Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Oct, 2021

By Atif Hussain

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

In this edition, we take a close look at September share price performance in several sectors. U.S. bank stocks continued to outperform the broader stock market. Several tech-forward banks were among the best performers with a median return of 33.3% year-to-date. On the other hand, some newly public U.S. financial stocks posted big losses last month amid concerns over inflation and the ongoing pandemic.

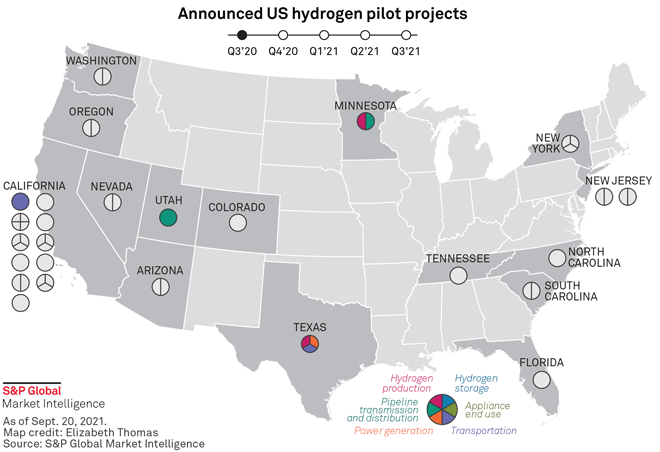

U.S. natural gas utilities have announced at least 26 hydrogen pilot projects in the past year as the industry works out how to make and transport the gas, as well as help customers migrate to the low-carbon fuel. Most of the projects are in West and East Coast states with ambitious climate targets and more than half involve hydrogen production, particularly green hydrogen.

Ethical concerns raised by Federal Reserve officials' personal trades seem to have put in doubt Chairman Jerome Powell's renomination, which appeared to be a sure bet a few weeks ago. Powell's potential ouster could trigger a sell-off in equities, flatten the Treasury yield curve and cause a spike in market volatility, according to OANDA senior market analyst Edward Moya.

US banks with lowest price-to-adjusted tangible book values in September

Texas Capital was the worst market performer in the S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

Tech-forward banks among top-performing US bank stocks by YTD total return

Several tech-forward banks are among the best-performing U.S. bank stocks by year-to-date total return, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

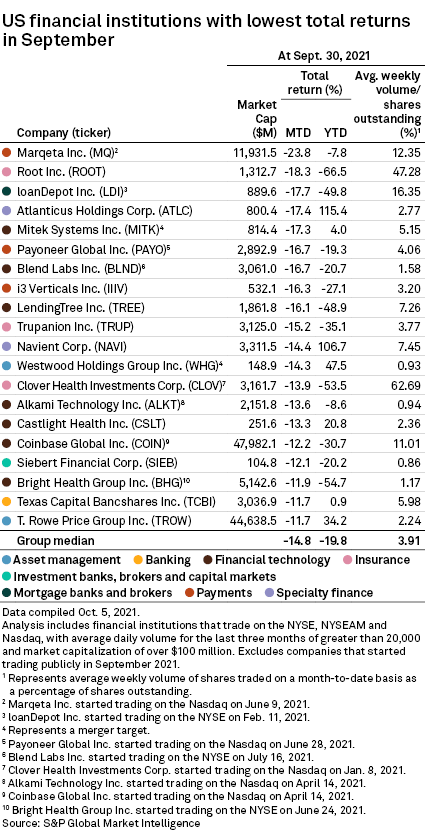

Some newly public US financial stocks post big losses in September

Eight of the 20 financial institution stocks with the largest losses in September began trading this year.

—Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Major Chinese banks log market cap declines in Q3, others post increases

Except for Postal Savings Bank of China, all other Chinese lenders among the 20 largest banks across Asia logged quarter-over-quarter declines in market cap in the quarter, according to data compiled by S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

US regional banks' rosy loan growth outlook unlikely to materialize in Q3

All eyes will be on loan growth when U.S. banks report third-quarter earnings as lenders look to deploy excess liquidity, but equity analysts anticipate another quarter of tepid loan growth.

Read the full article from S&P Global Market Intelligence

Analysts project weaker Q3 earnings for US banks despite signs of green shoots

Interest rates have increased recently but likely weighed on third-quarter results. Analysts say the most important thing is whether guidance supports expectations for a rebound in loan balances.

Read the full article from S&P Global Market Intelligence

US Bancorp's deal for MUFG Union Bank tests in-flux regulatory system

The deal might trigger regulatory scrutiny but if it goes through, U.S. Bancorp will gain market share in California, creating revenue opportunities.

