Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 02, 2023

By Ken Wattret

Core eurozone inflation rates, while still elevated, are beginning to moderate. Various metrics that we track are indicative of further declines ahead.

S&P Global Market Intelligence addresses a series of key questions related to inflation trends in the eurozone and our expectations for monetary policy.

Doesn't the ECB target the headline rate, not the core inflation rate?

Yes. The European Central Bank (ECB) defines price stability, its primary objective, as a year-over-year rate of change in the Harmonized Index of Consumer Prices (HICP) of 2% over the medium term.

This is the broadest measure of consumer price inflation in the eurozone and the simplest to understand, with equivalent rates in the eurozone's 20 member states typically the reference point for national wage negotiations.

So why is core inflation currently in focus?

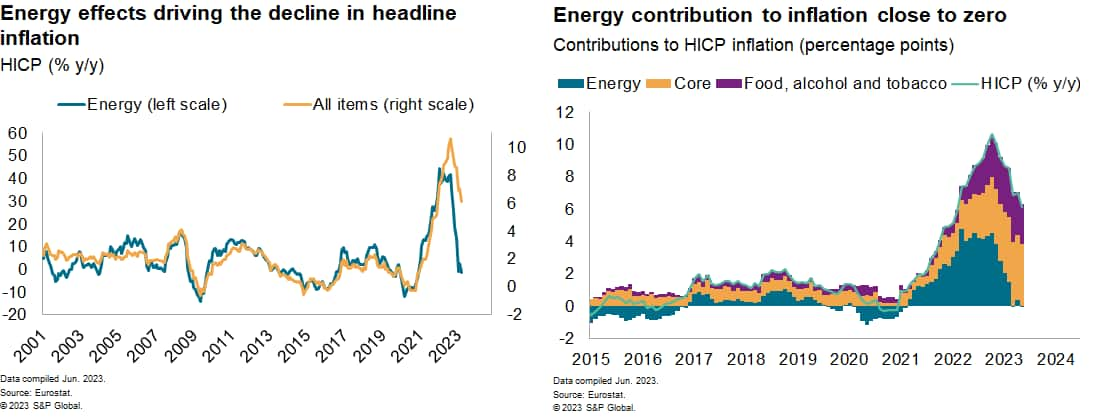

Headline inflation rates can be very noisy, due to swings in the most volatile HICP items such as energy and unprocessed food prices. These can obscure signals of underlying medium-term trends in inflation. Therefore, the ECB, like many other central banks, monitors a range of core inflation measures that strip out the most volatile price changes.

Has the ECB linked the evolution of core inflation to monetary policy prospects?

Yes, explicitly. In its recent policy statements, the ECB has stated that "the dynamics of underlying inflation" are one of three key drivers of the outlook for monetary policy.

In various communications, it has been made clear by ECB officials that evidence of moderating core inflation pressures will be required for the increases in policy rates since mid-2022 to come to an end.

Which core inflation rates do we monitor?

We track (and calculate) multiple measures to better gauge underlying price trends and to inform our monetary policy forecasts. They each have different properties, but in general they should all provide an indication of where headline inflation will settle in the medium term once short-term effects have 'washed out' of the data. These short-term effects include swings in energy and food prices.

These swings might ordinarily be 'looked through' by central banks; that is, they would not prompt changes in the monetary policy stance. However, monetary policy will respond if the swings are considered likely to generate 'second round' effects, as now; that is, to spill over into higher prices for other items, including via higher wage growth.

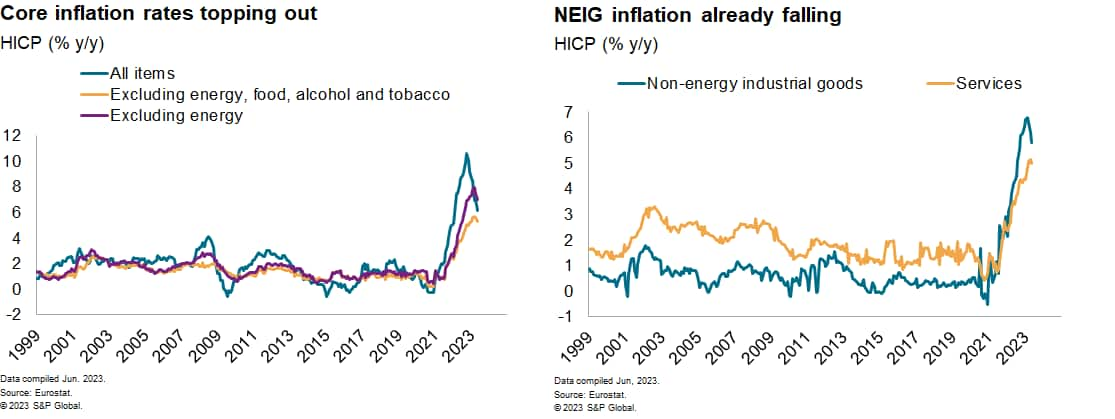

Has the 'traditional' core eurozone inflation rate peaked?

