Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Nov, 2022

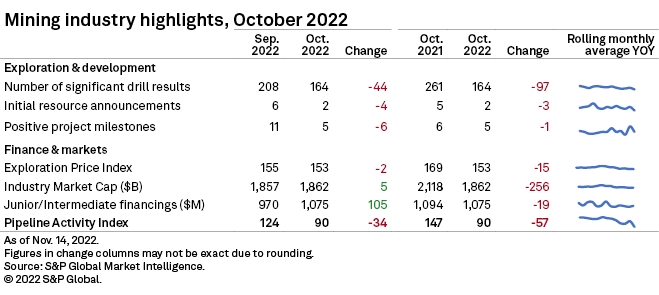

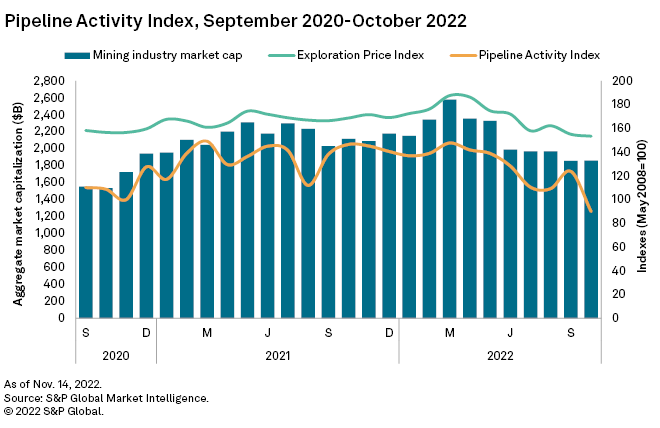

S&P Global Market Intelligence's Pipeline Activity Index, or PAI, declined to a 29-month low, falling 28% to 90 from 125 in September. Contributing to the precipitous drop were notable decreases in significant financings and drill results, as well as a lack of initial resources and milestones for base metals. The gold PAI plummeted to 128 — 44% lower than the previous month — and the base/other metals PAI slid 33% to 59 from 88.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel spreadsheet.

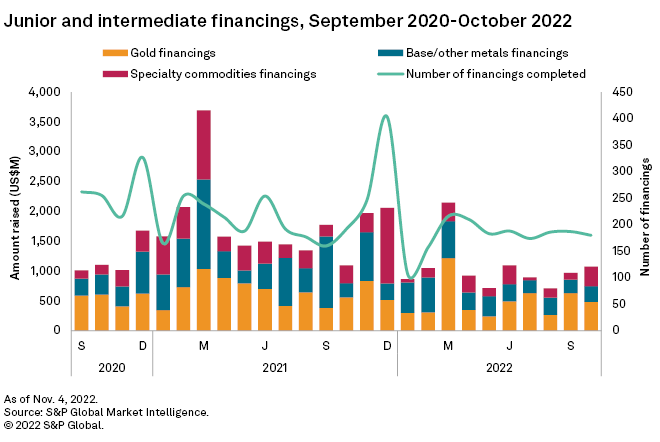

Financings for gold, base metals underperformed

Fundraising in October reached US$1.08 billion, up 11% from the US$970 million total in the previous month, despite 13 fewer significant financings by junior and intermediate companies. The number of significant gold and base metals financings, which is used in the calculation of the PAI, was down in October to 37 from 50 in September. Significant gold financings decreased to 23 from 35, while base/other metals financings declined to a 10-month low of 14. The overall increase in funding was the result of specialty commodities financing, vaulting to US$329 million from US$116 million in September.

The largest gold financing in October was the C$124.9 million (US$92.1 million) offering of royalty company Sandstorm Gold Ltd.

The month's largest financing for base/other metals was the US$79.3 million private placement of Horizonte Minerals PLC, which operates in Brazil. The fund is expected to be used for construction at the Araguaia site in Pará state in preparation for its 2024 launch.

Behind the sharp increase in specialty commodities funds raised was the bond issued by the Australian Securities Exchange-listed Hastings Technology Metals Ltd., valued at US$94.5 million. The company complemented this amount with a US$26.9 million private placement raised for its Yangibana rare earth elements mine in Western Australia.

Detailed information on junior and intermediate financings completed in October is available in the Financings article in this series.

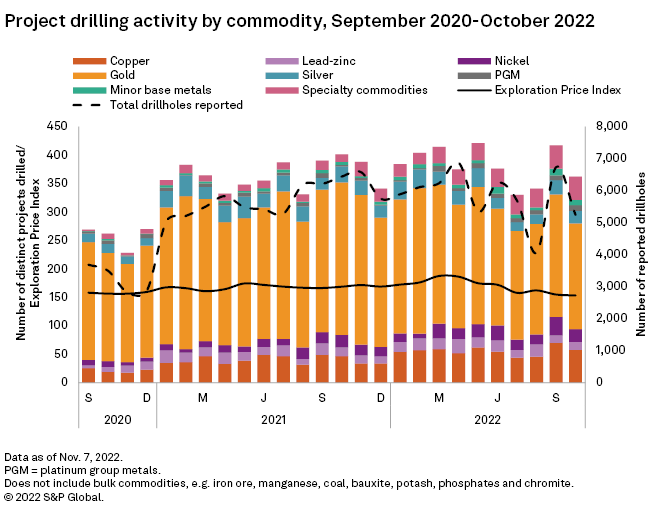

Drilling metrics down following September rebound

Global drilling activity decreased in October with a total of 362 projects drilled, down 13% over the previous month. The number of distinct holes dropped 22% to 5,240 — the second-lowest total year-to-date.

