Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Apr, 2022

By Alice Yu and Aude Marjolin

Introduction

The transition to electromobility plays a leading role in reducing carbon emissions and achieving carbon neutrality. The long-term switch from internal combustion engines, or ICE, to plug-in electric vehicles, or PEV, is boosting demand for traction lithium-ion batteries, or LIB. This article focuses on the drivers of LIB capacity growth in the PEV sector. A small portion of this capacity also serves the energy storage market, which is another factor powering the transition to greater renewable generation — an aspect not covered by the article.

LIB capacity investments accelerated in 2021 as more carmakers stepped up their commitments to PEVs, with decarbonization becoming a top global priority. We expect LIB capacity to increase more than threefold to 2.8 TWh in 2025 from 0.8 TWh in 2021, with the potential to surpass 5.9 TWh in 2030. The growth is led by expansion in China's locally integrated LIB supply chain, while Europe and the U.S. are building up their capacities to gain greater self-sufficiency.

There was a torrent of battery capacity investments in 2021, as battery producers attempted to expand capacity to align with automakers' deepening commitments to PEVs. We have upgraded our 2025 global LIB capacity estimate by 92.1% compared with our February 2021 projection, to 2.8 TWh from 1.4 TWh.

The LIB capacity investments remain concentrated in the top PEV markets — China, Europe and the U.S. — from increasing localization as well as the integration of battery production with PEV manufacturing and sales. The detailed rationale is outlined in our 2021 article.

China leads global LIB capacity; EU, US catching up, establishing local supply

We expect passenger PEV sales to rise at a 30.8% CAGR over 2021-25 to 18.8 million units, equivalent to 915 GWh of batteries installed in the vehicles sold. The top three PEV markets are at different stages of uptake. The EU leads in penetration rate, which averaged 18.2% in 2021, as a result of strict carbon emissions penalties and higher subsidies in key markets as part of their post-COVID-19 recovery packages. China is moving from subsidy- to market-led drivers; the passenger PEV penetration rate averaged 15.5% in 2021 and is forecast to exceed its 20% target set for 2025 this year. In the U.S., policymakers are debating how to broaden national subsidies to boost nationwide uptake, with the penetration rate only averaging 3.7% in 2021.

China will retain its lead position and dominate growth. The country's capacity is set to rise 2.3-fold to 1.6 TWh by 2025 and then to 3.4 TWh by 2030, driving 54.1% of global capacity growth over 2021-30. The country's share of global capacity will nevertheless decline to 58.3% in 2030 from 84.6% in 2021, due to more ferocious share growth in Europe over this period.

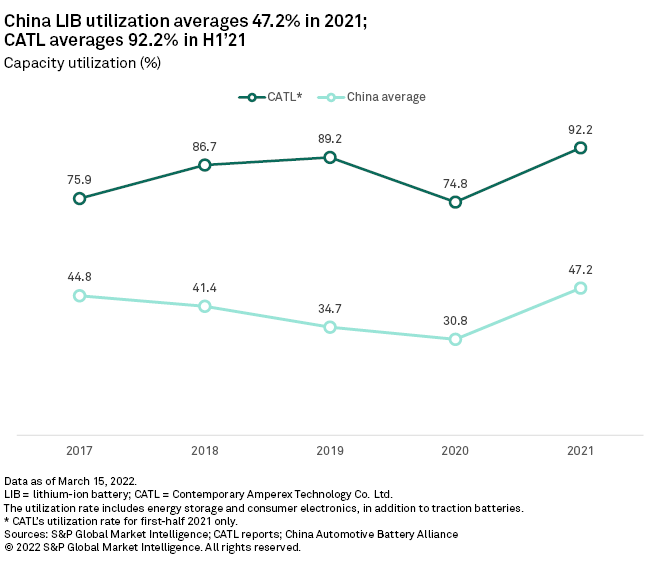

In 2021, Contemporary Amperex Technology Co. Ltd., or CATL, accounted for 13.0% of global LIB capacity and 52.1% of the top 10 companies in Chinese traction LIB installations, the latter according to the China Automotive Battery Innovation Alliance. CATL is forecast to remain the largest battery producer both in China and globally in 2025, with expansion investments supported by strong relationships with customers, high-quality products and robust cashflow today. Top-tier Chinese battery makers are facing a very different reality than those at the lower end. The former have been overwhelmed by orders, with many operating during the Lunar New Year holiday in February, while the latter face mounting debt and losses. In fact, CATL operated at a 92.2% utilization rate in the first half of 2021, while the Chinese industry's full-year average was 47.2%.

