Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 29, 2024

By Sean DeCoff

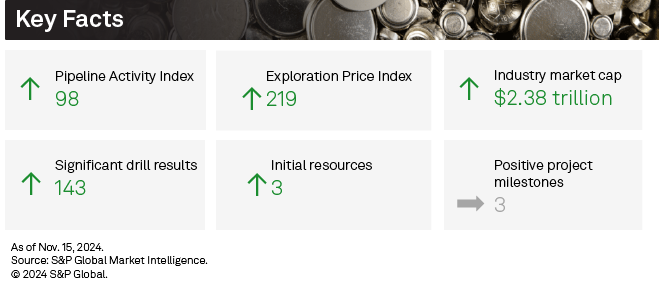

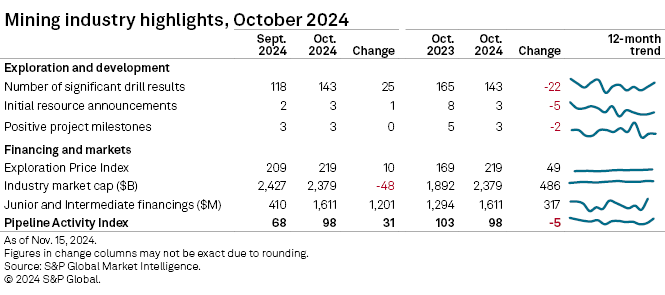

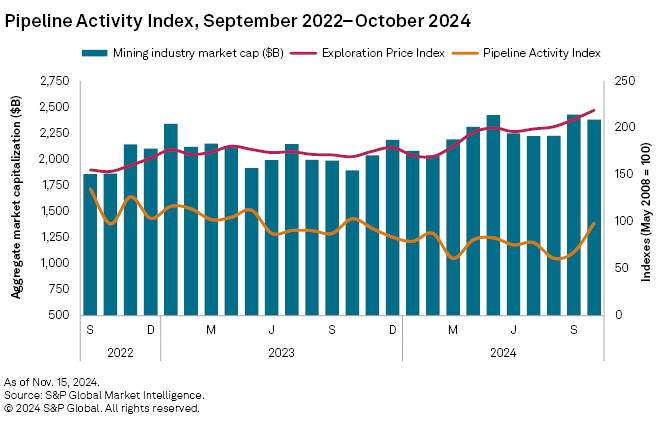

The S&P Global Market Intelligence Pipeline Activity Index improved significantly in October, increasing 45% to 98 from 68 in September, the highest in a year. The gold Pipeline Activity Index (PAI) increased 42% to 133 from 94, and the base/other PAI increased 56% to 71, compared to 45 in September.

The metrics used to calculate the PAI were again mostly positive in October. Significant drill results, financings and initial resources increased, while positive milestones were flat month over month. The Exploration Price Index (EPI) rose to another record high. Despite the monthly gold price hitting all-time highs and a strong monthly showing in base/other metal prices, mining equities lost steam and the aggregate industry market cap ended October down 2%.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel databook.

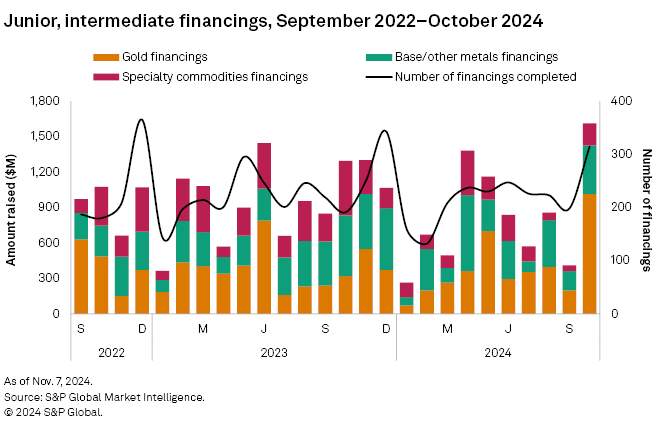

Financings surge pushes total funds raised to 31-month high

Funds raised by junior and intermediate companies nearly quadrupled to $1.61 billion in October — the highest level since March 2022 — with a surge in transactions and high-value financings reversing September declines. All commodity groups saw gains, led by gold. The total number of transactions increased to 315 from 198 in September, while the number of significant financings — transactions valued at more than $2 million — jumped to 97 from 39. There were five transactions valued at over $50 million, up from one in September.

