Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 04, 2023

By Matt Chessum

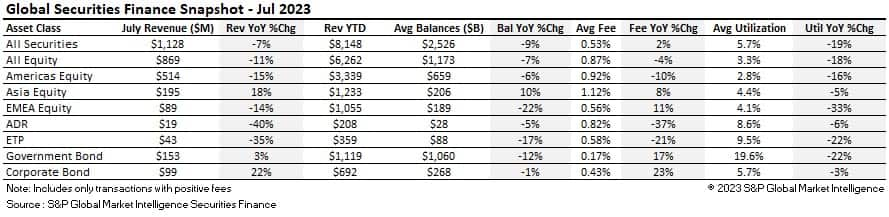

Securities finance activity generated market revenues of $1.128B during the month of July. This represents a decrease of 7% when compared YoY but an increase of 4.5% when compared MoM. Despite the annual decline, revenues for July remained solid when compared to both 2021 ($865M) and 2020 ($906M). Revenues across all of the main asset classes experienced declines YoY apart from Asian equities (+18%), corporate bonds (+22%) and government bonds (+3%). Balances declined by 9% YoY across all securities, but Asia equities experienced a surprise increase in balances of 10% (YoY). Asia equities was the standout asset class over the month with increases seen across all metrics apart from utilization. All asset classes experienced a fall in utilization YoY which has become a general trend over the last quarter. Utilization during the month remained lower than during previous years at 5.7% across all securities, falling below 6% for the first time during the last couple of years (looking back to 2020). This was the result of balances also trending lower (-9% YoY and -1% MoM) and the value of lendable inventory increasing significantly (+11% YoY and +3% MoM).

Fixed income assets continued to shine during the month with both government and corporate bonds posting revenue gains YoY. Despite a decline in balances, revenues increased by 17% and 23% respectively (YoY). As with all of the other asset classes, utilization declined due to an increase in the value of the lendable inventory and a decrease in loan balances.

US stock markets continued to move higher over the month following the strong returns posted during H1. The positive momentum continued throughout July with the NASDAQ 100 posting returns of 3.97%, the S&P 500 posting a return of 3.11% and the Dow Jones Industrial Average posting a monthly return of 3.46%. Markets moved higher despite persistent doubts about the sustainability of the bull market which was underscored by a deepening US treasury curve inversion and slightly weaker than expected earnings during the month.

During the month of July, Americas equities posted revenues of $514M, a decrease of 15% YoY (July 2022 was the highest revenue generating month for Americas equities) but a healthy increase of 20% MoM. Revenues posted their second highest level of the year so far (April $524.3M). Average fees increased significantly when compared with the previous month (June 79bps and July 92bps). This was again a decrease when compared YoY however (July 2022 102bps average fee). Balances remained flat on June, but the value of lendable inventories continued to increase as a result of increasing stock markets. This increase in valuations sent utilization tumbling to its lowest level of the year so far (2.8%).

In the US, US equities generated $477.5M in revenues (93% of all Americas revenues) (-17% YoY but +21% MoM). Average fees hit an impressive 94bps, but utilization continued to decline, falling to 2.63%.

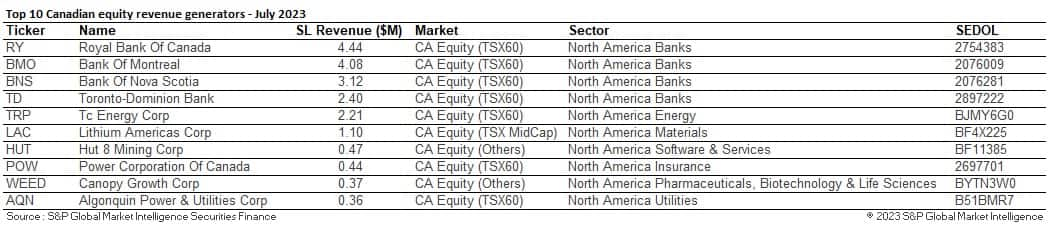

In Canada revenues increased 23% YoY and 7% MoM. Utilization increased throughout the month reaching a high of 9.23% on the 26th of July. Revenues also peaked on this day as the average fee across all Canadian equities hit 142bps (Volume Weighted Average Fee ex-financing).

