Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Jul, 2023

S&P Global Commodity Insights reports on investments and growth in lithium-ion battery capacity, specifically for the plug-in electric vehicle sector. The article leverages the Battery Cell Manufacturer Database provided by the Global Clean Energy Technology team, which tracks announcements of manufacturing capacity.

Two of the main pillars of the global green agenda — automotive fleet electrification and renewable-generated energy storage — hinge on lithium-ion batteries. Investments in battery capacity are robust, and we calculate manufacturing capacity will reach 6.5 TWh in 2030, led by China, which is projected to have over half the market share, alongside North America and Europe, each boasting over 1 TWh of lithium-ion battery capacity. Those two markets favor nickel-manganese-cobalt chemistries and have outlined official guidance over the past year to ensure greater security in the sourcing of these critical minerals and a more sustainable supply chain. The location of the battery capacity is therefore crucial, given the various policies regarding domestic manufacturing. While we calculate enough battery capacity to meet demand, the next step for the industry would be to focus on the upstream of the supply chain to address the expected market deficits.

Lithium-ion batteries underpin the decarbonization of the transport sector through electrifying the fleet and are also paired extensively with low-carbon power generation for greater control, given the intermittency of renewable generation. With many short- to medium-term decarbonization targets accelerating investments in lithium-ion battery production capacity, S&P Global calculates demand for traction batteries to increase at a 22.3% compound annual growth rate between 2022 and 2030. While energy storage and portable electronics are the other two key applications of lithium-ion batteries, the automotive and transport segment will have a market share of 93% in 2030.

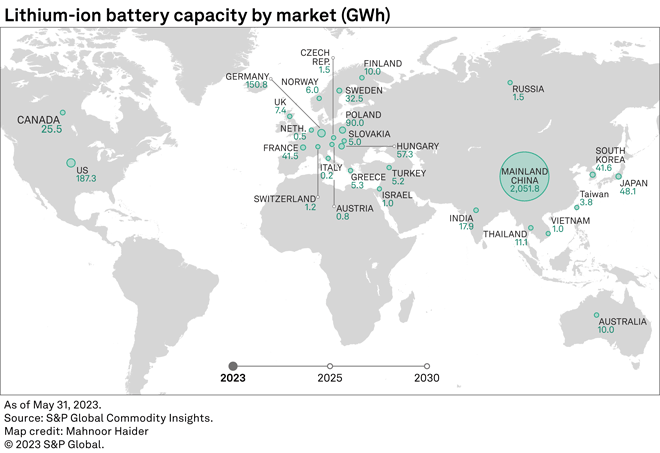

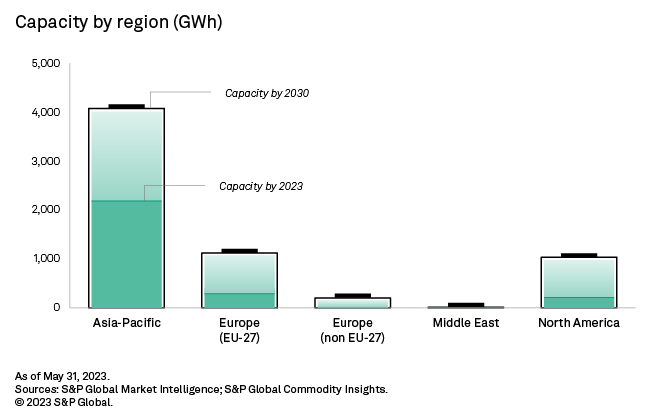

As of the end of the March quarter, global lithium-ion battery capacity stands at 2.8 TWh. Through the various capacity addition or build-up announcements released over the past few years — without any further assumptions as to delays or expansions — and tracking of stalled or canceled projects, we estimate this capacity will more than double by 2030 to reach 6.5 TWh. The planned lithium-ion battery capacity well covers demand. S&P Global expects demand from the EV sector to reach 3.7 TWh in 2030.

