Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2016 | 09:30

Highlights

This brief leverages the S&P Capital IQ Alpha Factor Library to explore questions that should aid investors in positioning for declining oil prices.

Which strategies or factors have historically been the best performers in an oil price decline regime?

With the price of West Texas Intermediate (WTI) in the mid-forties, oversupply concerns and the continued threat of a global slowdown have led many to fear a resumed oil price decline. The year-to-date performance of Oil & Gas (O&G) companies, particularly Integrated O&G entities has been strong, further contributing to concerns that oil may be poised to retrench.

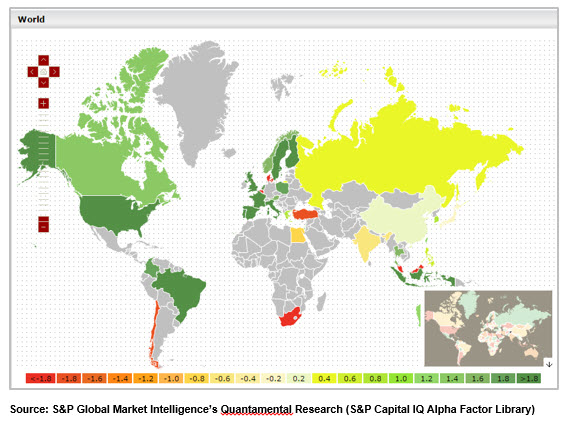

The heat map below shows the performance of the Energy Sector relative to the S&P Global BMI Index for each country. The darker green signifies stronger performance relative to the local market.

Leveraging the S&P Capital IQ Alpha Factor Library, containing over 500 equity strategies, this brief explores the following questions that should aid investors in positioning for a decline in oil prices:

Research