Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Dec, 2022

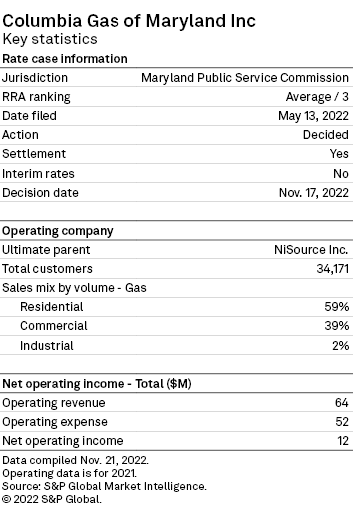

In allowing a public utility law judge's proposed order for Columbia Gas of Maryland Inc. to become final without modifications, the Maryland Public Service Commission effectively adopted the judge's finding that the approved "increase is reasonable and will provide the Company with the additional revenues that are necessary to continue providing safe and reliable service to its customers, but no more. The result is one that balances the needs of the Company to have an opportunity to earn a fair [rate of return] with the competing interests of its customers for reasonable rates."

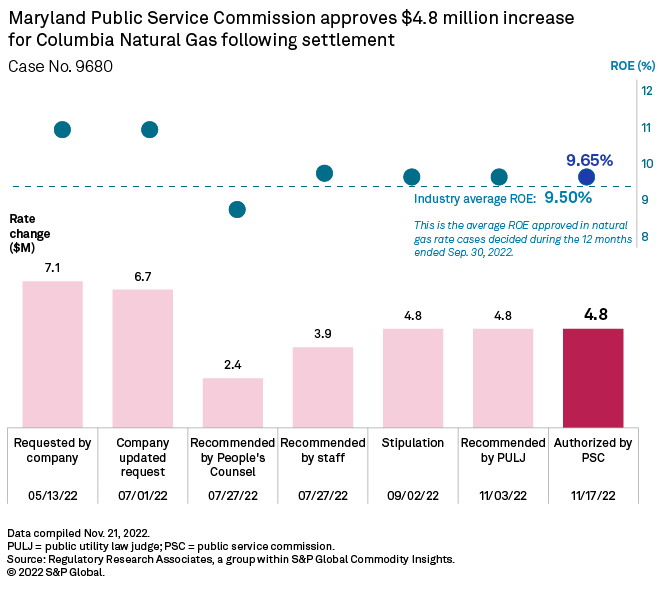

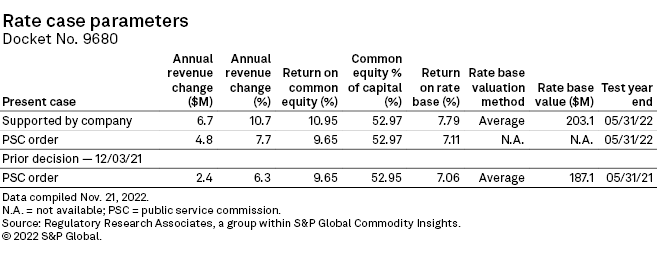

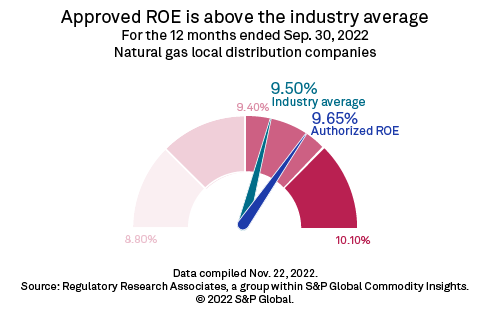

The decision in Case No. 9680 adopted a settlement authorizing the company, or CGM, a $4.8 million gas distribution base rate increase. The agreement incorporates a 9.65% return on equity. Prior to the settlement, CGM supported a $6.7 million rate increase premised upon a 10.95% ROE. All else being equal, the ability of the parties to reach a unanimous agreement is viewed as constructive from an investor viewpoint.

