Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Apr, 2021

Highlights

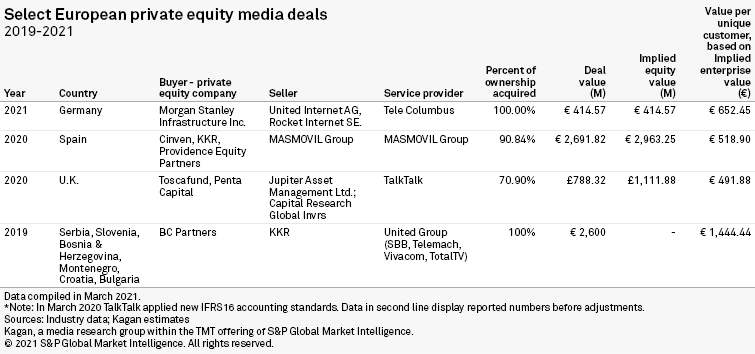

Morgan Stanley Infrastructure (MSI) Inc. supported the fiber expansion. The private equity firm committed to acquiring the entire stake of Tele Columbus AG for €3.25/share (through its subsidiary Kublai Gmbh) and consequently raising €475 million through Rights Offering

In December 2020, Toscafund Asset Management LLP and Penta Capital offered to acquire 70.9% of TalkTalk Telecom Group PLC, the third-largest provider of fixed broadband in the market, for 97 pence per share at an implied equity value of £1.1 billion.

BC Partners initially acquired United Group BV in 2019, after the company had already changed ownership twice. As an alternative telecom provider in the Balkan region, United Group operates in the countries of former Yugoslavia.

In the early 2000s, before the global economic crash at the end of the decade, private equity groups invested heavily in the telecom sector, primarily by consolidating smaller cable companies. Private equity firms, including KKR & Co. Inc., Providence Equity Partners LLC, CVC Ltd. and BC Partners are making a comeback, increasing investment activity in TMT companies. They have bought over $10.0 billion worth of media assets, including pay TV and broadband operators, between 2019 and 2021. Since 2019, eight major deals have been signed between private equity firms and telco companies, versus the three signed in the two years before that.

Telcos have not proved attractive to private equity investment in recent years, due to their aging systems, their inclusion of copper-line networks and the huge amounts of investment needed to revive their business. Now, the mix of low telco share values, the headway being made with fiber, 5G and internet of things, along with the increasing pace of the decommissioning of legacy infrastructure, highlight the scale of the growth opportunity. For operators, private equity funding offers a viable capital alternative to high-interest bank loans, as well as to bond or equity issuance. KKR & Co. Inc., one of the largest private equity players, with over $200.00 billion of assets under management, has been involved in the largest number of sizable media deals in the last five years. In November 2020, KKR, Cinven and Providence Equity Partners completed one of the largest acquisitions in Europe for the year, purchasing Másmóvil Ibercom at an enterprise value of about €4.62 billion.

Morgan Stanley Infrastructure (MSI) Inc. supported the fiber expansion in 2020. In December 2020 the private equity firm committed to acquiring the entire stake of Tele Columbus AG in Germany for €3.25/share (through its subsidiary Kublai Gmbh) and consequently raising €475 million through Rights Offering.

In December 2020, Toscafund Asset Management LLP and Penta Capital offered to acquire 70.9% of TalkTalk Telecom Group PLC, the third-largest provider of fixed broadband in the market, for 97 pence per share at an implied equity value of £1.1 billion. Toscafund already held more than 30% of TalkTalk. A year earlier, notably pre-COVID-19, TalkTalk had turned down an offer of £1.5 billion.

BC Partners acquired United Group BV in 2019, after the company had already changed ownership twice. As an alternative telecom provider in the Balkan region, United Group operates in the countries of former Yugoslavia. It was owned by Mid Europa Partners LLP until 2013, when it was sold to KKR.