Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 12, 2025

By Jim O'Reilly

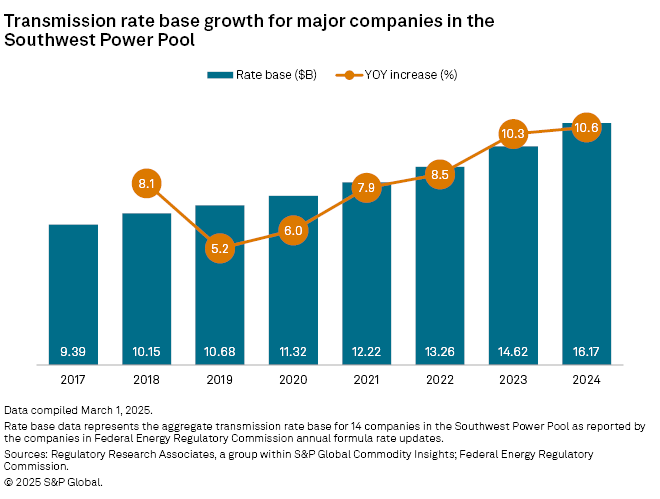

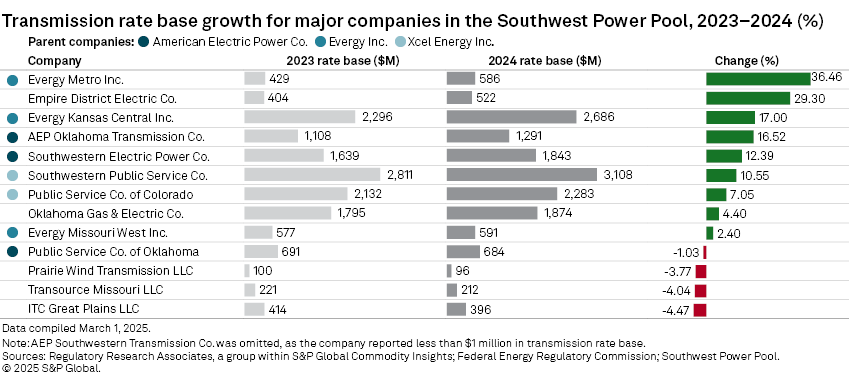

The aggregate transmission rate base for a group of 14 companies in the Southwest Power Pool rose to $16.17 billion in 2024 from $14.62 billion in 2023, or 10.6%, the fifth consecutive year of accelerating growth for the companies in the region.

The increase in 2024 was driven by six companies that recorded double-digit growth year over year, including two of Evergy Inc.'s three subsidiaries and two of American Electric Power Co. Inc.'s (AEP's) four subsidiaries.

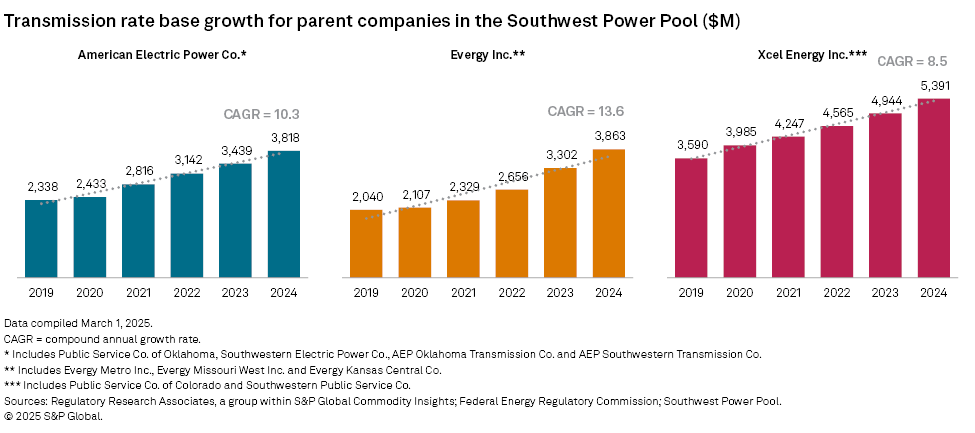

➤ The accelerating transmission rate base growth over the last five years has been driven by Evergy's three subsidiaries and three of AEP's four subsidiaries in SPP. Since 2019, Evergy has recorded an average annual rate base growth of 13.8%, adding more than $1.8 billion to the company's rate base. During the same period, AEP has recorded an average annual rate base growth of 10.4% and added nearly $1.5 billion to the company's rate base in SPP. From 2023 to 2024, the two companies combined added nearly $940 million to their transmission rate base in SPP.

