingly popular consumer discretionary, distribution and retail sector. The retailer stated during the month that it would attempt to sell an additional $300M of equity in the open market whist terminating its recent funding deal with Hudson Bay Capital Management LLP. It also stated that it may file for bankruptcy if it is unable to sell the additional shares. This news acted as a catalyst for a further decrease in the company's share price and a subsequent increase in the amount of stock on loan.

Russell 2000 stocks were heavily present amongst the most borrowed over the month. Nikola Corp (NKLA) was one of these. The company's share price reached a new all-time low during the month and was on pace for its largest monthly decrease since September 2020. The company, an electric vehicle maker, is reportedly short of cash and is planning to raise additional funds through the selling of further stock. Average fees increased on this news along with utilization which had previously been falling over the month.

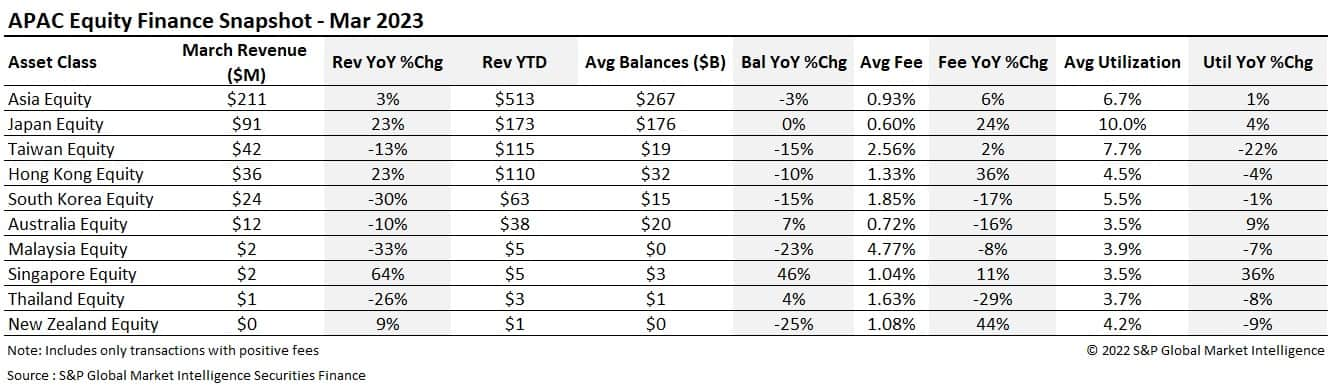

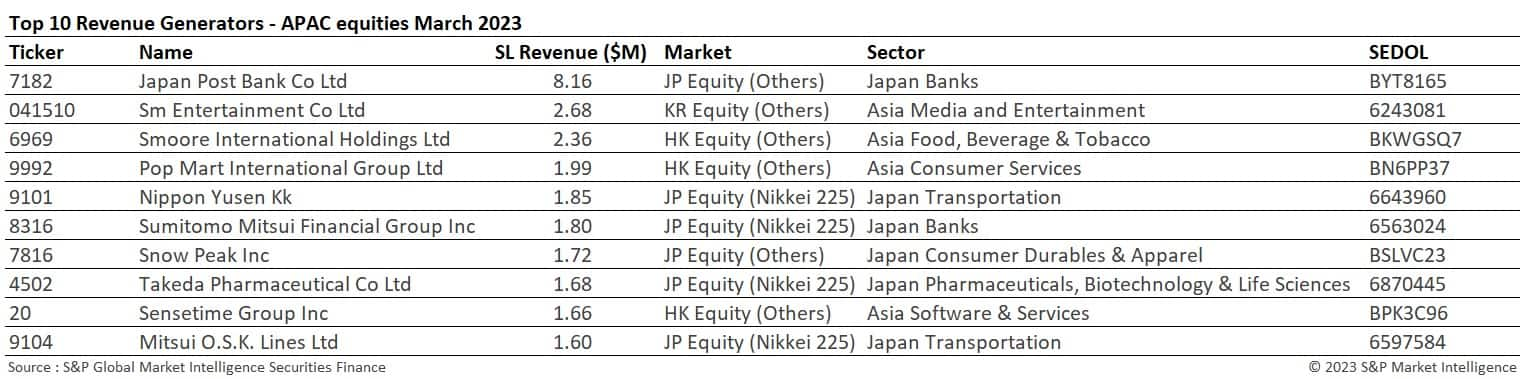

APAC securities finance activity generated $211M in revenues over the month. This is a 3% increase YoY and an increase of 50% MoM ($141M during February). March was the highest revenue generating month for the region since September 2021 ($219.4M). Q1 revenues ($513M) for the region were down 4% YoY (Q1 2022 $534.8M) but were higher than any quarter since Q1 2022. March average fees of 93bps were higher both YoY (+5.6%) and MoM (+8%) and quarterly average fees stood at 90bps. This was 1% lower on Q1 2022. Utilization continues to grow across the region reaching 6.73% during the month, the highest since September 2022 (6.91%). Utilization has been increasing over 2023 and the Q1 average of 5.44% is the highest quarterly figure since Q3 2022 (5.5%).

