Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Jun, 2021

By Inna Popesku

In our first blog of Impairment Latin American and Caribbean Market Considerations Blog Series we had a focus on IFRS 9. In this blog we will focus on the Loss Given Default (LGD) component.

Many institutions struggle with developing sound methodologies for LGD estimation due to the limited default and recovery data. As a result, historically most financial market practitioners used average historical losses as indicators of future expected losses. This simplified approach is not well suited for IFRS 9 purposes as averages, by definition, are not PIT nor supported by empirical evidence.

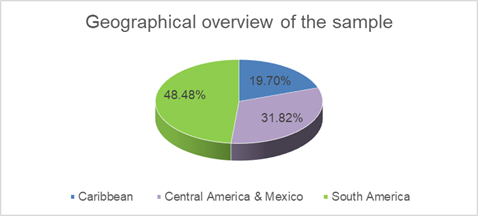

We have run an exercise that dives into the LGD considerations for The Caribbean and Latin American regions. As part of this exercise we have used the data from Capital IQ database as of March 2021. Using this data, we have created a portfolio of 66 entities in the region for which we have derived entity specific LGD. The results of this exercise were derived using the S&P Global Market Intelligence Loss-Given Default (LGD) model. Using our proprietary formula for economic expectations as utilized in our Corporate LGD model, we have generated weighted LGD that could be used for IFRS 9 purpose. In our generated portfolio, South America represented the biggest part of the sample with slightly over 48% as seen on the pie chart below.

Data extract: S&P Global Market Intelligence Capital IQ database as of 22 March 2021

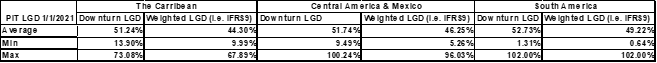

The result of the exercise indicates that on average the Downturn LGD as of the date of the assessment was 52.3%, while weighted LGD (i.e. Generated for IFRS9 purposes) was close to 47.8%. The minimum LGD was 1.3% and 0.6%, for Downturn LGD and weighted LGD respectively. In the meantime, the maximum LGD went as high as 102%, indicating a Loss above 100% accounting for the recovery costs. Therefore, as illustrated in this example, by using the “average” LGD without considering company and instrument specific recovery one runs into the risk of either under- or overestimating the level of credit risk in their portfolio.

To further support this argument, we have analyzed the data at a more granular level. As shown below, further investigation of sub-regional specific data indicates that instrument specific LGD can deviate from simple averages quiet significantly from one sample to another.

Data extract: S&P Global Market Intelligence LGD Scorecards.

Although above figures represent a hypothetical portfolio, they provide a valuable insight on the magnitude of the impact that one may expect to see when considering credit losses.

As demonstrated in the above sample, active monitoring of the portfolio including the impact of macroeconomic factors pertinent to Latin American and Caribbean Market is the key to accurate IFRS 9 provisioning. These factors will impact provisioning not only via Expected Credit Loss but also through Staging classification. Hence, when considering a solution for IFRS 9 purposes it is crucial to consider regional specific considerations.

The above study was conducted using the S&P Global Market Intelligence Loss-Given Default (LGD) model that allows to follow the process of recovery in order to obtain instrument specific LGD while taking into not only Economic Value at default, Insolvency regime, position in the debt waterfall and recovery package but also reflect economic expectations regarding sector-specific volatiles of Economic Value as part of this process.