Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 27 Jul, 2021

By Jason Sappor

Highlights

Nickel Mines says cash costs for NPI-nickel matte production comparable to NPI costs

Tsingshan's nickel matte plans could be 1st step into lithium battery value chain

The global nickel market is still dealing with the aftermath of China's Tsingshan Holding Group Co. Ltd.'s potential game-changing battery nickel supply announcement. On March 3, the company revealed plans to process nickel pig iron, or NPI, which is typically used by the stainless steel sector, into high-grade nickel matte that can be converted into nickel sulfate for use in the electric vehicle battery sector.

The announcement turned investor excitement based on expectations for long-term EV battery nickel excess demand into concerns over the potential for oversupply. The London Metal Exchange three-month nickel price reacted by dropping from a seven-year high of $20,110/t in trading Feb. 22 to $15,948/t March 30, the lowest since November 2020.

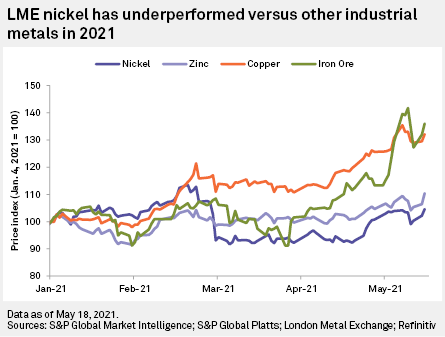

Prices ranged between $16,000/t and $16,500/t for most of April but surged to close above $18,000/t May 7 on market optimism regarding the global economic recovery. News that China's CNGR Advanced Material Co.Ltd. and, most notably, Australia's Nickel Mines Ltd. are also planning to convert NPI into nickel matte for the battery sector has, however, kept concerns over the potential for long-term battery nickel market oversupply in investor's minds and has prevented prices from settling above $18,000/t. Rising inflationary fears caused the LME three-month nickel price to drop from $17,968/t May 18 to $17,325/t May 19. Nickel has consequently underperformed versus other industrial metals such as copper and iron ore so far in 2021.

Tsingshan plans to produce nickel matte and NPI in Indonesia, with volumes dependent on market demand and prices. Economics will therefore be a significant factor in determining the amount of nickel matte that it will convert from NPI. Given Nickel Mines' close relationship with Tsingshan, with Nickel Mines previously acquiring interests in Tsingshan's two rotary kiln electric furnace plants from Shanghai Decent Investment (Group) Co. Ltd., a Tsingshan Group company, and both companies having operations in Indonesia's Morowali Industrial Park, Nickel Mines' NPI and nickel matte production costs may be indicative of Tsingshan's.

In Nickel Mines' early May statement outlining its nickel matte plans, the company said its costs of producing nickel matte via this route will be comparable to its costs of producing NPI. Our findings nevertheless suggest that Nickel Mines is underestimating the cost of producing nickel matte from NPI. This means the economics of producing nickel matte for the battery sector using this route could be less favorable than producing NPI for the stainless steel sector, depending on prices.

Nickel Mines says cash costs for NPI-nickel matte production comparable to NPI costs…

On May 3, Nickel Mines announced that it had signed a memorandum of understanding with Tsingshan's Shanghai Decent for two of its rotary kiln electric furnace, or RKEF, NPI production lines in Indonesia to be converted to enable production of a nickel matte product suitable for sale into the EV battery market. The modifications are expected to involve the addition of a nickel matte production circuit to the lines at either the company's Hengjaya RKEF or Ranger RKEF and will cost approximately $1 million per line, according to Nickel Mines.

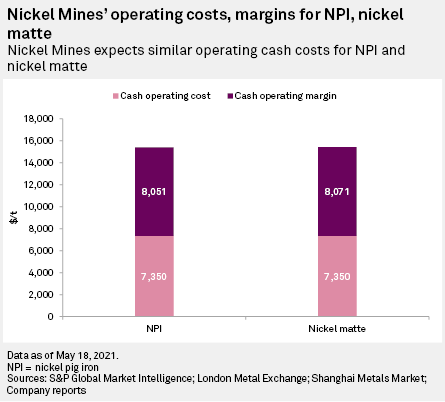

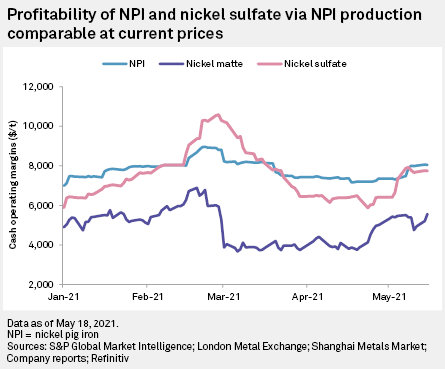

Nickel Mines said in its statement that the cash operating costs for producing 1 tonne of nickel in matte are expected to be comparable to the cash operating costs of producing 1 tonne of nickel in NPI. Cash operating costs include elements such as minesite labor and energy costs and smelting, refining and conversion costs. In its 2020 annual report, Nickel Mines reported an average cash operating cost of $7,350/t of nickel contained in NPI. Based on Chinese NPI prices, excluding value-added tax, closing at $15,401/t May 18, this yields a cash operating margin of $8,051/t of nickel in NPI. Based on Nickel Mines' expectations that production cash costs for nickel in nickel matte are comparable to those of NPI and nickel matte prices typically trading at around 85% of LME cash prices, which closed at $18,142/t May 18, this results in profit margins similar to NPI of $8,071/t of nickel in nickel matte.