Gold posted the largest increase in financings among the three commodity groups, jumping 412% to $1.02 billion in October — the highest total since March 2022. The number of financings rose to 177 from 101, and the number of significant financings more than doubled to 59 from 22 in September. Two transactions were valued at more than US$50 million, up from zero in September.

Funds raised for the base/other metals group increased in October, up 150% to $411 million — the highest in six months. The group's growth was fueled by higher copper fundraisings, which surged 260% to $311 million. The total number of transactions rose to 70 from 66, and there were two transactions valued at more than $50 million compared to one in September.

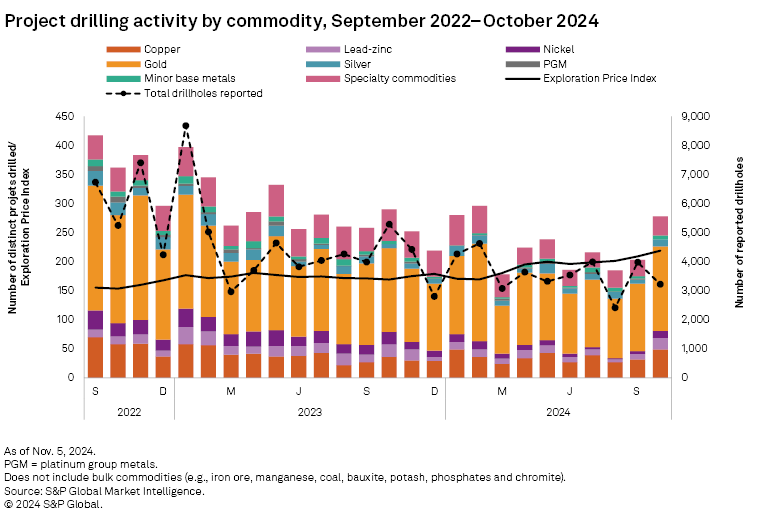

Drilling metrics show growth despite decline in drillholes

Almost all drilling metrics increased in October, driven by an increase in the total number of projects drilled across all commodities. However, total holes drilled was down 19%, primarily due to a 23% decrease in gold drilling and a 64% drop in specialty metal drilling. The total number of companies reporting also increased, up 32% to 254 — the most since January. Drilling increased across all stages, with early-stage projects rising 46% to 98, late-stage projects increasing 34% to 135, and minesite projects growing 48% to 49 total projects drilled.

October's top result came from TSX Venture Exchange-listed CanAlaska Uranium Ltd.'s West McArthur early-stage uranium project in Saskatchewan. The company reported an intersect of 25.8 meters grading 6.47% uranium. The company anticipates that the 2025 exploration program will begin in early January. Further details on programs and objectives are pending budget approval by the joint venture partner.

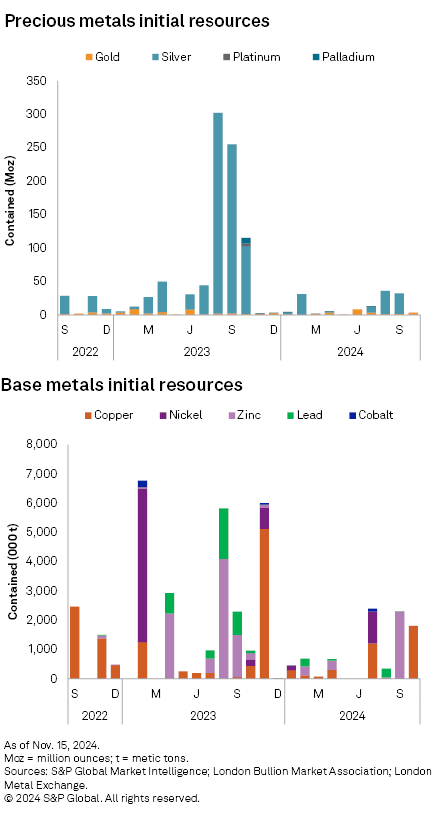

Initial resource announcements increase by 1

There were three initial resource announcements in October. Two were for copper-focused projects and one was for gold.