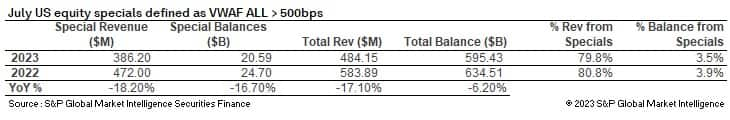

Specials activity in the US picked up again during the month with $386.2M of revenues generated by the lending of securities with an average fee of greater than 500bps. This equates to approximately 79.8% of all revenues being generated from approximately 3.5% of the balances. July posted the second highest level of revenues from US equity specials since the beginning of the year (April $393.2M). US equity specials to the end of July have generated $2.435B in revenues. At the end of July 2022, the second highest year for specials revenues, $1.897B had been generated.

In Canada, despite an increase seen in overall revenue numbers, revenues derived from Canadian specials activity declined MoM to $7.66M. This represented an increase of 4.3% YoY but also marked the lowest month of 2023 for specials revenues in this market. Specials revenues were generated from 1.4% of all balances and represented approximately 22.3% of total revenues.

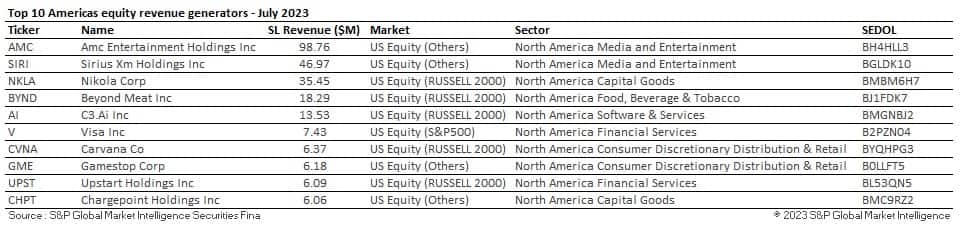

AMC continued to lead the monthly top revenue generating table, posting just shy of $100M. Revenues increased significantly during the month posting their highest level since April ($132M). During the month, the company was blocked by a Delaware judge from converting its controversial APE preferred units into common stock, a ruling that caused the company's class A shares to increase by 100%. The company, which is eager to recapitalize following heavy losses during the Pandemic, therefore has to rethink its plans to refinance its debt burden.

Carvana Co (CVNA) reentered the highest revenue generating table during the month. Despite a significant increase in its share price during 2023 (+900%) the company is planning on diluting shareholders to enable it to raise additional finance. After striking a recent debt deal, analysts believe that the refinancing could lead to further balance sheet weakness in the longer term.

Chargepoint Holdings Inc (CHPT) is another stock that bounced back into the highest revenue generator table during the month. The company that runs an electric vehicle charging network across the United States experienced a decline in average fees over the month despite utilization remaining north of 95%. Short loan quantity as a percentage of shares outstanding remained steady over the month, moving between 25-28%. Investors hold a negative view of the company as to date there has been no real evidence that the business can generate the profits needed to cover the debt burden needed to complete its ambitious plans.

Across Canada the banking sector remained in demand. The issuance of optional dividends pushed both fees and revenues higher for these stocks.

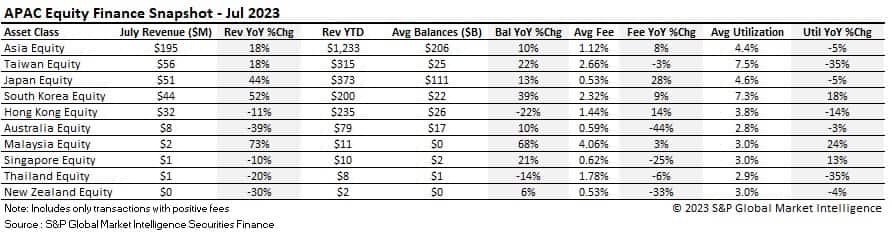

Revenues from Asia equities continued their positive trajectory during the month of July, posting $195M, an increase of 18% YoY and 9% MoM. July marked the second highest revenue generating month of the year so far for the region (March $210M). Average fees hit their highest level of 2023 so far at 112bps, an increase of 8% YoY and 6% MoM and the highest level since at least 2020. Average fees declined throughout the month, however. The first week of July experienced the highest fees, which hit 120bps (Volume Weighted Average Fee ex-financing) before paring back down towards the monthly average figure towards the end of the month.