European LIB capacity is set to rise 14-fold across 2021-25 to 673 GWh, and subsequently to more than double to 1.4 TWh in 2030. The inauguration of Tesla's Berlin Gigafactory will give Germany the largest capacity by 2023. In 2030, Italy could potentially take the top position as automaker Stellantis NV, created from the merger of Fiat Chrysler Automobiles and the French PSA Group, plans for 260 GWh of integrated LIB capacity. Sweden could vie for second position, as Northvolt AB's plans for a third gigafactory in the country could add up to 100 GWh of capacity as early as 2025.

From 2021 to 2025, eight countries in Europe will join the ranks of LIB producers with more than 1 GWh of capacity; six of these countries are part of the EU. By 2025, about half of EU countries will have LIB operations. Capacity volume will be more geographically diverse compared with 2021, when LG Energy Solution Ltd.'s Polish operation and Samsung SDI Co. Ltd.'s Hungarian operation represented an aggregate 71.8% of Europe's total capacity.

U.S. LIB capacity is forecast to rise 10-fold in 2021-25 to 382 GWh and further to 620 GWh by 2030. The largest capacity additions in the U.S. fleet over 2021-25 will come from joint investments between automakers and their battery partners. Planned capacity expansions by the joint venture between LG Energy Solutions and General Motors Automotive Co., and SK Innovation Co. Ltd. in collaboration with Ford Motor Co. will bring the total share of U.S. LIB capacity to 13.7% in 2025, from 4.7% in 2021. Beyond 2025-30, Tesla's in-house battery production capacity could lead the U.S. LIB output.

European policymakers have made greater headway in supporting local LIB production compared with the U.S., including the EU-funded European Battery Innovation Project, the U.K. government-backed Automotive Transformation Fund, loans from the European Investment Bank and loans backed by individual European governments. The Finnish government has further provided grants for midstream battery cobalt and nickel capacity expansion. The U.S. is calling to boost domestic LIB manufacturing, but federal funding priority is currently focused on charging networks to encourage uptake instead of production.

Battery raw material self-sufficiency, recycling

Battery-to-raw material integration has been the second driver of LIB capacity growth and regional diversification. A workable path to LIB supply security in North America lies in cooperation between countries. The U.S.-Mexico-Canada Agreement, or USMCA, only waives tariffs for light-duty electric vehicles where at least 75% of the traction battery as well as the vehicle's component value are made regionally. The North American battery value chain aspires to leverage the framework. GM, Ford and Stellantis are looking to build PEV manufacturing capacity in Canada; there are also plans for 130 GWh capacity, which will allow Canada to join the ranks of LIB producers from 2023. In the battery midstream, both BASF SE and a joint venture between GM and Posco Chemical Co. Ltd. plan to build precursor and cathode facilities in Quebec, while Toronto-headquartered Electra Battery Materials Corp. is targeting battery cobalt production in December. On upstream resources, the U.S. is looking to Canada to source regionally produced commodities for its PEV production, as Canada hosts nickel and cobalt operations and has historical lithium production.

The road to cooperation still has challenges. Canada and Mexico filed a dispute under the USMCA against U.S. tax credits proposals for locally made PEVs and batteries, which would favor U.S.-based production and undermine efforts to develop a regional supply chain.

Indonesia is an example of a resource-rich country successfully integrating downstream into batteries. The country is benefiting from an expansion in nickel and cobalt processing capacity, encouraged by the second ban on nickel ore exports, which started in 2020. Geographically, Indonesia sits astride the largest lithium shipping route from Australia to China. LG Energy Solutions is leading battery investment in the country, targeting 10 GWh capacity by 2024.

Battery recycling can be a key local source of raw materials in the major PEV markets as the pool of end-of-life LIBs grows. As the recycling industry is at an early stage of development, establishing a regulatory framework will take time. The Chinese recycling industry remains fragmented and has limited economic viability due to a lack of scale and collection networks. There are centralized efforts across China, however, to finalize a policy framework and set standards and specifications as the industry evolves. The EU is still discussing proposed updates to the Battery Directive, first issued in October 2020, which currently does not cover waste traction batteries for electric cars. The latest proposal includes requiring at least 70% recycling efficiency for lithium in the LIBs, and 95% for cobalt and nickel, by 2030.

