Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 28, 2022

To understand how chief financial officers (CFOs) of private equity (PE) firms are coping with the ever-changing investment landscape, we surveyed 30 CFOs in the U.S. and Western Europe, representing firms ranging in size between US $2bn and $40bn in assets under management (AUM). The survey, conducted by Mergermarket on behalf of S&P Global Market Intelligence, offers insights about the shifting demands and responsibilities of today's CFOs.

CFO role is increasingly outward-facing and more hands-on

The survey found most CFOs at private equity firms are extending their responsibilities far beyond their traditional roles. Respondents reported that financial oversight takes up between 10% to 50% of their time, underscoring the diversity of the CFO role today and the many pressures on these executives' time. Nearly two-thirds (64%) of CFOs agree that their role is much more outward facing compared to just a few years ago, including just over a quarter (27%) who strongly agree. Time allocation is becoming a more challenging balancing act for CFOs as their list of responsibilities expands. After financial oversight, respondents devote the largest portions of their time to regulatory matters and portfolio analysis. Other important responsibilities include technology oversight, investor relations and product development.

Experience and a broader skillset are essential

Experience counts for a lot in today's complex market environment. More than half the respondents (57%) have held the role of CFO for more than 10 years, an additional 23% have been in the role for 5-10 years. In addition to traditional finance-oriented responsibilities, they are increasingly charged with functions related to regulation, investment decisions and technology.

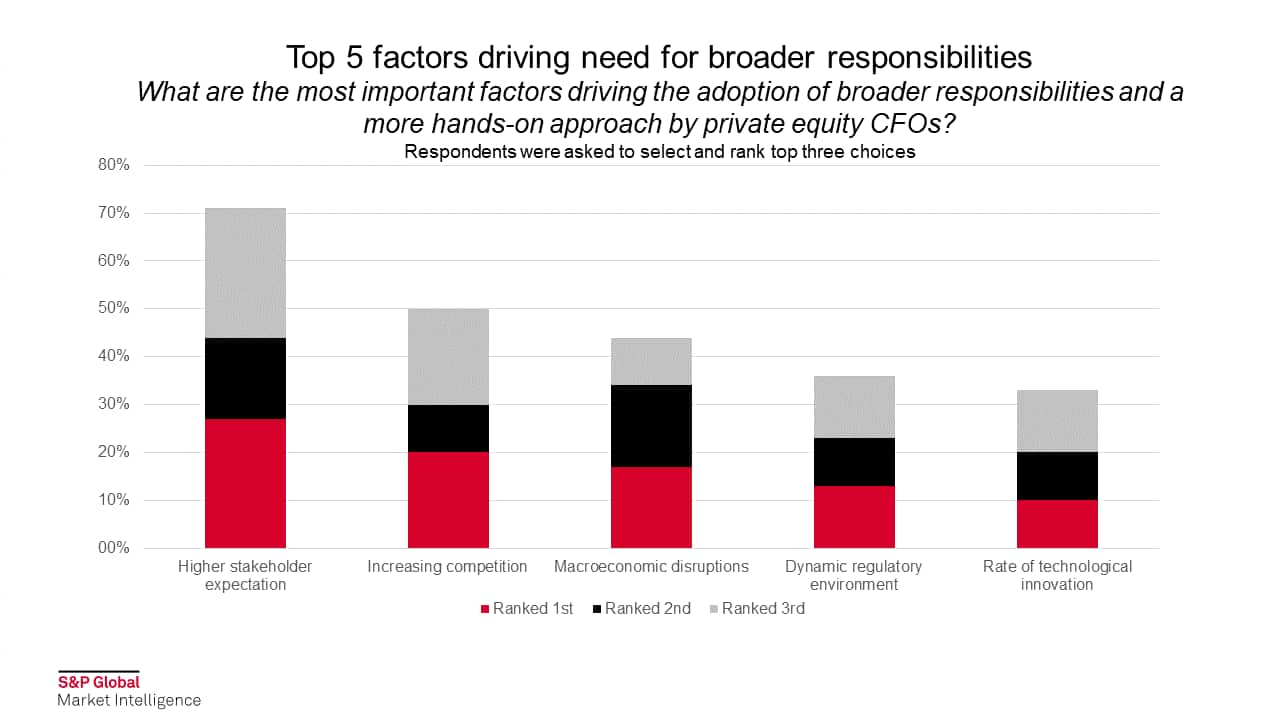

The clearest evidence of the changing role of the CFO is provided by the high proportion of respondents (70%) who report that they or members of their staff have pursued new skills through professional development courses or sought external expertise relating to developments in their role over the past 12 months. Survey respondents attribute the growing need for broader skills to a combination of factors, including higher stakeholder expectations, competitive and increasingly complex regulatory pressures and the disruptive macroeconomic landscape.

As the CFO of a US-based firm explained, "We are adopting broader responsibilities because stakeholder expectations have changed. Stakeholders are more vocal about these expectations and they also want complete transparency and disclosures." Nearly three-quarters of survey respondents (71% ) point to higher stakeholder expectations, with more than a quarter (27%) highlighting this as the single most important factor. Increasing competition (cited by 50% as a top-three factor) is also seen as being one of the main reasons why CFOs are now shouldering more responsibility. Among the other top five factors, respondents cited macroeconomic disruptions (44%), the dynamic regulatory environment (36%), and rate of technological innovation (33%).

CFOs are devoting more time to portfolio analysis

At the center of this burgeoning ecosystem, CFOs are taking an increasingly hands-on approach and allocating more time to portfolio analysis. Access to information from across the organization and relationships with key stakeholders makes the CFO a focal point for critical information flows. Our survey respondents report that they are playing a larger role not only in onboarding portfolio companies, but also sharing best practices with them throughout the holding period. "Portfolio managers are my most important collaborators. Their awareness about the opportunities and threats in the market is higher. They have actual experience dealing with third parties and stakeholders during transactions," says the CFO of a Netherlands-based firm.

In parallel, CFOs are devoting more time to the challenges of digitalization and regulation. Among smaller firms, only one of the eight firms from that subset retains a chief technology officer (CTO), which means those duties fall under the CFO's realm of responsibility. Each C-suite participant tends to wear a number of hats —CFOs in small and mid-sized firms in particular. Given the potentially high workloads, success hinges on effective support and load sharing.

What CFOs believe are the most important attributes for the job today

More than half the CFOs surveyed (57%) said that leadership skills are the most important attribute for the role. "Leadership qualities are important as they help to build stronger teams for the company," notes the CFO of a UK firm. "The firm's leadership is an example for the rest of the teams, and it is our responsibility to send the right message." Relationship building comes in as a close second with 50% naming it as among the top three skills in the role. The CFO of a US-based firm says: "The way we build relationships with our teams and investors dictates how successful we are in the long term." Not surprisingly, 43% of our survey respondents ranked adaptability as the third most important quality for CFOs to thrive.

Download our whitepaper to read the full results.