In this instance, the stipulated rate change is more than half that initially sought by CGM and is greater than the rate increases supported by the intervening parties. In addition, the agreed-upon ROE is above the average of ROEs approved in recently completed gas rate cases nationwide and higher than the ROEs recommended by the intervening parties. While the agreement does not specify the authorized rate base, it does lay out a process for addressing post-test-year capital additions in future proceedings.

As a result of the agreement, the rate case was resolved a few weeks sooner than a fully litigated case would likely have been completed. However, the rate change is not effective much sooner than it would have been otherwise.

As part of the settlement, CGM withdrew a proposed renewable natural gas pilot program, but the company is not barred from seeking approval of a similar program in future filings.

Regulatory Research Associates views the regulatory climate in Maryland as somewhat more restrictive than average from an investor viewpoint.

Procedural background

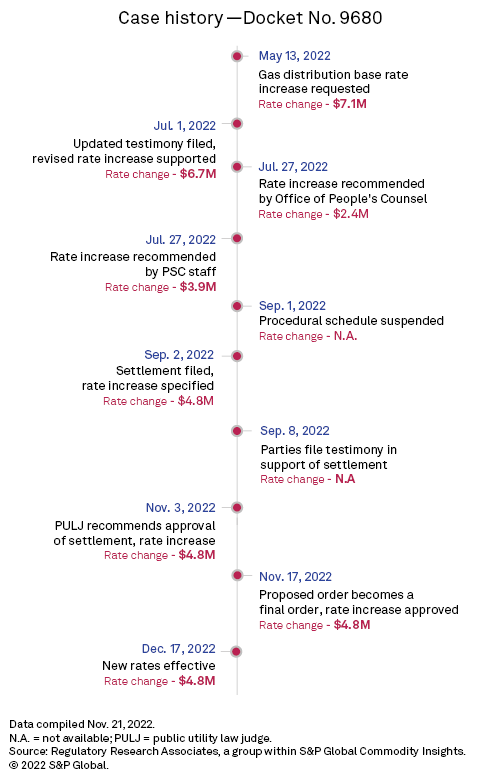

This proceeding was initiated May 13, when CGM filed for a $7.1 million, or 11.5%, rate increase. The NiSource Inc. subsidiary requested a 10.95% return on equity (52.77% of capital) and a 7.78% return on an average rate base valued at $204.1 million for a test year ended May 31.

On July 1, CGM filed updated testimony supporting a $6.7 million, or 10.73%, rate increase premised upon a 10.95% return on equity (52.97% of capital) and a 7.79% return on a $203.1 million rate base.

The requested base rate increase included $1.2 million of revenue and $10.8 million of rate base reflected in CGM's rider related to the Strategic Infrastructure Development and Enhancement program. If the PSC had approved the supported rates as filed, the rider would have been reset to zero, and customers would have experienced a net overall rate increase of $5.5 million.

The utility said the need for the requested revenue increase arose principally from its continued increased investment in the replacement of leak-prone pipeline infrastructure, increased operation and maintenance expenses, and "for a reasonable opportunity to earn a fair and reasonable return on its investment." According to CGM, absent the rate change, the company's rate of return on the adjusted rate base for the test year would be 5.293%, below the overall rate of return approved in the prior proceeding, Case No. 9664.

CGM also proposed a five-year renewable natural gas, or RNG, tariff pilot program known as the Green Path Rider. The proposed Green Path Rider was a fee-based, opt-in pilot rider that would offer customers the option to reduce some or all of their emissions related to their natural gas usage. To do this, CGM would purchase RNG, environmental attributes and carbon offsets to reduce the customer's emissions associated with their natural gas usage. This would have been available at the customer's election for either a 100% reduction or a 50% reduction in emissions. Customers opting into the Green Path Rider would be charged an additional fee per therm to reflect the cost of the renewable natural gas, environmental attributes and carbon offsets. The program would be offered to all residential and general service customers that were up to date on their bill payments.