Gold projects drilled dropped 13% month over month to 186, representing 56% of the total projects drilled in September. Copper and nickel were a drag on monthly base metal totals, decreasing 17% and 33% to 58 and 22, respectively. Drilled projects under specialty commodities were flat, remaining at the year-to-date high of 41.

Australia continued to claim the highest number of projects drilled at 134 — a slight decline from 139 in September. Most of the decline came from copper, nickel and minor base metals. Canada ranked second with 80 projects drilled — a three-month low — mainly due to declines in gold. The U.S. also decreased in October to 32 from 44.

Besides the decrease in the number of projects reporting drilling, the number of significant drill intersections used in the PAI calculation was flat in October with a total of 209. The number of gold announcements declined to 105 from 130 in September, while the total for base metals fell to 59 from 78.

Detailed information on all drilling activity in October is available in the Drill Results article in this series.

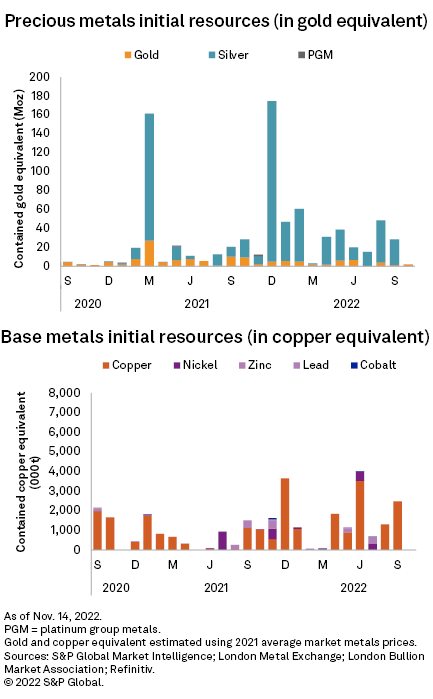

New resources decrease sharply

The number of initial resource announcements decreased sharply in October from six to two, both of which were for gold projects.

Toronto-based Omai Gold Mines Corp. announced one of October's new resources, which brought the Gilt Creek gold deposit and a Wenot deposit expansion into its mineral resource estimate before year-end. The inferred resource announcement at both deposits totaled 1.8 million ounces of gold at 3.35 grams of gold per tonne.

Australia-based Chesser Resources Ltd., owner of the Karakara deposit at Diamba Sud project in the Kédougou region, Senegal, announced the other new resource with a resource total of 116,000 ounces of gold at 2.1g/t Au.

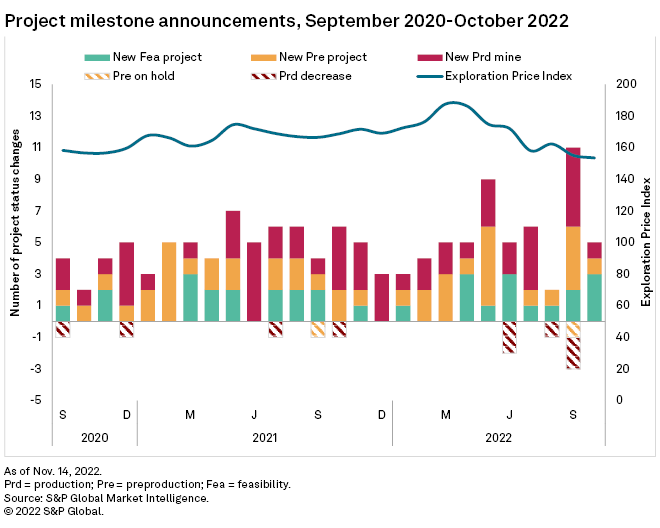

All positive milestones for gold

Positive project milestone activity was down in October to five announcements from 11 in September. There were no negative milestones.

October positive milestones comprised three projects entering feasibility, one project entering preproduction and one new production startup. All milestones were for gold projects.

In the month's largest milestone by far, Troilus Gold Corp. completed a feasibility study for its Troilus project in Quebec. The study considered a combination of open pit and underground operation at the site containing 7.1 Moz of gold. The company expects an immediate impact from the new zone, resulting in a shift in its engineering focus from an initially planned pre-feasibility study to a definitive feasibility study.

October's second largest milestone was Pantoro Ltd.'s pouring of first gold at the Norseman project in Western Australia. The project has an estimated resource of about 50 million tonnes at 3.0g/t Au containing 4.9 Moz of gold. The initial phase includes a mix of open pit and underground mining and a processing center expected to produce around 108,000 ounces of gold per year.

The month's third-largest milestone was from Endeavour Mining PLC announcing the completion of a definitive feasibility study, followed by the construction of its 80%-owned Lafigué project on the Fetekro property Vallée du Bandama district in Côte d'Ivoire. The project has a production profile of approximately 200,000 ounces per year at a cost of US$871 per ounce over the first mine life of 12.8 years.

Exploration price index extended decline

Metals prices decreased for a third consecutive month in October, lowering Market Intelligence's Exploration Price Index, or EPI, to 153 from 155. The indexed price fell for five of the eight constituents of the index — gold, copper, nickel, zinc and cobalt — and increased for silver, platinum and molybdenum.

The EPI measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.

Equities rise

After slipping in September, mining equities were marginally up in October as Market Intelligence's aggregate market value of the industry's listed companies based on 2,423 firms increased by less than 1% month over month to US$1.86 trillion. The aggregate market cap of the industry's top 100 companies was also up, growing 4% in October to US$1.54 trillion.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.