Across the regional markets, Taiwan increased revenues YoY by 18%, Japan by an impressive 44% and South Korea by a bumper 52%. All other markets experienced YoY declines with Australia experiencing a particularly sticky wicket, after experiencing a decline of 39% YoY, marking the country's worst performance of the year (despite retaining the Ashes) - not a great inning.

Average fees in Taiwan reached 266bps throughout the month which contributed to the higher revenues. Average fees also hit a 2023 high across South Korea, growing 10% MoM. Balances in South Korea have grown steadily since January surpassing $20B during June and increasing further during July ($22.4B). Utilization surpassed 7% during the month as revenues more than doubled their January values (January $20M). Activity has really started to grow in this market throughout the year and South Korea is proving to be a bright spot for Asian equities throughout H2 2023.

Asia equities experienced the best month of the year for specials revenues. $98.9M was generated (approximately 50% of the revenues) from 7.1% of the on-loan balances. Year to date $568.3M in specials revenues have been generated in the region, an increase of 1% YoY.

Ecopro Co Ltd (086520) continued to be a popular borrow throughout the month. During 2023, the stock has generated $23.7M. During July, the stock generated the highest level of monthly revenues so far.

Country Gardens Holdings Co Ltd (2007) reentered the top ten during the month as pressure upon the Chinese property sector continued to grow. Weaker than expected growth across the country is leading to a slump in house buying, which is weighing heavily on the company's share price. Debt worries involving major builders in the country continue to grow after two smaller companies failed to make bond payments during the month.

Interest remained high across the semiconductor and technology sectors as geopolitical risk, US sanctions and falling demand affected the sector. The global economy suffered a shortage of semiconductors and microchips during the COVID pandemic, companies have since started to stockpile chips to build up inventories but as the economy has slowed (particularly in China) and demand for products such as smartphones and laptops has declined, memory chip and semiconductor companies are now facing a tougher operating environment.

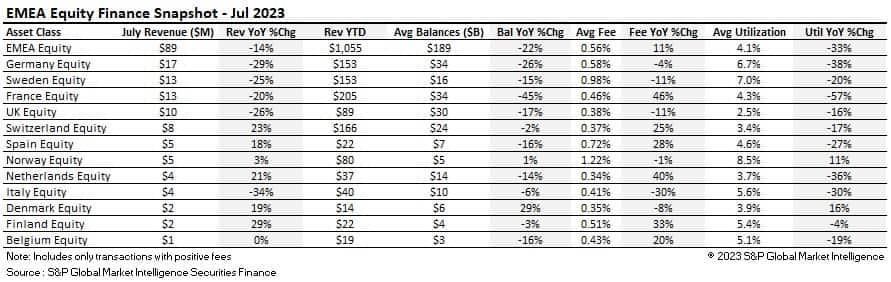

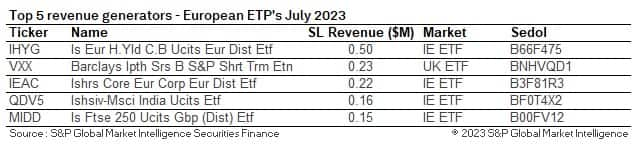

European equities generated $89M during the month of July which represents a decline of 14% YoY and 31% MoM. July produced the least revenues from European equities of 2023 so far. Revenues for the month of July also remained significantly lower than those generated during the same month of 2021 ($97M) and 2020 ($141M). Average fees increased 11% YoY, remaining equal to those seen during 2021 but again, significantly lower than during 2020 (83bps). Balances significantly declined MoM (-13% MoM and -22% YoY), whilst lendable supply continued to grow (+14% YoY and 3% MoM). Utilization subsequently fell to its lowest level since January 2022 as a result.

Across the individual countries, revenues declined YoY across Germany, Sweden, France, and the UK. In Germany average fees declined over the month losing 12bps between July 1st and July 31st. Balances continued to fall as well, decreasing by 26% YoY and 17% since January. Switzerland continued to outperform previous years generating $8M (+23% YoY). Average fees in the country also increased 25% YoY to 37bps. Annual revenues surpassed their 2022 level during May and the country's assets continue to experience strong demand. Revenues year to date exceed those generated during 2020 by 42%, 2021 by 50%, and 2022 by 16%.