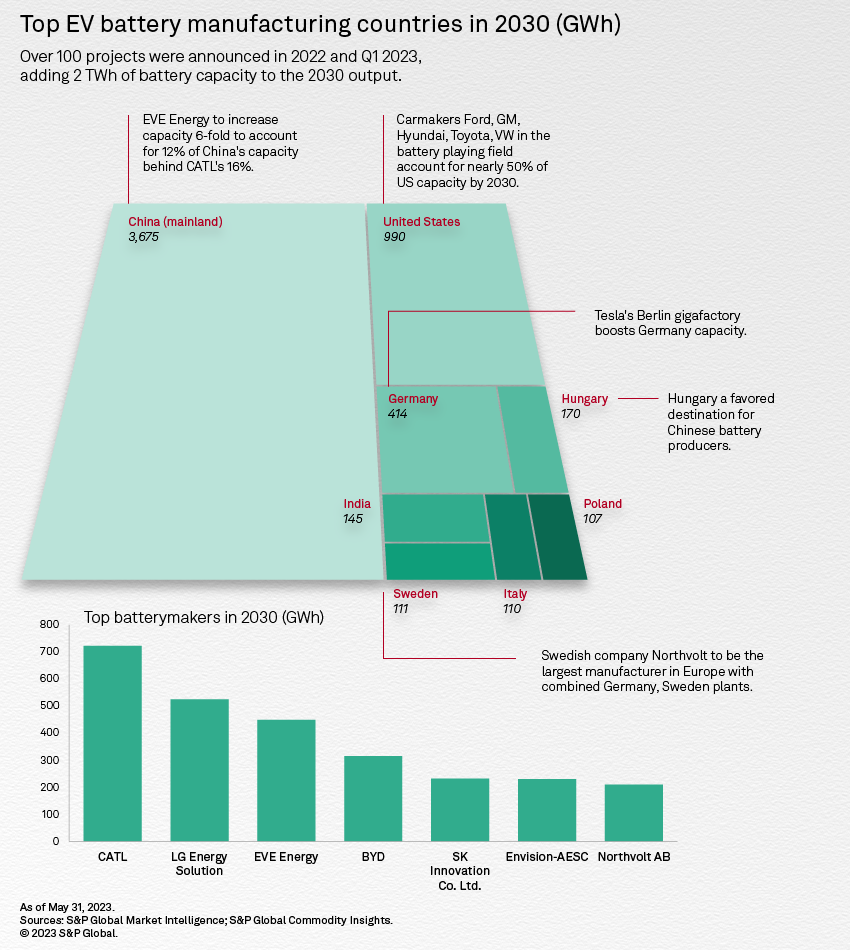

China will still lead growth in lithium-ion battery capacity production, though it will lose some of its market share between 2023 and 2030, expanding at a slower pace, given the market's already high base. Europe currently is and will remain the second-largest market, followed by North America, with both boasting over 1 TWh of capacity in 2030. Growth will be slightly more substantial in North America with a 2023-2030 compound annual growth rate of 22% compared with 16% in Europe. Most of the addition in North America will come from the US, with just two projects in the works in Canada.

India is also poised to significantly increase its manufacturing capacity to 145 GWh in 2030 from just 18 GWh currently, placing the market fifth globally at the end of the forecast horizon, behind Hungary. As the database only reflects manufacturer announcements, India's ambitions and plans to build up capacity may lead to significant additions in the next updates. The Indian government estimates it will need 120 GWh of lithium-ion battery capacity by 2030 to power EVs and for stationary energy storage — an achievable target if projects advance as announced. S&P Global anticipates EV sales in India will rise from just 60,000 in 2022 to 1.2 million in 2030, compared with 4.1 million in the US, with the government having plans to achieve a target of 30% EV adoption by 2030.

Meanwhile, Hungary is shaping up to be a favored destination for Chinese battery producers, with Contemporary Amperex Technology Co. Ltd. (CATL) and EVE Energy Co. Ltd. having already invested close to $10 billion in battery plants.

Germany spearheads Europe's lithium-ion battery capacity

In February, the EU approved a plan requiring all new cars sold in the region as of 2035 to have zero emissions as a stepping stone to its climate-neutrality goal for 2050 — a move that will accelerate the switch to EVs. The bloc also intends for nearly 90% of its battery needs to be met by the EU's battery manufacturers, amounting to at least 550 GWh in 2030. The 1 TWh of capacity expected to be online by 2030 — a tripling of current levels — will easily meet this goal. There has been no new announcement as of April 1 when the database had been updated for the March quarter, following 11 projects in 2022 and a peak of 18 in 2021.

Sweden-headquartered Northvolt AB will be the largest manufacturer in Europe, with its projected 210 GWh of output from five plants — two in Germany and three in Sweden — double that of second-place, France's Automotive Cells Company SE, which is building three 40-GWh gigafactories in France, Germany and Italy, with the first in Hauts-de-France expected to start operations this year.

