S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Nov, 2023

By Drew Wilson

To dive into the state of Debt Capital Markets, S&P Global Market Intelligence and Global Capital organized a webinar “Insights and strategies: Navigating Europe’s debt capital market dynamics” on 14th September 2023, which can be viewed on demand by clicking here.

This blog provides a summary of the webinar, covering:

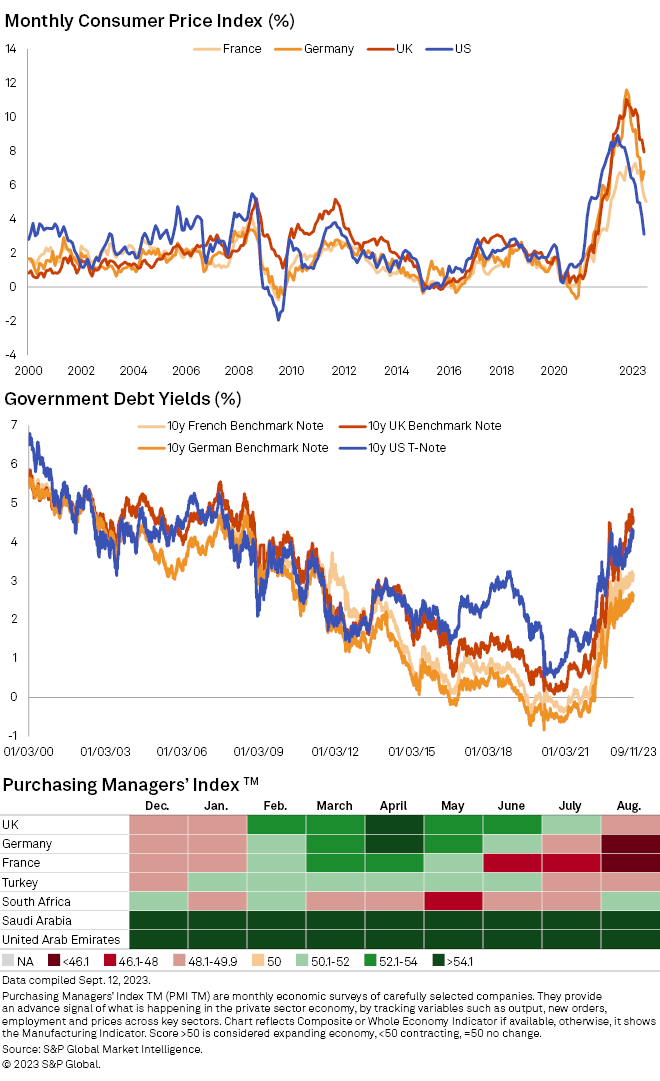

We kicked off the presentation by recapping the unprecedented number of market-moving events that we witnessed in the last few years. Starting with the pandemic, we saw supply chain constraints, followed by Russia Ukraine war, energy shocks, rise in inflation and subsequent need to raise interest rates as well as other events such as UK mini-budget crises, a string of bank failures and UBS-Credit Suisse shotgun merger.

All of the events had an impact on the market, especially the rise in inflation to levels that have not been seen in decades, which prompted central banks to spring into action and raise interest rates. Worth highlighting that the rates were increased significantly after a prolonged cycle of decreasing interest rates, and in such a short span of time. While tightening of monetary policy is helping control inflation, data from PMI shows contraction of economic growth across key European economies in recent months.