Across the region, Japan (+23%), Hong Kong (+23%) and Singapore (+64%) saw the largest increases in revenues YoY. Japan saw its highest monthly revenues for several years. March is traditionally the highest revenue generating month for this market but the $91M figure that was generated during March 2023 surpasses the March figure for the last few years ($73M 2022, $68M 2021 and $64M 2020). Q1 revenues in Japan of $173M were also 24% higher YoY and represent an increase on the Q1 figure for the last few years (Q1 2022 $139.6M, Q1 2021 $155M and Q1 2020 $166.4M). Revenues in this market were driven higher over the month by average fees of 60bps (+24% YoY). This is the highest monthly average fee since January 2020.

In Hong Kong average fees and revenues increased MoM despite a fall in utilization and balances. Q1 revenues for the market of $109.8M increased 25% on Q1 2022. Q1 average fees of 134bps represent the highest quarterly average for several years (Q1 2022 99bps, Q1 2021 106bps and Q1 2020 96bps).

Revenues in both Taiwan and South Korea increased when compared with February but continued to trend lower YoY. Quarterly revenues for both markets were also lower YoY (Q1 South Korea $63.1M and Q1 Taiwan $142.6M). Both markets continued to struggle under increased short selling restrictions. The South Korean regulator did make a statement during the month declaring that they would be removing all remaining short selling restrictions in the near future. This change should hopefully drive balances and revenues higher and have a positive impact upon APAC revenues in subsequent quarters.

Given the significant increase in Japanese revenues over the month it is unsurprising to see that Japanese stocks dominated the top revenue generating table for March. Sm Entertainment Co Ltd (041510), a South Korean stock, was the second highest revenue generating equity over the month. News reporting that Kakao Corp. cancelled an earlier plan to buy a 9.05% stake in the company triggered a fall in the company's share price and increased borrowing interest from market participants. Several Hong Kong listed stocks also appeared in the table over the month. Many of these have been covered in previous snapshot commentaries. Revenues in Smoore International holdings Ltd (6969) grew to an all-time monthly high as the company reported lower revenues than expected. In total, the top ten revenue generating stocks produced +40% more than the previous month.

