Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 21, 2024

By Jingyi Pan

Japan's private sector picked up growth momentum into the end of the first quarter, according to flash PMI data. This was attributed mainly to faster service sector expansion, though manufacturing output also declined at a slower rate in March. Notably, services new business grew at the quickest pace in nine months, helping to drive growth across the sector.

Amidst faster business activity expansion, price pressures intensified leading to higher output price inflation.

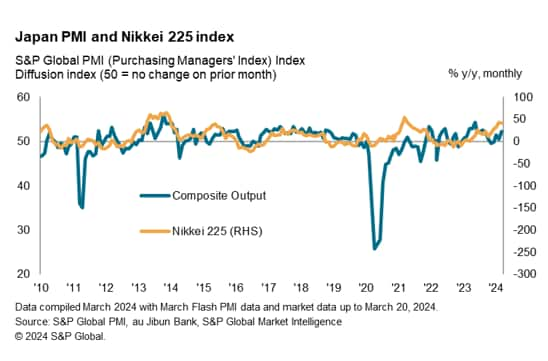

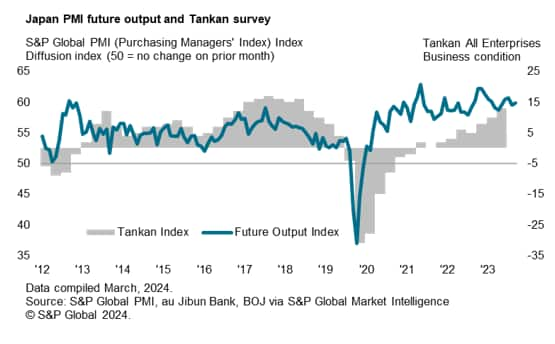

Optimism among Japanese private sector firms also improved in the latest survey period, the latest PMI reading supportive of gains in the equity market.

While the data hint a combination of faster growth and some resurgence of inflationary pressures, such developments are unlikely to fuel strong convictions for further monetary policy moves just yet, following the recent end to the negative rates regime.

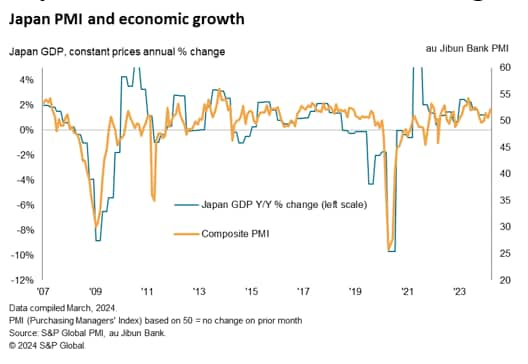

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 52.3 in March from 50.6 in February. The flash reading, based on approximately 85%-90% of total PMI survey responses each month, therefore suggests that Japan's private sector conditions improved at an accelerated pace at the end of the first quarter. The latest composite output reading - covering both manufacturing and services - is historically consistent with GDP growing at an annual rate of just under 2% at the end of the first quarter.

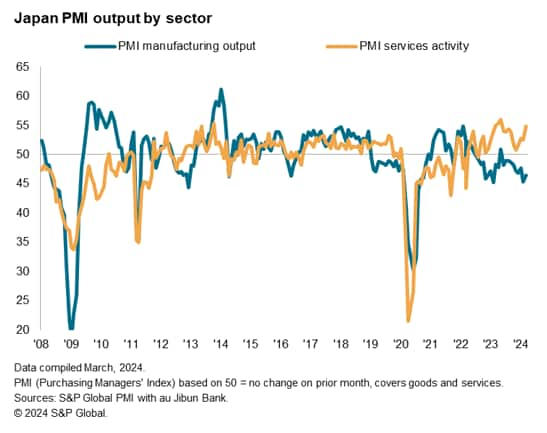

The service sector remained the main driver of growth in March. Services activity expanded at the fastest pace in ten months, supported by an acceleration in new business growth. Anecdotal evidence suggested that better economic conditions and increased tourism activity helped incoming new business rise at the quickest rate since June 2023. Moreover, March flash PMI data also revealed sustained pressure on capacity as the level of outstanding business again rose at a solid pace. The rise in outstanding business occurred despite firms raising their staffing levels at a solid rate to cope with ongoing operations.

Meanwhile, the manufacturing sector remained in contraction with output falling for a tenth straight month in March. Although the rate of manufacturing output declined eased from February, new orders placed at factories continued to fall at a marked pace, hinting at further reductions in manufacturing activity in the near-term. Forward-looking indications - including the Backlogs of Work Index and the Future Output Expectations Index - further signalled spare factory capacity and reduced optimism in March.

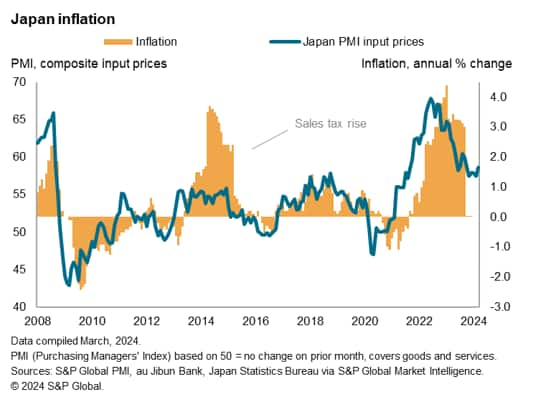

Amidst accelerating overall growth, the latest flash PMI data further outlined rising cost pressures for Japanese private sector firms. Both the manufacturing and service sectors recorded higher cost inflation in March, and at rates above their respective series averages. Higher raw material, fuel, transport and staff costs were listed as the main drivers of rising cost pressures, in turn pushing output prices higher at the joint-fastest pace since last July.

The latest PMI price indications are consistent with the headline CPI climbing in the months ahead, though remaining subdued below the 2.0% level. Given the Bank of Japan's (BoJ) March exit from the negative interest rate regime, ending months of speculation, the focus now shifts to how inflation will likely trend and guide possibilities of any further tweaks. The latest PMI prices data, while having suggested a slight increase in the inflation rate, nevertheless point to subdued price pressures in the coming months, therefore backing market expectations of a long BoJ pause.

Japanese equities continued to rally following the March BoJ meeting decision and would also find the latest PMI data supportive of ongoing gains. This is a departure from the deviation observed earlier between the Nikkei 225 and the composite PMI index at the start of 2024, when the Nikkei 225 rallied on despite subdued PMI performance. Given the strong historical correlation between the two, it is therefore positive news for equity market gains to see the composite PMI rising into the end of the first quarter.

Additionally, future sentiment across the Japanese private sector remained positive in March. The level of business confidence about the year ahead rose further above the series average to signal expectations of sustained business activity growth in the near term. Although the improvement to sentiment was mainly observed in the service sector, the latest data are indicative that the positive momentum may continue.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location