The rider rate would have comprised the negotiated price of renewable natural gas environmental attributes and carbon offsets procured from a third-party supplier. CGM negotiated a fixed price for the RNG attributes and carbon offsets, and this fixed price would have been passed through to the customers electing the rider on a dollar-for-dollar basis. The rider would have been updated annually to reflect any changes in the cost of the attributes and offsets procured.

The PSC staff and the state Office of People's Counsel filed testimony July 27. The staff recommended a $3.9 million increase premised upon a 9.75% return on equity (52.97% of capital) and a 7.16% return on a rate base valued at $198.3 million. A $2.4 million increase recommended by the Office of People's Counsel reflected an 8.75% return on equity (50% of a hypothetical capital structure) and a 6.496% return on a $203 million rate base. In both instances rate of return accounted for a significant portion of the revenue requirement difference relative to the company-supported rate change.

With regard to the RNG pilot, the intervening parties said the company failed to demonstrate that the pilot met the criteria established by the PSC for such programs, that the charges proposed under the tariff warranted further investigation, that any costs associated with the program should be borne by program participants rather than socialized to all customers, and that cost recovery procedures for such programs should be addressed generically and not as part of one utility's base rate case.

On Sept. 1, the PSC suspended the proceeding in light of ongoing settlement talks, and Sept. 2, the parties filed a settlement specifying a $4.8 million rate increase. The parties filed testimony in support of the agreement Sept. 8.

On Nov. 3, the public utility law judge, or PULJ, issued a proposed order calling for approval of the agreement without modifications. The judge's order indicated that the parties to the proceeding had waived their rights to appeal the proposed order, and therefore, the proposed order would become a final order of the commission, effective Nov. 17, if the PSC took no action to modify or reverse the proposed order or initiated further proceedings in this matter.

Had the parties not waived their rights to appeal, the appeals would have been due by Nov. 10 and replies would have been due by Nov. 18. The statutory deadline for a PSC decision was Dec. 9, and had the case been fully litigated, the new rates would have become effective shortly thereafter.

The PSC took no action to modify the PULJ's proposed order, and it became a final order Nov. 17. The new rates are effective Dec. 17.

Settlement provisions

The order says the parties "presented what amounts to a 'black box' settlement, noting that the Settlement Agreement is unanimous and a full settlement of all of the issues in the proceeding."

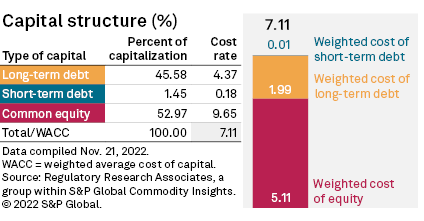

The approved settlement authorizes CGM a $4.8 million rate increase reflecting a 9.65% return on equity (52.97% of capital) and a 7.11% overall return. The approved rate base is not specified in the agreement.

The stipulated equity return is the same as that approved in CGM's prior base rate case and is within the range of ROEs approved by the PSC for other energy utilities in recently decided cases. In the 20 Maryland energy rate cases decided since 2017 in which a new equity return was determined, the PSC adopted equity returns ranging from 9.5% to 9.8%.

The approved ROE is also somewhat above the average of recent ROEs approved for energy utilities nationwide. According to data gathered by RRA, the average ROE approved for gas utilities nationwide in cases decided during the first nine months of 2022 was 9.42%, and the average for the 12 months ended Sept. 30 was 9.50%. These averages represent a decrease versus the 9.56% average observed in calendar 2021.

For additional information concerning trends in authorized ROEs and other rate case-related statistics, refer to RRA's most recent Major Rate Case Decisions Quarterly Update.

The agreement states, "rates will be designed on volumes based on a 20-year weather normalization." The agreement specifies a $16.15 monthly customer charge for residential customers versus the $18.82 charge proposed by CGM; this represents a modest increase versus the $16.00 charge approved in the prior case.

