Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 20, 2025

By Keith Nissen

Podcasts represent an opportunity to further add value to major US SVOD services, such as Netflix, Amazon Prime Video and Disney+. Profiles of podcast listeners in general and avid podcast listeners, in particular, can serve as a guide to content acquisition.

➤ About 45% of current subscribers to Netflix, Amazon Prime Video and Disney+ listen to podcasts, slightly higher than the 38% of overall US survey respondents who indicated being podcast listeners.

➤ Avid podcast listeners tend to be slightly older than the overall podcast-listening group. Avid listeners also tend to be college-educated, reside in suburban/small towns and get most of their news from podcasts.

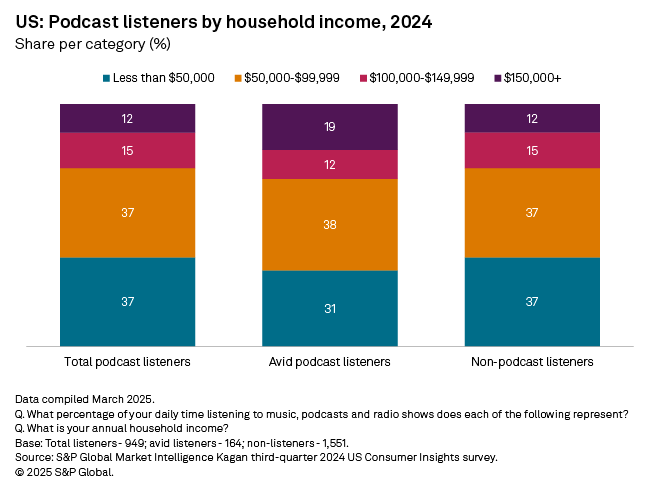

➤ Podcast listeners mirror the overall US online consumer population in terms of household income, with 37% earning less than $50,000 per year.

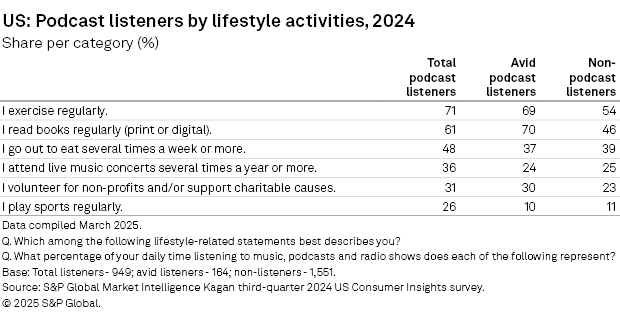

➤ Compared to overall podcast listeners, avid listeners tend to spend less time playing video games, interacting on social media, as well as other lifestyle activities, such as playing sports, dining out at restaurants and attending concerts.

Previous reports have focused on how major online subscription video services, such as Netflix, Amazon Prime Video and Walt Disney Co.'s Disney+ have expanded into live sports and other types of content. Adding podcasts to their content offerings may also be of interest since listening to podcasts is a popular pastime in the US. Results from S&P Global Market Intelligence Kagan US Consumer Insights surveys show that over the past seven years, nearly four in 10 internet adults listen to podcasts. In 2024, avid podcast listeners, those spending over half of their daily listening hours on podcasts, represented 7% of total US internet adults and 17% of total US podcast listeners.

The third-quarter 2024 Consumer Insights survey found that for each of the three major SVOD services that approximately 45% of current subscribers listen to podcasts, slightly higher than the overall podcast audience (38%) in the US. However, for all three major SVOD services the percentage of current subscribers that are avid podcast listeners is identical to that of the overall podcast market. This suggests that adding podcasts to SVOD content libraries may add value and subscriber loyalty. The selected podcast genres should be based on the demographics and lifestyle behaviors, as profiled in this report.