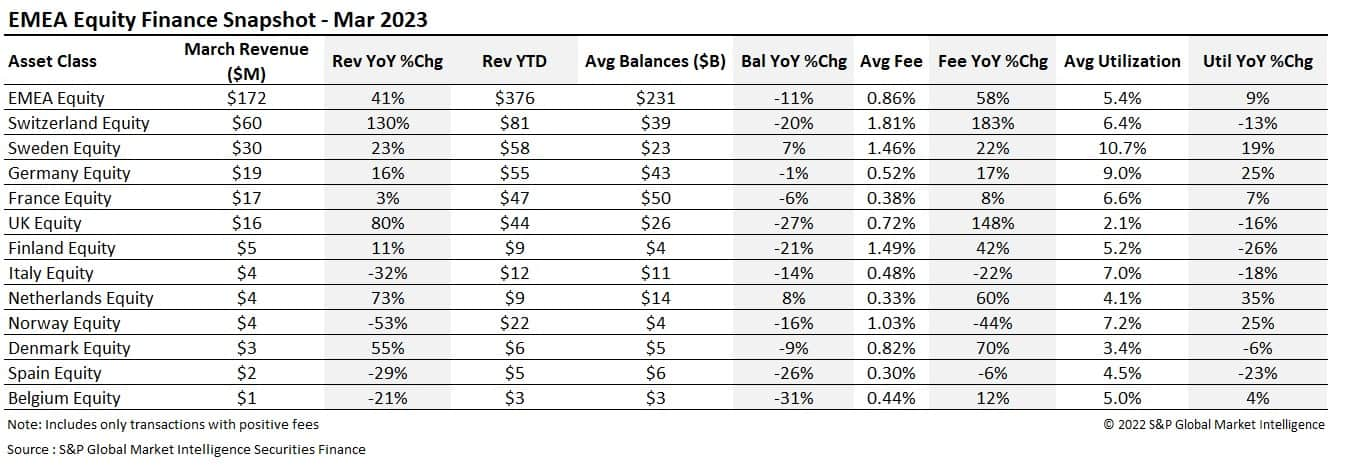

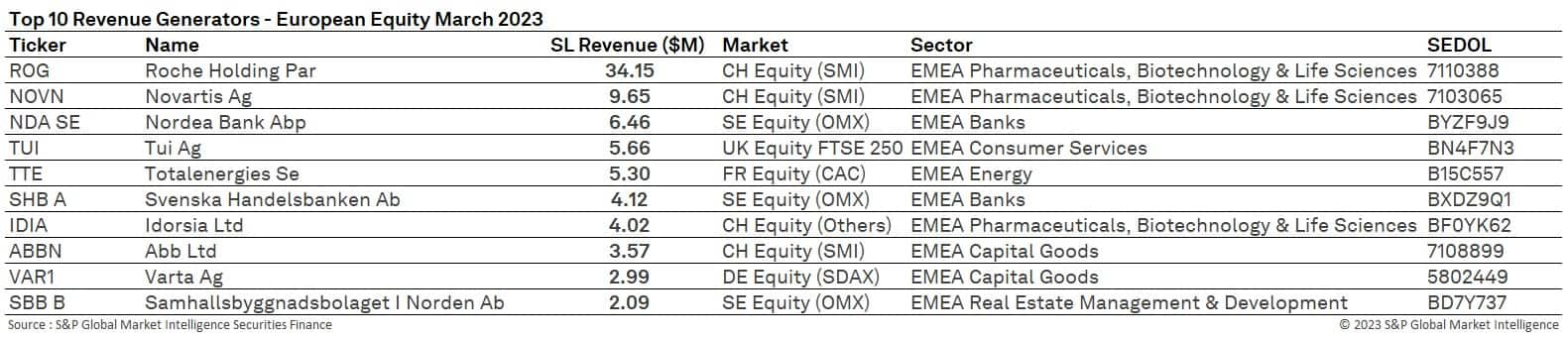

Securities finance revenues across the EMEA region increased 41% YoY and 85.5% MoM. The March monthly revenue figure was the highest since April 2022 and was pushed significantly higher by $60M of revenues generated by Swiss equities. Q1 revenues for EMEA were $376M which is also the highest Q1 revenue figure seen for several years. Average fees across the region were 86bps for the month, an increase YoY of 58%. The quarterly average fee reached 67bps (47bps during Q1 2022) which appears to be a direct result of the increased activity in the Swiss market where average fees reached 181bps during March.

Sweden was the second highest revenue generating market of the month with $30M of revenues. Sweden has been a high revenue generating market for several months and continues to outperform its larger regional peers. Q1 revenues for this market were $58.4M which were higher than Germany ($55M) and France ($47M), which are traditionally the highest revenue generating markets within the region. The only other market within EMEA to generate higher quarterly revenues was Switzerland which generated $81M. During the month utilization in Swedish assets also passed 10% for the first time since May 2022.

France and Germany continue to generate stronger returns YoY despite a fall in balances (YoY). In line with many other markets, average fees in both France and Germany are higher YoY indicating a more expensive borrowing environment. March revenues in the UK increased 80% YoY to $16M. Average fees also hit 72bps for the first time since July 2020. Quarterly revenues in the UK of $43.6M were the highest since Q4 2020. Revenues in the Netherlands were also higher both YoY and MoM as average fees in the market increased steadily.

The top revenue generators in the region were dominated by Swiss stocks over the month with $34M in revenues (46% of all revenues generated by the top ten) being generated by Roche Holdings (ROG). Several Swedish stocks also featured in the table along with TUI AG (TUI), which announced a capital raising during the month, and Total energies (TTE).

