Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Mar, 2022

By Sarah Cottle

Today is Tuesday, March 22, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition, we explore the potential impact of the Russia-Ukraine war on banking systems across regions. Banks in the U.S., Europe and Latin America are expected to see limited direct fallout from the conflict due to their minimal exposures to Russia. However, knock-on effects from the war such as higher oil prices, increasing inflation and weaker economic growth could put pressure on bank asset quality and profitability, according to S&P Global Ratings. Meanwhile, Russian lenders are facing the increasing risk of a liquidity squeeze as international sanctions sharply reduce the central bank's access to foreign exchange reserves.

The number of U.S. workers with at least a bachelor's degree hit an all-time high of 62 million in February, a 30% increase in about a decade, according to the Bureau of Labor Statistics. This shift in educational attainment among the American workforce will exacerbate an already tight labor market, forcing businesses to try to attract new hires with higher wages, economists said. College graduates have been unwilling to fill millions of jobs offering relatively low wages in industries like retail and hospitality.

Hydrogen pilot project updates from gas utilities show that the industry is starting to execute on its plans to demonstrate the fuel's ability to decarbonize distribution systems. Some of the more than two dozen projects announced since 2020 are preparing to get underway, while others are already producing data and yielding lessons for operators, according to a review by S&P Global Commodity Insights.

The Big Number

Trending

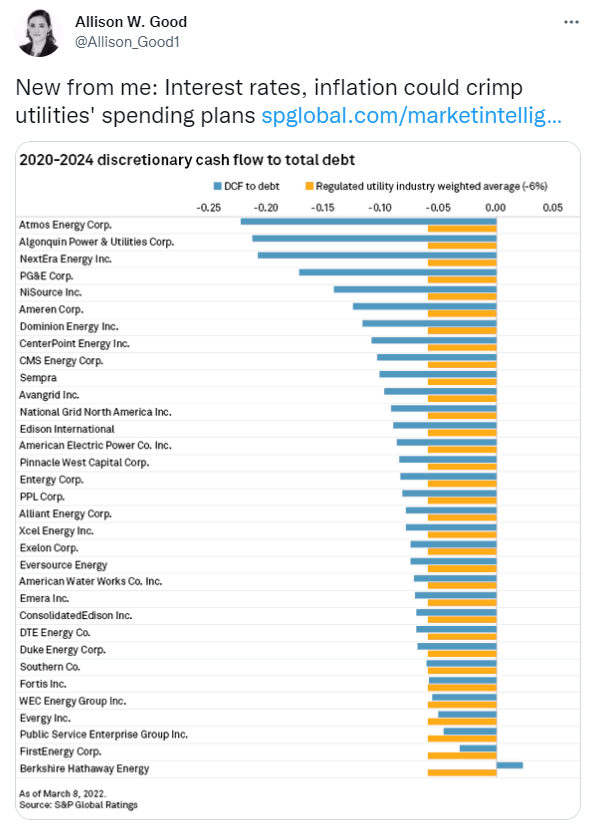

—Read more on S&P Global Market Intelligence and follow @Allison_Good1 on Twitter

Expand Your Perspective

S&P Global Market Intelligence has united with IHS Markit's Financial Services division. We're here to help our customers harness the volume and velocity of data in ways that unlock progress for us all.

Written and compiled by Louis Bacani