Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 11, 2024

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

The global economic expansion accelerated for a fifth successive month in March, buoyed by faster manufacturing output and services activity growth. This was again accompanied by rising selling price inflation, however, driven primarily by rising services charges.

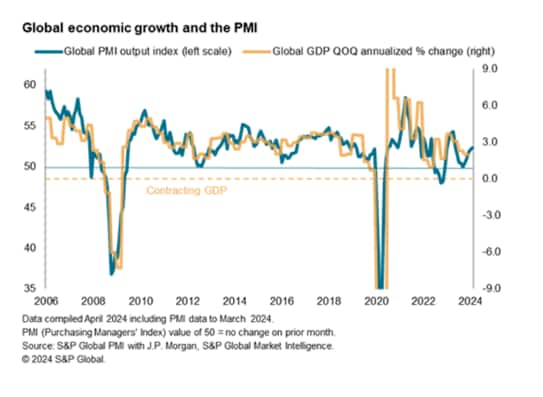

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - rose to 52.3 in March, up from 52.1 in February. The headline PMI, despite remaining below the survey's long-run average of 53.2, is the highest in nine months and is consistent with annualized quarterly global GDP growth of approximately 2.6%. Furthermore, the latest acceleration in global growth is accompanied by a more broad-based upturn, both across sectors and regions, thereby reflecting well-balanced improvements in global economic conditions at the end of the first quarter of 2024.

While the service sector continued to expand at a faster rate, the quickest in eight months, manufacturing production grew for a third successive month and at the fastest rate since June 2022. This was supported by improvements in demand conditions across both sectors. By market, emerging economies recorded the sharpest growth since May 2023 and developed economies also saw an acceleration in growth to a nine-month high.

However, average prices charged for goods and services rose at an accelerated rate again in March which, alongside indications of labour constraints, hint at worldwide inflationary pressures remaining elevated in the coming months. This is especially for services, which continued to record a high rate of inflation by historical standards, though manufacturing prices have also shown signs of reviving with developed markets manufacturing output price inflation accelerating in March. Further insights into how growth and prices trend at the start of the second quarter will be watched with the next release of flash PMI data on April 23.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.