S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 22, 2022

By Sara Johnson

Russia's invasion of Ukraine on 24 February has fundamentally changed the geopolitical landscape—with economic consequences. Four weeks into the war, Russia continues its bombardment of cities, encountering determined Ukrainian resistance. While the outcome is highly uncertain, a lengthy political impasse appears likely. Economic impact of Russia-Ukraine war on world economy and to both countries will be substantial. Through sanctions, trade policies, and private investment decisions, Russian economy will be isolated for years to come. Ukraine must endure the massive displacement of people and destruction of property.

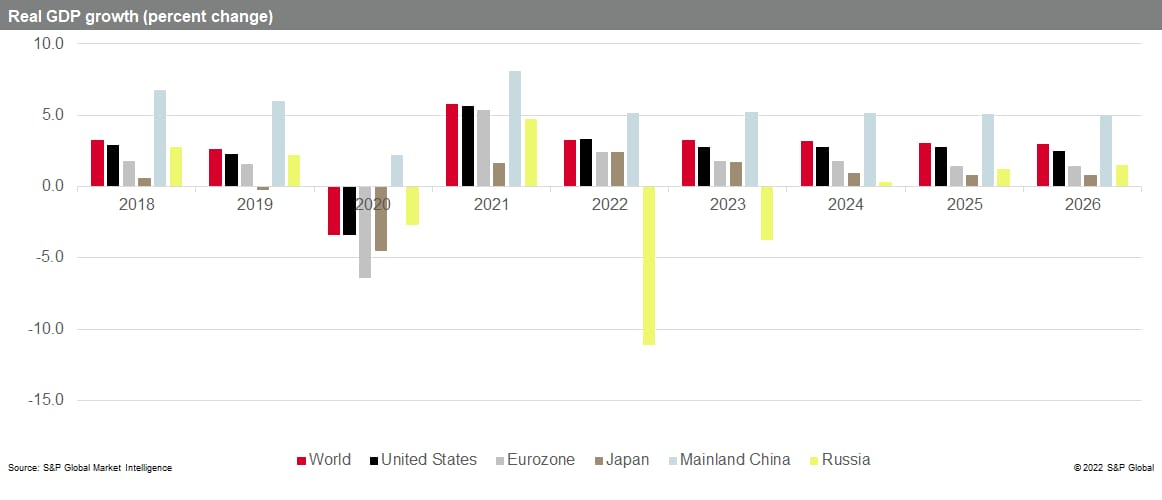

While the 2022 global growth rate represents a slowdown from 5.8% in 2021, the world economy has sufficient resilience to avert a recession. About 0.3 percentage point of the downward revision in 2022 growth is traced to sharp contractions in Russia and Ukraine, while another 0.3 percentage point reflects slower growth in Western Europe, a region hit particularly hard by the surge in prices of natural gas, oil, and electricity. Nearly every region is hurt by war-related supply disruptions and commodity price increases. A notable exception is the Middle East and North Africa, where oil and gas exporters will benefit from substantially higher energy prices.

In response to severe sanctions by western governments and a mass exodus of businesses, Russia's real GDP is projected to plummet 22% over the four quarters of 2022, reaching its lowest level since 2006. On an annual basis, output of the Russian economy will fall 11.1% in 2022 and 3.7% in 2023, with sharp declines in fixed investment, private consumption, and exports. The downward spiral began in late February when the United States, European Union, United Kingdom, and Canada imposed new sanctions to block the Russian central bank's access to its external assets and to block major Russian banks from using the financial messaging services of SWIFT. These actions triggered a collapse in the rouble's exchange value, prompting the Bank of Russia to raise its policy rate from 9.5% to 20.0%, its highest level in two decades. S&P Global Market Intelligence analysts expect the rouble will come under further pressure, forcing the central bank to raise its policy rate to 30% in May. Currency depreciation and supply chain disruptions will lift Russian consumer price inflation from 6.7% in 2021 to 23.6% in 2022. A difficult investment environment will impede economic recovery—real GDP of Russia is not expected to regain its 2021 peak until the 2030s.

Ukraine GDP is tentatively expected to experience a contraction of about 40% in 2022, along with a 30% surge in consumer prices according to S&P Global Market Intelligence analysts. The recovery pace of Ukraine economy will depend on the course of the war, governance, international aid for reconstruction, and a return of population. The United Nations estimates that 3.17 million refugees (7% of the population) have left Ukraine, while nearly 2 million have been internally displaced.

While Russia and Ukraine accounted for just 1.8% and 0.1%, respectively, of world GDP in 2021, the two countries play an outsized role in production of oil, natural gas, wheat, corn, sunflower oil, fertilizer, lumber, neon gas, aluminum, nickel, titanium, palladium, iron, and steel. Through mid-March the IHS Markit Materials Price Index advanced 33% year to date, reaching a new high. Prices will peak in the second quarter of 2022 and retreat about 20% during the final two quarters of 2022 in response to rising interest rates; softening demand growth; and the slowdown in mainland China's property market.

Energy prices are the main transmission channel through which the Russia-Ukraine war will affect inflation and economic growth. The forecast assumes losses in Russian oil production and exports of about 1-3 million barrels per day through 2023. The price of Dated Brent crude oil is expected to retreat from USD118/barrel in 2022 to USD96/barrel in 2023 and USD87/barrel in 2024. Reflecting regional supply dependencies, natural gas prices will be substantially higher in Europe and moderately higher in Asia as a result of the war.

The 2022 forecast is revised upward by 1.8 percentage points. While all regions will experience a significant pick-up in inflation in 2022, the sharpest accelerations are in Europe, where energy prices are soaring. The European Union (EU) imports 90% of its natural gas consumption, with Russia accounting for 45% of that total. Russia also accounts for 25% of the EU's oil imports and 45% of its coal imports.

The markdown is driven by sharply higher prices of food and energy, a tightening of financial conditions in light of elevated risks, and weaker growth in export markets. Higher commodity prices and lower stock prices will discourage consumer spending by reducing real income and wealth. US consumer price inflation is now projected to pick up from 4.7% in 2021 to 6.2% in 2022. After an initial rate increase in mid-March, the US Federal Reserve will raise the federal funds rate to a terminal range of 2.50-2.75% in the next few years. In the current uncertain environment, a flight to safety will help to attract capital inflows, supporting the dollar. The US will also benefit from being the world's largest producer of crude oil and fourth largest producer of wheat.

The forecast of eurozone's 2022 real GDP growth is revised downward by 1.3 percentage points to 2.4%. Indeed, S&P Global Market Intelligence analysts expect a contraction in real GDP in the second quarter of 2022. Growth of eurozone GDP is expected to resume in the third quarter as improving COVID-19 trends boost services activity. Accumulated household savings during the pandemic and potential fiscal stimulus could provide additional support. Eurozone consumer price inflation is expected to surge from 2.6% in 2021 to 6.9% in 2022, prompting the European Central Bank to start raising its deposit facility rate in December. Given the economic risks, withdrawal of policy stimulus will proceed at a gradual pace.

The forecast of mainland China's real GDP growth in 2022 is revised down slightly to 5.1%, reflecting the impacts of higher energy price inflation and slower growth in European export markets. While exports, fixed investment, and retail sales posted strong gains in the first two months of 2022, new outbreaks of COVID-19 variants could dampen industrial activity and consumer spending this spring. Lockdowns have been imposed in Shenzhen, Shanghai, Jilin, and Guangzhou. As needed, the government will increase fiscal and monetary stimulus measures to support mainland China GDP growth.

Discover more insightful analysis on the impact of the Russia-Ukraine war on the global economies.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.