Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 08, 2023

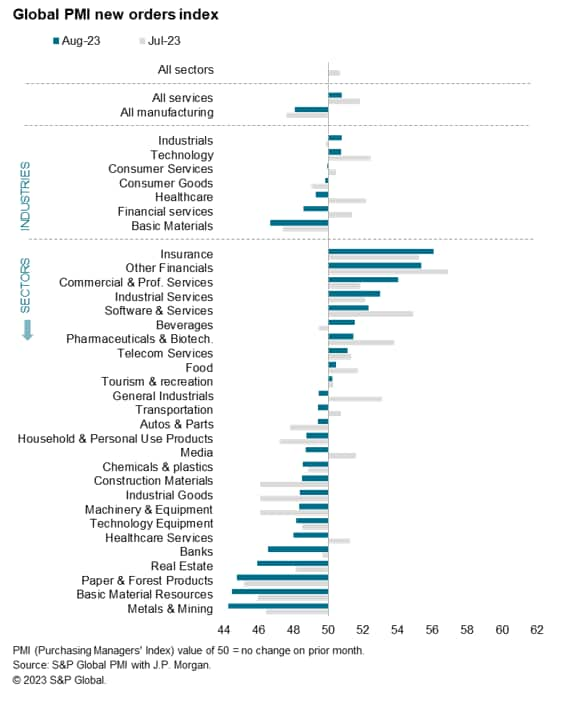

The Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - found a rising number of sectors slipping into decline in August as growing signs of economic malaise became more broad-based.

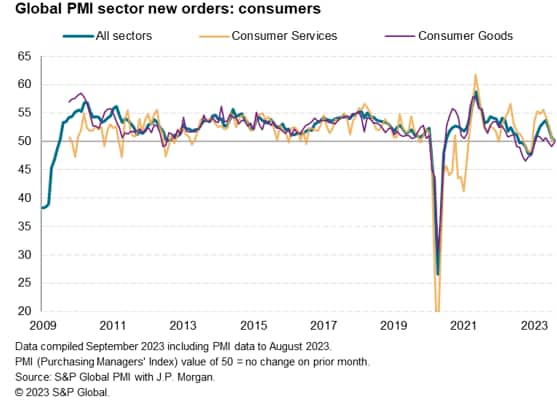

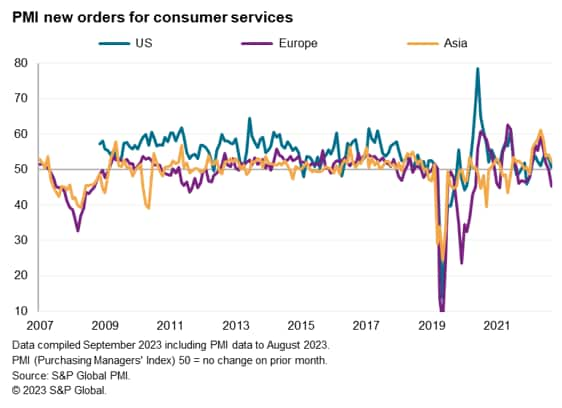

One key area of recent support to the global economy which is reporting a renewed decline in new orders - consumer services - is especially noteworthy, as this sector led the surprise growth revival seen globally in the second quarter. This growth spurt is now reversing amid rising interest rates and the increased cost of living.

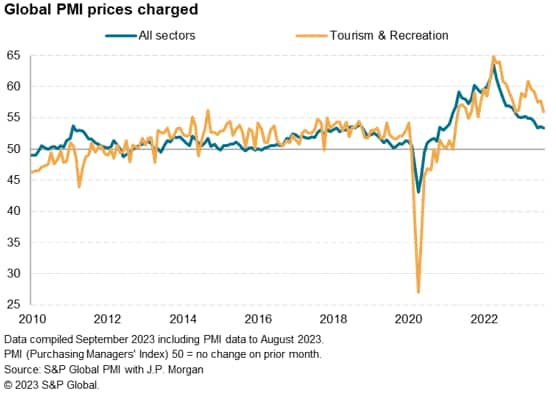

While this fading consumer spending spree on services is bad news for GDP growth in the world's major economies in the second half of 2023, it also signals a cooling of one of the major inflation hot spots seen in recent months, which could help pull global inflation lower in the coming months.

