Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jul, 2023

By Jim O'Reilly

The Federal Energy Regulatory Commission is likely to take up a series of major rulemakings, policy statements and orders in pending proceedings in the coming months amid considerable uncertainty over the commission's makeup. There is a vacant seat on the commission, and James Danly's term expired June 30, although he may remain at the commission until the end of the year if the US Senate does not confirm a nominee for the seat before then.

i

FERC Regulatory Review

Among the major proceedings awaiting FERC action are a pair of pending rulemakings that proposed substantial revisions to the commission's longstanding policies for incentive returns on equity (ROEs) for electric utilities.

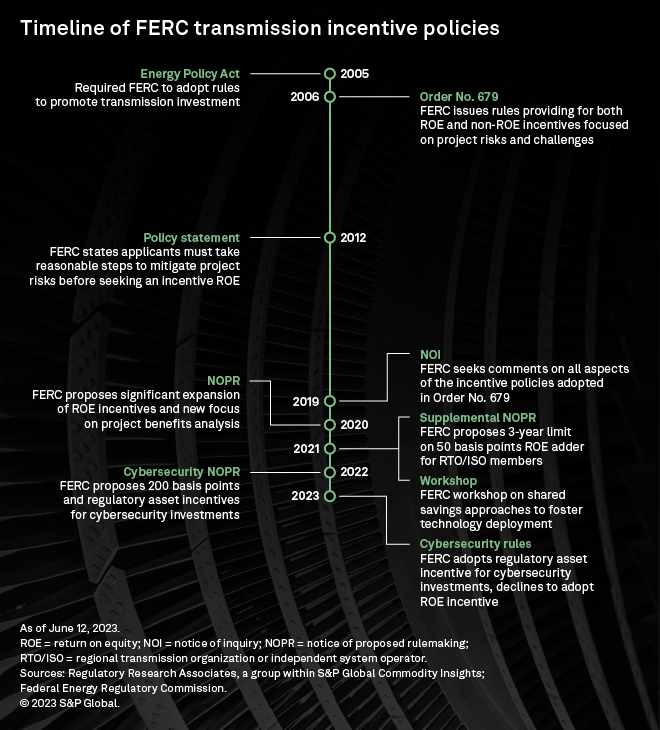

The first proposal FERC issued in 2020 would revise the scope of ROE incentives available to transmission owners for investments that meet certain benefit tests or enhance reliability, while a proposed modification issued in 2021 would curtail an incentive ROE adder for utilities that are members of a regional transmission organization or independent system operator as discussed in "Proposed FERC revisions to transmission ROE incentives await final resolution."

In a separate rulemaking, FERC issued a final rule April 21 that declined to adopt an incentive ROE adder of 200 basis points to encourage utilities to invest in advanced cybersecurity technologies, but the commission did adopt a regulatory asset incentive enabling a utility to defer cybersecurity investment expenses and include the unamortized portion in rate base as noted in "FERC finalizes new cybersecurity incentives for electric utilities."

The cybersecurity rulemaking was launched Sept. 22, 2022, when FERC issued a proposed regulatory framework on how a utility could qualify for incentives for eligible cybersecurity expenditures. Under the commission's proposed framework, eligible cybersecurity expenditures must: "(1) materially improve cybersecurity through either an investment in advanced cybersecurity technology or participation in a cybersecurity threat information sharing program; and (2) not already be mandated by Critical Infrastructure Protection Reliability Standards, or local, state, or federal law."

The transmission incentive rulemakings and other critical commission proceedings and issues in the electric power and natural gas industry sectors are examined more closely in a comprehensive and newly updated FERC Regulatory Review from Regulatory Research Associates.

RRA's review also provides critical historical perspectives on many of these FERC proceedings and issues, including the origins of regional transmission organizations and independent system operators, rulemakings and other efforts to address reliability and resilience of the interstate transmission grid, and the commission's framework governing formula-based rates for electric transmission.

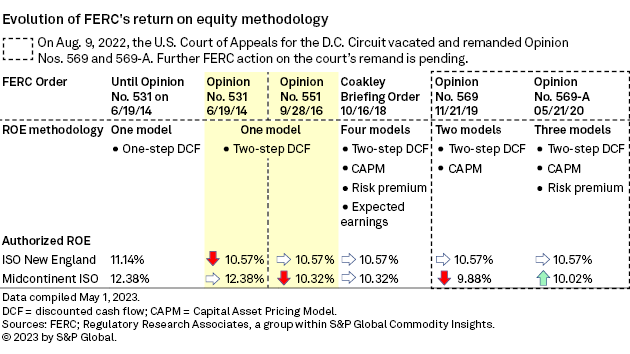

In addition to the transmission ROE incentive rulemakings, RRA's review examines the lengthy history and evolution of FERC's unsettled base ROE policy for electric utilities, which is before the commission on remand from the US Court of Appeals for the DC Circuit. The court's Aug. 9, 2022, remand will require the commission to try again to establish a lasting ROE policy and provide certainty to industry stakeholders. The court's remand and the commission's response will likely also impact multiple proceedings at FERC, particularly those where the commission or parties relied on a now-vacated policy, as discussed in "DC Circuit remand of FERC orders raises uncertainty for pending ROE cases."

The commission also wrapped up two rulemakings addressing transmission system vulnerabilities and planning for extreme weather impacts. FERC staff noted that the new rules will provide "a fuller record as to whether and how transmission providers assess and mitigate vulnerabilities to extreme weather and will enable coordination among transmission providers as well as information sharing on best practices." See "FERC approves rules to boost US power system readiness for extreme weather."

RRA's review also examines the history and status of proceedings addressing electric reliability and resilience at FERC, including the US Energy Department's highly controversial 2017 proposal "directing" the commission to adopt a new rule requiring operators of organized electric markets to "ensure that certain reliability and resiliency attributes of electric generation resources are fully valued." The DOE cited the premature retirement of coal and nuclear plants as a threat to grid resilience in a letter to FERC that accompanied the proposed new rule.

Other topics addressed in the electric power section of RRA's review include transmission open access, merchant transmission, energy storage and generator interconnection.

In the gas sector, RRA's review examines FERC's two controversial proposed policy statements that would update the commission's decades-old permitting process and outline policies for considering the climate change impacts of new projects. See "New gas permit policy toughens FERC approach to climate, project need."

After the policy statements faced criticism from lawmakers and the industry, the commission subsequently designated the proposals as drafts and sought further public comment, as noted in "FERC suspends new policies on gas projects, seeks more public comment."

The draft policy statements would update the commission's 1999 gas certificate policy statement by making multiple modifications, including a proposal to consider environmental impacts in analyzing new projects, along with all other impacts, as part of the commission's determination of whether a project is in the public interest. The commission also proposed quantifying a planned project's greenhouse gas emissions that are reasonably foreseeable and have a reasonably close causal relationship to the proposed action.

Other issues addressed in this section of RRA's review include FERC's ROE policy for gas pipelines, regulatory processes for new gas projects, gas-electric coordination and gas storage regulation.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.