…but we believe this is unrealistic

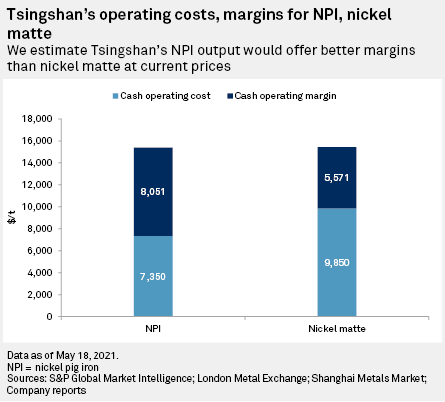

Based on our research and analysis, we believe that Nickel Mines is underestimating the cash operating costs of producing nickel matte via NPI production. Nickel Mines' cost estimates therefore may not be representative of Tsingshan's production costs. This means that Tsingshan's nickel matte output could be less profitable than Nickel Mines' cost expectations suggest.

The conversion of nickel matte from NPI will require the addition of sulfur in a converter, which will add to the production costs. We understand that the NPI-to-nickel matte conversion cost ranges between $1,000/t and $4,000/t on a cash operating cost basis, depending on factors such as the NPI grade. Taking the average of $2,500/t combined with the $7,350/t cash operating cost for producing NPI results in a cash operating cost of $9,850/t for Tsingshan's nickel matte operations.

Given nickel matte prices of roughly $15,421/t May 18, we calculate a profit margin of $5,571/t for Tsingshan's nickel in matte. This is lower than Nickel Mines' expected profit margin for nickel in matte at current prices.

Tsingshan's nickel matte plans could be 1st step into lithium battery value chain

Although Tsingshan's nickel matte production could be less profitable than its NPI output, we anticipate that the group may see its nickel matte strategy as a first step into the lithium-ion battery value chain. It could then move up to produce higher-value-added nickel-containing battery-related products in the longer term. Tsingshan's next move may be to convert its nickel matte into nickel sulfate, a component of such batteries.

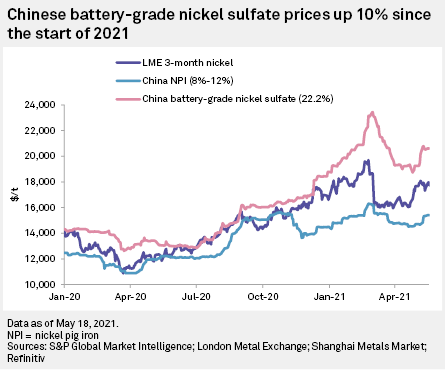

Nickel sulfate prices have been just as volatile as LME nickel prices this year. Growing demand from the battery sector amid a shortage of nickel sulfate due to a low availability of class 1 nickel feedstock, and expectations that these trends would continue, propelled Chinese battery-grade nickel sulfate prices from $18,741/t on Jan. 4 to a high of $23,440/t on March 2, according to Shanghai Metals Market. Prices dropped to $18,730/t on April 26, however, following Tsingshan's battery nickel supply announcement but followed LME nickel prices higher to $20,595/t on May 18. Chinese nickel sulfate prices have consequently remained above LME nickel and Chinese NPI prices so far this year.

A cash cost of $9,850/t for producing nickel matte via NPI combined with $3,000/t cash cost for refining nickel matte to nickel sulfate yields a cash operating cost of $12,850/t for nickel sulfate production via NPI, according to our calculations. This would generate a profit margin of $7,745/t for nickel sulfate production, near our expected cash operating margin for NPI and over $2,000/t higher than our estimated nickel matte margin as of May 18.

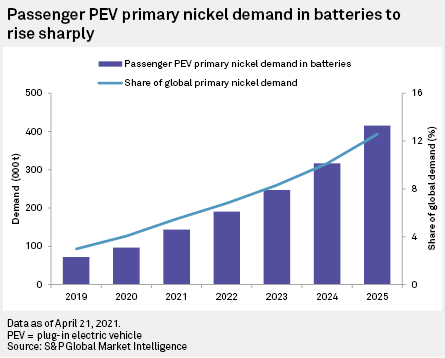

The potential for higher margins, as nickel demand from the passenger plug-in EV battery sector expands on increasing plug-in EV penetration rates in the long term, may encourage Tsingshan to move to converting nickel sulfate from its nickel matte.

Rather than selling this nickel sulfate to the market, we anticipate that Tsingshan could also use the material for its own lithium-ion battery plants. The company said in April that it aims to expand its annual production capacity for lithium batteries from 6 GW currently to 200 GW by 2025 as it looks to meet growing demand for such batteries in China. As part of this ambition, the group plans to invest $1.57 billion to build a captive lithium-ion battery plant in China's Guangdong province.

Potential ESG impact of Tsingshan's plans an issue

We believe that concerns over the potential environmental impact of Tsingshan's NPI/nickel matte production strategy will be a significant headwind to its long-term success, given the EV industry's key role in the wider green revolution of the global economy.

We previously highlighted that the global warming potential from the production of nickel in ferronickel, a higher-grade version of NPI, is 3.5 times higher than that of LME-grade class 1 nickel production. The environmental, social and governance implications of this may deter EV battery producers outside China from using nickel-containing battery-grade products derived from Tsingshan's nickel output.

Subscribe to receive our content into your inbox directly.

Learn more about our Metals & Mining solution.

Blog

Blog