Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Aug, 2024

By Jim Davis

The New Mexico Public Regulation Commission on July 25 adopted a "black box" settlement according New Mexico Gas Co. Inc. a $30 million gas distribution rate increase. Prior to the settlement, the utility had supported a $48.4 million rate hike (Case No. 23-00255-UT).

➤ The authorized rate increase is more than 60% of that supported by the company (NMGC) prior to the settlement.

➤ The adopted return on equity (ROE) is below prevailing industry averages authorized in recent periods and is equivalent to that adopted for NMGC in its previous rate case, according to Regulatory Research Associates.

➤ The adopted settlement permits the utility to continue to operate under a weather normalization adjustment mechanism.

➤ RRA views the New Mexico regulatory environment as restrictive for utility investors.

The adopted rate hike is premised on a 9.375% return on equity (52% of capital) and a 6.79% return on an average rate base valued at $955.1 million for a fully forecast test year ending Sept. 30, 2025. The company is to implement new rates pursuant to the commission's (PRC) order Oct. 1.

The 9.375% equity return specified in the adopted settlement and order is below both the 9.83% average of returns accorded to gas utilities in all decisions issued in the first half of 2024 and the 9.63% average for full year 2023, according to RRA. For further information regarding return on equity trends, see RRA's latest "Major Rate Case Decisions Quarterly Update" report.

The PRC decision adopted a hearing examiner's findings that approval of the settlement would result in "fair, just and reasonable rates" for NMGC. In its written order adopting the settlement without modification, the PRC said the examiner's recommendation was "well-taken, reasonable, and founded upon substantial evidence."

Regarding the adopted ROE, the PRC agreed with the examiner's conclusion that "the evidence demonstrates that the stipulated ROE will continue to provide the company with the necessary financial attributes to continue to attract capital, maintain healthy financial metrics, and continue to serve customers."

The adopted settlement provides for NMGC to establish a regulatory asset associated with a customer information system upgrade. In addition, the authorized rate change reflects the amortization of certain regulatory assets, including assets related to the COVID-19 pandemic.

The settlement and order also provide for the utility to continue to operate under a weather normalization adjustment mechanism and for the mechanism to no longer be considered a pilot program with an automatic sunset.

Pursuant to the provisions of the adopted settlement, NMGC withdrew its requests to establish regulatory assets to address costs associated with seeking a certificate of public convenience and necessity to construct a new LNG facility, and customer credit card payment fees.

Case history

This case was initiated Sept. 14, 2023, when NMGC filed for a $49 million rate increase premised upon a 10.5% return on equity (53% of capital) and a 7.38% return on a $972.6 million rate base.

NMGC said the filing was necessitated by increased capital expenditures and expenses pertaining to operations and maintenance, depreciation and amortization. In its rate application, the utility highlighted more than $278 million of investments directed at improving and maintaining its pipeline assets, the company's integrity management program, and various IT and telecom projects.

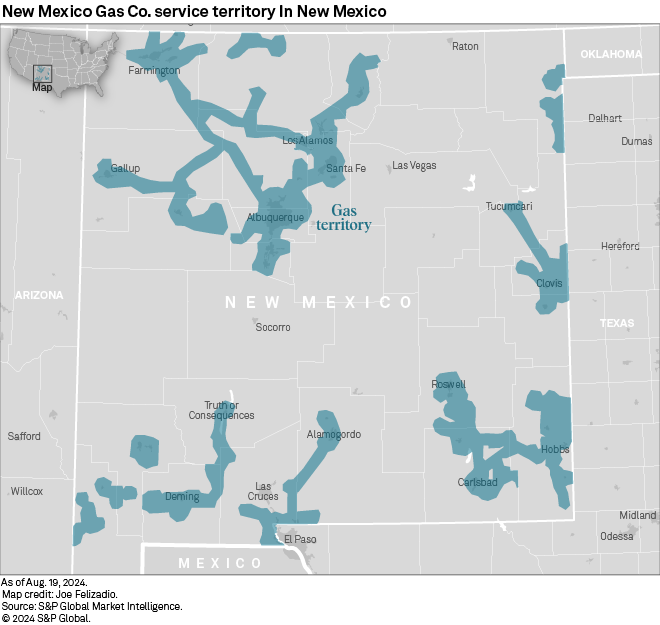

NMGC specified that it provides natural gas service to more than 545,000 customers in New Mexico, with residential and small business-class customers comprising about 90% of the utility's customer base.

