Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2020

Highlights

The COVID-19 pandemic has led to widespread closures of retail stores, offices and hotels. Foot traffic data can be combined with traditional financial ratios to provide a more holistic view of business health for both credit and equity investors.

This report extends our prior analysis of foot-traffic data by setting foot traffic figures in the context of a screen for identifying where risks may be highest.

The analysis in this report can help: i) Creditors identify customers that require additional credit facilities to support growth, or companies where existing credit lines need to be reassessed given bleak prospects; and ii) Equity investors identify companies where revenues may be accelerating or firms that may have difficulty meeting financial obligations.

Foot traffic can be used by both lenders and investors as a proxy for business health - an increase in footfall may indicate business expansion, while a decline may suggest business contraction. Lenders can use this information combined with other factors to identify customers that require additional credit facilities to support growth, or companies where existing credit lines need to be reassessed given bleak prospects. For equity investors, foot traffic can help identify companies where revenues may be accelerating or firms that may have difficulty meeting financial obligations. An extended deterioration in footfall activity implies fewer customer visits, lower sales and reduced cash flows.

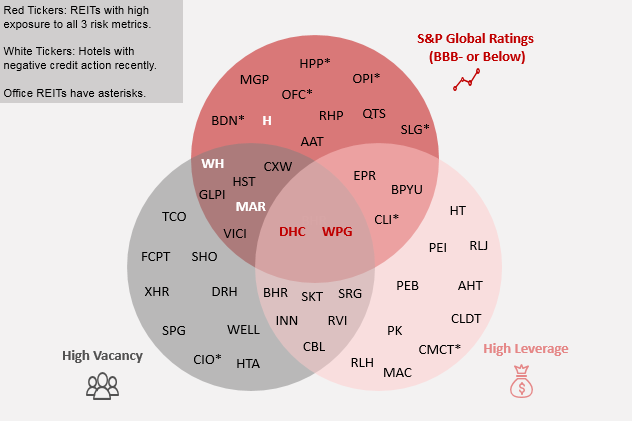

Figure 1 shows real estate investment trusts (REITs) that saw large declines in foot traffic at their properties and also had unfavorable exposures to the following measures of business risk:

Figure 1: REITs with the Largest Decline in Foot Traffic, Highest Credit Risk and

Unfavorable Vacancy Demographics - Russell 3000 (March 2020)

Source: AirSage, S&P Global Market Intelligence Quantamental Research. Data as at 04/15/2020.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Download The Full Report

Research

Products & Offerings

Segment