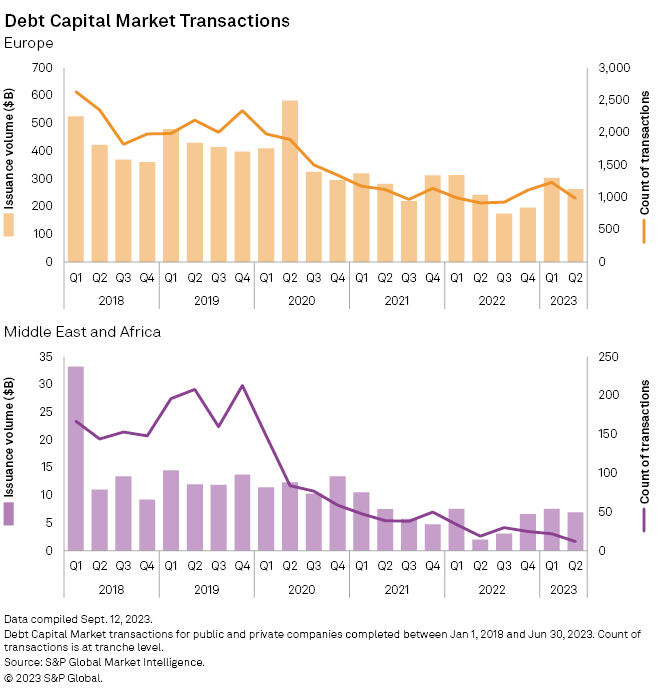

Looking at the DCM activity in EMEA, one can see that the economic uncertainty and high borrowing costs have dampened issuances across EMEA. Within EMEA, Middle East and Africa especially got hit the hardest with 2022 Q2 having the lowest issuance volume since 2018.

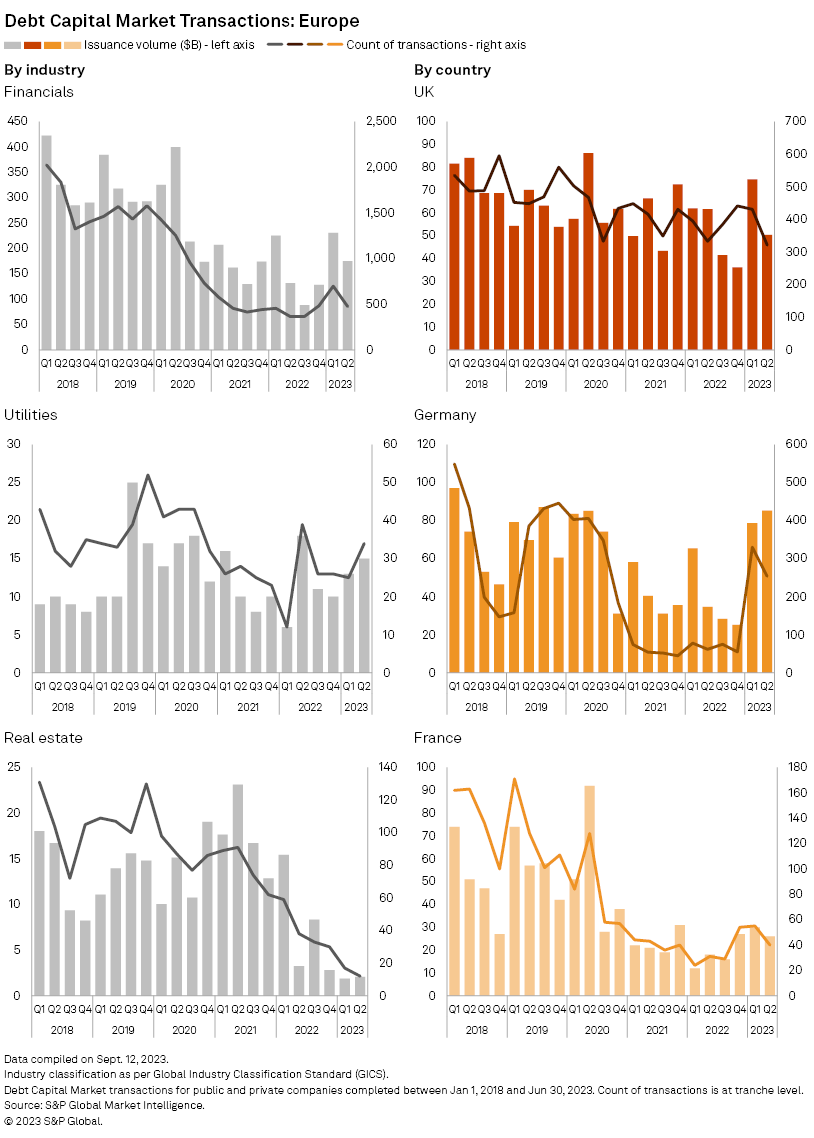

Within Europe, financials sector accounted for 70% of total transaction volume since 2018, which saw a decline in issuances during the last few quarters, dampening the overall issuance volume of Europe. 2023 Q1 saw an increase compared to previous quarters, which was driven primarily by DZ Bank, Landesbank Hessen-Thüringen, and KfW in Germany. The real estate sector was also hit hard with 2023 Q1 having the lowest volume of issuances and 2023 Q2 having the lowest count of transactions. On the other hand, European utilities performed strong with 2023 H1 having 54% higher issuance volume compared to 2018 H1. Energy transition is a major theme across utilities sector within Europe, which requires substantial capital expenditure and the need to issue debt.