➤ Recent project announcements by SPP and utilities in the region, as well as utility capital expenditure forecasts, indicate the upward trend in rate base in the region will likely continue. In 2024, SPP announced "the single largest portfolio of transmission investments" in the region's history. The portfolio of transmission investments consists of 89 projects representing 2,333 miles of new transmission lines and 495 miles of transmission rebuilds across SPP's 14-state footprint.

➤ The base return on equity (ROE) for each of the 14 companies in SPP has remained unchanged since 2020, providing a level of financial and regulatory certainty for the region's transmission owners. All the companies except Xcel Energy Inc. subsidiary Public Service Co. of Colorado (PSCo) have also been authorized a 50-basis-point ROE adder for membership in a regional transmission organization or independent system operator. In addition, three transmission-only companies (transcos) in the group have been authorized ROE adders for specific transmission projects.

Overview

Regulatory Research Associates annually publishes a series of transmission ratemaking analyses covering the six RTOs/ISOs in the US, and an additional report covering 14 utilities in the West and Southeast regions of the US that are not members of an RTO/ISO. RRA also compiles the seven regional reports annually into one national report that analyzes a total of nearly 100 companies.

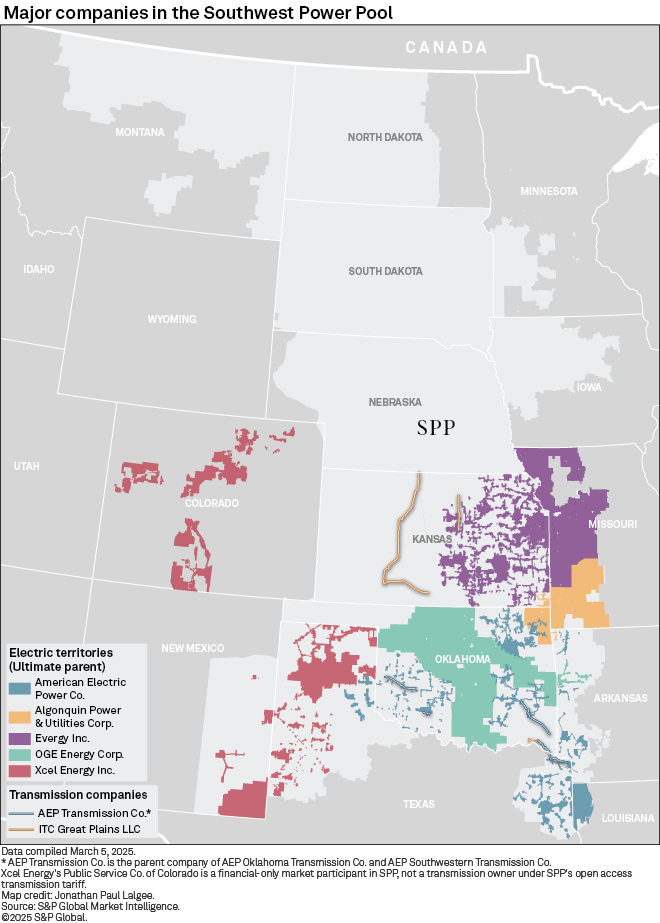

The 14 companies in RRA's SPP analysis represent ultimate parent companies AEP, Algonquin Power & Utilities Corp., Berkshire Hathaway Energy (BHE), Evergy, Fortis Inc., OGE Energy Corp. and Xcel Energy.

The SPP group consists of nine vertically integrated operating utilities and five transcos. The analysis is based on data reported by the companies in annual transmission formula rate updates filed with the Federal Energy Regulatory Commission.

Two transcos in the analysis have multiple owners. Prairie Wind Transmission is owned 50% by Evergy, 25% by AEP Transmission Holding Co. and 25% by BHE subsidiary BHE America Transco LLC. Transource Missouri is 100% owned by Transource Energy LLC, which is 86.5% owned by AEP Transmission Holding and 13.5% by Evergy Transmission Co. LLC. The parent company totals for AEP and Evergy in this analysis do not include their respective ownership stakes in Prairie Wind Transmission and Transource Missouri.

