Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 22, 2023

By Jingyi Pan

Japan's private sector economy continued to grow in September, extending the sequence of expansion that commenced at the start of 2023. That said, the pace of improvement slipped to the weakest in seven months according to flash PMI data. Slower service sector growth, attributed in part to a renewed decline in new business from abroad, and a quicker fall in manufacturing output underpinned the latest slowdown. Moreover, business confidence further declined in September, foreshadowing weaker conditions to come.

The slower rise in private sector output was however accompanied by softer cost pressures for firms which led to businesses raising their charges at a slower pace at the end of the third quarter. While the expected near-term performance for Japan CPI remains above the 2% mark, the latest flash PMI may offer some relief for Bank of Japan watchers fearing any sudden end to the ultra-accommodative policy.

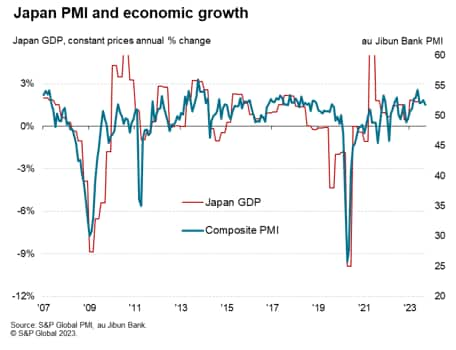

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, slipped to 51.8 in September from a final reading of 52.6 in August. The latest reading was the weakest in seven months but is nevertheless consistent with a ninth monthly rise in private sector output in September. This brings the Q3 average reading to 52.2, softening from the Q2 average of 53.2. Furthermore, the latest composite output reading, covering both sectors, is broadly consistent with GDP growing at an annual rate of around 1.5%, which remains higher than the pre-pandemic 10-year average of around 1.0%.

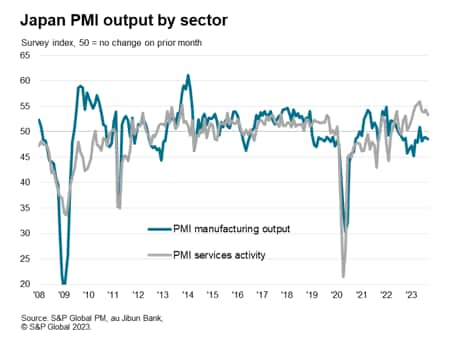

Japan's economic expansion remains driven by services in September as the sector extended the sequence of expansion to 10 months. Although the pace of growth was the shallowest in eight months, it remained solid. Service providers continued to see improvements in conditions following the easing of pandemic restrictions from around a year ago, but this was mainly domestic-driven as new business from abroad fell for the first time since last August. Services firms were also the least upbeat in eight months, outlining the potential for further moderating of growth momentum in the coming months.

Meanwhile Japan's manufacturing output fell for a fourth straight month in September and at a faster rate since August. New orders for Japanese manufactured goods declined at a historically elevated pace in September as global market conditions worsened and with destocking efforts still ongoing at clients according to anecdotal evidence. Likewise for manufacturers, business confidence eased from August and the sustained shedding of the volume of backlogged work in the manufacturing sector further outline the likelihood for the downturn to persist.

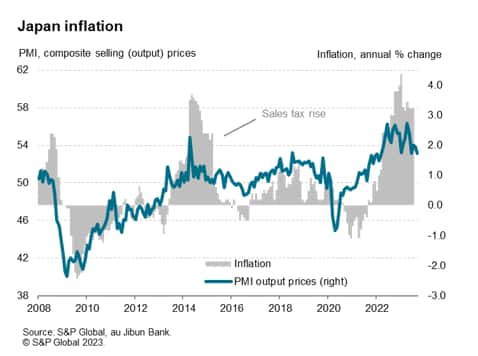

Alongside the near stagnation of new orders growth, measures across manufacturing and services, price pressures eased in September. Input cost inflation fell in the latest survey period after climbing in the past two months. This was mainly due to lower service sector cost inflation as manufacturers faced faster rise in prices from a weakening yen and higher raw material and energy costs. Consequently, firms passed on higher costs at a slower rate, though again attributed to a slowdown in service sector charge inflation with manufacturing selling price inflation staying unchanged in September.

The implication here for Japan's CPI, which the PMI output price index tends to lead from a trend perspective, is that the index may lower in the coming months. This offers some relieve for market watchers concerned of any increased impetus for the Bank of Japan to exit current monetary policy settings, even though the departure from the ultra-lose monetary policy settings in 2024 appear to be the broad market expectation at present.

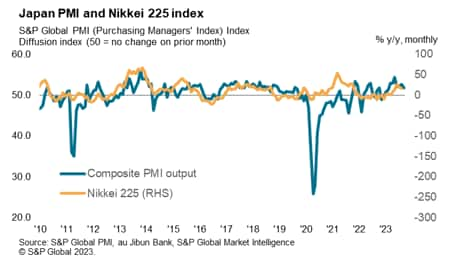

Finally, the Japanese equity market, which finds a broad correlation with PMI data could see upsides capped in the near-term given the latest PMI update showing softening growth. The lower Future Output Index further alludes to the likelihood we may see prices trend lower for the likes of the Nikkei 225.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location