NMGC subsequently submitted testimony Dec. 15, 2023, specifying it was supporting a revised $48.4 million rate increase. However, the filing did not include a completed set of rate case parameters. Subsequent filings tendered in the case disclosed that the utility's revised rate hike request was premised upon a 10.5% return on equity (53% of capital) and a 7.44% return on an updated rate base valued at $968.1 million.

On Feb. 21, 2024, the PRC staff filed testimony recommending that the commission accord the utility a $30.7 million rate increase premised upon a 9.85% return on equity (53% of capital) and a 7.09% return on a $948.9 million rate base.

On March 1, the parties filed the settlement. The signatory parties to the settlement were NMGC, the commission staff, the New Mexico Department of Justice, the Western Resource Advocates, the New Energy Economy (NEE) and various other parties.

The parties, including NMGC and the PRC staff, filed testimony in support of the settlement March 13. While none of the nonsignatory intervenors in the case opposed the settlement, the NEE sought to somewhat amend the settlement; its changes were opposed by the other signatory parties.

Specifically, the NEE's proposed changes involved adding supplemental language stating essentially that the aforementioned regulatory assets agreed to as part of the settlement could only be reflected in rates after NMGC successfully demonstrates in a subsequent proceeding that the underlying assets provide a net public benefit to ratepayers. In addition, the group proposed to include language stating that because the utility failed to demonstrate that the project provided a net public benefit (in Case No. 22-00309-UT), the matter was "properly" excluded from the stipulation and consideration in the instant case.

Hearing examiner's findings

On June 6, the examiner recommended that the commission adopt the settlement without modification.

Regarding the agreed-upon black-box rate increase, the examiner said that pursuant to the terms of the settlement, NMGC agreed to delay "the dates of deployment of some of its proposed capital investments" and that such actions would mitigate the impact on ratepayers through a $10 million reduction to the utility's net plant balances, relative to the levels proposed by the NMGC prior to the settlement. The examiner added that the utility "did not identify specific projects that would be affected, but averred that they will be able to identify projects that can be delayed without negatively affecting the safety or reliability of the system."

With regard to the NEE's proposal to amend the settlement language, the examiner said, "It would be improper to make factual findings or conclusions on issues that were withdrawn, not fully vetted in the proceeding, or were not actually included in the specific agreed upon provision of the stipulation." The examiner added that the "NEE's conduct in filing a pleading contrary to the stipulated agreements ... appears to be an impermissible attempt to change or modify the stipulation."

Notably, the settlement characterized the stipulated overall return as a "tax unadjusted average cost of capital of 6.79%." However, the examiner characterized the return as the "post-tax weighted average cost of capital (WACC) of 6.79%." According to NMGC, the 6.79% overall return adopted in this proceeding is an after-tax calculation in line with the certificate of stipulation assessment.

Prior Case

NMGC was accorded a $19.3 million rate increase in a December 2022 PRC ruling that followed a settlement (Case No. 21-00267-UT). The authorized increase was premised upon a 9.375% return on equity (52% of capital) and a 6.44% return on an average rate base valued at $809.2 million for a calendar 2023 test year. The ultimate parent of NMGC is Emera Inc.

RRA's view of NM regulatory environment

RRA views the New Mexico regulatory environment for energy utilities as relatively restrictive from an investor perspective and accords the state a Below Average/1 ranking. PRC equity return authorizations have generally either approximated or been below prevailing industry averages when established.

Regulatory lag is a persistent issue as rate cases generally take more than a year to conclude. Although the use of fully forecast test years has ceased to be a contentious issue, PRC rate decisions are frequently challenged through an appeal process that, in some cases, has taken two or more years to conclude. The state's utilities have typically failed to earn their authorized returns.

The PRC has, at times, been receptive to mergers. However, the commission rejected Avangrid Inc.'s proposed acquisition involving Public Service Co. of New Mexico in 2021. That deal was ultimately scrapped earlier in 2024 while a protracted appellate process was pending before the state Supreme Court. Notably, shortly after the conclusion of this rate case, it was announced that Emera has entered into a merger agreement with Bernhard Capital to sell its NMGC utility business. The parties have not yet submitted a formal filing seeking PRC approval of the proposed transaction.

For additional information concerning RRA's regulatory rankings, refer to the latest "State Regulatory Evaluations Quarterly Report."

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.