We believe so. Although it continued to rise in late 2022 and early 2023 while headline inflation was falling because of energy effects, the increases from month to month over that period were generally diminishing.

Moreover, it fell in April and May 2023 — the latest data available — and we expect further gradual declines over the remainder of 2023 and a downward trend out to 2025.

What is driving the moderation?

In 'big picture' terms, a rebalancing of supply and demand. This rebalancing follows an exceptional period of negative supply and positive demand shocks that led inflation to surge from 2021, initially related to the coronavirus disease 2019 (COVID-19) pandemic and compounded by Russia's invasion of Ukraine and its knock-on effects.

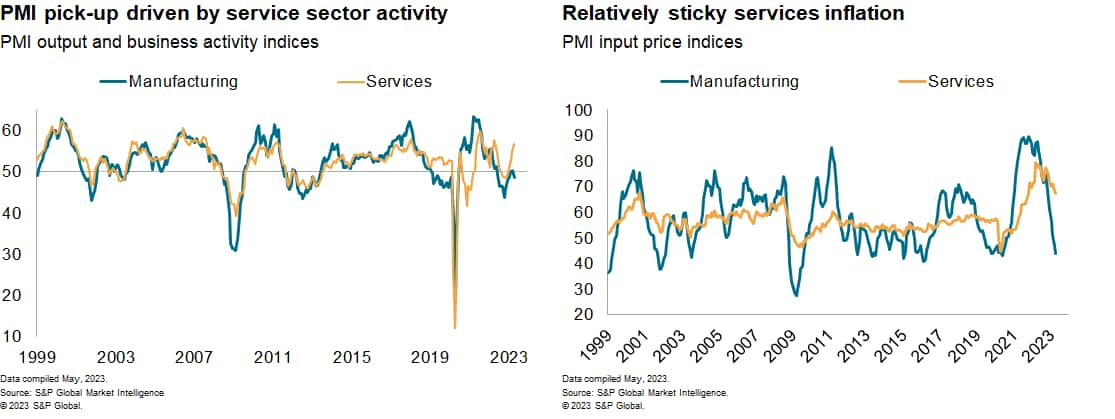

Why is services inflation expected to be relatively sticky?

Non-energy industrial goods (NEIG) inflation is more sensitive to global trends in supply chain developments and commodity prices — which have both become less inflationary — while services inflation rates tend to be more domestically driven and influenced more by labor cost dynamics.

Recent survey data suggests ongoing pent-up demand for some services previously blighted by the pandemic, while the manufacturing sector is struggling. This difference is also captured in the divergence of pricing surveys for the two sectors.

Exceptionally high inflation and tight labor markets, with labor shortages having been evident in many sectors, have combined to drive up wage growth, which typically reacts only with a significant lag to changes in economic conditions.

We expect services inflation to moderate but somewhat later and more gradually than NEIG inflation.

When is core inflation forecast to return to 2%?

It is not forecast to be close to 2% until well into 2025.

Will a moderation in core inflation bring ECB policy rate hikes to an end?

Yes, in conjunction with other developments inside and outside the eurozone that reflect the unprecedented speed of hiking cycles by key central banks, including the ECB, since inflation shot up. These include banking sector turbulence, rising insolvencies, falling house prices and tightening credit conditions.

The ECB has already signaled that the pronounced tightening of credit standards currently in train is likely to reduce the degree of monetary policy adjustment required to tame inflation.

In tandem with the developments highlighted above, the moderation in core inflation and the ECB's decision on May 4 to reduce the pace of its rate hikes suggest that the peak in policy rates is not far off.

What are the key risks to monitor?

First and foremost, persistent stubbornly high core inflation. This would force the ECB to extend its tightening cycle and maintain more restrictive financial conditions for much longer.

In turn, this would significantly raise the likelihood of more intense and widespread financial turbulence, accelerate the declines in house prices and aggravate the upward trend in business failures. The risk of a vicious circle emerging, pushing Europe into a recession, would rise materially.

While escalating financial stress would be likely to shorten the gap between the final rate hikes and the initial reductions, as we have highlighted previously shorter policy 'pivots' are typically not a positive augury for growth prospects.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.