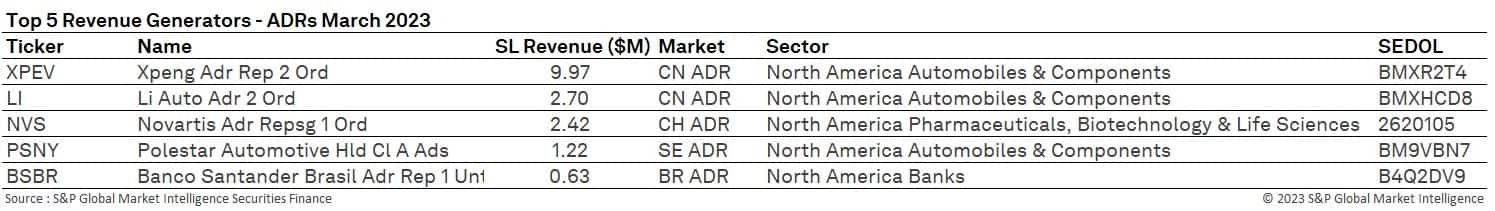

ADR's experienced their strongest monthly revenues since August 2022. Revenues increased an impressive 113% YoY and 23% MoM. Average fees also increased over the month (+109% YoY 139bps) along with utilization and on loan balances. Q1 revenues for ADRs totalled £103M equalling the highest quarter of 2022 (Q3).

The Electric Vehicle (EV) sector still dominates the ADR segment. Xpeng (XPEV) continues to generate strong revenues. Li Auto (LI) was a new addition over the month generating $2.7M in revenues. A reported fall in the cost of producing car batteries has created a more competitive market for new electric cars in China. The industry is now reportedly facing a period of intense competition as prices are being reduced and market share is becoming harder to win. Chinese EV makers are expected to experience a slower growth in vehicle sales during the year when compared with 2022 despite nearly 30% of all cars in the country being electric.

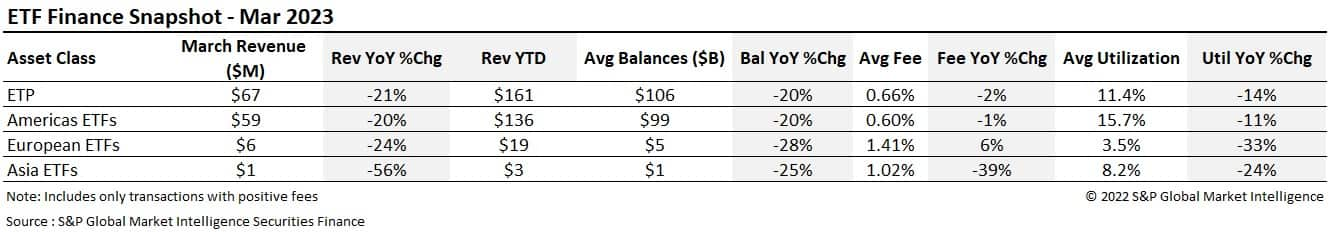

ETF flows over the month of March were reflective of the market conditions. A flight to quality was seen taking place by investors with Government bond and Money Market ETFs seeing near record inflows in the space of a few days. Despite the volatility seen in investor flows, borrowing in ETFs remained resilient. Revenues generated by ETPs declined 21% YoY to $67M but increased MoM by 40%. Over the first quarter of 2023 ETPs generated $161.4M which is a reduction of 25% when compared with Q1 2022. Americas ETPs generated $136M, European ETPs $19M and Asia ETPs $2.5M over the quarter. March average fees for ETPs also declined YoY to 74bps. Over Q1, the average fee for all ETPs was 67bps which is a decline of 9% when compared with Q1 2022.

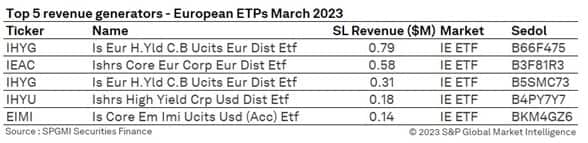

Revenues in the iShares iBoxx High Yield Bond fund (HYG) hit the highest monthly level since April 2022, during March. This equates to 64% of all Q1 revenues for this stock. Demand increased once again for shares in HYG over the month as uncertainty regarding the direction of future interest rate increases took centre stage. At the beginning of the month many investors believed that conditions were right for the Fed to pause its hiking cycle, but this changed following the turmoil seen in the banking sector and another raft of economic data that surprised once again to the upside. Main index equity ETFs were also popular borrows over the month as investors looked to hedge positions and exploit the equity market volatility seen throughout the month. In Europe, a similar situation took hold with fees in European high yield equivalents seeing increased demand and higher fees.