With just over 400 GWh of planned capacity by 2030, Germany will lead battery manufacturing in the region and will round up the top three countries globally. Despite the presence of up to 13 companies in the market by 2030, Tesla Inc.'s Berlin gigafactory and Northvolt's two plants will produce half of Germany's 2030 capacity, based on the announcements, although the companies have signaled they may scale back plans to focus on their US assets. Among the other major players are Sweden, Italy, Poland and France with about 100 GWh of capacity each, led by Northvolt, Italvolt, LG Energy Solution Ltd. and Automotive Cells Co., respectively.

US legislation boosts battery capacity announcements

In the US, the Inflation Reduction Act of 2022, which was signed into law in August of that year, outlines several sourcing, assembling and manufacturing requirements and associated tax breaks that incentivized companies to invest in the US EV battery landscape. Since the beginning of the December quarter of 2022, there have been nine gigafactory announcements in the US for a cumulated 315 GWh of additional capacity by 2030. This is equivalent to about one-third of the US' expected total output of just shy of 1 TWh — an indication of the boost provided by the bill. Nevertheless, the Inflation Reduction Act may not have had the impact markets expected. The pace of investment had been steady prior to the legislation, with 274 GWh by 2030 announced in 2021 and peaking at 506 GWh in full-year 2022. Likely, manufacturers were hesitant to commit to plans, waiting for clarification around the sourcing requirements and other terms of the bill that materialized at the end of the March quarter. Four companies will dominate US battery production in 2030 with over 100 GWh of annual capacity each and all headquartered in Southeast Asia.

While investment in battery capacity is robust, the up- and downstream supply chains might lag. Strict sourcing requirements calling for specific partners-in-trade paired with geographic localization of resources, long lead times to mine development and the need for refining or converting the mined minerals into battery-grade compounds make for a more arduous path to tread for upstream players like miners, smelters and refiners. While carmakers are renewing their commitment to developing and producing EVs, whether buy-in by consumers will grow at a similar rate will depend on many factors, from the incentives outlined in the Inflation Reduction Act to the practicality of an adequate charging infrastructure and a robust electric grid across the US.

Top battery makers in China also dominate globally

With a decadelong head start on the rest of the world, China remains the leading nation in operating and planned battery capacity, as well as the world's largest EV market. The end of state subsidies in January, coupled with China's economic pressures, has subdued EV production in 2023 to date; battery makers remain optimistic on the long-term prospects, however, with 247 GWh of new capacity announced in the first quarter of the year alone.

About half of this new capacity will be brought online by EVE Energy, which will propel the company to become China's second-largest battery manufacturer in 2030 behind CATL, with a nearly 500% increase in capacity from 2023 output. The major players will remain the same over the forecast period, with BYD Company Ltd., CALB Group Co. Ltd. and SVOLT Energy Technology Co. Ltd. rounding out the top five. By 2030, three more manufacturers, Sunwoda Electronic Co.Ltd., Chuneng New Energy and Funing Technology, will also boast more than 100 GWh each of total battery output in China. The battery manufacturing space in China is a dynamic and fast-changing landscape, however, and the possibility remains that there will be new major players in 2030.

Battery chemistries: evolution and implications

Lithium nickel-manganese-cobalt (NMC) chemistries are the dominant battery chemistry mix so far, in part on its superior energy capacity — intrinsically linked to driving range — especially compared with the cheaper and safer lithium-iron-phosphate (LFP) batteries. While energy density is a key factor of battery choice, another factor was at play in the market: the use of LFP technology in China was exempt from patent fee, which was not the case in other markets prior to 2022.

The first-mover advantage of LFP in China and of NMC in markets elsewhere has created stickiness in the prevailing battery-choice mix.

NMC batteries account for just over half the global market share in 2023. In Europe, that share is up to nearly 70% and will reach 77.2% in 2030; while some projects have not disclosed the cathode type, the known LFP market share in the bloc is a mere 5.2% in 2023, dropping further to 0.5% by the end of our forecast period. In the US, LFP batteries will only make around 20% of the market by 2030, compared with 50.2% for NMC batteries and 15.3% for the NMC-Aluminum variant.