Balances declined across the European region during the month by a greater value and percentage than any other region, which had a knock-on effect to both revenues and utilization.

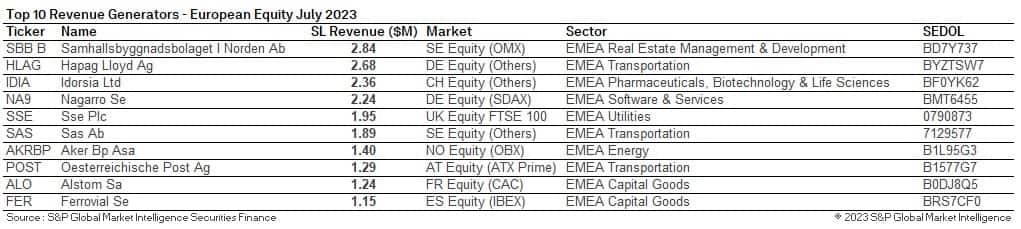

Specials activity in Europe generated $37.9M during the month of July. This accounted for approximately 42% of all revenues from 1.7% of all on loan balances. July was the lowest specials revenue producing month of the year so far and when compared YoY represents a decline of 10.4%. Despite this, year to date $317.3M in specials revenues have been generated which is an increase of 21% YoY and the highest value (YTD) since 2016.

Seasonal activity continued to influence the top revenue generators throughout the month of July. SSE Plc experienced as Scrip dividend towards the end of the month increasing average fees for cash guaranteed stocks. The optionality embedded in Scrip dividends pushes lending fees higher as borrowers look to take advantage of the discount provided by the company for agreeing to be paid in stock rather than cash. SBB B remained in demand throughout the month and July saw the second highest monthly revenues of the year so far (Jan $4.9M). The company continues to suffer from a significant increase in interest rates and from allegations of poor corporate governance.

ADR revenues decreased by 40% YoY and 33% MoM during July ($19.2M), posting their lowest levels of 2023 so far. July was the first month of 2023 to experience a decrease in revenues YoY. So far, throughout 2023, ADRs have experienced a marked increase in activity and revenues, as several high revenue generating stocks have helped the asset class to recover after a disappointing 2022. Average fees declined to 82bps during the month, -37% YoY and again, falling to their lowest level of 2023 so far. Balances remained steady MoM and lendable inventory increased by 2% YoY and 1% MoM.

Sendas Distribuidora ADR (ASAI) was the highest revenue generating ADR during July. The company's parent Casino Guichard (CO) continued to suffer under its debt burden and recently put its stake in the company up for sale. Average fees in the stock peaked on July 12th but started to decline towards the end of the month.

Ehang Holdings ADR (EH) appeared on the table for the first time during the month. Ehang is an aerospace company focused on autonomous aerial vehicles, including some big enough to transport passengers around cities. It is one of several so-called "flying taxi" start-ups competing for investor attention. The company has made progress working toward regulatory certification in China and has been running trials of its passenger craft. Despite its progress to date, investors remain aware of the fact that the company represents emerging technology, and being currently priced at circa 120 times earnings, a lot of future, potential growth is priced into its share price.

AMTD Digital (HKD) also reentered the table after the company's board agreed to an extension of a previously agreed lock up period until August 2025. As a result, the liquidity offered by lenders has increased in value. Average fee continued to trade above 3000bps throughout the month.