Regional growth

The 10.6% year-over-year growth in aggregate rate base for the group of 14 companies in SPP was the fifth consecutive year of accelerating growth for the group and more than double the growth rate of 5.2% recorded in 2019. The group added $1.5 billion in transmission rate base from 2023 to 2024, the largest annual addition to the group's rate base in at least 10 years.

Recent developments indicate the region is poised for continuing growth in the coming years. In October 2024, SPP's integrated transmission planning process reached a milestone when the grid operator's policy committee voted to support billions of dollars in new transmission projects: Southwest Power Pool stakeholders endorse $7.68B transmission projects portfolio. On Feb. 5, 2025, SPP selected Xcel Energy to build three of the projects in the portfolio, consisting of approximately 350 miles of new transmission lines with an estimated cost of $1.76 billion: SPP picks Xcel Energy to build its first 765-kV transmission line.

Xcel Energy's PSCo is also developing the $1.7 billion Colorado Power Pathway project, a 550-mile, 345-kV transmission line that includes four new substations and the expansion of four existing substations. The project is intended to provide a backbone network transmission system in eastern Colorado to integrate new renewable energy resources needed to meet Colorado's clean energy goals. The project is under construction and is expected to be completed in segments between 2025 and 2027.

Parent companies

At the parent company level, the aggregate rate base for Evergy's three subsidiaries increased 17.0% year over year, to $3.86 billion in 2024 from $3.30 billion in 2023. Since 2019, Evergy's total transmission rate base has nearly doubled, from $2.04 billion to $3.86 billion, a compound annual growth rate (CAGR) of 13.6%.

According to a recent RRA analysis, Evergy's capital expenditures also nearly doubled from 2019 through 2023, from $1.21 billion to $2.33 billion, and the company was on pace to top its 2023 total with capital expenditures of over $1.30 billion through the first half of 2024. The RRA analysis also reported that Evergy forecasts capital investments in transmission averaging more than $625 million each year for the next five years: Energy utility capex projected to eclipse $790B from 2025 through 2028.

The four subsidiaries of AEP in SPP reported an aggregate rate base of $3.82 billion in 2024, an increase from $3.44 billion in 2023, or 11.0%. The two subsidiaries of Xcel Energy in SPP reported an aggregate rate base of $5.39 billion in 2024, an increase from $4.94 billion in 2023, or 9.0%.

According to RRA's capital expenditures report, Xcel Energy forecasts transmission capital expenditures averaging nearly $2.4 billion each year for the next five years. Because the forecast data in RRA's analysis is reported at the parent company level, Xcel Energy's forecast would include capital expenditures for subsidiary Northern States Power Co. in the Midcontinent ISO.

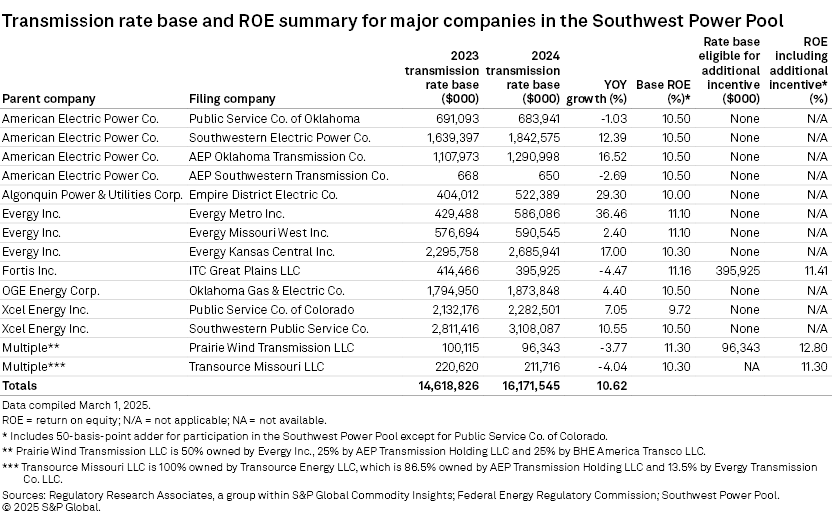

The accompanying table highlights the SPP companies covered in this analysis listed by parent company, each company's reported transmission rate base for 2023 and 2024, their base ROE, and any additional ROE incentive adders where applicable.

Refer to the linked data tables for transmission rate base, authorized ROEs and other ratemaking parameters from 2018 through 2024 for the SPP companies by parent company and an appendix containing transmission rate base data for the same companies from 2011 through 2024 as available.