—Read the full article from S&P Global Market Intelligence

Insurance

New telematics-only programs provide GEICO optionality in a fast-changing time

The No. 2 U.S. private-passenger auto insurer, "late" to realizing the value telematics can play in matching rate to risk, may be making up for lost time as a series of recent filings detail its efforts to roll out new programs.

—Read the full article from S&P Global Market Intelligence

Premium relief by Calif. auto insurers may significantly exceed reported credits

As California's insurance commissioner ordered three carriers to provide additional COVID-19 relief to policyholders, a review of statutory results reveals a decline in earned premiums that credits only partially explain.

—Read the full article from S&P Global Market Intelligence

Credit and Markets

Market risks grow as Powell's Fed future becomes less certain

Federal Reserve Chairman Jerome Powell's renomination seemed like such a lock a few weeks ago that most Fed watchers thought any discussion of a central bank leadership shake-up was a waste of breath. A trading scandal seems to have changed all that.

—Read the full article from S&P Global Market Intelligence

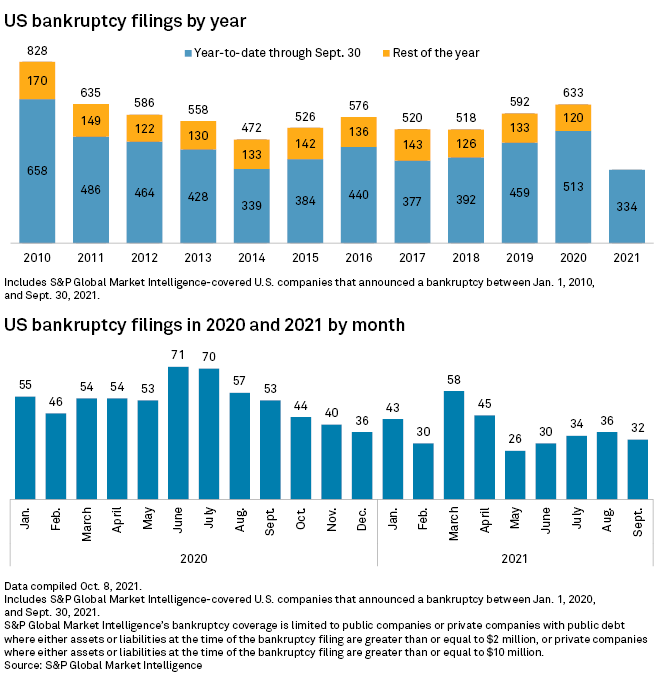

US corporate bankruptcy pace likely to speed up in 2022

In the meantime, experts predict a slow pace for the rest of the year as companies continue to reap the benefits of easy access to credit and government stimulus.

— Read the full article from S&P Global Market Intelligence

Energy and Utilities

Nuclear backers rally around tax credit as Congress grapples with Biden agenda

The nuclear power industry wants Congress to enact a nuclear power production tax credit as part of a massive reconciliation bill. If that plan fails, a bipartisan infrastructure bill includes a "safety valve" in the form of a federal credit program.

—Read the full article from S&P Global Market Intelligence

US hydrogen pilot projects build up as gas utilities seek low-carbon future

Gas utility operators have announced at least 26 hydrogen trials in the past year, largely focused on producing green hydrogen and preparing their distribution networks to carry the low-carbon fuel.

—Read the full article from S&P Global Market Intelligence

Fintech

Mendon Capital founder launches fintech fund for banks eager to upgrade tech

A new investment fund focused on banking technology will look to raise $100 million from banks eager to invest in, and partner with, fintech startups.

—Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

CityFibre funding helps TMT remain top VC investment choice in September

Investors deployed $48.03 billion of global venture capital last month, and technology, media and telecommunications businesses accounted for about half, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

UK software fundraising heats up as venture capital fuels pandemic boom

With software companies booming as digitalization accelerates during the pandemic, more institutional investors are putting money in venture capital funds.

—Read the full article from S&P Global Market Intelligence

Metals and Mining

Market value of metals, mining companies drops for 4th consecutive month

The median market capitalization of companies in the metals and mining sector declined 6.0% through September, with several iron ore producers recording losses in value, according to an S&P Global Market Intelligence analysis.

Read the full article from S&P Global Market Intelligence

Mining sector weighs vaccine mandates after pandemic measures bolster output

Mining companies moved forcefully to prevent COVID-19 spread after shutdowns last year. The latest surge in cases has also brought consideration of mandatory vaccination policies to the fore.

—Read the full article from S&P Global Market Intelligence

The Week in M&A

Market sells off Umpqua-Columbia deal creating only $50B bank in Northwest

JPMorgan Chase says more M&A could be on the horizon

Bank M&A 2021 Deal Tracker: USB's acquisition sends 2021 deal value over $50B

Southwest Gas adopts poison pill to prevent takeover attempt by Icahn

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @mollyknc on Twitter.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.