Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Jun, 2022

Introduction

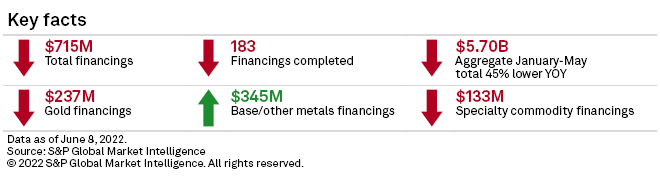

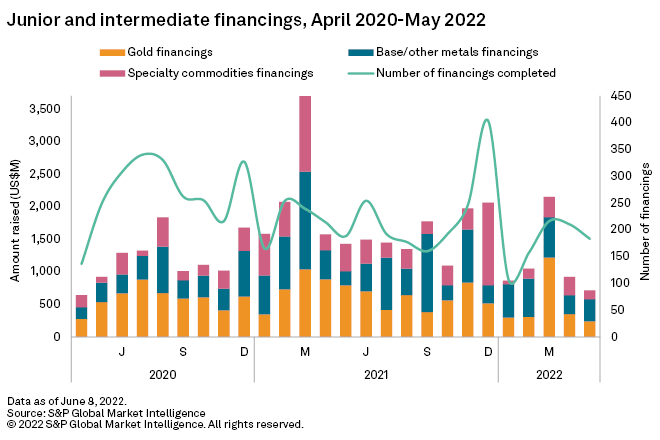

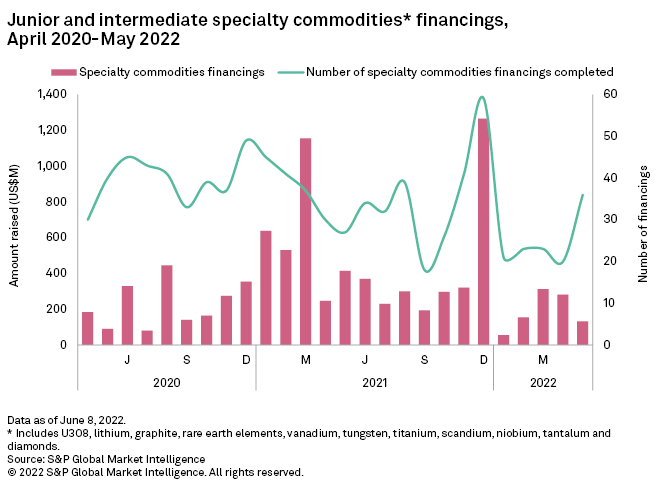

Funds raised by junior and intermediate companies slid for a second consecutive month to US$715 million in May, a record monthly low and the lowest total year-to-date since the year-ago period. May's total was 23% lower than April's US$924 million, with the number of deals also falling, by 13% to 183 from 210. Significant financings — transactions valued at US$2 million or more — accounted for 89% of the funds raised. The average offering amount declined to US$3.9 million from US$4.4 million in March and was the lowest in 20 months.

The May total was just one-third of the recent funding surge in March — when the total doubled month over month to a 12-month high of US$2.15 billion — and the lowest total year-to-date. Declines in funds raised for gold and specialty commodities pulled the total down, and an increase in base/other metals financings was not enough to buoy the May numbers. There were no transactions over US$100 million. The year-to-date total stood at US$5.7 billion, just over half the US$10.4 billion raised in the first five months of 2021. The number of offerings fell to 873 from 1,060 in April.

Financing was down across all types. Equity offerings continued to account for the bulk of funds raised at 92% but recorded a slight decrease of 8% to US$656 million. Initial public offerings accounted for 8% of the month's total, with a 32% decline to US$55 million. There were no debt transactions, compared with the US$132 million recorded in April.

Funds raised on the Australian Securities Exchange and Toronto Stock Exchange were at par in share of the total, at 43% and 42%, respectively. However, ASX transactions declined the most, to US$304 million — 37% less than in April. Financings on the TSX recorded a minimal increase of 6% to US$300 million. Offerings on Asian exchanges ranked a distant third with 5%, or US$36 million.

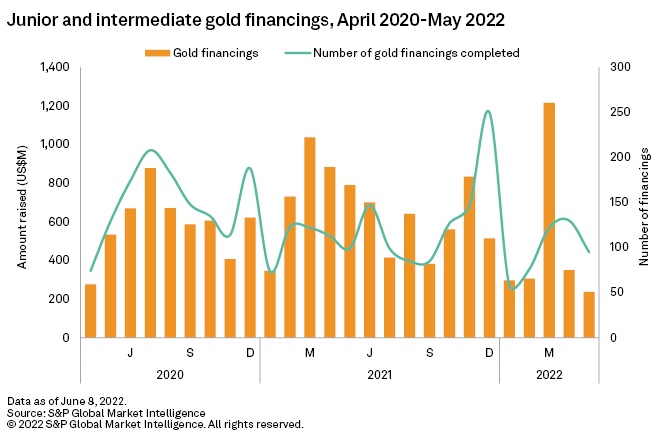

Gold financings at 28-month low

After the record-high total of US$1.22 billion in March, gold financings declined for a second consecutive month to US$237 million — 81% off from the March high and the lowest monthly total since January 2020. The number of transactions fell to 95 from 130 in April, with none valued above US$50 million.