Individual companies

For the second consecutive year, Evergy Metro Inc. recorded rate base growth of more than 36% and led the SPP group in rate base growth from 2023 to 2024. After the company recorded strong year-over-year growth of 38.5% in 2023, Evergy Metro recorded a nearly equally strong 36.5% year-over-year growth in 2024. Since 2022, Evergy Metro's rate base has climbed from $310.2 million to $586.1 million, or almost 90%.

Four of the five largest companies in the SPP group also recorded year-over-year double-digit growth, led by Xcel Energy's Southwestern Public Service Co. (SWPS), the largest company in the SPP group as measured by rate base. SWPS reported $3.11 billion in rate base in 2024, an increase from $2.81 billion in 2023, or 10.5%. Evergy Metro's sister company, Evergy Kansas Central Inc., recorded year-over-year growth of 17.0%. Two AEP companies in SPP, Southwestern Electric Power Co. and AEP Oklahoma Transmission Co. Inc. (AEPOKT), recorded year-over-year growth of 12.4% and 16.5%, respectively.

Empire District Electric Co., a subsidiary of Algonquin Power and the smallest utility operating company in the SPP group, reported a rate base of $522.4 million in 2024, an increase from $404.0 million in 2023, or 29.3%.

AEPOKT reported the only year-over-year rate base growth of the five transcos in the SPP group. AEP's second transco in the group, AEP Southwestern Transmission Co. Inc. (AEPSWT), reported less than $1 million in transmission rate base in 2024. AEPSWT's rate base is included in both AEP's and the SPP group's annual totals but has been omitted from charts where noted.

Three of the transcos — Prairie Wind Transmission, Transource Missouri and ITC Great Plains — reported a decline in rate base year over year. The three transcos completed major long-distance transmission projects in the region between 2012 and 2016. According to the three transcos' annual formula rate updates, Prairie Wind Transmission and ITC Great Plains have reported a general decline in their rate base each year since 2016. Transource Missouri has reported a general decline in the company's rate base each year since 2017.

Return on equity in SPP

FERC has established base ROEs for transmission owners in SPP on a company-by-company basis. Base ROEs range from 9.72% for Xcel Energy's PSCo to 10.80% for Prairie Wind Transmission, excluding any ROE incentive adders.

The most recent adjustment to the base ROE for a company in the SPP group of companies occurred in 2020 when AEP reached a settlement to resolve a complaint challenging the 10.70% base ROE in the transmission formula rate of AEP's four subsidiaries in SPP. The complaint was filed by East Texas Electric Cooperative Inc., and the settlement in the proceeding reduced the base ROE in the formula rate for the AEP companies to 10.00%.

Apart from base ROEs, FERC has authorized a 50-basis-point ROE adder for all the companies in SPP except PSCo for participating in an RTO/ISO. PSCo is a financial-only "market participant" in SPP, not a transmission owner under SPP's open access transmission tariff. Financial-only market participants participate in SPP's markets through virtual energy offers, virtual energy bids, transmission congestion rights auctions and/or bilateral settlement schedules.

FERC has also authorized additional ROE incentive adders of 25 basis points for Fortis subsidiary ITC Great Plains, 100 basis points for Transource Missouri and 150 basis points for Prairie Wind Transmission.

RRA's analyses and the SPP companies

Given the complexities inherent in determining a company's rate base from an outside perspective, the RRA analyses of transmission ratemaking in the six RTOs/ISOs in the US and the seventh report covering utilities in non-RTO/ISO regions, with very limited exceptions, include transmission rate base only for those companies that report such data in their annual updates under a formula-based rate framework.

The mechanics of determining rate base — the items that may be reflected in rates at a given time and how their value should be calculated for ratemaking purposes — are explained in greater detail in Rate base: It's more complicated than it sounds.

The transmission rate base and other data in RRA's analyses are drawn from the companies' initial formula rate updates filed each year and may not reflect subsequent revisions or true-ups filed by any of the companies.

RRA first published this analysis of utilities in SPP in 2015. The first report compiled five years of rate base and other data — 2015 data and four years of historical data. RRA has subsequently published annual updates to that first report for a total historical dataset covering 13 full years from 2011 through 2023, where available.

The first SPP report included the same 14 companies that make up the current roster, although data was not available for Transource Missouri from 2011 through 2013. Transource Missouri data was added beginning in 2014.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location

Products & Offerings

Segment