Uncertainty in the direction of interest rate moves is still creating unprecedented volatility within the fixed income markets. During the month of March, bond yields have continued to move at breakneck speed due to the fluidity in any consensus regarding future interest rate moves.

The ECB was the first central bank to raise rates during the month, followed by the Fed and the Bank of England. All central bankers clearly stated in their addresses that bringing inflation back down to 2% was non-negotiable and highlighted the fact that inflation was the central bank's main concern -rather than equity market stability. In the US, the Fed raised rates by another 25bps, increasing the deposit rate to 5%. Economists are currently projecting a 25-basis-point interest-rate increase during each of the next two policy meetings. During his speech, Fed Chairman Powell alluded to the fact that the recent banking turmoil may have an impact upon regional bank's ability to support lending into the broader economy. It is expected that this may be positive for any future rate increases in the US as a lower level of lending into the economy is likely to help to reduce inflation further. The recent financial sector turmoil is thought to have saved all central banks at least one 25bps increase as a result.

In Japan the situation was slightly different. The Bank of Japan's board members have indicated they will wait before moving away from substantial easing. This has tempered market expectations of any dramatic changes to monetary policy and has in turn been driving JGB lending rates even higher.

All the recent Central bank tightening subsequently pushed yields higher towards the end of the month. Investors remained split on where interest rate policy is heading and are asking whether the global economy has moved from soft landing to no landing, to a possible crash landing. Investors are therefore hoping for further bad news in the economic data to give them more confidence in the future direction of future policy moves.

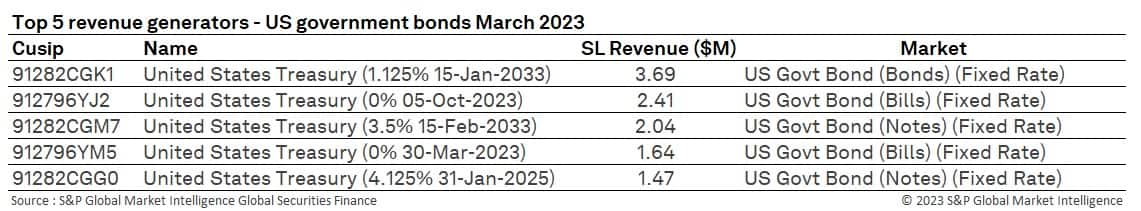

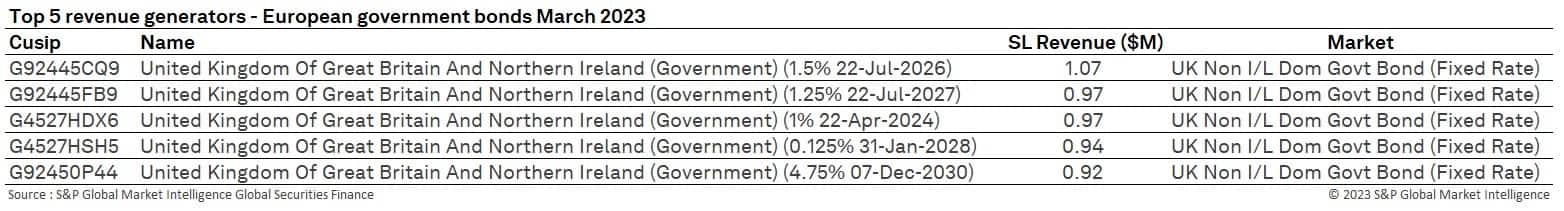

Over the month Government bonds returned $170M in revenues (highest month of Q1). This was an increase of 11% YoY and 18% MoM. Over the first quarter of 2023 average fees remained steady at 18bps which represents a 35% increase on Q1 2022. Balances, lendable and utilization were all lower during every month when compared on a YoY basis over every month of Q1. The increase in fees and the sustained demand for short-dated government bonds has helped to push revenues higher throughout Q1 and with volatility and uncertainty remaining, little change is expected as we head into Q2.