The number of significant financings halved to 25 from 53 in April. Almost three-quarters of gold transactions were valued below US$2 million. Gold's year-to-date total of US$2.41 billion was 36% less than the US$3.79 billion recorded in the year-ago period. Equity offerings accounted for 91% of the gold fundraisings, with the remainder in IPOs. Financings on the TSX held almost half of the gold total, and the ASX was second with only 24%, after dropping more than half month over month.

May's largest gold financing and the second largest overall was the HK$157 million (US$36 million) rights offering by Hong Kong-listed Grand T G Gold Holdings Ltd., a gold miner in China. The proceeds will go for debt repayment and working capital.

The second largest was the first tranche of a private placement by TSX Venture Exchange-listed Pure Gold Mining Inc. amounting to C$28 million (US$22 million). The company will use the funds to ramp up output at its namesake mine in Ontario to 800 tonnes per day by the third quarter, reduce capital costs and achieve positive site-level cash flow.

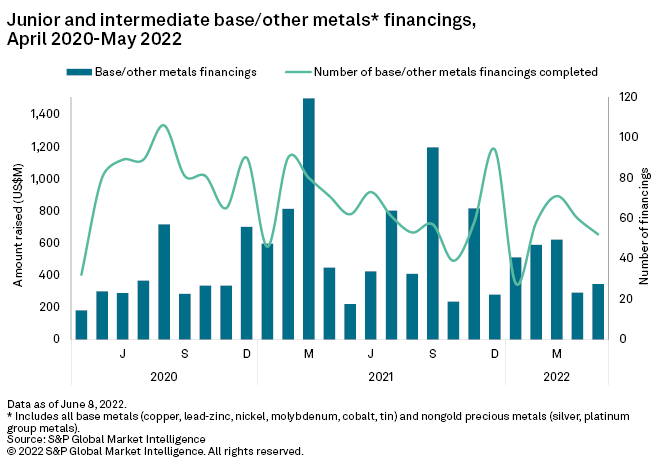

Copper financings buoy base/other metals totals

After dropping 53% in April, funds raised for base and other metals rebounded 18% to US$345 million from US$292 million in April, mostly supported by higher copper financings. The number of transactions fell to 52 from 60, but both smaller and significant fundraisings increased in value month over month, pushing the totals for the commodity group up from its lowest year-to-date level in April. Equity offerings accounted for 91% of the total, with the remainder in IPOs. Funds raised on both the ASX and the TSX rose almost 60%, with more than half the total raised by ASX-listed companies at US$176 million.

Funding for copper increased 46% to US$153 million, or 44% of the commodity group total. Nickel was second with US$90 million, while zinc and silver were below US$20 million with US$19 million and US$16 million, respectively.

The largest base/other metals financing and the month's largest overall was the A$100 million (US$71 million) institutional placement by ASX-listed Chalice Mining Ltd. The company will use the funds for exploration, drilling and scoping study completion at its wholly-owned Julimar nickel project in Western Australia.

The second largest and the third largest overall was a £25 million (US$31 million) offering by Vancouver-based Cornish Metals Inc. This financing was part of a £40.5 million fundraising for the South Crofty tin project in the U.K., which will be mainly for mine dewatering efforts and feasibility study completion.

Lithium, graphite pull down specialty metals financing

Although the number of transactions for specialty metals climbed to 36 from 20 month over month, their total value recorded a reverse trend. Fundraising for specialty metals dropped more than half from April, to US$133 million from US$282 million. This was mostly due to a decrease in lithium and graphite financings.

Almost all transactions were equity offerings, with only 4% from IPOs. Funding for both types declined around 25% month over month. ASX-listed companies accounted for 53% of the total despite a 70% decrease month over month to US$70 million. TSX funding surged 80% to US$49 million but remained in the second spot in terms of share at 37%. The remainder was split among companies on the London Stock Exchange and other exchanges.

Funds raised across all metals in the specialty commodities group decreased month over month. Graphite fell the most in dollar terms, down to US$23 million — one-fifth of the previous month's record US$126 million. Lithium funding decreased less severely, by 48% to US$45 million. Lanthanides financings fell to US$20 million from US$56 million, and offerings for diamonds fell to just US$4 million. Although there were funds raised for tungsten and vanadium, they only accounted for a combined 17% of the monthly total.

The largest specialty commodities fundraising was the C$28 million (US$22 million) private placement by TSXV-listed Lithium Chile Inc. with Chengxin Lithium Group Co. Ltd. The company will use the proceeds mainly for expanded exploration at the Salar De Arizaro lithium project in Argentina.

The second largest was Western Australia-based Black Rock Mining Ltd.'s A$25 million (US$17 million) placement, which it will use to advance development of its Mahenge graphite project in Tanzania.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.