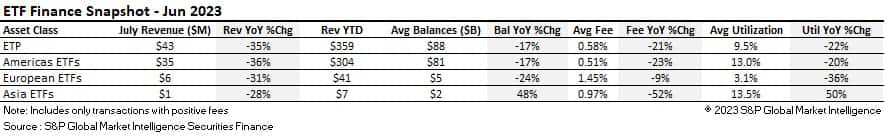

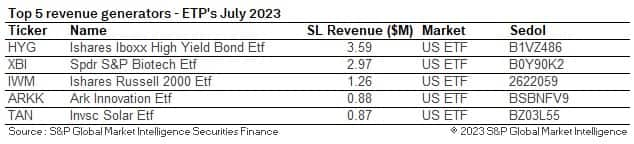

Global exchange traded funds' assets under management reportedly hit a record high towards late June / early July with asset values surpassing $10.5T, representing an increase of 13.5% year to date. During the month the Direxion Daily TSLA Bull 1.5X Shares (TSLL) became the first single stock ETF to surpass $1B in AUM. Despite these positive figures, monthly securities lending revenues continued to disappoint (after a bumper year during 2022) as the asset class generated $43M during the month of July which represents a decrease of 35% YoY and 5% MoM. Up to the end of July, monthly revenues have been on average 30% lower when compared with 2022. Balances, average fees, and utilization were all down YoY across the board (except Asia balances). Americas ETFs continued to generate the vast majority of the revenues (81%). July marked the lowest revenue generating month of the year so far for US ETFs as average fees also hit their lowest level of 2023 so far as balances decreased. Utilization fell 20% YoY and 2% MoM.

Many of the top revenue generating ETFs remained the same during the month. Despite the rally seen in corporate debt, borrowing interest and revenues generated by the iShares Iboxx High Yield Bond (HYG) did start to grow during July. Does this point to skepticism over the health of US corporate debt despite resilient market data? XBI the SPDR S&P Biotech ETF remained in focus along with IWN the iShares Russell 2000 ETF. Across Europe many of the same borrowing trends could be seen with the FTSE 250 UCITS ETF (MIDD) and the (IHYG) iShares European High Yield ETF remaining popular borrows.

Minutes from June's Fed interest rate decision showed that the consensus was built around what the market liked to call a hawkish pause, so it was no surprise to market participants that the Fed decided to recommence hiking interest rates during the month by a further 25bps. A sharp cooling in US inflation figures to their slowest pace in more than two years and more favorable employment data gave markets confidence during the month that the Fed is nearing the end of one of the quickest and most aggressive tightening cycles in history.

In Europe, the European Central Bank also raised interest rates by 25bps, bringing its main rate to 3.75%, the highest level in 22 years. It didn't share any forward guidance about any future moves, but it did raise the possibility of another rate during September. A headline inflation reading showed the headline rate coming down to 5.5% in June from 6.1% in May - still far above the ECB's 2% target. In the UK, the Bank of England followed suit with an additional increase of 25bps. Data in the UK seems less conclusive and despite markets lowering terminal rate expectations over the month, the Bank of England has taken on the mantle of the "last hawk standing" - despite being one of the first central banks to start hiking in 2022.

Across Asia, the divergence between regional central banks was clear. The Bank of Japan officials tweaked the central banks yield curve control policy to allow long term rates beyond the 0.5% cap leading to an increase in yields across global markets due to fear of divestment across global government bonds in favor of a repatriation of funds into Japan. The Peoples Bank of China engaged in discussions regarding market stimulus for targeted sectors of the economy including the property sector and the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% to give it more time to assess the state of the economy and any associated risks.

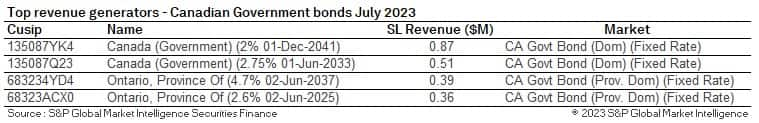

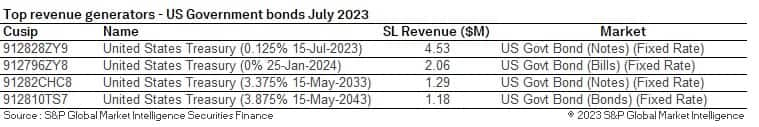

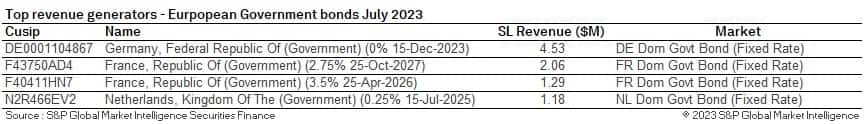

In the securities lending markets government bonds experienced another impressive month generating revenues of $152M. This represents an increase of 3% YoY and a decrease of 5% MoM. Revenues during the month helped to push YTD revenues through the $1B mark ($1.119B to the end of July). Average fees declined by 1bps MoM to 17bps, but this remains significantly higher than during July 2022 (+17% 14bps average fee). On loan balances increased by $2B during the month but despite this slight increase, utilization continued to decline, falling 5bps MoM to 19.62%.