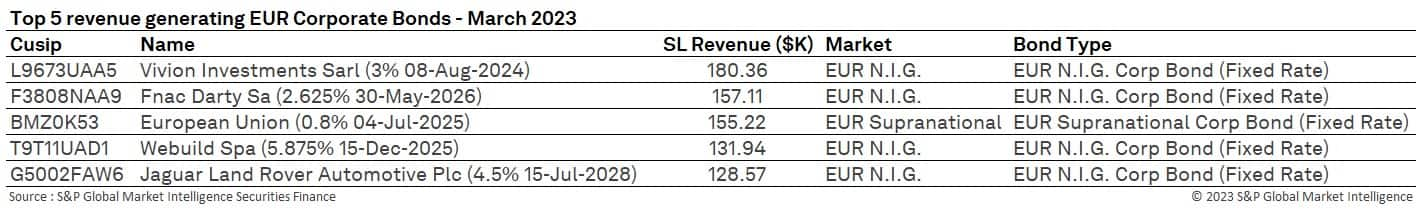

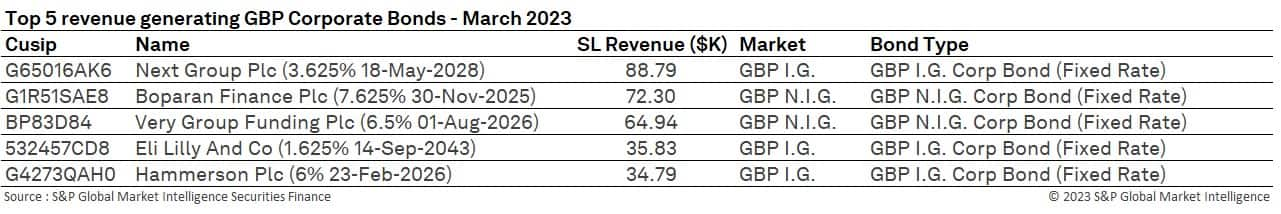

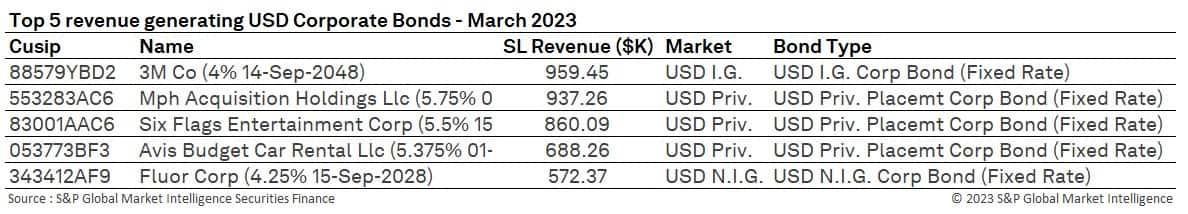

As interest rates continue to rise and equity markets remain volatile, the interest rates being offered by corporate bonds continue to become increasingly attractive to cash investors. Demand for corporate bonds remains strong in the securities finance markets and revenues over the month of March surpassed $100M for the second time this year. Revenues surpassed $100m for the first time in January 2023 and this has led to an incredible Q1 for the asset class. Q1 revenues of $297.7M surpasses any quarter of 2022 which saw record revenues for the asset class. The strength for the asset class was also reflected in the average fee which was 46bps for both the month and the quarter (+55% YoY). Balances remained steady over the quarter, but YoY reductions were seen across all months. Utilization has increased steadily over the year (5.7% Jan, 5.86% Feb and 5.96% March) producing a recent quarterly high of 5.84% - which again surpasses any month or quarter during 2022.

Many specials remain within the commercial property and retail sectors. Non-investment grade corporate bonds continue to be the most sought after, generating the highest revenues over the month.

Both the month of March and the first quarter of 2023 have continued to generate strong revenues for securities lenders. With monthly and quarterly revenues surpassing any month and quarter from 2022, the securities finance markets are currently on track for a record-breaking year. Realising that three quarters of the year remains; it is sensible to also acknowledge that a lot can change before the end of the year. Recent events have proven that financial markets move at an increasingly rapid pace and investor sentiment can change in a matter of hours and days. Whilst the problems seen within the banking sector appear to be controlled, multiple unknown unknowns are likely to still exist.

Please ensure that you join us to hear more about the Q1 securities finance activity by registering for our upcoming webinar on the 26th/27th April. To assist us in our analysis, we will be welcoming Laurence Fletcher, Deputy Markets News Editor from the Financial Times. He will be discussing the market events that have been making the headlines over the first quarter of the year and deliberating the stories that have been attracting the most interest across the Hedge Fund community.

We look forward to you joining us at 10am EST / 3pm UK on the 26th April 2023 and 11am HKT on the 27th April.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.