Ero Copper Corp. announced an initial mineral resource estimate for Furnas, a copper-gold project located in Brazil. The indicated resource estimate shows 35.20 million metric tons, grading 1.04% copper and 0.69 grams gold per metric ton, which brings the total contained copper to 364,700 thousand metric tons and 775,300 ounces of gold. Inferred resources estimates added an additional 647,400 metric tons of copper and 1.24 million ounces of gold.

The second copper-focused announcement was also located in Brazil and came from Lara Exploration Ltd. The company reported the initial resource estimate of the wholly owned Planalto Copper-Gold project. Indicated Resources estimate was 47.7 MMt, grading 0.53% copper and 0.06 g/t gold. Contained total equaling 253,000 metric tons copper and 92,000 ounces of gold. Inferred resources are estimated to be 154 MMt at an average grade of 0.36% Cu and 0.04 g/t Au, containing 549,000 metric tons of copper and 223,500 ounces of gold.

The other announcement came from Axcap Ventures Inc., which announced an updated Mineral Resource Estimate for the Rattlesnake Hills Gold Project in Wyoming. Measured and indicated resources of 24.9 MMt at 0.77 g/t Au for 612,000 ounces and inferred resources of 19.6 MMt at 0.69 g/t Au for 432,000 ounces.

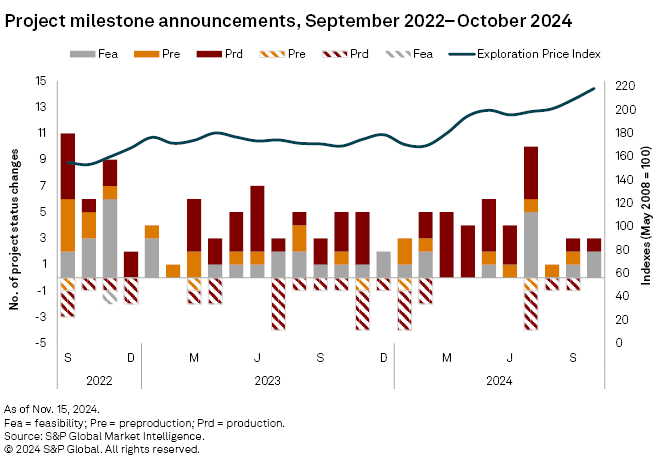

Positive milestones flat

Three positive milestones were registered in October, the same as in September — one for gold and two for copper-related projects. The copper project milestones were both feasibility stage while the gold milestone was production related. There were no negative milestones recorded this month.

The first milestone came from Capstone Copper Corp., which announced the results of a feasibility study for their Mantoverde brownfield expansion copper project, located in Chile.

The second milestone came from Castile Resources Ltd., who announced the start of the bankable feasibility study at their Rover copper project, located in Northwest Territories, Canada. The last positive milestone came from Pan African Resources PLC which announced the successful commissioning of their South African Mogale Gold TSF Tailings Retreatment operation.

Exploration Price Index at record high again

S&P Global Market Intelligence's EPI rose again in October, coming in at 219, surpassing the record high of 209 registered in September. This is the fourth consecutive monthly increase. Gold remained elevated, gaining 4.7% month over month and hit all-time highs in October. Other precious metals posted sizable monthly gains, with silver up 8% and platinum up 3.5%. Base metals also gained (zinc +8.9%, nickel +3.6%, copper +2.7%, molybdenum +1.6%) while cobalt was flat month over month.

The EPI measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Equity values pull back

Unlike last month, strong gold price and base metals prices were not enough to prevent a minor pullback in mining equities valuation. Market Intelligence's aggregate market capitalization of the 2,682 listed mining companies decreased 2.0% to $2.38 trillion from $2.43 trillion in September.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.