European and US short-dated bonds remained attractive to borrows with slightly longer dated issues remaining more popular in Canada. News that the US Treasury is set to ramp up issuance of longer dated securities due to a sizeable budget deficit and higher interest servicing charges has started to increase demand for longer dated bonds. High issuance at longer maturities and a higher than targeted inflation rate is likely to put pressure on the prices of longer dated bonds. This offers potential opportunities for investors looking to take advantage of progressively higher yields as issuance and availability grows.

2023 was supposed to be the year of the bond market before the AI frenzied rally took off across the US tech sector. That prediction may however still ring true for the second half of the year as interest rates continue to increase and coupons remain attractive. As economic data keeps surprising to the upside and the economic environment remains robust, credit risks continue to be controlled. Whilst refinancing remains a concern in the market, with many maturities one year or more away, investors remain attracted to the asset class. Despite this resilience, it was reported by the Financial Times during the month that the 1.35T high yield bond market has contracted by nearly $200B since its record high two years ago. Rising interest rates, reduced bond issuance and a shift towards private markets have reportedly decreased the value of high-yield bonds by 13%, limiting investment options.

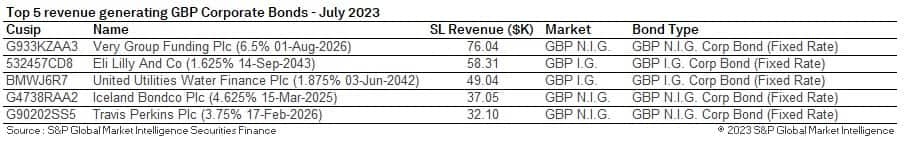

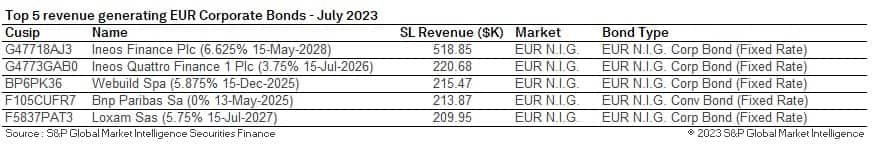

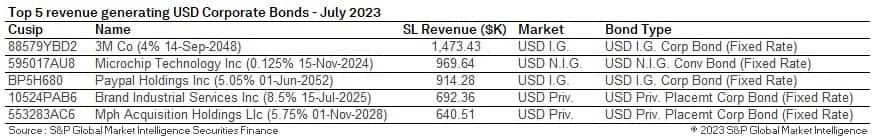

In the securities finance markets corporate bonds continued their stellar trajectory producing $98.5M in securities lending revenues. This represents an increase of 22% YoY and 3% MoM. Average fees decreased slightly (-1bps) over the month to 43bps marking the lowest average fee of 2023 so far. Balances increased by $5B over the month and utilization continued its decline, averaging out over the month at 5.66%.

In Europe, non-Investment grade corporate bonds generated the strongest revenues whilst private placements remained popular across the USD denominated bonds.

Securities lending revenues remained robust over the month of July despite a growing trend of declining balances and slightly lower fees. Asia equities was the bright spot over the month with strong revenues seen in Japan, South Korea, and Taiwan. Revenues started 2023 very strong but have been weakening over the year. When compared YoY, both June and July experienced a decrease. Despite this, given the strong revenues experienced throughout Q1 and Q2, revenues remain significantly higher than 2022 when compared on a YTD basis (2023 $8.15B vs 2022 $7.32B).

Market events and economic data will continue to dictate future returns and activity. Opportunity exists in many different scenarios for securities lending markets however as higher markets generally lead to more corporate activity and Initial Public Offerings, potentially more shorting (if valuations exceed expectations) and a fall in markets often provides volatility and directional momentum. Given the uncertainty regarding levels of inflation (is it really under control?), economic growth, economic resilience in China and the ability of central bankers to generate a soft landing, there is plenty to continue to play for heading into the next few months.

In the meantime, we thank you for taking the time to read our monthly snapshots and we wish you all a pleasant and restful vacation - if you're lucky enough to get away during the summer break. We look forward to seeing you all relaxed and refreshed in the coming months.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.