We further looked at issuances at country level by presenting data on United Kingdom, Germany, and France, which were the top three countries by issuance volume since 2018. UK witnessed a decline but has not been as pronounced as the other countries. Germany also saw a steep decline, but the last two quarters exhibited signs of recovery primarily driven by high issuance volume of DZ Bank, Landesbank Hessen-Thüringen, and KfW. France, on the other hand, has significantly low issuance volume compared to pre-pandemic times.

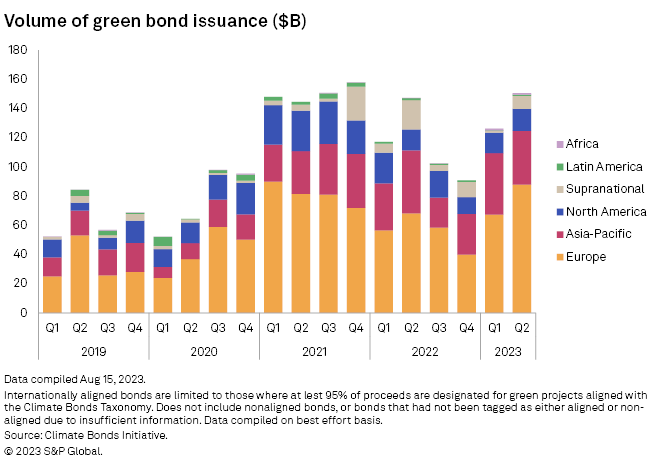

During the webinar, we also presented data on how issuances of short-, medium-, and long-term tenors evolved. In addition, we looked at the levels of debt maturing in Europe, Middle East, and Africa during the next five quarters. We wrapped up the presentation by presenting data gathered by our News and Research team on green bond issuances which shows that Europe has been leading the pack in issuance volume, which is likely to accelerate further due to supportive environment in Europe.

After the presentation, we moved to a panel discussion with Atul Sodhi (Global Head of Debt Capital Markets at Crédit Agricole) and Pierre Verlé (Head of Credit at Carmignac), which was moderated by Rashmi Kumar (Capital Markets Financial Correspondent at Global Capital). Despite the challenging environment, the credit markets are functioning very well – a view shared by both Sodhi and Verlé. Sodhi mentioned that in anticipation of headwinds such as inflation, interest rates, and slowing economy, a lot of companies either funded already or brought funding forward to withstand tougher times ahead and take risk off the table. And, while there was a slow-down by issuers to see how it all plays out, Pierre said that “not issuing is to take a view on rates, which is not [issuer’s] job and that rates might be higher or might be lower” and therefore issuers are coming into the market again.

The panel discussion also delved into the real estate market, which has been affected by a mix of factors such as impact on office space by working from home and change in retail and brick/mortar behavior. To get better yields due to low yield environment in the past, many investors shifted their attention to real estate. But with the move towards higher yield environment, the investor base is shifting with the departure of such investors, since not only is real estate affected by rising interest rates the value of assets is also on the decline. This is having an impact on real estate sector issuances, in addition to the challenging operating environment.

Rashmi also steered the discussion towards additional tier 1 market, which took a hit due to wipe out of additional tier 1 of Credit Suisse. Sodhi and Verlé shared the view that while in the immediate days following the wipeout there was an impact, the markets have recovered since then. Sodhi said that investors are still skeptical, but there are upcoming maturities on issuers side along with refinancing needs and issuers will come back into the market. Pierre also reminded that such instruments are inherently risky, which is why the yields are high, but are otherwise functioning in the way it’s expected.

In the final part of the discussion, Rashmi asked Sodhi and Verlé for their views on ESG. Verlé highlighted that we should not just restrict to engagement with best-in-class companies but also focus on companies operating in “controversial” sectors. This will lead to big impact by changing behavior of such companies through funding/incentives offered as a result of improving ESG compliance. He also mentioned that investors view ESG as an important topic because not considering it can lead to taking on higher credit risk. Highlighting the need for entities to incorporate ESG culture, Sodhi said that “almost no conversation with issuers on accessing markets is complete without how they will address the investor’s questions on sustainability”.

Of course, there was a lot more discussed during the webinar. If you’d like to get all the insights such as increase in covered bonds, resurgence of interest in carry, and many more, you can watch the webinar by clicking here. If you would like to get details about Capital IQ Pro and how it can help you, whether you’re a DCM banker or investor, please click here.

Webinar