Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 13, 2023

Developments for 2022 were the driving force of change in many areas of global trade with particular influence on global and especially European armaments. The aim of this analysis is to make an assessment on trends and developments in armaments trade in recent years. It is worth noting that this analysis applies only to nonconfidential reported trade data and does not cover secret arms purchases. It should also be noted that exports should not be confused with total armaments production, as armaments industry supplies mainly domestic demand.

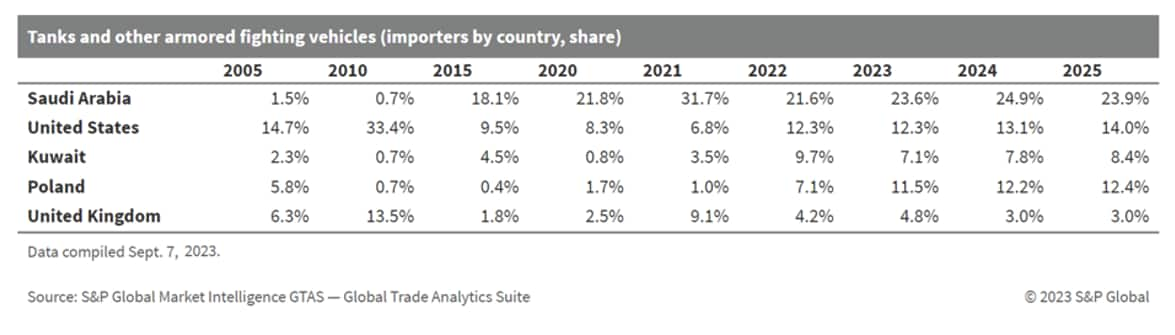

Looking at imports of tanks and other armored fighting vehicles from the perspective of individual countries, the main importers in 2022 were Saudi Arabia, the United States, Kuwait, Poland and the United Kingdom. The total share of these countries in global imports was 55%, and this share is expected to increase to over 61% by 2025. The largest increase in 2022 compared with the previous one was recorded by Poland, from 1.0% in 2005 to 7.1% in 2022 with upward trend and with an increase to 12.4% in 2025.

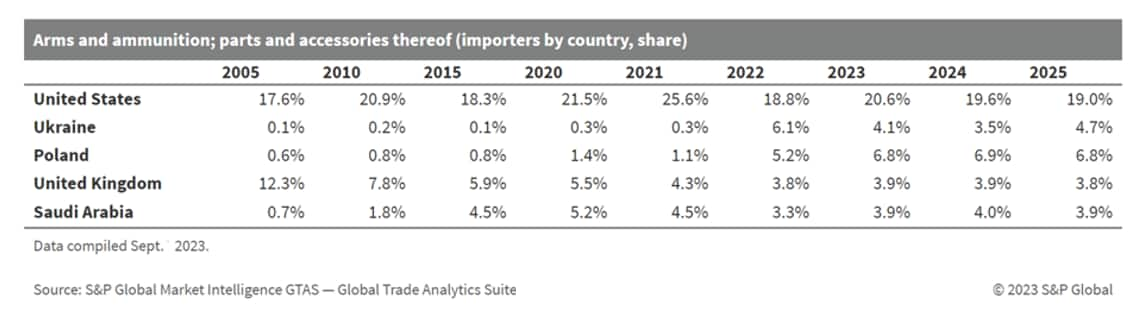

According to the Market Intelligence GTAS Forecasting, the largest importer of arms and ammunition; parts and accessories thereof are the United States, its share in world imports ranged from 17.6% to 25.6%. The largest increase in world imports was recorded by Ukraine, which is not surprising owing to its armed conflict with Russia. And so, Ukraine's share in 2021 was 0.3%, while in 2022 it was already 6.1%, depending on how this conflict develops, the trend may be downward or upward, as of today it is expected that this share will decrease to 4.7% in 2025. The next country is Poland, which also seems natural because Poland borders Ukraine and Russia, two countries that are at conflict with each other.

The largest exporters in terms of value of tanks and other armored fighting vehicles are the United States and Canada, their total share in global exports was over 54% in 2022. According to the Market Intelligence GTAS Forecasting, it is estimate that in 2025 it will reach over 50%. The next main exporter is South Korea, whose share in global exports is steadily growing and so this share was 0.1% in 2005, while in 2022 it was 8.7% and it is expected to reach 14.6% in 2025.

In the case of Europe, 2022 saw a stable increase in tanks and other military vehicles export. Although domestic European exports slightly decreased from $424 million to $383 million between 2020 and 2022, growth in exports from Asia and US more than made up for these declines. From outside of Europe major exporters were South Korea (growth from $74 million (2020) to $207 million (2022), 177% increase), United States ($83 million in 2022, 50% increase) and Canada ($21 million, 327% increase). At the same time domestic European export whose share had decreased from 58% to 45% also changed its structure. Downward trend was mostly caused by Switzerland, which limited its exports from $293 million to $163 million from 2020 to 2022.

In the case of arms and ammunition exports increase in imports was much more significant. Total value of export grew from $4.4 billion to more than $9.2 billion. Domestic European exports did not change its share in whole exports to Europe significantly — from 50% in 2020 to 57% two years later. Among major non-European exporters, it was the United States that remained its major position in 2020 and 2022. US exports constituted respectively to 17.5% and 17.4% of all European imports. Rapid growth in exports could be observed among domestic exporters — Bulgaria surpassed the United States in nominal value of exports and became the biggest exporter of arms and ammunition to other European countries. At the same time, rapid growth in exports can also be observed in Poland, Germany and Slovakia.

To sum up, recent years have been a period of intensified changes in the arms trade, which have contributed to major shifts in the global hierarchy of arms suppliers. Countries such as Poland and Ukraine increased their share in global military imports significantly while at the same time others such as the United States strengthened their positions as major exporters. Some countries such as Bulgaria and South Korea experienced rapid growth in their military exports, which allowed them to join the world's largest exporters. As we can see, changes in the armament trade are very dynamic and further investments in the arms industry, especially in European countries, suggest that this trend will continue in the future.

This column is based on data from S&P Global Market Intelligence Global Trade Analytics Suite (GTAS) & GTAS Forecasting.

For more details about Global Trade Analytics Suite (GTAS) please visit the product page

For more details about GTAS Forecasting please visit the product page

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?