Global PMI survey data, based on data from S&P Global's 40 national business surveys, showed the overall rate of output growth fading for a third month running in August, dropping to its lowest since the current upturn began in February.

However, another way of gauging the health of the global economy is by looking at sectoral performance. The advantage of the worldwide PMI data is that the survey results can be analysed at both the country level and a detailed sector leve1.

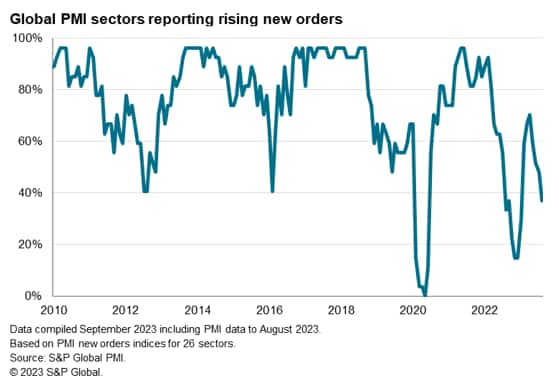

The data reveal that, of the 26 detailed sectors covered by the global PMI, only 10, or 38%, reported higher new orders in August. This is one of the lowest proportions recorded since comparable data were available in late-2009, and down from 48% in July and 70% in April. Only COVID-19 lockdown months saw more sectors in decline.

Media, healthcare services, transportation, general industrials all reported renewed order declines in August, though beverages returned to growth.

Although the steepest contractions continued to be recorded for primary industries, such as metals & mining and material resources, amid widespread inventory reduction trends, real estate and banks are now also seeing worryingly steep downturns.

The previously strong-growing tourism & recreation sector is meanwhile close to stalled alongside the dip in transportation.

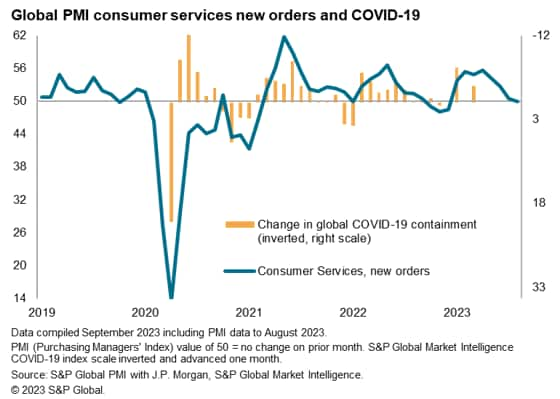

A key take-away from the detailed analysis of PMI data has therefore been the fading of the third pandemic-related wave of rising consumer spending on services, which accompanied the recent easing of global COVID-19 containment measures at the start of the year.

The second quarter of 2023 saw the strongest period of consistent growth in new orders for consumer services recorded to date by the global PMI, barring only prior periods of loosened COVID-19 containment measures. Comparisons indicate that this upturn in spending on services diverted spend from goods, new orders for which have been broadly unchanged during this spending spree.

However, the August PMI data hint that this consumer services spending boom could be moving into reverse. Companies have reported a drop in new orders amid a natural fading of the initial resurgence in demand for activities such as travel alongside the dampening effects of rising interest rates and the higher cost of living. Demand for consumer services consequently fell globally, albeit marginally, in August for the first time in eight months.

The downturn in new orders for consumer services was most pronounced in Europe, though the demand expansion also slowed close to stagnation in the US and in Asia.

This cooling of demand for consumer services such as tourism and recreation has been accompanied by a moderation in the rate of inflation of prices charged for these activities. The PMI data showed prices charged for consumer services and its tourism and recreation sub-sector rose in August at the slowest rates since last November, albeit remaining higher than any rate seen in the decade preceding the pandemic. This softening of what has been a main driver of stubbornly high global inflation so far this year is nevertheless welcome news.

Access the global sectors PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.