Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 24, 2024

By Jingyi Pan

Japan's private sector returned to growth at the start of the second half of 2024. The rate of expansion was solid, though driven mainly by a booming service sector while manufacturing production contracted marginally in July.

Meanwhile, the theme of rising inflationary pressures lingered into July, with rates of input cost and output price inflation both increasing - albeit with variations by sector. The intensification of cost pressures adds reasons for the Bank of Japan to further normalise its monetary policy, though a cooling of business confidence in July and the unbalanced output conditions add uncertainty to the outlook for the interest rate path.

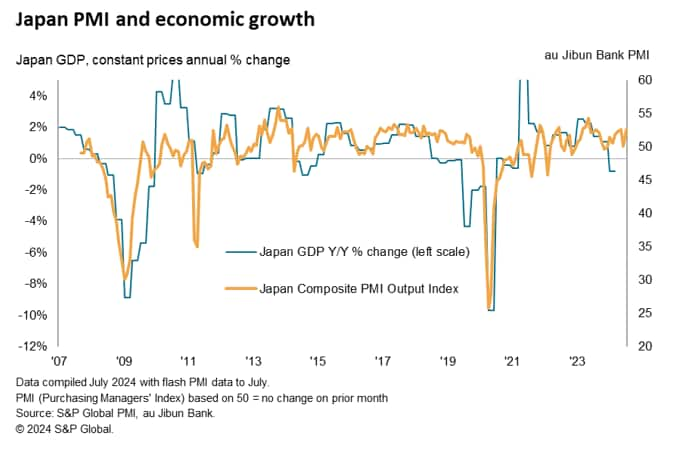

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 52.6 in July, up from 49.7 in June. Rising past the 50.0 neutral mark, the flash reading, based on approximately 85%-90% of typical PMI survey responses each month, indicated that Japan's private sector conditions improved again following a brief deterioration in June.

Furthermore, the rate of growth was solid and the joint-fastest in the past 14 months, matching by both August 2023 and May 2024. Overall, the latest composite output reading - covering both manufacturing and services - is historically consistent with GDP growing at an annual rate of slightly over 1% at the start of the third quarter.

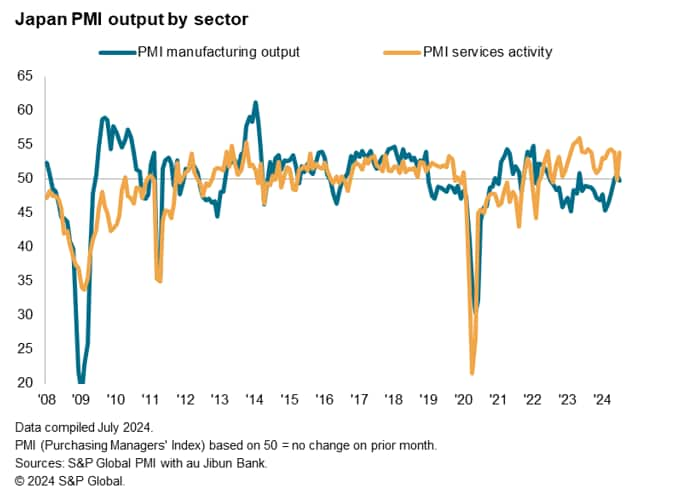

A reversal in sector performance was observed again in July, this time with services returning to lead growth while manufacturing output shrank.

Services activity rose at the fastest pace since April, supported by solid expansions in services new business amid improved demand conditions. More importantly, greater recruitment of staff on both full- and part-time bases meant that service providers were better able fulfil orders, facilitating the latest uptick in activity. The level of outstanding business nevertheless accumulated at the fastest pace since March, despite the solid rise in employment levels, and is therefore indicative of services activity rising further in the coming months.

In contrast, manufacturing output fell in July after recording the first expansion in 13 months during June. Although the rate at which production contracted was only marginal, marked reductions in both new orders and the level of backlogged work hint at further downturn for the goods producing sector. Where lower new orders were reported, Japanese manufacturers often mentioned subdued domestic and external demand conditions underpinning the fall in new work, with weakness in the auto sector often highlighted. Although Japanese manufacturers continued to raise staffing levels, the solid reduction in purchasing levels and reluctance to hold additional inputs and raw materials spoke to the reduction in optimism regarding future output.