The monthly customer charge for small general service customers will be set at $58.82 versus the company-proposed $65.61 charge. The previously approved fixed charge for this customer class was $57.11.

CGM is to file a "make-whole" proceeding prior to filing its next base rate case that will reflect the 9.65% ROE and 7.11% overall return specified in the case; fully actual results for a 12-month period, which may be presented initially with up to three months of estimated data under the proviso that said estimated data will need to be updated with actual data before parties file their respective cases; a 13-month historical average rate base, and a terminal or year-end valuation for safety and reliability plant additions, as well as two months of post-test year safety and reliability plant additions that are known and measurable.

For future filings under the STRIDE program, the company is to use the rate of return parameters set in this case.

In future rate cases, CGM is to provide enhanced data regarding general corporate costs allocated to the Maryland jurisdiction by NiSource, including joint assets and operating costs by function, such as legal, engineering services, information technology and human resources.

In addition, CGM agreed to withdraw a proposed renewable natural gas pilot program. However, the company is not limited from proposing a Green Path Rider or similar program in future proceedings, and this does not bar the company from pursuing RNG alternatives. The agreement requires that prior to accepting RNG into its system, Columbia will notify the staff and OPC and must jointly develop with staff a proposal for an RNG gas quality standard, and any resultant gas quality standard proposal must be filed with the commission and subject to stakeholder and commission review.

RRA view of Maryland regulation

For many years, RRA viewed the regulatory environment in Maryland to be one of the most restrictive in the country from an investor viewpoint. During this time, the PSC's ROE authorizations were largely below prevailing industry averages when established.

In addition, the PSC's reliance on test periods that were fully historical at the time of filing, in conjunction with average rate base valuations, rendered it difficult for the utilities to earn the authorized returns.

However, in recent years, Maryland has gradually implemented policies to mitigate regulatory lag. The PSC's rules for multiyear rate plans allow for the use of forward-looking test years, removing one aspect of regulatory lag, and the PSC is considering allowing the companies to incorporate performance incentives into these plans. The PSC has approved multiyear plans for two of the major investor-owned energy utilities in the state.

Recent rate case decisions not entailing multiyear rate plans have also incorporated above-industry-average ROEs, and in these cases, the PSC has allowed post-test-year adjustments to rate base and expense items; has used year-end, rather than average, test year values for certain types of investments; and in some instances, has approved inflation adjustments.

In light of these constructive trends, the regulatory climate in the state has moved closer to the industry average when it comes to investor risk, and RRA accords the jurisdiction an Average/3 ranking. However, with the recent election of a new governor, there could be changes to both the tenor and direction of energy policy in the state, and there may well be changes in the makeup of the commission, as two commissioners are serving pending confirmation, having been appointed or reappointed by the outgoing governor, and the commission chairman's term expires in June 2023. For additional information concerning the regulatory climate in Maryland, refer to the Maryland Commission Profile.

For additional detail concerning RRA's regulatory rankings, refer to the latest Quarterly State Regulatory Evaluations report.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights provides content for distribution on Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

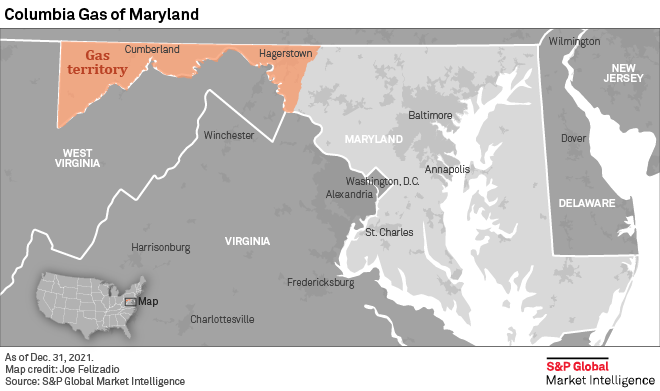

Joe Felizadio contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.