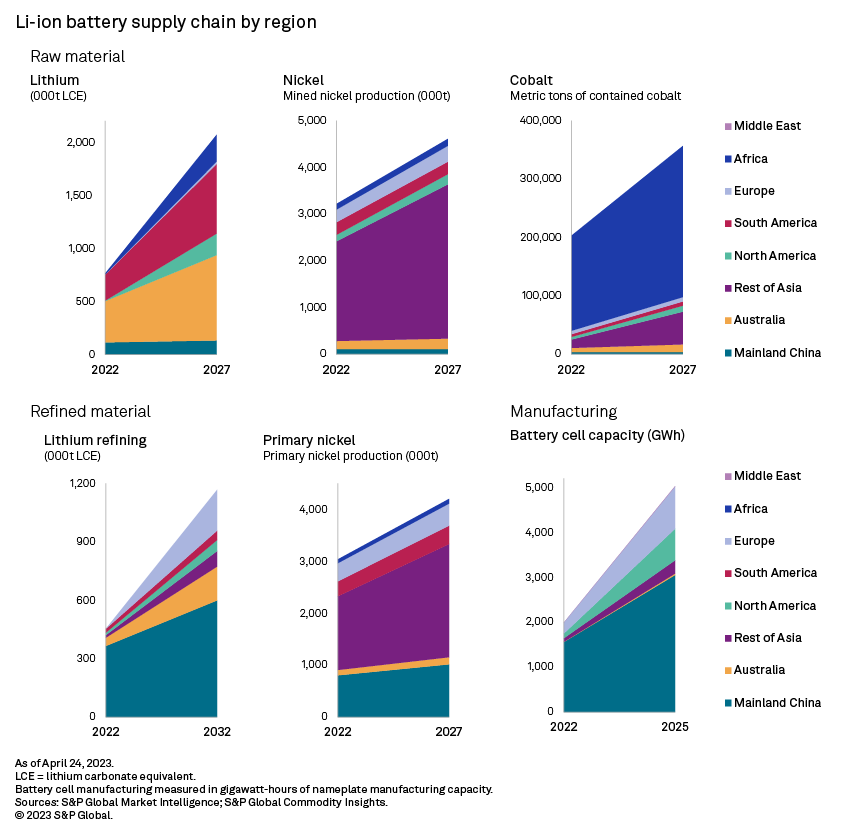

The growing share of NMC battery capacity in Europe and the US can be surprising, given the limited local reserves and resources of the critical minerals. The supply of mined cobalt and nickel used in NMC batteries are highly concentrated: cobalt in the Democratic Republic of Congo and nickel in Indonesia. Most of the material is currently being converted to battery-grade compounds and fabricated into battery cathodes and cells in China. Although the US Inflation Reduction Act and the EU Critical Raw Materials Act have been defined to ensure a secure and circular supply of strategic minerals critical to the green energy transition and their value-added transformation during the various steps of the battery supply chain, developing the necessary infrastructure, from mines to recycling facilities, to establish the supply chain will be lengthy and perhaps exceed our forecast horizon. On the other hand, sourcing for lithium for LFP batteries would be an easier problem to solve because of lithium's abundance across geographies.

In addition to traction batteries, the LFP chemistry mix is also a popular choice for stationary energy storage, where the weight and size of the battery pack is not a limiting factor. Competition for materials will arise from this concurrently growing sector and will need to be accounted for. Automakers and traction battery producers have typically been on the winning side, however, having been involved in offtake agreements that miners have honored amid the lithium shortage of 2022, while energy storage clients who buy on the spot market were left short-handed.

Future of the supply chain

Looking ahead, we can expect a boost to both regional supply chains and the global battery inventory through recycling. Many small companies are working on providing clean technology solutions to battery recycling by extracting the various mineral components for new feedstock, an approach that will cement the circularity aspect of the US and European roadmaps. Those will also likely be finetuned as concerns arise regarding the political implications of some of the most stringent aspects, such as those two "friendly" economies competing for the same resources.

Commodity Insights also expects global markets for many of these critical materials to be in deficit before the end of the decade, and with lengthy permitting and building timelines, mined resources might become a bottleneck of battery capacity development. Indeed, while we calculate enough battery capacity to meet demand, the next step for the industry would be to focus on the supply chain upstream and address the expected shortages in more creative ways — by exploring new deposits in new geographies and developing new extracting and processing methods — to supply the lithium the world needs.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research