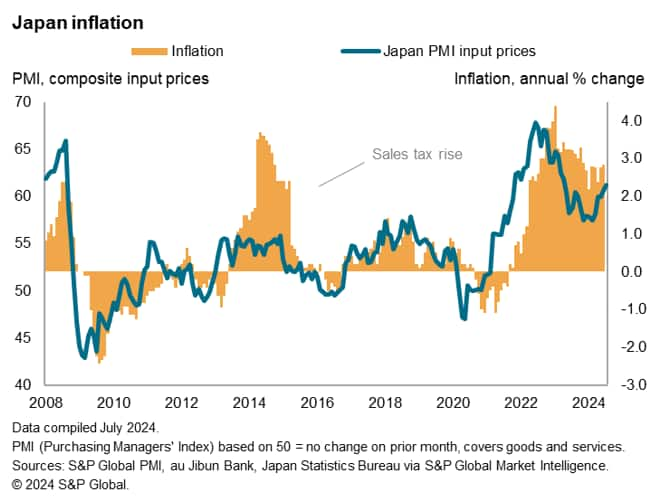

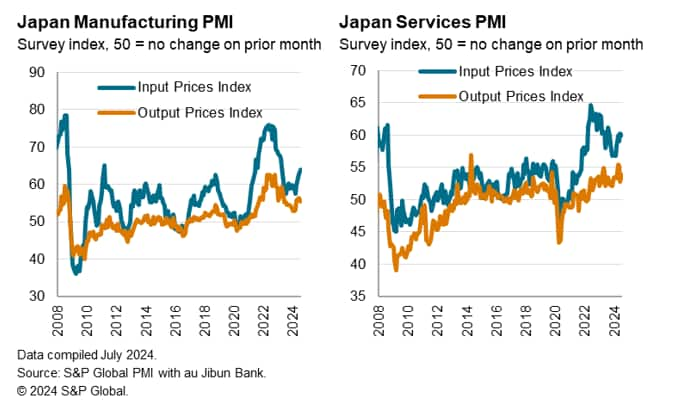

Cost pressures meanwhile climbed alongside the overall rise in business activity in July. Average input prices, measured across both the manufacturing and service sectors, rose at the fastest pace since April 2023 on the back of the yen weakness. This led to private sector firms raising their selling prices at a quicker rate in July.

That said, a closer look at the price trends by sectors reveal divergences in pricing power. While Japanese manufacturers experienced the highest input cost inflation in 15 months, the rate of factory output price inflation eased to a four-month low as producers sought to price more competitively to support sales. In contrast, Japanese service providers lifted selling prices at an accelerated pace in July even though input costs increased at a slightly slower pace compared to June. This pricing power variance is reflective of the differences in demand conditions between the two sectors.

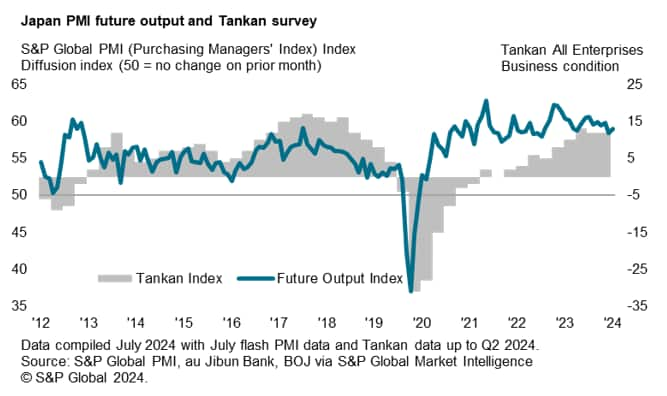

The PMI Future Output Index also revealed divergences in sentiment. The overall level of confidence was dragged down to a nine-month low amidst the paring of optimism in the manufacturing sector. Concerns among goods producers centered mainly around softening demand conditions and an uncertain global growth outlook. Services firms were the most upbeat since May, in contrast.

As such, the latest flash PMI data embodied the Bank of Japan's dilemma over whether to raise rates at their upcoming monetary policy meeting. On one hand, the sustained increase in inflation pressures, attributed partially to the weak domestic currency, adds to arguments to hike rates. On the other hand, the more detailed sector PMI data revealed the imbalance in economic conditions by sector when one looks under the hood, with the slowdown in the manufacturing sector one of concern.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.