Cost of going electric

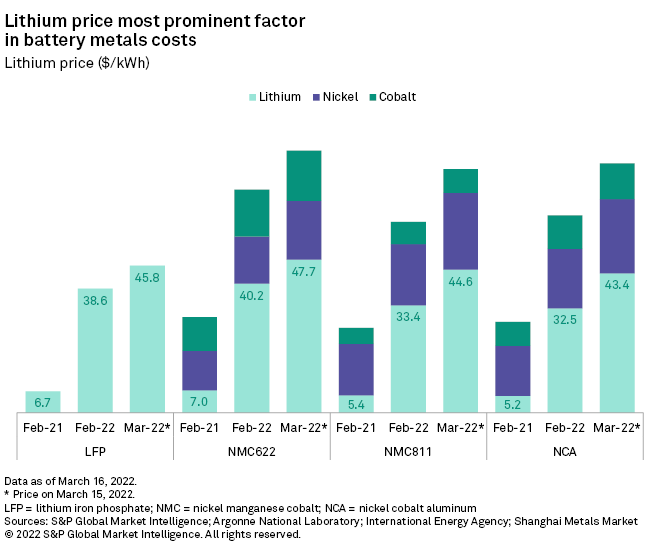

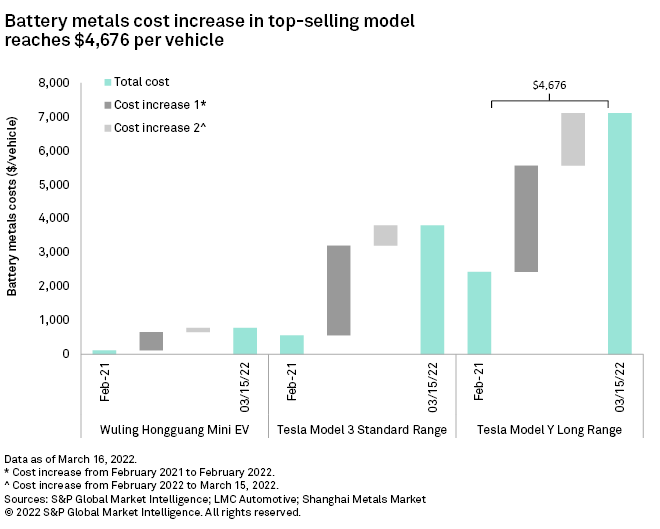

PEV prices have risen considerably since 2021 on higher chip and battery metals costs. Year over year in February, costs of battery metals — lithium, cobalt and nickel — in China were up 475.5% for lithium-iron-phosphate batteries on a kilowatt-hour-per-kilogram basis and 130.3% on average for nickel-manganese-cobalt batteries. Lithium has been the largest driver of cost increases since February 2021, even when factoring in the nickel price surge in the first half of March 2022.

The costs of battery metals in China-made Tesla Model 3 and Model Y were up $3,241 and $4,676 per vehicle, respectively, between February 2021 and March 15, 2022, with higher lithium prices contributing to 78%-100% of the increase. The markups were equivalent to 7%-9% of the vehicle ticket price in February 2021.

We nevertheless remain upbeat regarding PEV sales. Policy supports are making PEVs more attractive than ICEs, thereby supporting long-term battery capacity additions. Higher battery metals costs will lead battery and auto innovators to cut costs through design innovations and to realign supply chains in light of recent geopolitical events.

LIB capacity investments accelerated in 2021 as more carmakers stepped up their commitments to PEVs, and as battery producers attempt to expand capacity to meet this future demand.

Battery producers like CATL are expanding in response to capacity tightness and anticipated strong demand. Joint ventures between battery makers and auto producers is an important force in delivering near-term capacity additions in Europe and the U.S. — the second- and third-largest PEV markets.

There are growing commitments by automakers, such as Tesla in the U.S. and Stellantis in Italy, to increasing in-house battery capacity proximity to PEV production, and sales could make them their countries' largest LIB players by 2030. Battery producers are also looking to resource-rich nations to build downstream capacity, such as LG Chem's Indonesia venture.

While it appears LIB capacity is gaining sufficient investment interest for at least the next five to six years in meeting the PEV transition, the availability of raw materials remains a limiting factor.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.