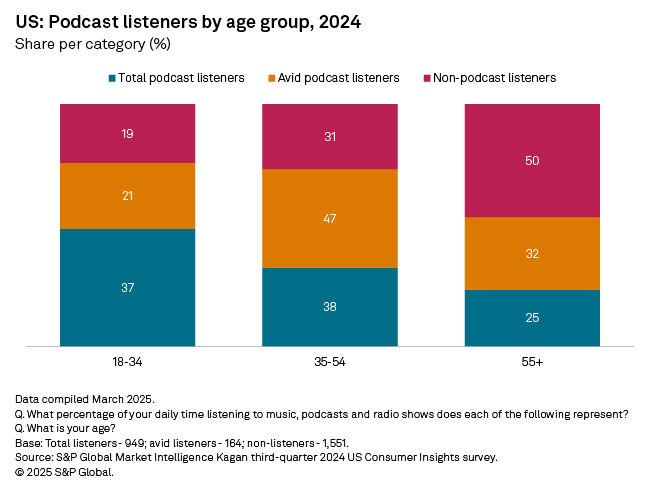

The 2024 survey data found that podcast listeners, in general, tend to skew toward younger adults with over one-third (37%) of listeners being adults under 35 years of age, and only one-quarter (25%) being those 55 and older. In contrast, half of those that never listen to podcasts (but listen to music or radio) were adults 55 and older, while only 19% were in the under 35 age bracket. Nearly half (47%) of avid podcast listeners were adults between the ages of 35 and 54. The average age for avid podcast listeners was 49, compared to 43 for total podcast listeners and 52 for non-listeners.

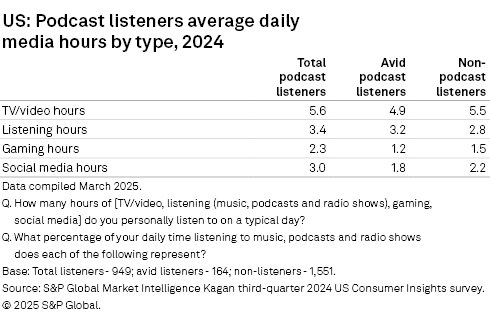

Listening to podcasts does not appear to significantly alter the amount of TV/video content that is consumed on a daily basis. For instance, the survey data shows that podcast listeners spend 5.6 hours per day, on average, watching TV/video content, nearly identical to the 5.5 hours of non-listeners. Podcast listeners tend to have more overall listening hours each day (3.4), as well as spending more time playing video games and on social media than those not listening to podcasts. This may be reflective of the age differential between the two groups.

Avid podcast listeners spend nearly the same amount of time listening (3.2 hours) per day as overall podcast listeners but spend far less time playing video games and on social media. Again, this is probably more of a reflection of their age than factors linked to podcasts.

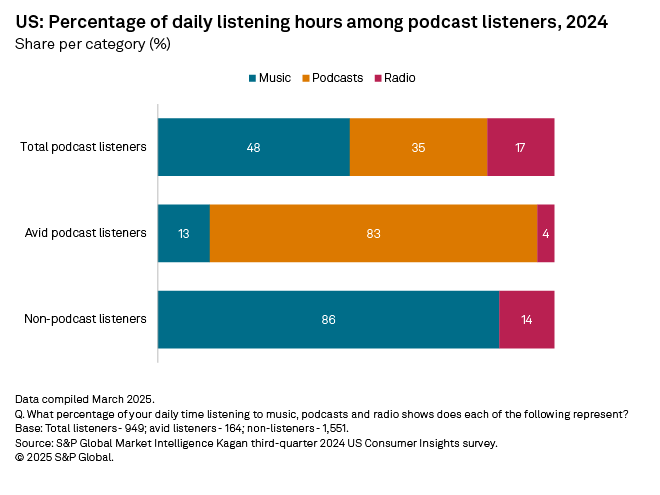

The survey found that, on average, podcast listeners in the US spend about half (48%) of their daily listening hours on music and 35% on podcasts, whereas non-podcast listeners spend nearly all of their time enjoying music. In contrast, the survey found that avid podcast listeners spend 83% of their daily listening hours on podcasts, with extremely little time dedicated to music or radio.

In terms of household income, the survey data shows there is no distinction between podcast listeners and non-listeners. Over one-third (37%) of podcast listeners and non-listeners reside in households with an annual income of less than $50,000, and another 37% are in households earning between $50,000 and $99,999 per year. Both categories mirror the income distribution for the entire US internet population. Avid podcast listeners were only slightly different with 31% having incomes of over $100,000 per year.

There are other characteristics that separate podcast listeners, avid listeners and non-listeners from each other. For instance, avid podcast listeners tend to reside in small/rural towns, rather than metropolitan areas and are typically college-educated. They also tend to read books and get their news from podcasts far more than either other podcast listeners or non-listeners. Yet, except for reading books and volunteering time at charities, avid listeners tend to have a lifestyle closer to non-podcast listeners. They tend to dine out at restaurants, attend music concerts, and play sports less than podcast listeners, overall.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

The Kagan third quarter 2024 US Consumer Insights survey was conducted during September of 2024, consisting of 2,500 internet adults. The margin of error is +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.